Monday.com (NASDAQ:MNDY): A High-Growth SaaS Giant Redefining Workflow Management

Monday.com’s Position in the SaaS Landscape

Monday.com (NASDAQ:MNDY) has emerged as a leader in the SaaS ecosystem, delivering robust solutions for work management, CRM, and enterprise collaboration. Known for its innovative low-code, no-code platform, Monday.com provides businesses with highly customizable tools that stand apart from legacy players like Salesforce and ServiceNow. As of its most recent trading levels near $278, the stock reflects the company’s strong financial foundation, strategic investments, and accelerating adoption across enterprises worldwide.

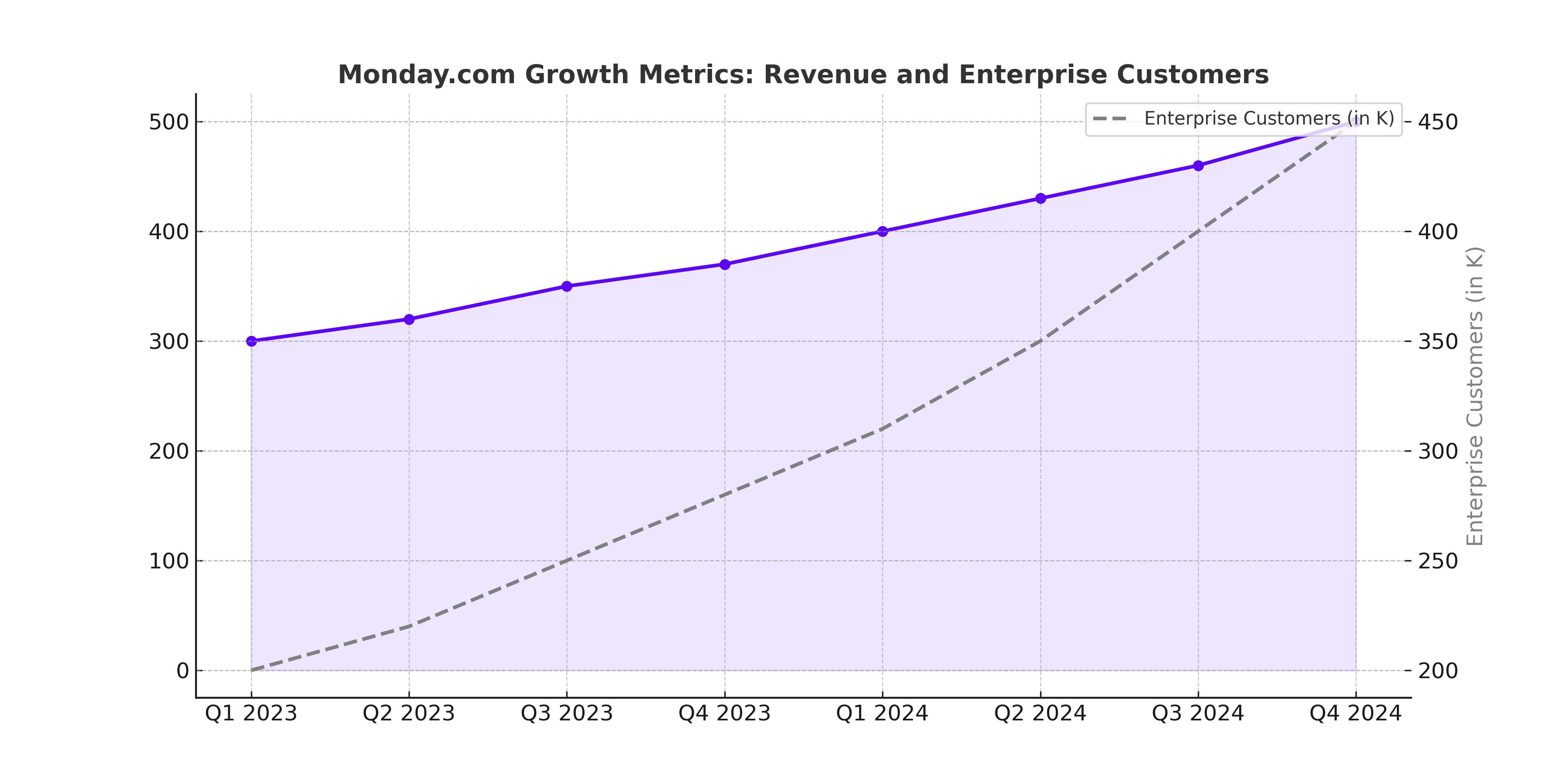

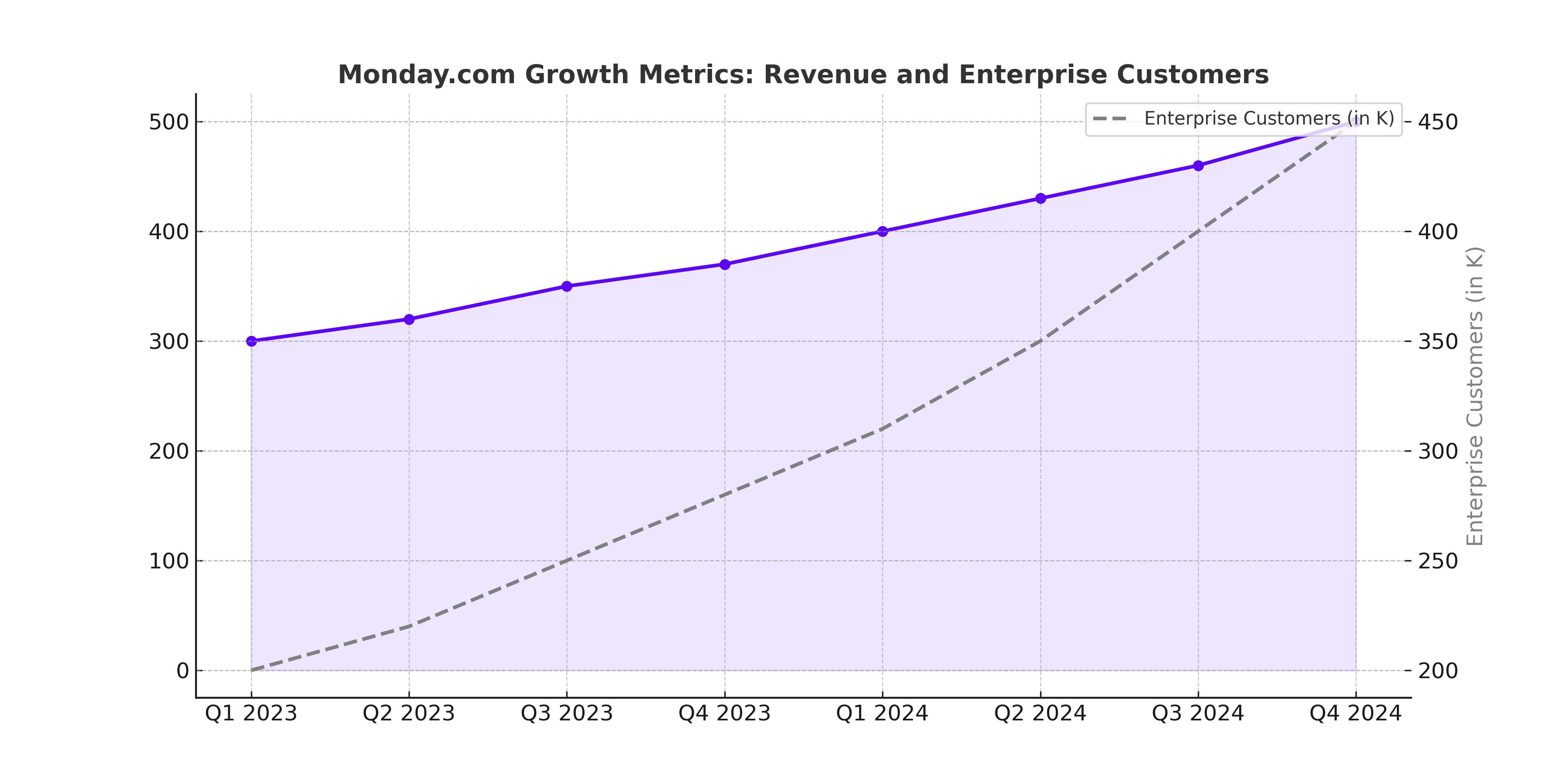

In Q3 2024, the company crossed the landmark of $1 billion in annual recurring revenue (ARR), driven by 33% year-over-year revenue growth. Larger enterprise clients have increasingly turned to Monday.com, as evidenced by a 44% increase in customers generating more than $100,000 in ARR. The continued expansion into AI-driven automation and the introduction of new products such a s Monday Service signal the company’s intent to capture a greater share of the estimated $100 billion total addressable market.

s Monday Service signal the company’s intent to capture a greater share of the estimated $100 billion total addressable market.

Monday.com’s stock performance has remained strong despite broader market volatility, with its valuation underpinned by consistent top-line growth and robust free cash flow generation. Investors are watching closely to see how its evolving product suite and enterprise focus could drive the next leg of growth in 2025 and beyond.

Track Monday.com’s Real-Time Stock Performance

Expanding Enterprise Adoption Through Innovation

Monday.com’s success is largely attributed to its ability to scale effectively while maintaining a reputation for innovation. The platform offers businesses across industries a unified workspace for managing workflows, projects, and customer relationships. Its flagship workflow management tools, combined with CRM and service management offerings, have positioned the company to compete effectively against entrenched competitors like Atlassian, Asana, and ServiceNow.

A significant driver of Monday.com’s growth has been its enterprise-focused strategy. Customers with ARR exceeding $50,000 grew 40% year-over-year, while those generating over $100,000 rose by 44%. The ability to scale adoption among larger organizations is a testament to the platform’s flexibility and performance, particularly with the introduction of MondayDB 2.0, which enhances scalability for enterprise deployments.

While smaller competitors like Asana reported just 10% year-over-year growth in their latest quarters, Monday.com’s 33% growth highlights its increasing dominance in the space. Its ability to offer a customizable and intuitive solution resonates strongly with enterprises looking to modernize their workflow and collaboration tools without being burdened by rigid, legacy platforms.

AI-Driven Innovation Enhances Competitive Advantage

One of Monday.com’s standout offerings is its AI-enabled workflow blocks, which allow businesses to streamline processes and automate complex tasks with minimal technical expertise. Popular features such as thread summarization, data extraction, and risk assessment have seen a 150% increase in adoption compared to the prior quarter. These tools not only improve productivity but also position Monday.com as a leader in integrating AI capabilities into everyday business operations.

In addition to enhancing its core workflow management tools, Monday.com has embedded AI functionality across its CRM and service management offerings. Monday Service, set to officially launch by the end of 2024, is designed to disrupt the service management market by automating ticket resolution and improving customer support efficiency. Competing directly with ServiceNow, Monday Service is expected to capitalize on an $11 billion market opportunity while offering a more accessible price point for enterprises.

The introduction of AI-driven CRM tools has also bolstered adoption among enterprise clients. Features such as email marketing automation and collaborative sales management differentiate Monday CRM from competitors like Salesforce, enabling it to win customers in a crowded market.

Robust Financials and Free Cash Flow Growth

Monday.com’s financial strength is reflected in its $1.4 billion cash reserve and absence of debt, providing unmatched stability in a competitive SaaS market. With gross margins at a stellar 89.65%, up from 88.53% in the prior year, the company demonstrates an exceptional ability to generate profitability even as it invests heavily in growth.

The company’s free cash flow margin reached 33% in Q3, significantly above the 22% forecast at the start of the year. This performance underscores Monday.com’s ability to scale efficiently while maintaining cost discipline. Despite elevated spending on sales and marketing to support expansion, the company achieved a Rule of 66—a combination of 33% revenue growth and a 33% free cash flow margin.

Dilution remains minimal, with fully diluted shares increasing by just 2.3% year-over-year. Stock-based compensation as a percentage of revenue has also decreased, signaling management’s commitment to shareholder alignment while retaining top talent.

Insider Transactions and Leadership Stability

As a founder-led company, Monday.com benefits from strong alignment between leadership and shareholders. Co-founders Roy Mann and Eran Zinman hold 15.4% of outstanding shares, reinforcing their vested interest in the company’s long-term success. Insider transactions have been a point of interest, with details available on the Monday.com Insider Transactions Page.

Recent leadership changes, including the appointment of Adi Dar as COO, have strengthened the company’s operational capabilities. While the departure of Chief Revenue Officer Yoni Osherov introduced some uncertainty, the focus on scaling enterprise operations and expanding sales capacity has reassured investors.

Valuation: Justifying a Premium for Growth

Trading at approximately 11.3x EV/S, Monday.com’s valuation reflects its superior growth trajectory and profitability compared to peers like Atlassian and Asana. Analysts forecast revenues of $1.53 billion by 2026, implying a 30% CAGR over the next two years. With a free cash flow margin expected to reach 35% by 2025, the stock’s forward price-to-free cash flow multiple of 30x appears justified given its growth potential.

Monday.com’s evolving product suite, including the upcoming Monday Service, is expected to drive incremental ARR and expand its addressable market. The company’s multi-product strategy, combined with its AI capabilities, positions it for sustained 30%+ revenue growth, making it an attractive investment in the SaaS space.

That's TradingNEWS

s Monday Service signal the company’s intent to capture a greater share of the estimated $100 billion total addressable market.

s Monday Service signal the company’s intent to capture a greater share of the estimated $100 billion total addressable market.