NASDAQ:ARGX Stock Soars on FDA Approval and Impressive Financial Results

Examining the Surge in Argenx SE (NASDAQ:ARGX) Stock: FDA Approval of Vyvgart for CIDP and Strong Financial Performance Drive Market Optimism | That's TradingNEWS

In-Depth Analysis of NASDAQ:ARGX: Financial Performance and Strategic Outlook

Argenx SE (NASDAQ:ARGX), a leading biotechnology company, has been making significant strides in the treatment of autoimmune diseases with its flagship product, Vyvgart (efgartigimod). The company has seen substantial growth and received positive market responses following its recent FDA approval for Vyvgart Hytrulo for chronic inflammatory demyelinating polyneuropathy (CIDP). This analysis delves into the company's recent performance, market position, and future potential.

Recent Financial Performance and Market Reaction

Q1 Earnings Report and Stock Performance

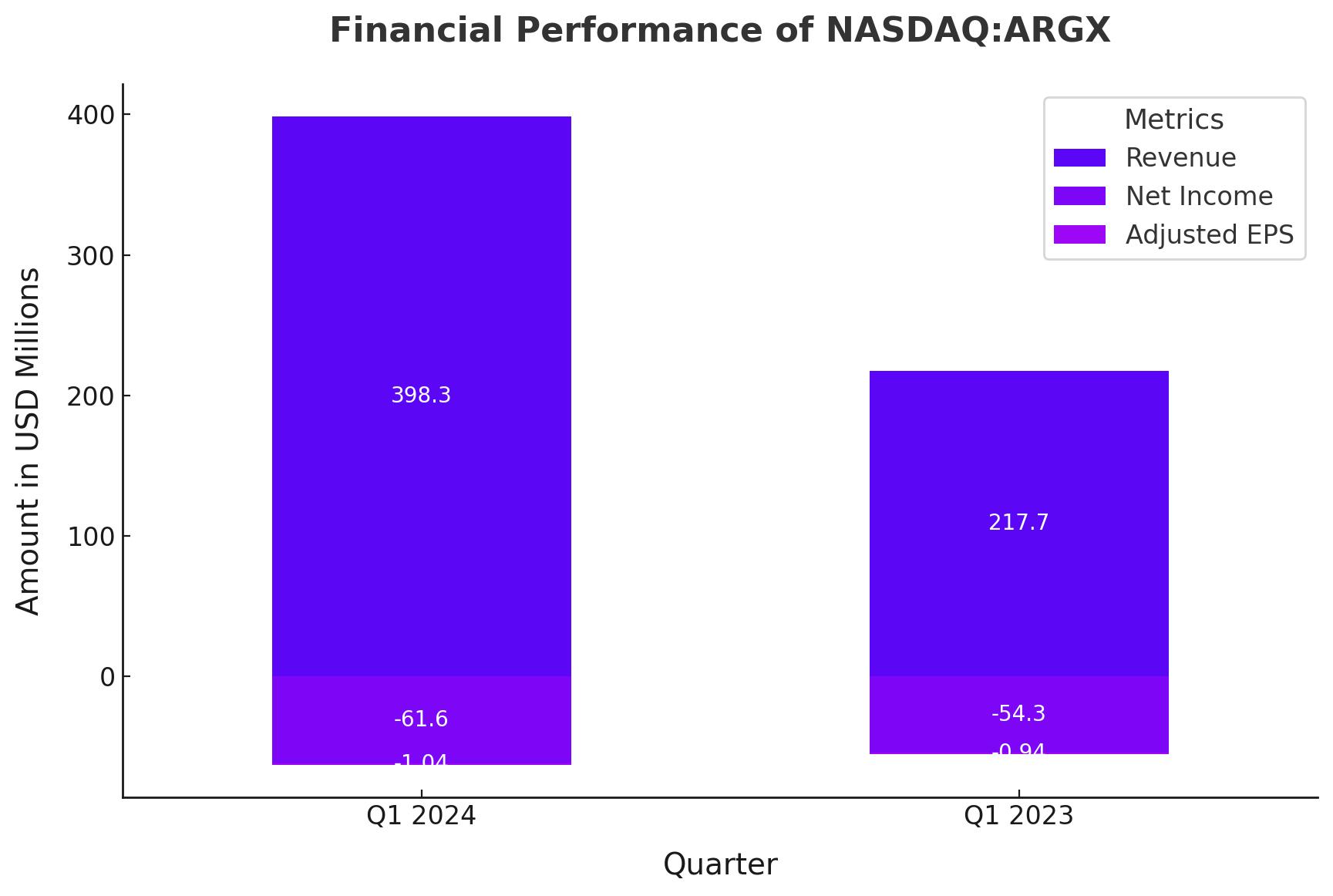

Argenx SE (NASDAQ:ARGX) delivered an impressive financial performance in its latest quarterly report, showcasing significant growth. The company achieved revenues of $398.3 million, an 83% increase compared to the same period last year, primarily driven by the strong market performance of Vyvgart. Despite this revenue surge, argenx reported a net loss of $61.6 million, translating to a loss of $1.04 per ADS. Nonetheless, the market reacted favorably to these results, with the stock opening at $464.36 on Thursday, reflecting investor confidence in the company’s growth trajectory.

Stock Ratings and Price Targets

The robust financial results have prompted several analysts to revise their price targets for argenx. Truist Financial raised its price target from $480.00 to $540.00, assigning a “buy” rating to the stock. Similarly, Oppenheimer upgraded its rating to “outperform” with a new price target of $546.00. Although Morgan Stanley slightly reduced its price objective to $510.00, it maintained an “overweight” rating on the stock. The consensus among analysts remains highly positive, with an average price target of $535.37 and a general “moderate buy” recommendation, indicating strong confidence in the company’s future prospects.

Strategic Developments and Future Outlook

FDA Approval and Market Expansion

The FDA's approval of Vyvgart Hytrulo for CIDP marks a significant milestone for argenx. The approval is expected to expand the addressable market substantially, with the estimated net price per patient per year for CIDP patients being approximately $450,000. This is double the price for generalized myasthenia gravis (gMG) patients due to higher dosing frequencies. The company estimates there are around 48,000 CIDP patients in the U.S., with an initial target of 12,000 patients who are not well controlled on existing therapies. This represents a potential $5.5 billion annual market in the U.S. alone.

Vyvgart's Market Performance and Projections

Vyvgart has shown strong commercial performance since its launch, with U.S. sales for gMG reaching $94 million in the first two quarters. The recent CIDP approval is expected to contribute significantly, with anticipated net sales exceeding $700 million in 2025. The company's overall revenue for 2025 is projected to be between $3.1 billion and $3.2 billion, driven by continued growth in gMG, expansion into CIDP, and the introduction of a prefilled syringe version of Vyvgart Hytrulo.

Potential Market Risks and Mitigation Strategies

Competitive Landscape and Emerging Threats

Despite the bullish outlook for argenx, it is crucial to acknowledge the competitive landscape and potential risks. The approval of Vyvgart has positioned argenx as a leader in the FcRn inhibitor market, but competition from major pharmaceutical companies remains intense. For instance, Johnson & Johnson's nipocalimab and UCB's Rystiggo have demonstrated strong efficacy in reducing IgG levels, posing significant competition to Vyvgart. Argenx’s strategy to mitigate these threats includes the timely launch of the prefilled syringe version of Vyvgart Hytrulo and the development of next-generation candidates like ARGX-213.

Regulatory and Clinical Risks

While regulatory approval for Vyvgart in CIDP is a significant milestone, the company must navigate additional regulatory hurdles for other indications. The recent discontinuation of Vyvgart’s development for PC-POTS and previous failures in immune thrombocytopenia and pemphigus vulgaris highlight the inherent risks in clinical trials. Argenx’s robust cash position of $3.1 billion and no debt provide a financial cushion to support ongoing and future clinical trials, reducing financial risk.

Financial Performance and Future Projections

The financial outlook for argenx is promising, with revenue from Vyvgart expected to approach or slightly exceed $2 billion in 2024. The CIDP market alone is projected to contribute over $700 million in 2025, with global sales potentially reaching $3.1-$3.2 billion. This growth trajectory is supported by the continued expansion of Vyvgart’s indications and the expected approval of the prefilled syringe version, which will enhance patient convenience and market penetration.

Insider Transactions and Institutional Confidence

Institutional confidence in argenx is reflected in the recent increase in holdings by various asset management firms. For example, Blue Trust Inc. increased its holdings by 620%, while J.Safra Asset Management Corp raised its stake by 590%. These moves signal strong institutional belief in argenx’s growth potential. Investors should keep an eye on insider transactions for further insights into the company’s prospects. Detailed insider transaction data can be accessed at argenx Insider Transactions.

Pipeline Development and Long-Term Growth

Argenx’s pipeline extends beyond Vyvgart, with empasiprubart targeting three autoimmune diseases and ARX-119 being developed for congenital myasthenic syndrome and amyotrophic lateral sclerosis. The company’s goal to have 15 indications under regulatory review or clinical investigation by 2025 underscores its commitment to long-term growth. This diversified pipeline reduces dependency on a single product and positions argenx to capitalize on multiple market opportunities.

Analyst Ratings and Market Sentiment

The positive market sentiment is further reinforced by analyst ratings. More than a dozen firms, including Wedbush, Jefferies, and Citigroup, have reiterated or assigned Buy ratings on argenx, with price targets ranging from $468 to $607. This consensus reflects a strong belief in the company’s strategic direction and growth potential. On average, analysts expect argenx to transition from a net loss of $3.03 per share in 2024 to a net gain of $3.30 per share in 2025, highlighting significant anticipated growth.

Strategic Recommendations

Argenx’s financial performance, strategic initiatives, and market positioning make it a compelling buy for long-term investors. The company’s flagship product, Vyvgart, has shown significant commercial success, with sales reaching $1.2 billion in FY23. The recent FDA approval for Vyvgart’s use in treating chronic inflammatory demyelinating polyneuropathy (CIDP) expands its market potential significantly. This approval alone opens up a near $5.5 billion market opportunity in the United States, with a high net price per patient due to the chronic nature of CIDP treatment. This expected revenue surge from CIDP patients, coupled with the drug’s existing success in treating generalized myasthenia gravis (gMG), underpins a strong growth trajectory for Vyvgart.

The strategic development of next-generation therapies, such as the prefilled syringe (PFS) version of Vyvgart, positions argenx competitively against other players developing self-administered treatments. The PFS version is anticipated to further penetrate the market by offering enhanced convenience, which could drive higher adoption rates among patients who prefer self-administration over frequent visits to healthcare providers. This strategic move is not just defensive but also aims at expanding market share by addressing patient preferences and improving treatment accessibility.

Moreover, argenx’s diversified pipeline adds another layer of growth potential. The company is advancing efgartigimod, the active ingredient in Vyvgart, for several other autoimmune conditions, including thyroid eye disease, Sjogren's syndrome, and myositis. Each of these indications represents significant market opportunities and could contribute substantially to future revenues. The clinical success of these trials could solidify argenx’s position as a leader in autoimmune disease therapies.

Institutional confidence in argenx is robust, with notable increases in holdings by major asset management firms, signaling strong market belief in the company's growth potential. This confidence is further reflected in positive analyst ratings, with price targets frequently revised upwards following recent strategic and clinical successes.

Conclusion

Argenx (NASDAQ:ARGX) stands at a pivotal point, well-positioned for sustained growth driven by strategic initiatives and favorable market conditions. The FDA approval of Vyvgart for CIDP is a major milestone that significantly broadens the drug’s market potential, with an anticipated annual revenue contribution of over $700 million from the U.S. alone. This approval not only validates Vyvgart’s efficacy but also sets the stage for its expanded use in other indications, further enhancing its market footprint.

The company’s robust financial health, evidenced by its substantial cash reserves of $3.1 billion and no debt, provides a strong foundation for continued investment in its pipeline and strategic initiatives. This financial stability allows argenx to navigate the competitive landscape effectively and invest in next-generation therapies that could further differentiate it from competitors.

Despite the inherent risks associated with clinical trials and regulatory approvals, argenx’s proactive strategies to mitigate these risks, such as developing a more convenient prefilled syringe version of Vyvgart and advancing other promising candidates like empasiprubart, highlight its commitment to innovation and market leadership. The company’s ability to adapt and address competitive threats positions it favorably for future growth.

Investors should capitalize on argenx’s upward trajectory, driven by its strategic expansions, solid financials, and positive market sentiment. The ongoing development of additional indications for Vyvgart, combined with a promising pipeline of new therapies, underscores a long-term growth outlook that makes argenx a valuable addition to an investment portfolio. Staying informed about market trends and regulatory developments will be key to leveraging the full potential of this investment opportunity.