NASDAQ:DJT’s Explosive Election-Fueled Rally – Stock Jumps 18% Amidst Wild Market Swings!

From meme stock status to political speculation, DJT surges 10% after-hours as Trump’s campaign momentum drives investors. High risk, high reward – will the rally hold? | That's TradingNEWS

(NASDAQ:DJT) - Explosive Market Movements Amidst Election Drama

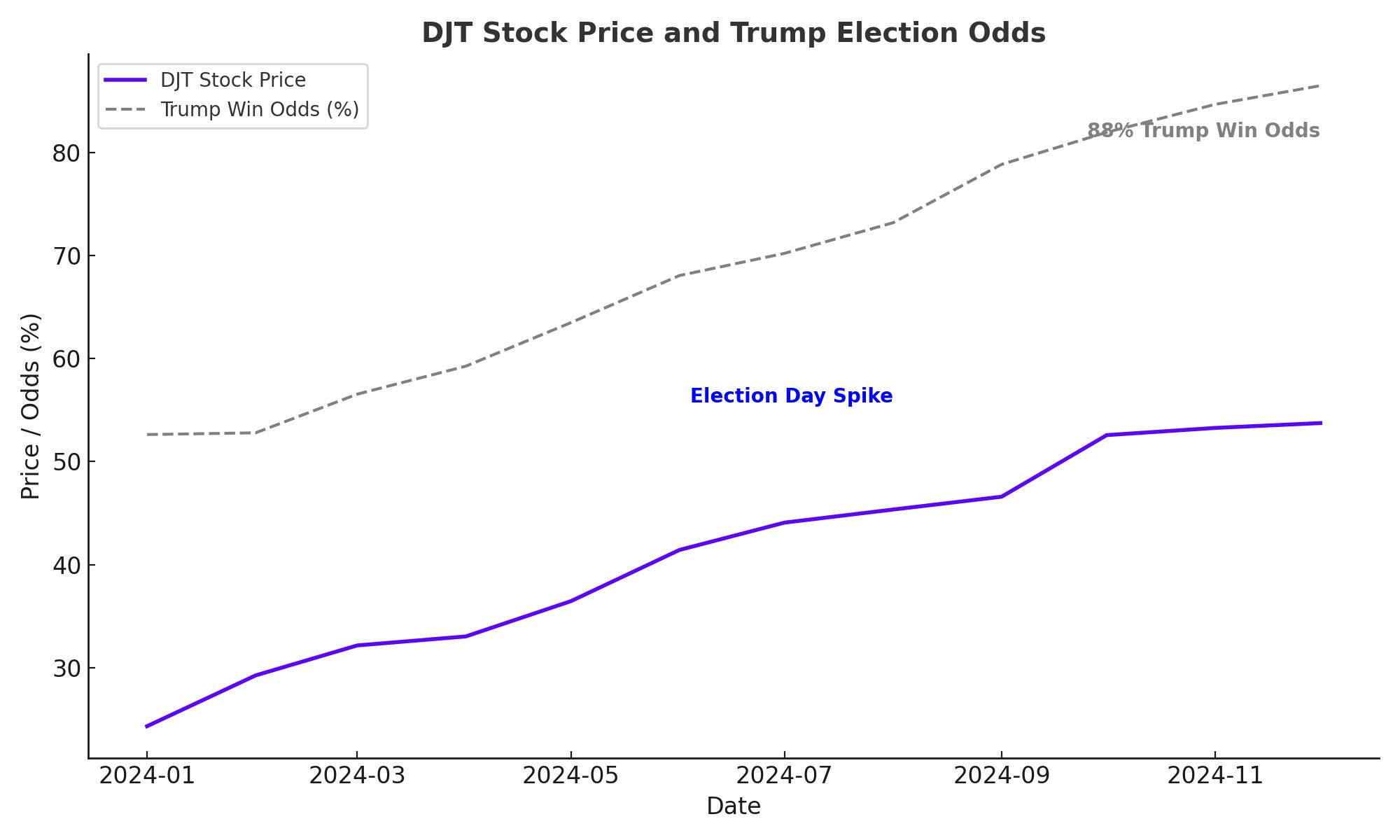

The Trump Media & Technology Group (NASDAQ:DJT) has been on an extraordinary rollercoaster in recent days, surging in response to the ongoing U.S. presidential election. Shares of DJT, tied closely to former President Donald Trump, have seen extreme volatility, jumping nearly 18% on election day before ending down by over 1%. Even as votes were still being counted, DJT surged 10% in after-hours trading, reflecting the company’s strong correlation with Trump’s political fate rather than its financial fundamentals. For up-to-the-minute tracking, refer to DJT Real-Time Chart.

Financial Weakness Meets Meme Stock Frenzy

Despite this price rally, DJT’s recent earnings report paints a far bleaker picture of the company's health. For Q3 FY24, the company posted a net loss of $19.25 million, an improvement from last year’s $26.03 million but still troubling. Revenues also fell by 5.6% to $1.01 million, primarily from early advertising on the Truth Social platform. These figures underscore the company’s financial instability, as it struggles to achieve any substantial revenue or profit growth.

DJT’s current valuation, sitting at an eye-popping $6.8 billion, is incredibly high relative to its modest performance. With Truth Social’s 4 million monthly active users—pales in comparison to established platforms like Meta’s Facebook or Elon Musk’s X—the current market cap looks highly speculative. Given these figures, DJT appears to be overvalued, driven by retail and meme stock investors more than fundamental market strength. For further details on DJT’s financial standing, visit DJT Stock Profile.

Political Betting Markets Drive DJT Speculation

This recent rally isn’t just about the company's fundamentals. DJT stock has effectively become a "bet" on Donald Trump's political prospects. Betting markets like Polymarket have shown a swing towards Trump in the days leading up to the election, sparking increased interest in DJT. Short sellers have also been active, cashing in on DJT's price swings as it moves like other high-volatility meme stocks. DJT’s stock mirrors the GameStop phenomenon, where price movement often decouples from financial performance, driven by political events and social sentiment rather than business fundamentals.

Election-Linked Gains and Risks for NASDAQ:DJT

Financial Strategies Amid Declining Revenue

While DJT’s financial results are sobering, the company has laid out an aggressive growth strategy. Under CEO Devin Nunes, DJT has launched Truth+, a streaming extension of the Truth Social brand. The platform has recently expanded to iOS, Android, and connected TV, and the company has mentioned future plans for fintech and other acquisitions. However, these ambitions are not yet backed by solid financial results, and DJT still burns cash at an unsustainable rate. At the end of Q3, DJT reported cash reserves of $672.9 million with no debt, which provides some financial runway, but without a turnaround in revenue, this alone won’t ensure survival.

Technical Analysis - Meme Stock Volatility and High Risk

DJT’s stock behavior shows classic meme-stock volatility, with investors banking on speculative gains tied to the Trump name. Interactive Brokers strategist Steve Sosnick has noted that DJT has taken on a “life of its own” in the market, trading more on social sentiment than actual business metrics. DJT’s movement is highly sensitive to any Trump-related news, making it a potentially lucrative yet extremely risky investment. The stock is expected to continue its wild swings, especially if the election result remains undecided.

Insider Transactions and the Trump Factor

Insider transactions have also played a role in DJT's movement, with high visibility around Trump’s ownership and his decision not to sell shares even as lockup periods expired. This commitment has lent credibility to DJT’s market stance, reinforcing it as a Trump-aligned investment rather than a standalone business. For insider activity, you can explore DJT Insider Transactions.

Conclusion - High-Risk Investment or Political Speculation?

In essence, NASDAQ:DJT's fate is intricately tied to Donald Trump’s political trajectory, not the company’s business fundamentals. DJT has become a high-risk, high-reward investment for those speculating on Trump’s influence and potential return to office. If Trump wins, we may see DJT maintain its elevated status as a political meme stock. However, given the company’s significant operational weaknesses and lack of revenue growth, a bearish stance is warranted if Trump does not secure office, as the stock could face a steep decline or even collapse.

Investors should weigh the election’s outcome and market volatility carefully, knowing that (NASDAQ:DJT) remains speculative, with its fate hinging not on business success but on Trump’s political fortunes.