NASDAQ:EBAY's $57 Buybacks and Facebook Deal: Is Growth on the Horizon?

Will eBay’s Facebook Integration and $750M Buybacks Revive Its Stock Performance? | That's TradingNEWS

NASDAQ:EBAY's Strategic Moves and Performance Outlook

NASDAQ:EBAY’s Marketplace Expansion Through Facebook Integration

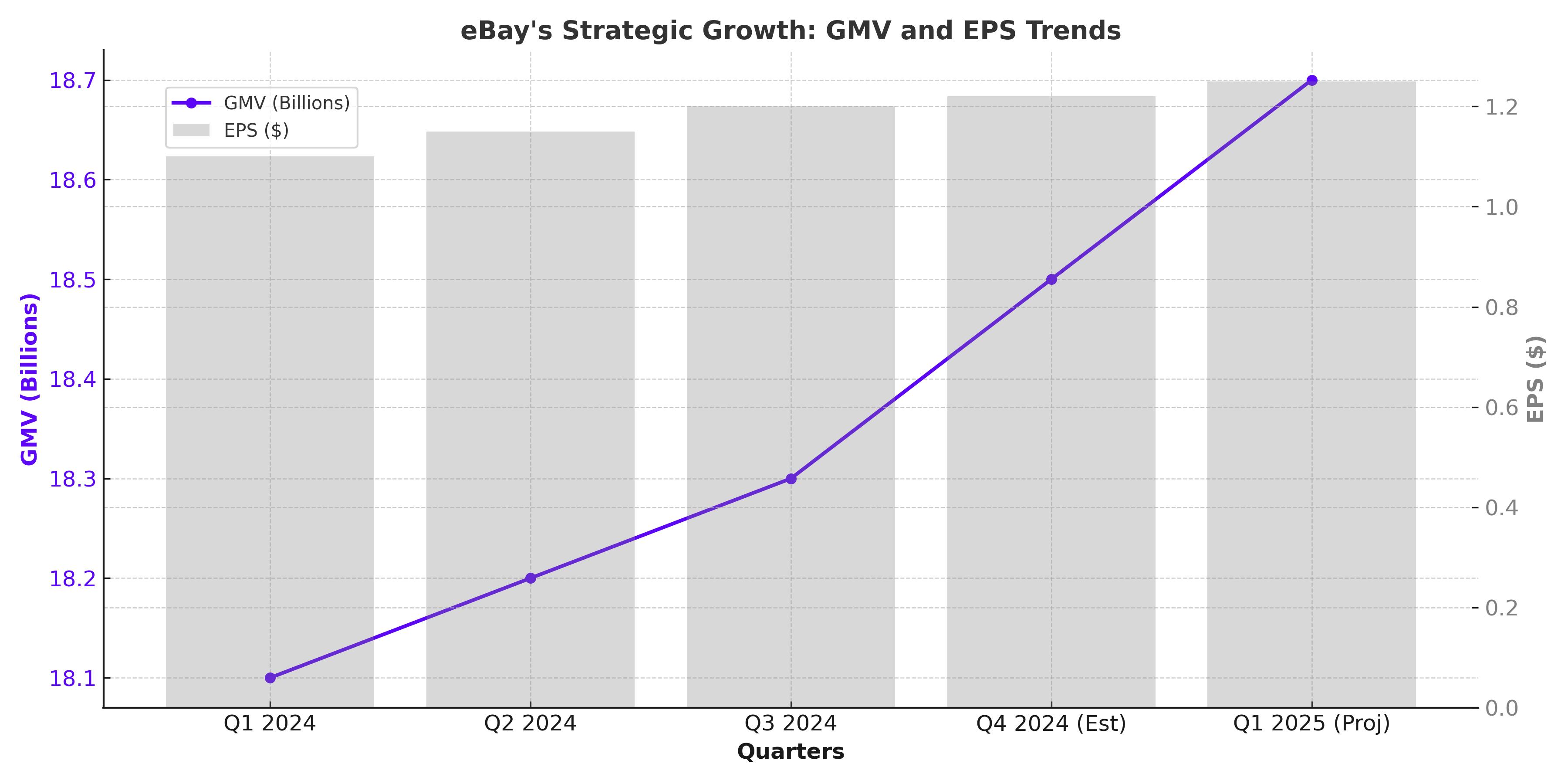

eBay Inc. (NASDAQ:EBAY) has positioned itself for potential growth by integrating its listings into Facebook Marketplace. This partnership aims to capitalize on Facebook’s massive user base, exceeding 1 billion monthly users. Meta Platforms initiated this collaboration to comply with a European Commission ruling against unfair trade practices, which required increased marketplace inclusivity. eBay listings are now visible to Facebook users in the U.S., Germany, and France, directing transactions to eBay’s platform. Analysts estimate this could increase eBay's GMV (Gross Merchandise Volume) by 6%, adding approximately 9% to EBIT, assuming 25% of users make 1.75 purchases annually. This move could provide a much-needed boost to eBay's stagnating GMV, which recorded $18.3 billion in Q3 2024, a mere 2% growth year-over-year.

eBay’s Competitive Position Amid Rising E-Commerce Giants

Over the last decade, eBay has struggled to maintain its dominance in the e-commerce space. From holding 9% of the U.S. market share in 2014, eBay’s share has dwindled to just 3% in 2023. Rivals like Amazon, Etsy, and Alibaba have outpaced eBay with innovations in logistics, customer experience, and platform capabilities. Amazon's revenue has grown at a staggering 23% CAGR during this period, while eBay managed a tepid 1.6%. Despite these setbacks, eBay has shifted its focus to niche markets such as collectibles, luxury goods, and parts, where it has retained a loyal customer base.

Capital Allocation and Its Impact on Growth

One of eBay's most significant challenges has been its capital allocation strategy. While competitors like Amazon reinvest profits into R&D and logistics, eBay has consistently prioritized share buybacks. Over the past decade, eBay reduced its outstanding shares from 1.25 billion in 2014 to 510.5 million, boosting EPS without commensurate growth in core operations. In 2023, eBay allocated just $1.54 billion to R&D, a stark contrast to Amazon’s $85.62 billion. This divergence has limited eBay's ability to innovate, leaving it vulnerable to competitors.

Ad Revenues Provide Temporary Growth Cushion

eBay’s advertising revenues have become a vital component of its growth strategy, generating $396 million in Q3 2024, a 14% increase year-over-year. This accounts for 15.4% of total revenue. However, the pace of ad revenue growth has decelerated, reflecting broader market trends and limitations in eBay’s GMV growth. While ad revenues contribute to profitability, they cannot fully offset stagnation in core transactional revenues.

Strong Capital Returns Bolster Shareholder Confidence

eBay has aggressively returned capital to shareholders. The company authorized an additional $3 billion in share repurchases, supplementing the $1.2 billion remaining from a prior program. During Q3 2024, eBay repurchased $750 million worth of shares at an average price of $57, reducing the share count to 494 million. This buyback program equates to a nearly 10% net share buyback yield. eBay’s current dividend yield stands at 1.6%, bringing its total net payout yield to over 10%.

Valuation and Future Prospects

eBay trades at a forward P/E of 13x based on 2025 EPS estimates of $5.22, a favorable valuation compared to historical and peer benchmarks. The consensus estimate suggests an 8% EPS growth rate, driven primarily by share buybacks rather than organic growth. The Facebook Marketplace integration introduces a potential inflection point, but long-term GMV growth remains uncertain. Investors will closely monitor Q4 2024 performance, where EPS is projected at $1.22, with full-year EPS expected to reach $4.80.

Financial Strength and Leverage

eBay maintains a solid financial position, with a cash balance of nearly $5 billion offset by $6.4 billion in debt, resulting in a net debt position. The company generated $1.4 billion in free cash flow through September 2024, ensuring continued capacity for capital returns and operational investment. However, with a debt-to-equity ratio of 1.37, eBay’s high leverage underscores the importance of maintaining profitability to manage interest obligations and support strategic initiatives.

Challenges for NASDAQ:EBAY Amid Market Expansion

A critical challenge for eBay lies in its capacity to maximize the Facebook Marketplace integration's benefits effectively. While the collaboration presents a substantial opportunity to elevate GMV by leveraging Facebook’s vast user base of over 1 billion monthly active users, there are lingering doubts about its sustained impact. Market share erosion due to aggressive competitors like Amazon and Walmart continues to overshadow eBay’s potential gains. Additionally, regulatory compliance by Meta, spurred by European Commission rulings, introduces an element of uncertainty. Should Meta reverse or scale back these integrations under appeal, the expected growth in GMV could stall, leaving eBay’s marketplace business underwhelmed by unmet expectations.

Dividend Program and Shareholder Returns

eBay’s capital allocation strategy underscores its commitment to shareholder value. With a dividend yield of 1.6% and a robust share buyback program, the company has significantly reduced its outstanding shares. In Q3 2024 alone, eBay repurchased $750 million worth of shares at an average price of $57. The authorization of an additional $3 billion in share repurchases bolsters the stock’s attractiveness for income-focused investors. These measures, combined with $1.4 billion in free cash flow generation through September 2024, position eBay as a steady performer for those seeking income and value investments.

A Pivot Toward Sustainable Growth

For eBay to regain its footing, it must address its long-term stagnation in GMV, which has hovered around $18 billion quarterly. The shift toward niche categories such as collectibles, luxury goods, and auto parts shows promise but remains insufficient without meaningful innovation and platform enhancement. Competitors like Amazon and Etsy have gained market share by reinvesting heavily in R&D and logistics. eBay’s R&D spend of $1.54 billion in 2023 pales compared to Amazon’s $85.62 billion, further emphasizing the need for strategic reinvestment to sustain long-term growth.

Conclusion: Is NASDAQ:EBAY a Buy?

eBay’s integration with Facebook Marketplace offers a rare opportunity to boost GMV growth, leveraging Meta’s billion-strong user base to re-energize its platform. However, this growth hinges on flawless execution and Meta’s ability to maintain regulatory compliance. The partnership is promising but cannot overshadow eBay’s broader challenges, including stagnant GMV, fierce competition from Amazon and Walmart, and underinvestment in platform innovation.

At its current valuation of just 13x forward EPS and with a strong shareholder return program—highlighted by over $3 billion in share repurchases and a reliable dividend—eBay remains an attractive option for value-focused investors. Yet, the stock’s long-term success will depend on its ability to evolve and reclaim relevance in a rapidly transforming e-commerce market.

For those seeking a mix of stability, income, and potential upside from the Facebook integration, eBay presents a compelling investment case. However, the stock should be approached with caution, as market dominance remains elusive without meaningful innovation. To track eBay’s performance in real time, visit NASDAQ:EBAY Real-Time Chart.

That's TradingNEWS

Read More

-

FTEC ETF Climbs to $226.76 as Tech Bid Targets $240 High

22.12.2025 · TradingNEWS ArchiveStocks

-

XRPI at $10.97, XRPR Near $15.8: XRP-USD Stalls at $1.94 as $82M XRP ETF Inflows Hit the $2 Wall

22.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Stays Pinned Near $4 as LNG Pull Beats Warm Weather

22.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Pulls Back to 156.95 After 157.75 Spike as BoJ Hike Triggers Intervention Alarm

22.12.2025 · TradingNEWS ArchiveForex