MicroStrategy (NASDAQ:MSTR): Uniting Bitcoin and Financial Innovation

Can NASDAQ:MSTR's bold Bitcoin strategy withstand regulatory risks and volatility? | That's TradingNEWS

MicroStrategy (NASDAQ:MSTR): A Comprehensive Analysis of Strategic Moves, Bitcoin Holdings, and Valuation

NASDAQ:MSTR: The Pioneer of Bitcoin Integration in Capital Markets

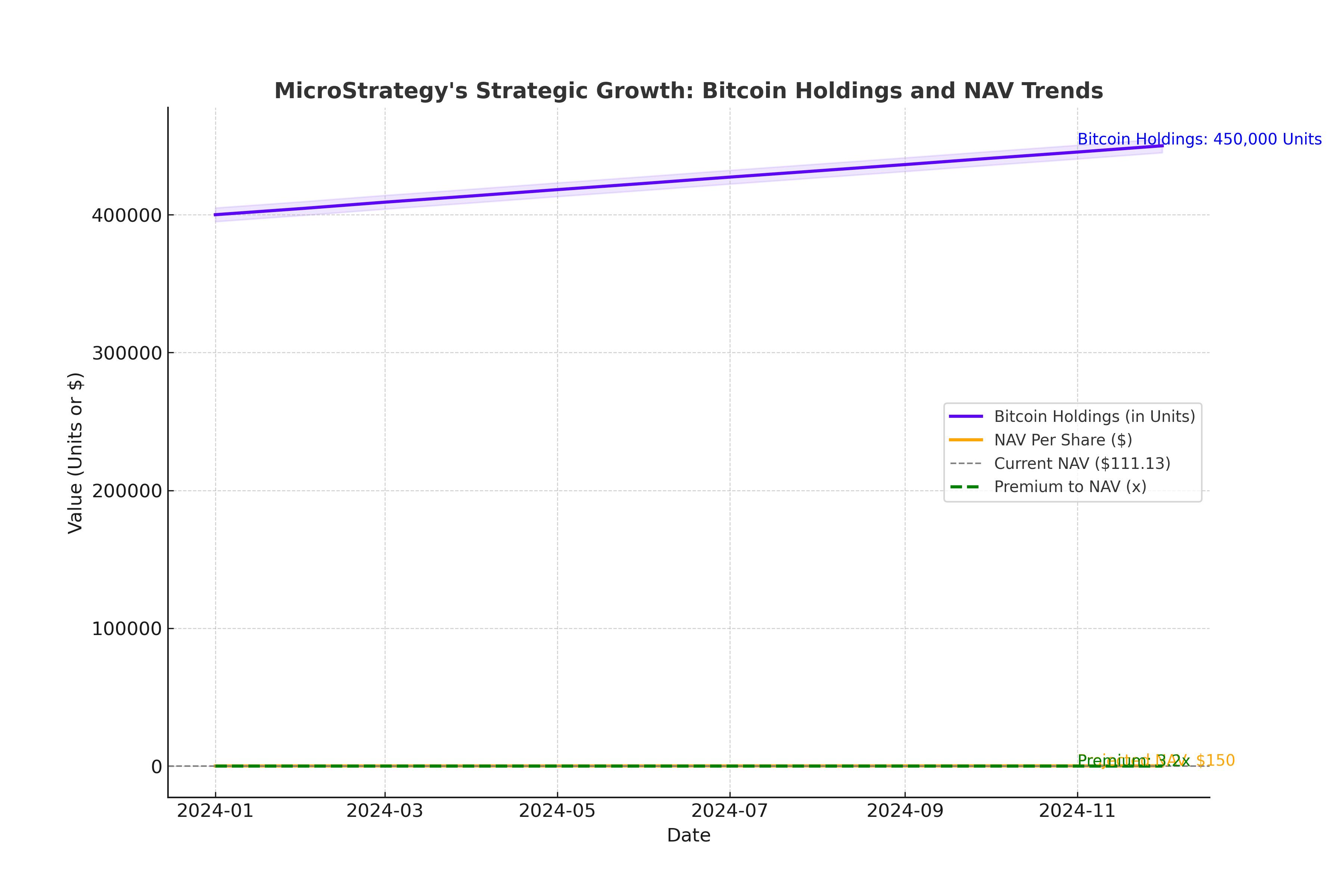

MicroStrategy Inc. (NASDAQ:MSTR), currently trading at $330, has redefined its identity, transforming from a software company to a Bitcoin-driven financial innovator. As of Q4 2024, the company owns 447,470 Bitcoin, valued at $41.79 billion, placing it among the largest corporate holders of the cryptocurrency. The company's strategic approach, driven by founder and chairman Michael Saylor, revolves around leveraging equity and debt markets to accumulate Bitcoin and generate significant shareholder value through Bitcoin yield growth. This unique model has propelled MSTR's stock price by 479.68% over the past year, marking its inclusion in the NASDAQ 100 index.

Bitcoin Holdings and the 21/21 Plan

MicroStrategy's innovative 21/21 plan aims to raise $42 billion—$21 billion from at-the-market equity offerings and another $21 billion through fixed-income instruments, primarily convertible debt. These funds will be used to purchase more Bitcoin, amplifying the company's Bitcoin holdings and increasing its per-share Bitcoin yield. In Q4 2024, MSTR’s Bitcoin yield surged to 48%, a dramatic increase compared to the targeted annual yield of 6–10%.

Each issued share dilutes existing holdings but adds cash to acquire Bitcoin, ultimately increasing the net asset value (NAV) per share. With a current NAV of approximately $111.13 per share, the market values MSTR at a significant premium, reflecting investor confidence in Saylor’s ability to compound Bitcoin yield effectively.

Valuation: Premium Above Net Asset Value Explained

Trading at a 2.95x premium to its NAV, MSTR’s valuation reflects the market’s expectation that the company will outpace Bitcoin’s annual growth rate of 50% through effective financial engineering. By leveraging its equity and convertible debt issuance strategies, MSTR has created a model that rewards long-term investors with a compounding Bitcoin yield. If the company sustains a 15% Bitcoin yield CAGR over the next decade, NAV growth could exceed 4x, suggesting further upside potential for the stock.

Recent Developments in Equity and Preferred Shares

To support its ambitious growth strategy, MicroStrategy has proposed increasing its authorized common shares from 330 million to 10.33 billion and its preferred shares from 5 million to 10 billion. Preferred shares, offering steady dividends, attract yield-seeking investors, enabling MSTR to diversify its funding sources while minimizing direct dilution to common shareholders. The company recently issued $2 billion in perpetual preferred shares with conversion features, signaling its intent to tap into broader segments of the capital market.

These moves bolster MSTR's ability to raise capital efficiently, providing additional liquidity to fuel Bitcoin purchases and improve leverage ratios. This strategy enhances MSTR’s financial flexibility and positions the company to capitalize on future opportunities in Bitcoin and blockchain technology.

Bitcoin’s Role in MSTR’s Long-Term Growth

Bitcoin’s historical CAGR of 142% over the last 14 years underscores its potential as a high-growth asset class. While Saylor conservatively projects a 50% annual Bitcoin growth rate, MSTR’s financial strategy aims to amplify this through its Bitcoin yield, projected to grow by 6–10% annually. If achieved, this would result in NAV growth significantly outpacing Bitcoin’s price appreciation, justifying MSTR’s premium valuation.

Navigating Risks: Regulatory Challenges and Bitcoin Volatility

MicroStrategy’s reliance on Bitcoin is both its defining strength and a significant vulnerability. The company’s strategic focus on accumulating and leveraging Bitcoin holdings exposes it to considerable risks from regulatory interventions and Bitcoin’s inherent volatility. With 447,470 Bitcoin on its balance sheet, worth approximately $41.79 billion at current prices, MicroStrategy is heavily tethered to the cryptocurrency’s performance. A sharp decline in Bitcoin’s price could significantly impact the company’s net asset value (NAV), reducing its financial flexibility and eroding investor confidence. Furthermore, fluctuations in Bitcoin prices might lead to heightened strain on the company’s leverage strategy, particularly given its $8 billion in convertible debt.

Regulatory scrutiny poses an equally formidable challenge. With governments and financial regulators globally ramping up oversight of cryptocurrency transactions, there is a persistent risk of new laws or restrictions disrupting MicroStrategy’s operations. For instance, restrictions on cryptocurrency holdings or limitations on debt-funded acquisitions could hamper the company’s ability to execute its ambitious 21/21 plan. Despite these challenges, MicroStrategy benefits from a robust investor base and a track record of strategic capital allocation, which collectively provide a buffer against adverse developments.

Bolstering Financial Health and Capital Efficiency

MicroStrategy’s financial stability and operational efficiency have underpinned its aggressive Bitcoin acquisition strategy. The Q3 2024 financials highlight the company’s solid foundation, with $70.9 billion in cash and marketable securities. This liquidity ensures the company can continue to fund its operations and execute its strategic plans without immediate financial distress. MicroStrategy’s ability to raise capital at attractive terms, even during periods of market uncertainty, demonstrates the confidence investors place in its management and strategy.

The company’s $8 billion in outstanding convertible bonds is a pivotal component of its financial toolkit. Convertible debt allows MicroStrategy to balance the dual goals of preserving liquidity and acquiring Bitcoin, with the added benefit of reducing interest rate exposure. Additionally, the recent decline in implied volatility (IV) has further enhanced the company’s ability to issue convertible bonds efficiently. Lower IV means reduced cost for issuing these instruments, positioning MicroStrategy to capitalize on favorable market conditions and potentially accelerate Bitcoin yield growth in Q1 2025. This combination of liquidity, strategic debt management, and market timing underscores MicroStrategy’s financial acumen.

Expanding Dominance in the Bitcoin-Backed Financial Ecosystem

MicroStrategy has redefined its role in the financial markets by positioning itself as a leader in Bitcoin-backed capital innovation. Unlike traditional cryptocurrency investment vehicles, MicroStrategy integrates Bitcoin directly into its capital structure, offering investors exposure to Bitcoin alongside the potential benefits of financial engineering. The company’s ability to structure financial instruments—including common shares, convertible bonds, and newly introduced perpetual preferred shares—demonstrates a keen understanding of investor needs across various risk appetites.

The 21/21 plan exemplifies this approach, leveraging both equity and debt markets to maximize Bitcoin yield for shareholders. Through strategic offerings, MicroStrategy has effectively created a new avenue for institutional and retail investors to gain exposure to Bitcoin’s growth while benefiting from the company’s disciplined financial management. By diversifying its capital structure and expanding its reach across investor segments, MicroStrategy is solidifying its position as a pivotal player in the Bitcoin-backed financial ecosystem. This strategy not only attracts capital but also enhances the company's resilience against market volatility.

Conclusion: NASDAQ:MSTR—Seizing High-Risk, High-Reward Potential

At $330 per share, NASDAQ:MSTR offers a unique investment proposition, blending the high-growth potential of Bitcoin with innovative financial strategies. The company’s aggressive acquisition plans, supported by the 21/21 strategy and innovative use of convertible bonds and preferred shares, have set it apart from traditional Bitcoin investment options. These measures provide investors with a diversified exposure to Bitcoin’s growth while leveraging MicroStrategy’s expertise in capital management.

Despite the risks of regulatory intervention and Bitcoin price volatility, MicroStrategy’s strong liquidity, robust investor support, and ability to compound Bitcoin yield position it as a leader in this niche. As Bitcoin adoption and institutional interest continue to grow, MicroStrategy’s bold approach could yield substantial long-term returns. For real-time updates on NASDAQ:MSTR’s performance and market trends, visit NASDAQ:MSTR Real-Time Chart.