NASDAQ:INTC – Is Intel’s AI & 18A Foundry Strategy the Key to a Massive Stock Rebound?

With Intel (NASDAQ:INTC) trading near $19, can its AI-driven 18A chips and foundry push send shares soaring past $40? Investors eye 2025 as the turning point, but does Intel have the execution to back it up? | That's TradingNEWS

NASDAQ:INTC – Can Intel’s AI & Foundry Push Revive the Stock’s Glory?

Intel’s (NASDAQ:INTC) Multi-Year Struggle: Can 18A Chips and AI Turn Things Around?

Intel (NASDAQ:INTC) has been a battleground stock for years, struggling to keep pace with Taiwan Semiconductor (TSM) and Advanced Micro Devices (AMD). While the semiconductor industry has soared, Intel has lagged, plagued by delays in chip advancements, declining margins, and a missed opportunity in AI. Yet, the company is at a crucial turning point. With the long-awaited 18A process node on the horizon, a renewed focus on AI chips, and a foundry expansion that could redefine its business, Intel is positioning itself for a comeback.

The question remains: Will this be enough to push Intel back to dominance, or is the company still too far behind to compete? With shares hovering around $19, some analysts believe Intel could see a sharp turnaround, while others argue its challenges are too great. Investors need to weigh the upside potential of Intel’s AI ambitions against the execution risks that have haunted the company for years.

Q4 2024 Earnings: A Glimpse of Hope but Weak Margins Raise Concerns

Intel’s Q4 2024 results were better than expected, but the underlying fundamentals still show a company struggling to regain its footing. The company reported revenue of $14.26 billion, beating estimates by $434 million. However, gross margins declined by nearly 7% year-over-year, dropping to 42.4%, a sharp contrast to the robust margins of competitors like TSMC and NVIDIA.

Despite exceeding revenue estimates, Intel’s net income remained weak, with GAAP EPS at -$0.03, though better than the projected -$0.23. Non-GAAP EPS came in at $0.13, beating estimates by a single cent. The forward guidance for Q1 2025 was underwhelming, with revenue expected at $12.2 billion to $13.2 billion, a sequential decline, raising concerns about continued pressure on sales.

The foundry business, a major component of Intel’s long-term strategy, remains a massive drag on profitability. Intel Foundry Services (IFS) reported a loss of over $2 billion, with negative 50% margins, underscoring the challenge of transitioning into a viable foundry competitor. Despite these concerns, Intel’s leadership maintains that by 2027, the foundry business will break even, a crucial milestone in its turnaround plan.

The 18A Node – Intel’s Last Shot at Process Leadership?

For nearly a decade, Intel has been playing catch-up in the semiconductor race. The long delay in moving past its 14nm and 10nm nodes allowed TSMC and Samsung to take the lead in advanced chip manufacturing. Now, Intel is betting on its 18A process, expected to begin volume production in late 2025.

Intel’s upcoming Panther Lake chips, built on the 18A process, are touted as a game-changer. If successful, this would place Intel ahead of TSMC’s 2nm process, marking a significant shift in industry dynamics. The chip giant has already begun sampling these products with customers, and CEO Michelle Johnston Holthaus has indicated that volume production is on track for the second half of 2025.

However, skepticism remains. Moving to a new process node is a capital-intensive and execution-heavy endeavor, and Intel’s past delays raise concerns about whether the company can truly deliver on time. The industry has seen this before—Intel’s 10nm struggles set it back years. If the 18A node fails to launch on time or doesn’t meet performance expectations, Intel’s turnaround plan could unravel.

Another major challenge is customer trust. Intel Foundry is still an unproven competitor to TSMC, which has long dominated the advanced chip manufacturing market. Even if Intel’s 18A chips are technologically competitive, major semiconductor companies will be hesitant to shift production without proven reliability. This means early adoption will be slow, and widespread customer interest may take years to materialize.

AI: Can Intel Catch Up in the Most Profitable Chip Market?

While NVIDIA dominates AI chips, Intel is scrambling to position itself as a serious competitor. The AI chip market is expected to grow at an annual rate of 37% over the next decade, making it one of the most lucrative segments in the semiconductor industry.

Intel recently scrapped its Falcon Shores GPU project, initially meant to compete with NVIDIA’s high-performance AI accelerators. Instead, the company is focusing on Jaguar Shores, a next-generation AI processor that aims to deliver a more competitive solution. However, with NVIDIA’s deep software ecosystem and AMD aggressively expanding its AI lineup, Intel faces an uphill battle.

Despite these challenges, Intel’s strength lies in AI-driven PC chips. The company has been integrating Neural Processing Units (NPUs) into its latest CPU designs, allowing AI workloads to run directly on consumer laptops and desktops. This could help Intel capitalize on the AI boom without competing directly against NVIDIA’s dominant data center GPUs.

The Lunar Lake and Arrow Lake CPUs, launching in late 2024 and early 2025, will feature AI acceleration capabilities that could give Intel a strong foothold in the growing AI PC market. Microsoft, for example, is pushing for more AI-powered Windows PCs, which could benefit Intel as it supplies chips to major OEMs.

However, whether AI-powered PCs will be a true market mover remains unclear. AI in data centers is where the real money is, and Intel remains a distant third behind NVIDIA and AMD in this space.

Intel’s Foundry Gamble: A Long-Term Play with Short-Term Losses

Intel’s ambition to become a global foundry powerhouse is a bold but costly endeavor. The company is investing tens of billions into Intel Foundry Services (IFS), hoping to compete with TSMC for manufacturing contracts from major tech companies.

IFS reported nearly $5 billion in revenue in Q4, but the division is still deeply unprofitable, with negative 50% operating margins. Intel expects this business to break even by 2027, but that’s a long runway, and profitability is far from guaranteed.

The biggest hurdle is trust. Semiconductor companies have spent decades building relationships with TSMC, and switching to Intel is a risk. Intel will need to prove that its foundry services can consistently deliver high yields, reliability, and cost efficiency—something it has yet to demonstrate.

One bright spot is the Chips and Science Act, which has allocated billions in subsidies for U.S. semiconductor manufacturing. Intel has already received its first round of funding, and additional government support could accelerate its foundry expansion. However, political uncertainties and potential changes in U.S. leadership could impact future funding.

Valuation: Is Intel Stock a Buy at $19?

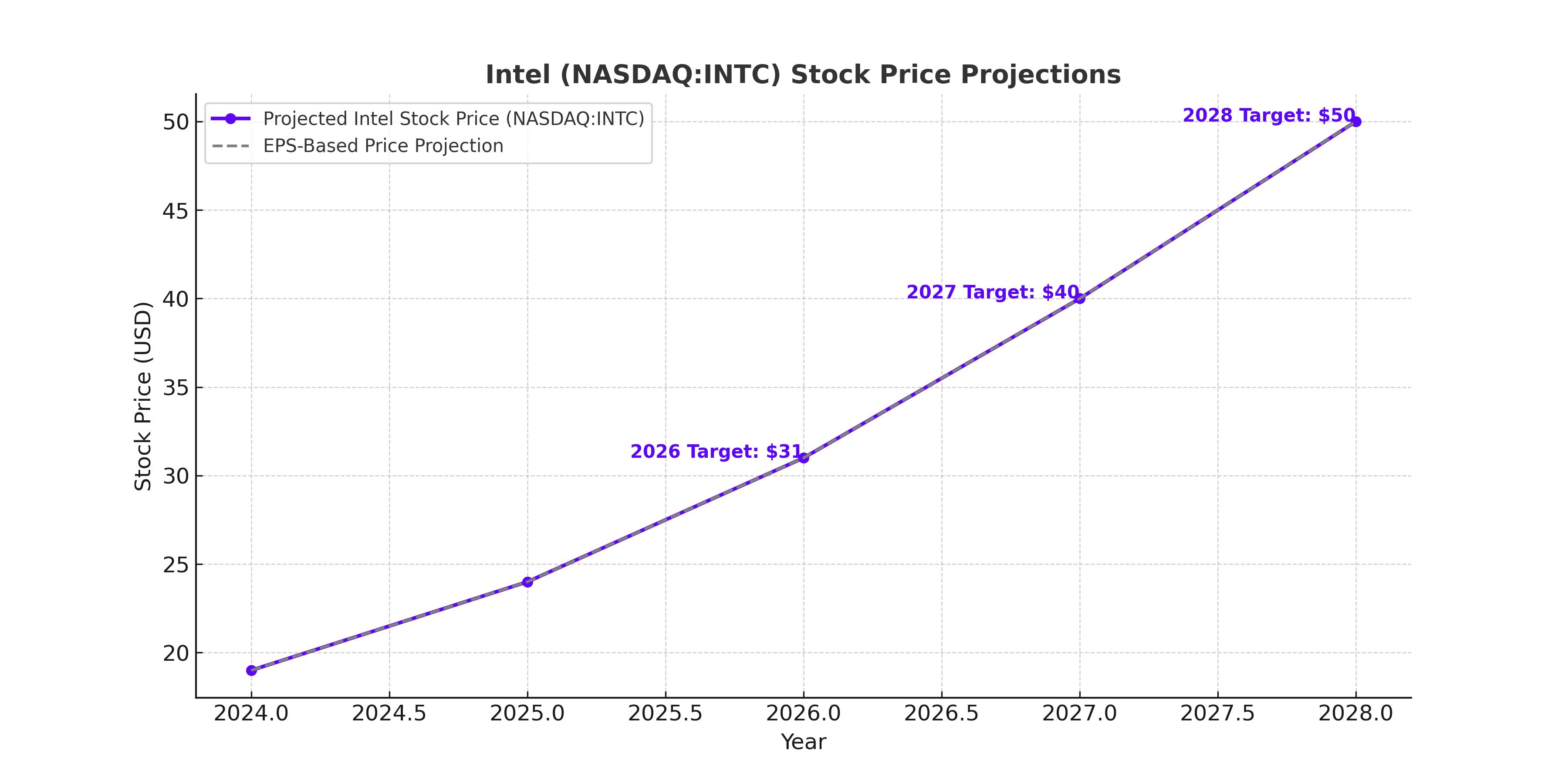

Intel’s stock currently trades around $19, a level that many believe undervalues its long-term potential. Analysts expect Intel’s EPS to rise significantly in the coming years:

- 2025 EPS: $0.49

- 2026 EPS: $1.19 (141% YoY growth)

- 2027 EPS: $1.69 (43% YoY growth)

- 2028 EPS: $2.13 (26% YoY growth)

At current levels, Intel trades at 39x forward 2025 earnings, which seems expensive. However, by 2027, its P/E is expected to drop to 7.09, assuming earnings continue to grow. If Intel successfully executes its foundry expansion and AI chip strategy, the stock could easily double over the next three years.

Final Thoughts: Buy, Hold, or Sell?

Intel’s turnaround is in motion, but it’s far from guaranteed. The success of the 18A node, the adoption of its AI PC chips, and the ability of Intel Foundry to compete with TSMC will determine whether Intel stock can recover.

For long-term investors willing to take on execution risk, Intel at $19 presents a compelling value. If the 18A node launches on time and delivers competitive performance, the stock could see a rapid re-rating toward $40 or higher. However, any delays or missteps could keep shares range-bound, making this a high-risk, high-reward investment.

Right now, Intel is a speculative buy, but one that could pay off massively if its turnaround stays on track.