MicroStrategy's Stock (NASDAQ: MSTR) Soars Over 500% in 2024 – A Phenomenal Rise!

MicroStrategy's stock has experienced an extraordinary surge of over 500% in 2024, captivating investors and market analysts alike | That's TradingNEWS

MicroStrategy’s (NASDAQ:MSTR) Pioneering Bitcoin Strategy: A Deep Dive into Its Transformation and Market Dynamics

MicroStrategy Incorporated (NASDAQ:MSTR) has emerged as a groundbreaking player in the intersection of traditional finance and cryptocurrency, fundamentally altering its business model under the leadership of Michael Saylor. This pivot, transitioning from an enterprise software provider to a Bitcoin-focused financial innovator, positions MicroStrategy as a unique investment vehicle for those seeking exposure to Bitcoin through the equity market. By leveraging its robust Bitcoin acquisition strategy, the company has become the single largest publicly traded holder of Bitcoin, creating both unprecedented opportunities and significant risks. This analysis provides a comprehensive exploration of MicroStrategy’s strategy, financial position, market impact, and potential future in an evolving crypto landscape.

Bitcoin as the Lifeblood of NASDAQ:MSTR’s Performance

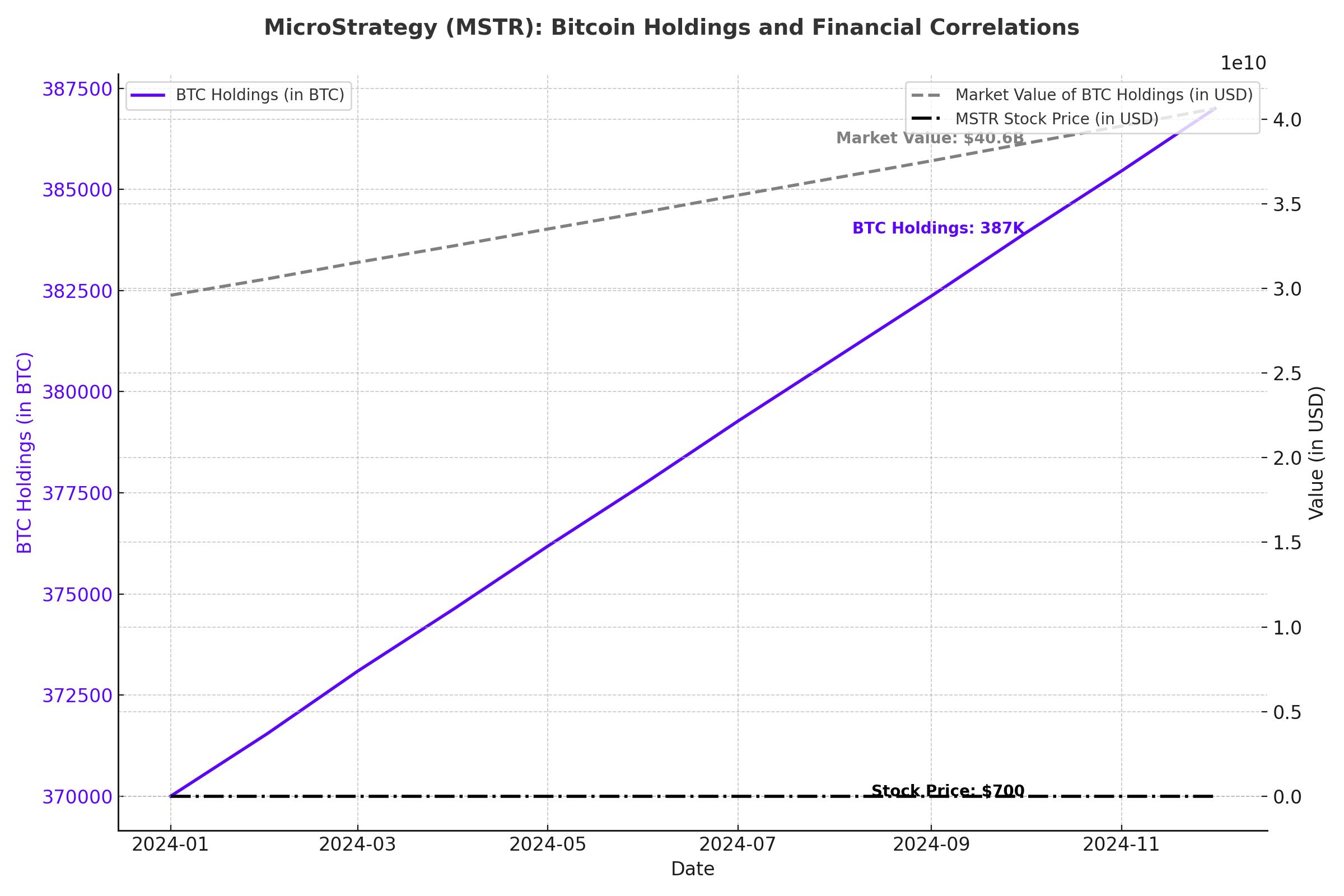

MicroStrategy’s stock performance is inextricably linked to Bitcoin’s price movements. Recently, a notable 4.44% pre-market surge in MSTR’s share price mirrored Bitcoin’s recovery to $96,596.96, after dipping to $92,000 earlier in the week. This tight correlation underscores the symbiotic relationship between the two assets, where Bitcoin’s trajectory drives investor sentiment toward MicroStrategy. With holdings of 387,000 BTC—representing 1.5% of Bitcoin’s global supply—MicroStrategy has firmly positioned itself as a proxy for Bitcoin within the traditional equity market.

The stock’s consensus price target of $449.50 highlights the market’s mixed views, ranging from a bullish $690 to a bearish $140. These figures reflect both optimism about Bitcoin’s long-term growth potential and concerns about the inherent volatility of a Bitcoin-dependent strategy. Investors in MSTR are essentially betting on Bitcoin’s future as a global reserve asset, with analysts closely watching its progress.

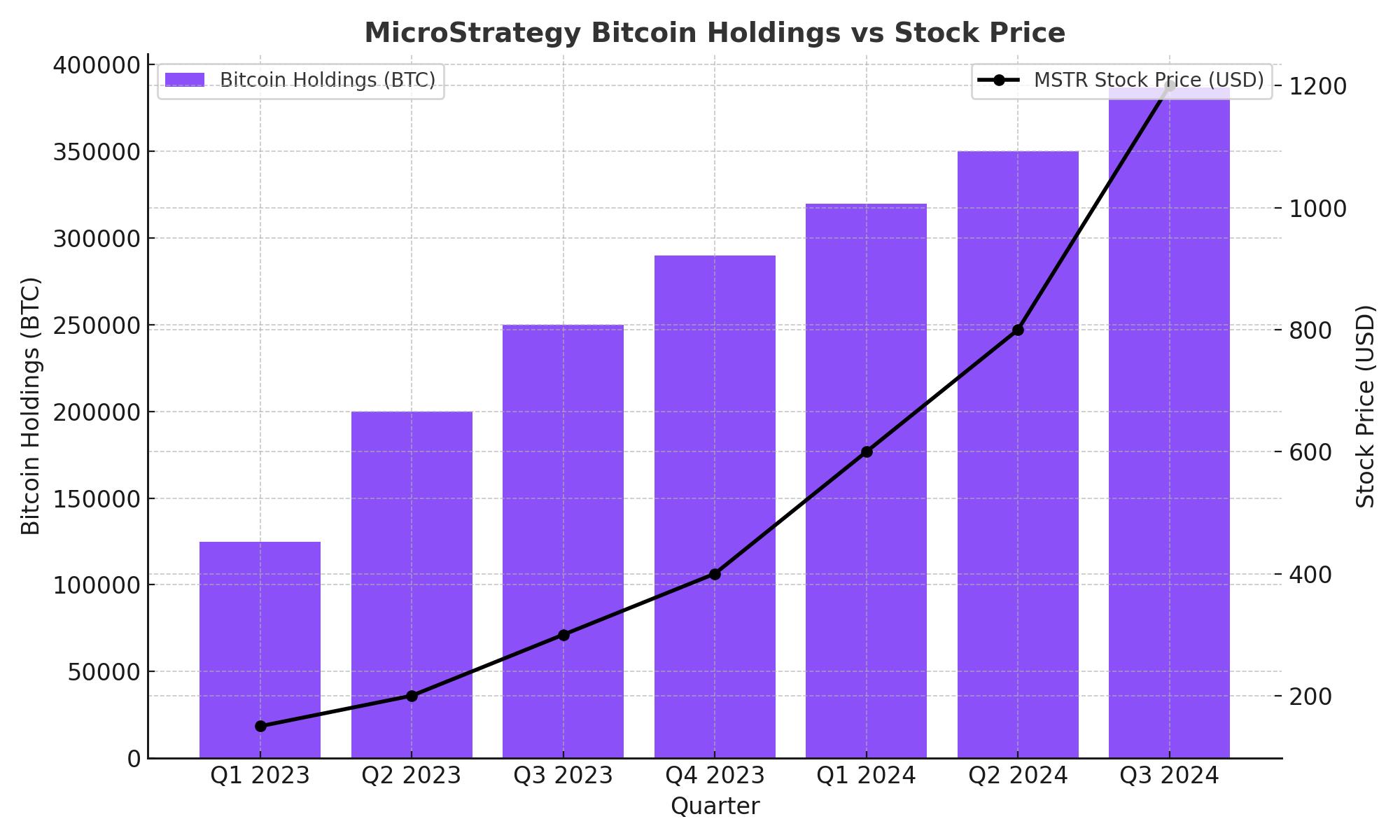

Microstrategy Bitcoin Holdings (BTC-USD) VS. Stock Price (NASDAQ: MSTR)

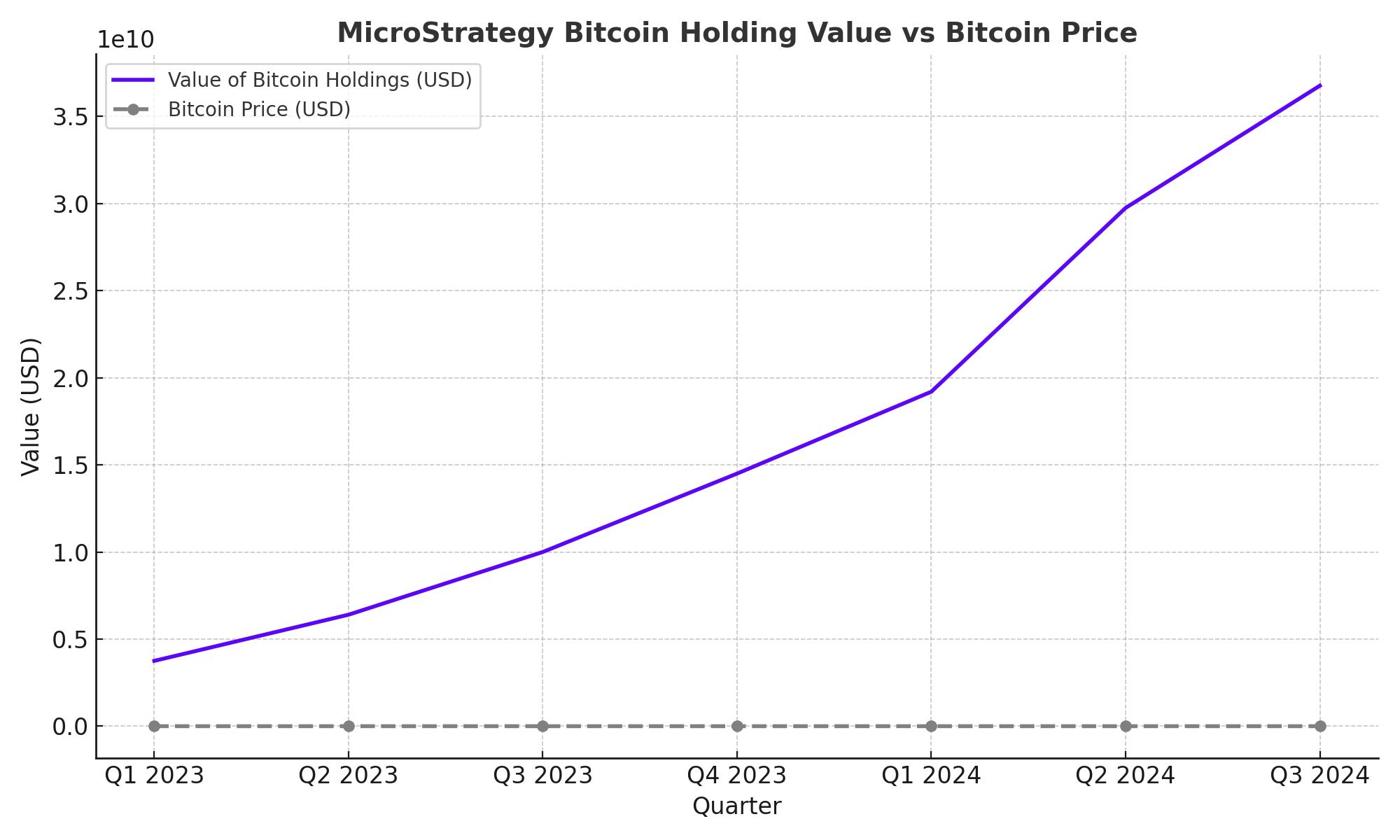

Microstrategy Bitcoin Holding Value (BTC-USD) VS. Bitcoin Price

Evolving Beyond a Treasury: The Emergence of a Bitcoin Bank

Under Michael Saylor’s visionary leadership, MicroStrategy has not just hoarded Bitcoin but actively sought to redefine its role in the financial ecosystem. The company has branded itself as a “Bitcoin bank,” aiming to bridge traditional finance (TradFi) with cryptocurrency. This evolution is rooted in leveraging its NAV premium—the market value of MicroStrategy compared to the value of its Bitcoin holdings.

This premium, which at times has reached three times the NAV of its Bitcoin reserves, has allowed the company to implement innovative financing strategies. By issuing zero-interest convertible notes and engaging in At-The-Market (ATM) equity offerings, MicroStrategy has raised billions to acquire additional Bitcoin. The result is a self-reinforcing cycle: as the company buys more Bitcoin, its stock becomes increasingly attractive to investors seeking Bitcoin exposure, driving up share prices and enabling further acquisitions.

Beyond financing, MicroStrategy has expanded its offerings to include consultancy services for corporations interested in adopting Bitcoin. This strategic shift positions the company as a thought leader in the crypto space, fostering credibility and enhancing its competitive edge. MicroStrategy’s potential to offer Bitcoin-backed financial products—such as margin loans—adds another dimension to its growth prospects, particularly if Bitcoin evolves into a global reserve currency.

Institutional Demand: A Testament to MSTR’s Strategic Position

MicroStrategy’s ability to attract institutional investors is a cornerstone of its strategy. The company’s recent $2.6 billion zero-interest convertible debt issuance, nearly double the initial $1.75 billion target, exemplifies its appeal. Investors like Allianz SE, Germany’s largest insurance company, participated in this offering, signaling confidence in Bitcoin-backed financial instruments despite a high-interest-rate environment.

The convertible notes are structured with a conversion price 60% above MSTR’s current market value, underscoring institutional optimism about MicroStrategy’s future. This innovative financing has allowed the company to expand its Bitcoin holdings without imposing significant interest burdens, creating a financial model that aligns with its long-term strategy.

The Bull Case: Justifying the NAV Premium

MicroStrategy’s valuation consistently trades at a premium to the net asset value (NAV) of its Bitcoin holdings. This premium is justified by several factors, including its status as the largest publicly traded Bitcoin holder, its first-mover advantage, and its efforts to position itself as a financial intermediary for Bitcoin adoption. The company’s role as a “Bitcoin bank,” offering consultancy and potentially Bitcoin-backed financial products, enhances its appeal to investors seeking regulated exposure to cryptocurrency.

As of late 2024, the company’s Bitcoin holdings were valued at $37 billion, while its market capitalization exceeded $100 billion. This disparity highlights investor expectations for significant future growth, driven by Bitcoin’s appreciation and MicroStrategy’s strategic initiatives.

Financial Performance: A Dual Narrative

While Bitcoin has become the centerpiece of MicroStrategy’s narrative, its traditional enterprise software business continues to contribute to revenue. In Q3 2024, the company reported $116 million in revenue, a 10% decline year-over-year. However, these figures have taken a backseat to Bitcoin-related metrics, such as the BTC Yield—a measure of Bitcoin holdings per share—which reached 20.4% month-to-date in November 2024, far exceeding the company’s annual target of 6-10%.

Earnings per share (EPS) projections also reflect Bitcoin’s influence. For FY2025, analysts estimate EPS at $67.54, a stark contrast to the -$2.38 projected for FY2024. This anticipated turnaround hinges on Bitcoin’s continued appreciation, underscoring the high-stakes nature of MicroStrategy’s strategy.

Risks and Vulnerabilities: Navigating Uncharted Waters

MicroStrategy’s Bitcoin-centric approach is not without risks. The company’s heavy reliance on Bitcoin exposes it to the cryptocurrency’s notorious volatility. A significant price drop could impair its ability to meet debt obligations or raise additional capital, particularly given its reliance on convertible debt and equity offerings.

Regulatory uncertainty further compounds these risks. As governments and regulators worldwide grapple with how to oversee cryptocurrency markets, changes in policy could impact MicroStrategy’s operations. For instance, stricter regulations on corporate Bitcoin holdings or transactions could limit its ability to execute its strategy.

The company’s leveraged position adds another layer of vulnerability. While the use of zero-interest debt has minimized immediate costs, it increases the risk of financial strain during market downturns. Additionally, the potential for shareholder dilution through future equity offerings could deter long-term investors.

Insider Activity: Signals from Within

Recent insider transactions have provided mixed signals about MicroStrategy’s outlook. Executive Vice President Wei-Ming Shao sold 18,000 shares for $6.6 million, while CFO Andrew Kang sold 5,700 shares for $1.46 million. These transactions represent significant profit-taking but also reflect confidence in the stock’s current valuation.

These insider movements can be explored further on the company’s stock profile page.

A Unique Role in the Crypto Ecosystem

MicroStrategy’s influence extends beyond its corporate strategy to its impact on the broader cryptocurrency market. On several occasions, its Bitcoin purchases have exceeded the combined inflows of all Bitcoin ETFs, underscoring its role as a major market participant. This buying power has made MicroStrategy an essential player in Bitcoin’s price dynamics, further solidifying its position as a market leader.

The company’s approach has also inspired imitators, with smaller firms adopting similar strategies to gain Bitcoin exposure. While this trend could increase competition, MicroStrategy’s first-mover advantage and scale provide it with a significant edge.

Strategic Vision: Betting on Bitcoin’s Future

MicroStrategy’s commitment to Bitcoin as a global reserve asset defines its long-term vision. The company’s ambitious “21/21” plan, which aims to raise $42 billion over three years to expand its Bitcoin holdings, reflects its confidence in this thesis. If successful, this initiative could position MicroStrategy as a dominant force in the crypto economy, holding an even larger share of Bitcoin’s total supply.

However, this vision comes with inherent risks. The company’s success depends on Bitcoin’s continued adoption and appreciation. Any significant deviation from this trajectory could undermine its strategy, highlighting the high-stakes nature of its approach.

For more real-time updates on MicroStrategy’s performance, visit here.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback