Morgan Stanley (NYSE:MS) Stock Has Soared 35% – But Is There 20% Upside Left?

With a 35% Gain in 2024, Is Morgan Stanley Overvalued or Still a Buy? | That's TradingNEWS

Morgan Stanley (NYSE:MS) Stock Analysis – Is the Rally Sustainable or Are Risks Growing?

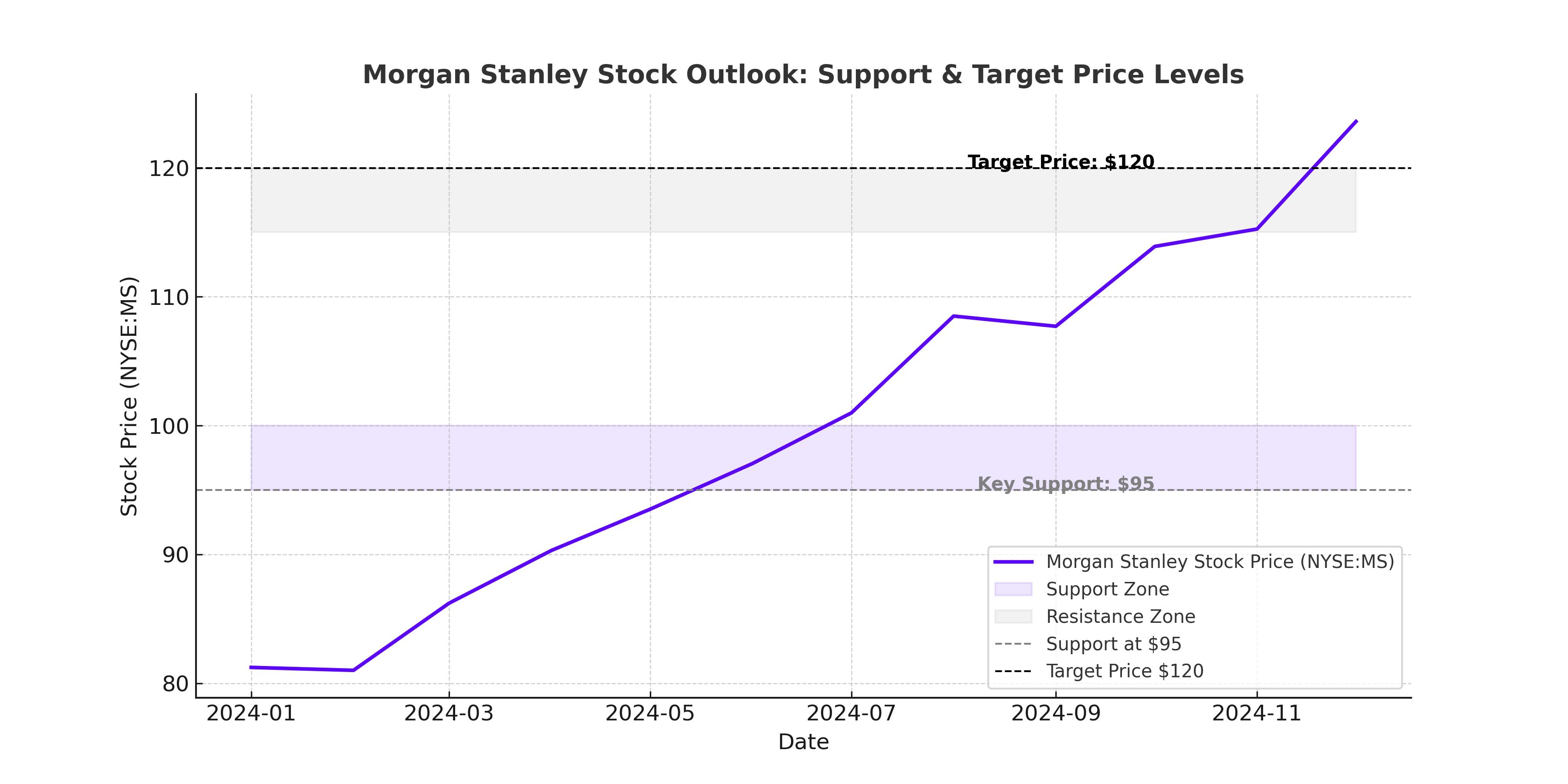

Morgan Stanley (NYSE:MS) has been on an impressive run, surging 35% in 2024 and outperforming the S&P 500 by 10 percentage points. But as the stock trades near all-time highs and at a valuation premium compared to peers like Goldman Sachs (NYSE:GS), investors are now faced with a key question: Can MS sustain its momentum, or is it time to take profits?

Q4 Earnings Performance – Strong Across Core Segments

Morgan Stanley’s latest earnings report showcased impressive revenue growth, particularly in its Institutional Securities and Wealth Management divisions. The firm reported Q4 revenue of $16.22 billion, representing a 7.92% year-over-year increase, and an EPS of $2.22, significantly beating expectations with a 32.13% surprise.

Institutional Securities revenue surged 47.2% YoY, with equities trading revenue jumping 51% and investment banking revenue rising 25%, reflecting a robust environment for deal-making and market activity. Meanwhile, Wealth Management was the firm’s biggest revenue contributor, bringing in $7.48 billion, or 46% of total revenue. Higher asset values and strong net inflows contributed to this segment’s strength, reinforcing Morgan Stanley’s growing reliance on its wealth advisory business.

Investment Management also showed steady performance, with a 12% YoY rise in net revenue, driven by higher market valuations and $4.3 billion in long-term net inflows. Total assets under management reached $1.67 trillion, solidifying Morgan Stanley’s position as a dominant force in asset management.

Profitability and Cost Efficiency – Margin Expansion Signals Strength

Morgan Stanley’s efficiency ratio—a key measure of cost control—improved substantially, dropping from 84% a year ago to 69% in Q4, signaling strong revenue growth combined with disciplined expense management.

Another positive was the return on tangible common equity (ROTE), which surged to 20.2% in Q4, up from 8.4% in Q3 2023. This metric is crucial in evaluating banks' profitability, and Morgan Stanley’s performance here is a key reason behind its valuation premium over competitors.

Dividend Growth and Shareholder Returns – Strong but Sustainable?

Morgan Stanley’s 2.6% dividend yield is higher than key peers, including Goldman Sachs, Charles Schwab, and JPMorgan. More importantly, the firm has a five-year dividend CAGR of 22%, significantly above the sector average of just 5.4%.

With a payout ratio of 45%, there’s room for continued dividend growth, supported by steady earnings expansion. The company’s aggressive share buyback program, which repurchased $2.5 billion in Q4 alone, further enhances shareholder value. However, the key question is whether MS will continue these buybacks at its current valuation levels, which may be considered stretched.

Valuation Concerns – Is Morgan Stanley Overpriced?

One of the most pressing concerns for investors is valuation. Morgan Stanley’s price-to-tangible book value stands at 3.08x, significantly above Goldman Sachs' 2.06x. Historically, Morgan Stanley has traded at a premium to Goldman, but the current gap is wider than usual.

The forward P/E ratio of 16x is also notably higher than the financial sector average of 12x, raising the question of whether the stock’s upside is limited from here. Analyst price targets reflect this concern, with the consensus target at $144.67, only 5.4% above the current share price.

Another red flag is the stock trading 23% above its 200-day moving average, suggesting a possible near-term pullback as investors look to lock in profits.

Macroeconomic and Policy Risks – Can Regulatory Uncertainty Stall Growth?

Morgan Stanley is benefiting from strong market conditions, but macroeconomic factors remain a wildcard. The Federal Reserve has signaled that it is in no rush to cut interest rates, meaning the expected M&A boom may not materialize as quickly as some had hoped. Rising long-term yields could also impact deal-making activity, one of Morgan Stanley’s key revenue drivers.

Additionally, President Trump’s tariff and financial policy proposals introduce an element of uncertainty. While initial expectations of deregulation boosted bank stocks, concerns about potential tariffs and changes to tax structures—particularly regarding carried interest in alternative investments—could weigh on certain segments of Morgan Stanley’s business.

Competitive Positioning – Wealth Management Is the Key Differentiator

One area where Morgan Stanley continues to stand out is its dominance in wealth management. The firm added significant net new assets in 2024, and its focus on expanding fee-based business helps provide more stable revenue compared to the volatility seen in trading and investment banking.

Notably, six out of the top 10 private wealth management teams in Barron’s 2024 rankings are affiliated with Morgan Stanley, with the top-ranked team managing over $49 billion in AUM. This suggests that even if investment banking faces headwinds, the wealth management division should continue to drive long-term earnings growth.

Final Assessment – Is Morgan Stanley (NYSE:MS) a Buy, Sell, or Hold?

Morgan Stanley has demonstrated strong earnings growth, improving profitability, and dominant positioning in wealth management. However, valuation concerns, macroeconomic risks, and the stock’s significant rally in 2024 suggest that much of the good news is already priced in.

While long-term investors may still find value in holding MS for its dividends and stable wealth management business, buying at current levels carries increased risk. A pullback could present a better entry point, especially given the stock’s overextended technicals.

Verdict: Hold for now, buy on a dip.