Constellation Energy (NASDAQ:CEG): Can Its $305 Stock Justify Its AI-Driven Clean Energy Expansion?

With a $26.6B Calpine acquisition and 13% annual EPS growth target, is Constellation Energy (NASDAQ:CEG) a buy as it leads the AI-driven energy revolution? | That's TradingNEWS

Dominance in Clean Energy: Constellation Energy (NASDAQ:CEG) Emerges as a Leader

Constellation Energy’s Unmatched Nuclear and Renewable Energy Portfolio

Constellation Energy (NASDAQ:CEG), trading at $305.19, has asserted itself as the largest clean energy producer in the U.S. This dominance stems from its unrivaled nuclear power generation capacity, a portfolio of renewable energy assets, and its ability to secure transformative contracts with global tech giants like Microsoft. In 2024, CEG’s revenues surged by 33.9% year-over-year, reaching $87.52 billion, driven by its leadership in zero-emission energy and its strategic response to the rising power demands of AI and data centers.

High-performance computing (HPC) now accounts for 51% of CEG’s revenue, up from 42% in 2023. This growth reflects its pivotal role in supporting the exponential energy needs driven by AI and hyperscaler infrastructure. The company’s 95% nuclear capacity factor reinforces its reliability, while agreements such as its 20-year partnership with Microsoft ensure a steady revenue stream.

The Transformative $26.6 Billion Calpine Acquisition

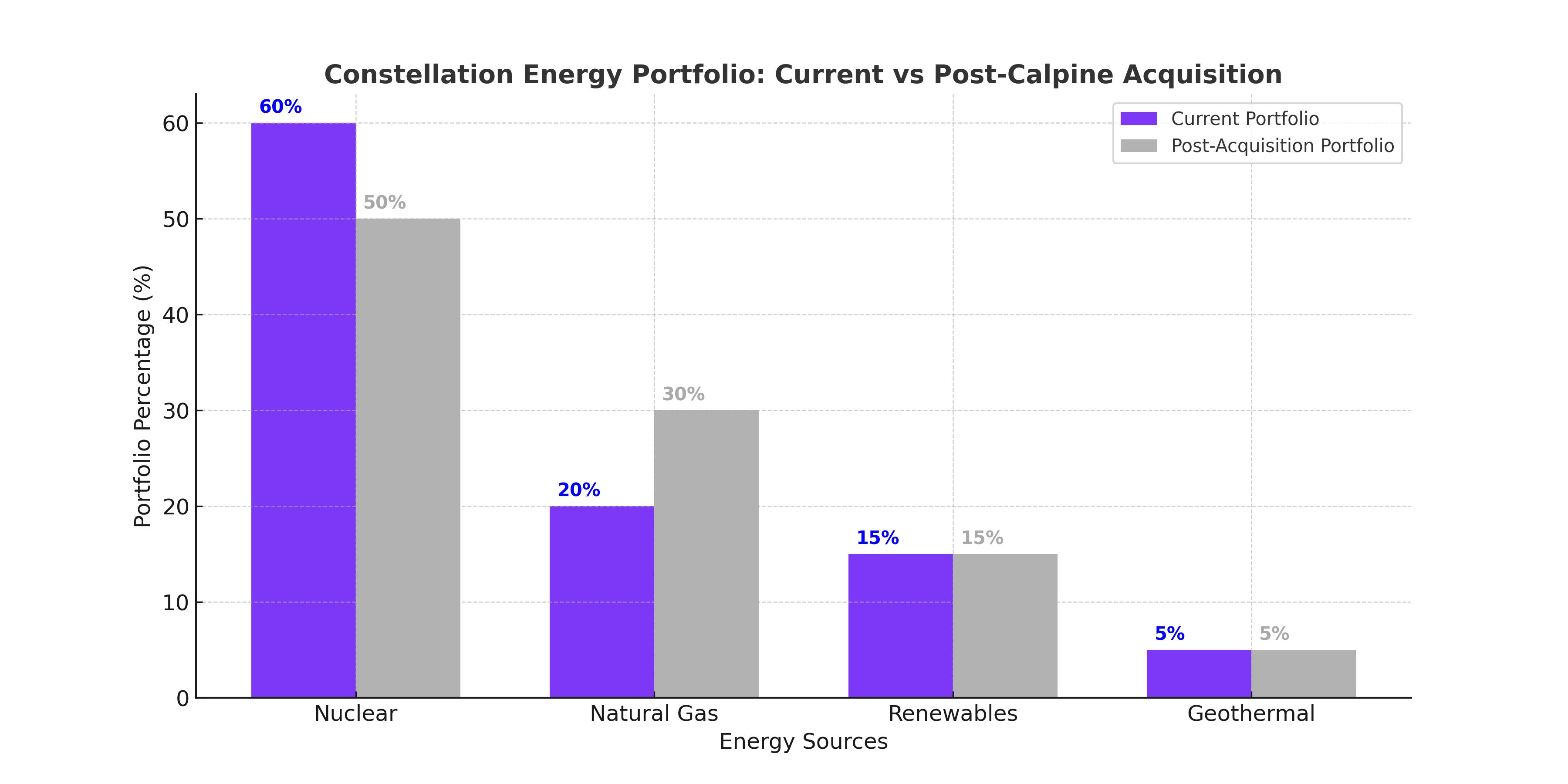

Constellation’s acquisition of Calpine Corporation for $26.6 billion marks a strategic shift, expanding its portfolio into natural gas and geothermal power. This deal solidifies CEG’s position as the largest U.S. clean energy provider, adding 27,000 megawatts of capacity to its arsenal. The transaction, comprising $4.5 billion in cash, $12.7 billion in assumed debt, and 50 million CEG shares (now worth $15 billion at $305/share), underscores the company’s commitment to diversification.

Investors have responded positively, with CEG stock surging 25% post-announcement, reflecting market confidence in the merger’s potential to deliver $2 billion in free cash flow annually and increase EPS by at least $2 by 2026. The integration of Calpine’s assets offers Constellation a broader array of energy products, catering to diverse customer needs while mitigating reliance on nuclear energy.

Strategic Expansion and Regulatory Tailwinds

CEG’s geographic and operational expansion further insulates it from geopolitical and market risks. The company’s $65 billion investment in the Arizona Fab 21 facility, already yielding 4% higher output than its Taiwan counterparts, demonstrates its ability to meet growing energy demands efficiently. Similarly, its $10 billion Japanese facility focusing on geothermal power addresses the increasing demand for diversified energy sources.

Despite challenges such as FERC’s regulatory hesitations on co-locating nuclear plants with data centers, bipartisan support for nuclear energy continues to bolster Constellation’s position. Legislative initiatives like the ADVANCE Act and President-elect Trump’s renewed focus on energy security suggest a favorable policy environment for CEG’s growth.

Financial Strength and Valuation

Constellation’s financial performance reflects its operational efficiency and strategic foresight. Q3 2024 GAAP EPS soared to $3.82, with adjusted operating earnings reaching $2.74 per share. The company subsequently raised its full-year EPS guidance to $8.00–$8.40, signaling continued confidence in its growth trajectory.

With a BBB+ credit rating and long-term debt of $9.26 billion—significantly lower than competitors like Duke Energy ($79.54 billion) and Exelon ($44.01 billion)—CEG demonstrates financial discipline. Its return on assets (5.22%) outpaces its peers, underscoring superior capital utilization.

However, at a forward P/E of 29.3x, Constellation trades at a premium relative to the utility sector median of 18.3x. Analysts forecast a fair value of $276–$300, suggesting the current price incorporates much of the anticipated growth. Yet, with a forward PEG ratio of 2.25x, the stock remains attractive for long-term investors, given its 13% annual EPS growth target through 2030.

AI-Driven Growth and Long-Term Prospects

The burgeoning demand for clean energy from AI applications positions Constellation for sustained growth. By 2030, AI data centers are projected to consume 12% of U.S. electricity, a fourfold increase from 2023 levels. Contracts like Microsoft’s 20-year agreement highlight Constellation’s strategic advantage in this space, ensuring steady revenue streams and further entrenching its market dominance.

Additionally, CEG’s commitment to innovation, including its $1.6 billion Crane Clean Energy Center project and exploration of small modular reactors (SMRs) with Rolls-Royce Nuclear, reflects its forward-thinking approach. These initiatives align with its goal of achieving 100% carbon-free electricity by 2040, solidifying its position as a clean energy leader.

Risks and Challenges

Despite its robust growth prospects, Constellation faces risks, including regulatory delays for the Three Mile Island restoration and competition from renewable energy providers. Financially, the $900 million in debt maturing in 2025 and significant capital expenditures for the Microsoft contract may strain cash flows. However, its strong balance sheet and recurring revenues from long-term contracts mitigate these concerns.

Conclusion: Is NASDAQ:CEG a Buy at $305?

Constellation Energy’s dominance in clean energy, coupled with its strategic expansion into natural gas and AI-driven infrastructure, makes it a compelling investment. While its valuation appears stretched, the company’s 13% annual EPS growth target and robust financial health justify its premium pricing. Regulatory and financial challenges exist but are outweighed by its long-term growth potential.

For investors seeking exposure to the AI-powered energy revolution, Constellation Energy (NASDAQ:CEG) remains a strong buy on dips, offering a unique combination of stability and innovation in a rapidly evolving market.

For real-time stock updates, visit Constellation Energy’s real-time chart.