MicroStrategy (NASDAQ:MSTR): The Bitcoin Giant Surpassing S&P 500 Stocks

How MicroStrategy’s Bold Bitcoin Bet Transformed It into a Market Leader—Can It Keep Winning? | That's TradingNEWS

MicroStrategy (NASDAQ:MSTR): A Comprehensive Analysis of Its Bitcoin-Centric Strategy

MicroStrategy's Bold Transformation: From Software to Bitcoin Giant

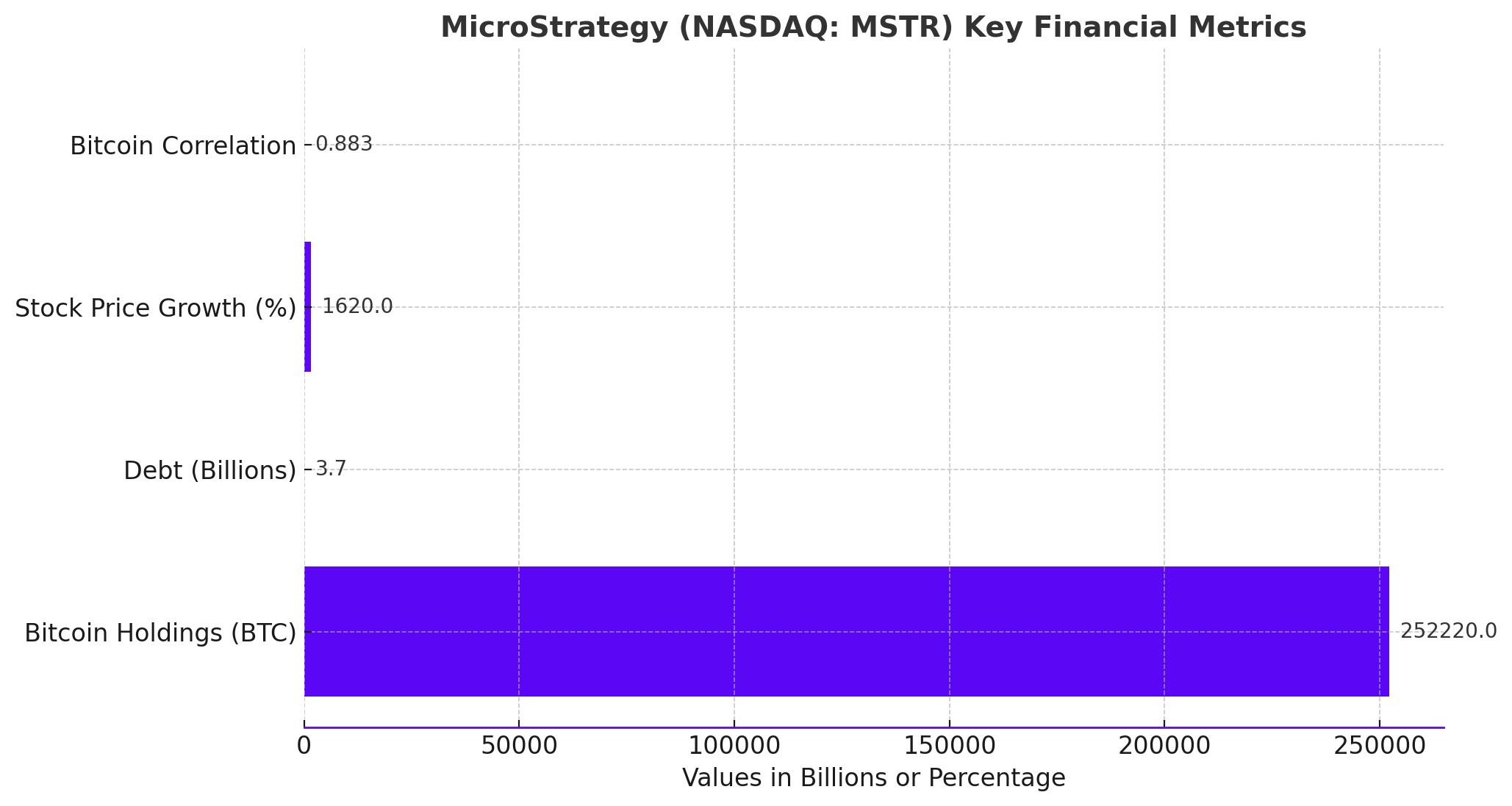

MicroStrategy Inc. (NASDAQ:MSTR), once known solely for its enterprise analytics software, has undergone a dramatic transformation, positioning itself as a key player in the cryptocurrency space. Since 2020, the company, led by Michael Saylor, has focused on aggressively accumulating Bitcoin, with its holdings now reaching 252,220 BTC, worth approximately $15 billion. This strategic pivot has shifted the company’s identity and market behavior, transforming it into a leading proxy for Bitcoin exposure, which has fueled its stock performance over the past few years.

NASDAQ:MSTR Outperforms S&P 500 With Unparalleled Bitcoin Exposure

MicroStrategy’s shift into Bitcoin has turned it into a stock market powerhouse, outperforming not just Bitcoin itself but also the top performers in the S&P 500. Since August 2020, NASDAQ:MSTR has surged by an astonishing 1,620%, vastly outpacing Bitcoin’s 426% gain over the same period. To put that into perspective, even market darlings like Nvidia, which has surged 1,054%, and Tesla, up by 928%, have trailed behind MicroStrategy’s growth.

This phenomenal performance stems from MicroStrategy’s dual nature—on one hand, its enterprise software business, and on the other, its growing Bitcoin reserves, which now constitute a massive portion of its market valuation.

Track real-time stock movements for NASDAQ:MSTR here.

Impact of Bitcoin on NASDAQ:MSTR Stock Price Correlation

Before MicroStrategy began purchasing Bitcoin, its stock exhibited a negative correlation with Bitcoin at -0.658. This inverse relationship meant that when Bitcoin rose, NASDAQ:MSTR stock tended to fall. However, after its first Bitcoin purchase in August 2020, this relationship flipped dramatically. The stock now shares a correlation of 0.883 with Bitcoin, signifying that MSTR moves almost in lockstep with Bitcoin’s price movements. This shift in perception is vital to understanding the stock’s volatility, as MicroStrategy’s stock now behaves more like a cryptocurrency proxy rather than a traditional software stock.

MicroStrategy’s Debt-Fueled Bitcoin Purchases

The company’s aggressive strategy to buy Bitcoin hasn’t been without financial maneuvers. To fund these acquisitions, (NASDAQ:MSTR)has relied heavily on issuing convertible debt. As of the latest filings, the company holds $3.7 billion in long-term debt, a significant portion of which is dedicated to financing its Bitcoin acquisitions. This has transformed MicroStrategy into a highly leveraged company, betting that Bitcoin’s future price appreciation will more than compensate for the debt burden.

For instance, in its most recent Bitcoin purchase of 7,420 BTC, MicroStrategy utilized a combination of debt and equity to bring its total Bitcoin holdings to over 252,000 BTC. This move continues to solidify its position as the largest corporate holder of Bitcoin globally.

Despite the debt, NASDAQ:MSTR’s stock performance has remained resilient. The market seems to price in a premium for its Bitcoin holdings. Historically, this premium has hovered around 15.22%, with investors willing to pay more for MSTR shares in anticipation of further Bitcoin price gains. This premium reflects investor sentiment that views MicroStrategy not just as a software firm, but as a unique vehicle for Bitcoin exposure.

The Potential of NASDAQ:MSTR Joining the S&P 500

MicroStrategy’s ambitious shift into Bitcoin could soon earn it a spot in the S&P 500, a move that would further legitimize its position as a serious contender in both the technology and cryptocurrency spaces. One of the key obstacles to inclusion in the S&P 500 has been the company’s history of losses. However, a recent change in accounting standards by the Financial Accounting Standards Board (FASB) may boost MicroStrategy’s earnings by allowing the company to recognize the fair value of its Bitcoin holdings, rather than being forced to report unrealized losses.

This shift could improve NASDAQ:MSTR’s earnings, with estimates indicating that the company could see an increase in retained earnings by approximately $3.1 billion. Such an improvement would make MicroStrategy eligible for inclusion in the S&P 500, which would likely drive additional demand for its stock as index funds and institutional investors seek exposure to the stock.

Insider Transactions at (NASDAQ:MSTR)

Insider activity has also been a critical point of interest for NASDAQ:MSTR. Michael Saylor, who remains deeply invested in the company, continues to actively support MicroStrategy’s Bitcoin strategy. According to insider transaction data, Saylor has shown unwavering confidence in the company’s direction, adding more Bitcoin holdings and increasing his personal stake in the firm’s future. His leadership has made him a prominent figure in the crypto world, earning admiration for his bold stance on Bitcoin as a corporate asset.

MicroStrategy’s Strategic Bitcoin Holdings: A Financial Revolution

MicroStrategy’s vision for the future is clear: it aims to become the leading Bitcoin-centric financial institution. Michael Saylor has likened his vision for (NASDAQ:MSTR)to that of a "Bitcoin bank," where the company would not lend out Bitcoin like a traditional bank but instead offer a suite of Bitcoin-based financial products. Saylor predicts that Bitcoin’s value could rise into the millions per coin, potentially catapulting MicroStrategy’s valuation to a staggering $300-$400 billion, or even higher.

Saylor has expressed plans to borrow funds through diverse capital market instruments, with an expectation of generating an average annual return of 29% through Bitcoin investments. He envisions NASDAQ:MSTR building a $300-$400 billion company that benefits from Bitcoin’s meteoric rise, with the potential to become a trillion-dollar enterprise as Bitcoin adoption continues to grow globally.

Risk Factors: The Double-Edged Sword of Bitcoin Exposure

While NASDAQ:MSTR’s strategy has been wildly successful, it comes with significant risks. The company’s fate is now tightly intertwined with the volatile price of Bitcoin. If Bitcoin’s price were to decline sharply, the stock would likely follow suit, erasing much of its recent gains. Additionally, the company’s heavy reliance on debt to purchase Bitcoin introduces financial risk. If Bitcoin’s price stagnates or falls, MicroStrategy may find it difficult to service its growing debt burden, which could negatively impact its stock price.

However, Saylor remains optimistic, betting that Bitcoin will continue to appreciate in value over the long term. His firm belief that Bitcoin is a superior store of value compared to traditional currencies and assets underpins MicroStrategy’s bold strategy.

MicroStrategy’s Unique Position in the Market: A Buy, Hold, or Sell?

Investors looking to gain exposure to Bitcoin without directly holding the cryptocurrency may find NASDAQ:MSTR an appealing option. The company’s stock has consistently outperformed Bitcoin in recent years, thanks to its leveraged position and the premium investors are willing to pay for its shares. However, this strategy also makes MSTR highly volatile and susceptible to swings in Bitcoin’s price.

While MicroStrategy’s financial fundamentals in the software sector remain underwhelming, its Bitcoin strategy has propelled it to new heights. Analysts remain divided on whether MSTR is a buy or hold, but much of the sentiment hinges on one’s outlook for Bitcoin’s future. For investors bullish on Bitcoin’s long-term prospects, MicroStrategy presents a leveraged opportunity to capitalize on future price gains.

Track insider transactions and stock performance for (NASDAQ:MSTR) here.

Final Thoughts on )NASDAQ: MSTR)

MicroStrategy’s pivot toward Bitcoin has redefined its business model and market perception. What was once a data analytics company is now widely recognized as a leading corporate Bitcoin holder. With over 250,000 BTC in its reserves and more acquisitions planned, MicroStrategy is set to continue as a major player in the crypto space.

However, with great reward comes great risk. Investors should consider the company’s debt-fueled strategy and its heavy reliance on Bitcoin’s price movements. As long as Bitcoin continues its upward trajectory, (NASDAQ: MSTR)will likely remain a high-performing stock. But any significant downturn in Bitcoin could present challenges for the company.

For now, MSTR is a stock that offers massive potential upside but carries significant risk. Investors who are bullish on Bitcoin’s future may find MicroStrategy an attractive play, offering both the benefits of a corporate entity and exposure to the leading cryptocurrency.

That's TradingNEWS

Read More

-

SCHD ETF Price at $27: Can SCHD’s 4% Yield and 9.15% Dividend Growth Beat High-Yield Covered Call ETFs?

15.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Close on $1B Inflows as XRPI at $10.92 and XRPR at $15.52 Hit 52-Week Lows

15.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Holds the $4 Floor as Oversupply Clashes with 2026 LNG Demand

15.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen At 155: Yen Strength Builds As BoJ Hike And NFP Collide

15.12.2025 · TradingNEWS ArchiveForex