NASDAQ:AAPL Stock Struggles – Is Apple Still the Best Tech Investment?

iPhone Sales Decline, China Competition Heats Up – Can Apple Maintain Its Market Dominance? | That's TradingNEWS

Is NASDAQ:AAPL Overvalued or a Long-Term Buy?

Apple Inc. (NASDAQ:AAPL) is facing one of its most challenging investment debates in years. On one hand, the stock remains a dominant force in the market, trading at $227.63, close to all-time highs, with a forward P/E of 28x. On the other, there are growing concerns over iPhone sales, intensified competition in China, longer upgrade cycles, and a mixed reception to its AI strategy. Despite these headwinds, Apple remains a cash-generating machine, with a $3.5 trillion valuation and a rock-solid services business. Investors are now questioning: Is Apple still a buy, or are its best days behind it?

iPhone 16 Sales Disappoint – Is Apple’s Core Business Slowing Down?

For years, Apple’s iPhone business has been its lifeblood, accounting for over 50% of total revenue. However, recent iPhone 16 sales have underwhelmed, with reports indicating a 4% year-over-year decline in Q4. Consumers are holding onto their devices longer, a trend driven by rising prices, minimal innovation in new models, and economic uncertainty.

Historically, Apple has faced skepticism around new iPhone cycles. In 2017, doubts surfaced about whether consumers would pay over $1,000 for a smartphone, yet Apple thrived. The 2020 pandemic brought supply chain concerns, yet demand remained strong. The real question is whether iPhone 16 sales are a short-term hiccup or a sign of a structural slowdown in Apple’s hardware business.

China Becomes a Major Problem – Will Apple Lose Market Share?

Apple’s Greater China region has become a major headache, with revenue declining 11% year-over-year. Competition from Huawei, Vivo, and other domestic smartphone brands is intensifying, as Chinese consumers opt for homegrown alternatives amid U.S.-China trade tensions.

Apple’s reliance on China goes beyond sales—it’s also about supply chains. In 2020, over 50% of Apple’s suppliers were based in China. That figure has since dropped to 33%, as Apple aggressively shifts manufacturing to India and Vietnam. While this diversification helps mitigate risk, Apple remains exposed to China’s economic policies, which could further impact its sales. The question is whether Apple can regain momentum in China or if the region will continue dragging on growth.

Apple’s Services Segment: The Real Growth Engine

Amid concerns over iPhone sales, Apple’s services business has quietly become its biggest long-term strength. In Q1 2025, Apple reported $26 billion in services revenue, a 14% year-over-year increase.

The key to Apple’s services dominance is its 75% gross margin—far higher than hardware sales. Apple’s ecosystem, from App Store commissions to Apple Music, iCloud, and Apple TV+, continues to grow, providing stable, high-margin recurring revenue.

Even with regulatory risks—such as antitrust lawsuits over App Store fees—Apple’s services segment remains a compounding machine. Investors must now ask: Can Apple’s services business continue offsetting slowing iPhone growth?

Apple AI and Custom Silicon – The Next Big Growth Opportunity?

Apple’s AI strategy has been underwhelming compared to competitors like Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL), but that could be changing. The company is betting big on on-device AI, integrating Apple Intelligence into its products to enhance Siri and power AI-driven apps.

Unlike other tech giants that rely on cloud-based AI, Apple’s approach focuses on AI models running locally on devices. This aligns with Apple’s privacy-first philosophy and reduces dependence on expensive cloud computing infrastructure.

Apple is also developing its own AI server chips in partnership with Broadcom (NASDAQ:AVGO). With Taiwan Semiconductor Manufacturing Company (TSMC) producing the chips, Apple is reducing its reliance on NVIDIA (NASDAQ:NVDA) while expanding into the AI-driven computing space.

If Apple can successfully integrate custom AI hardware into its ecosystem, it could drive a new wave of innovation across its devices. The question for investors is: Will AI be a game-changer for Apple, or is the company lagging behind competitors in the AI race?

Smart Home and Wearables – Apple’s Next Big Consumer Play?

Apple is expanding beyond smartphones, with smart home devices and wearables emerging as key growth areas.

The Apple Watch continues to dominate the wearables market, with double-digit sales growth in Q4 2024. Apple’s rumored smart home hub, which could integrate AI-powered assistants with iPhone connectivity, is seen as the next frontier in home automation and digital assistants.

With competitors like Amazon (NASDAQ:AMZN) and Google leading in smart home devices, Apple’s ability to differentiate itself with tight ecosystem integration will be crucial. The big question is whether Apple can turn smart home and wearables into meaningful revenue streams or if these remain niche products.

Is NASDAQ:AAPL Stock a Buy, Sell, or Hold?

With a market cap of $3.5 trillion, Apple is one of the most valuable companies in history, yet it still trades at a 31x forward P/E ratio—a premium compared to competitors like Microsoft (35x) but well above Amazon’s 33x and Meta’s 26x.

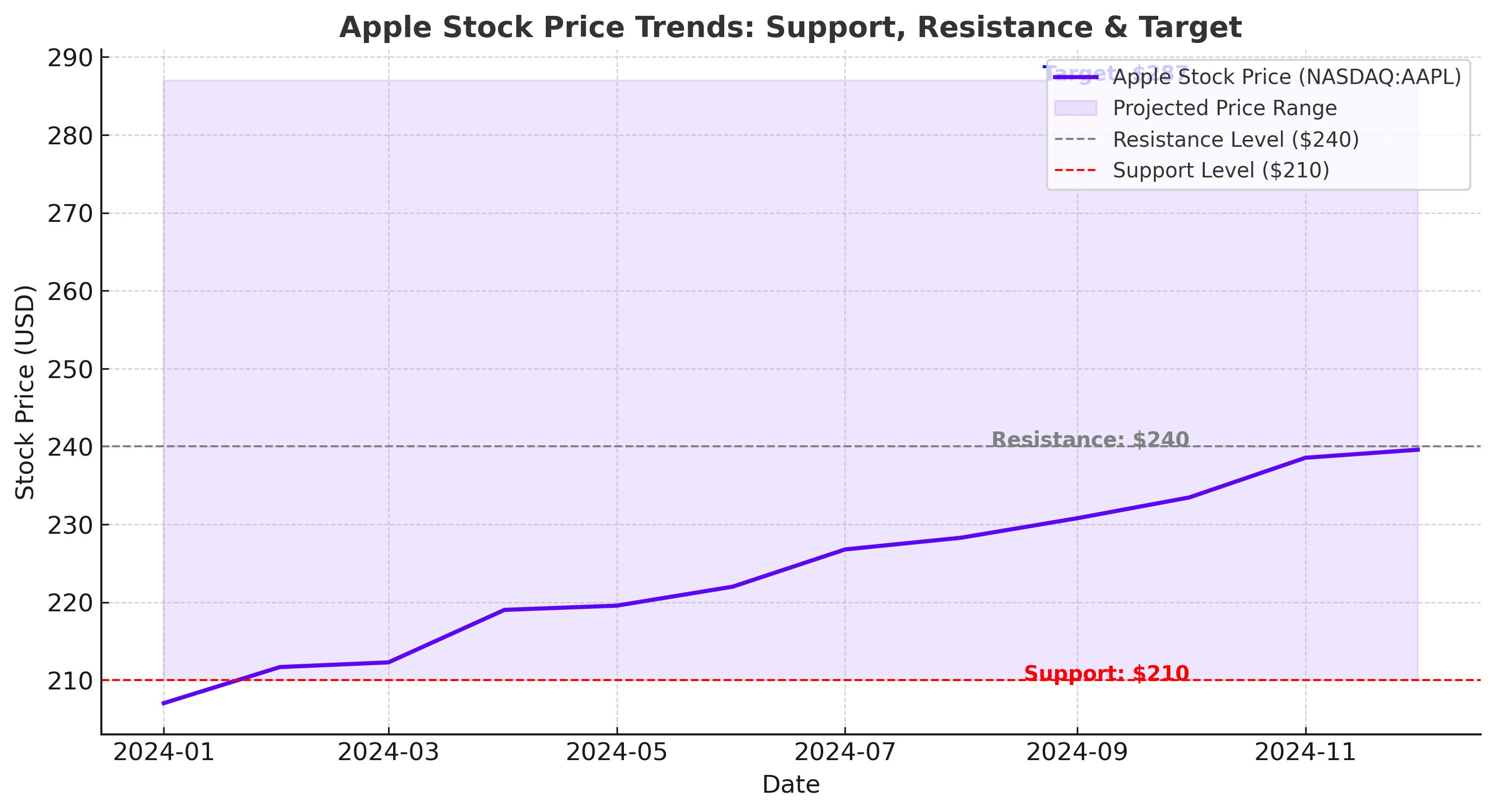

- Key Support Level: $210 – If AAPL falls below this level, it could trigger further downside.

- Major Resistance Level: $240 – A breakout above this could signal a rally to new highs.

- Projected Upside: Analysts estimate a 12-month target of $287 per share, implying a 25% upside.

With Apple’s services business growing, AI potential emerging, and smart home expansion underway, the company remains a formidable force. However, slowing iPhone sales and China risks could cap near-term upside. Investors must decide: Is Apple still the best long-term bet in tech, or is the stock priced for perfection?

Final Verdict – Should You Buy NASDAQ:AAPL Stock Before the Next Big Move?

Apple’s long-term investment case remains strong, but there are real risks ahead. The company is no longer the hyper-growth stock it once was, but it continues to dominate multiple industries while expanding into AI, custom silicon, and smart home technology.

For investors seeking a reliable, cash-generating business with strong brand loyalty, Apple remains a solid buy. However, those looking for explosive growth may need to wait for further clarity on AI and China market dynamics.

With analysts forecasting $287 per share within the next year, this pullback could be a long-term buying opportunity before Apple’s next breakout.