NASDAQ:PLTR – Can Palantir Justify Its Sky-High Valuation, or Is It Overheating?

With a 250x P/E and soaring revenues, is PLTR an unstoppable AI powerhouse or an overvalued tech bubble waiting to burst? | That's TradingNEWS

NASDAQ:PLTR – Is Palantir’s AI Growth Enough to Justify Its Soaring Valuation?

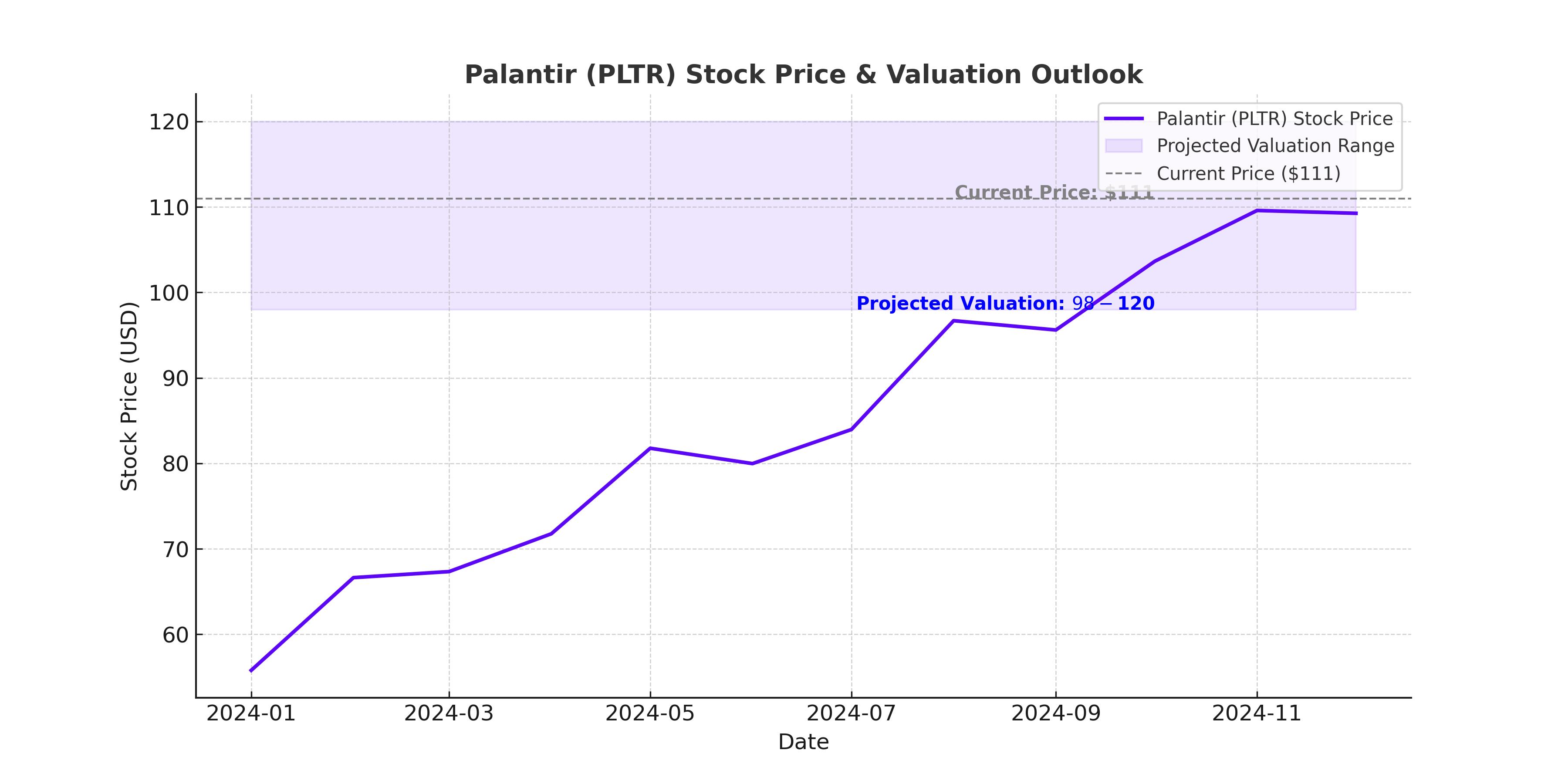

Is NASDAQ:PLTR Worth $111 or Is the Stock Overstretched?

Palantir Technologies (NASDAQ:PLTR) has been on an unstoppable rally, now trading above $111 with a market capitalization exceeding $250 billion. Investors are divided—some see an AI-driven software giant with limitless potential, while others warn of an overhyped stock with valuation metrics bordering on insanity. The company’s 36% YoY revenue growth, 60% free cash flow margin, and its dominance in U.S. government contracts and AI-powered commercial software make a compelling case for long-term upside. However, declining billings, a reliance on interest income, and sky-high valuation multiples raise serious concerns.

Is Palantir truly worth 100x forward sales, or is this a bubble waiting to pop? Let’s break down the company’s business model, financial performance, and risk factors to determine whether PLTR can justify its valuation—or if a correction is on the horizon.

Explosive Growth in U.S. Commercial Revenue—Can It Keep Up?

One of the biggest reasons for Palantir’s meteoric rise has been the explosive growth in its U.S. commercial sector, which jumped 64% YoY in Q4 2024. The company signed 129 new deals, including 32 contracts worth over $10 million each, proving that enterprise clients are increasingly reliant on Palantir’s software. The launch of its Artificial Intelligence Platform (AIP) has accelerated adoption, as businesses integrate AI-driven analytics, machine learning models, and predictive data systems to optimize operations.

The commercial division’s momentum has been critical in diversifying revenue away from government contracts, which historically made up the bulk of Palantir’s business. In contrast, government revenue growth came in at a more modest 45% YoY, still strong but not as dominant as before. This shift signals that Palantir is evolving into a true enterprise AI powerhouse rather than just a government defense contractor.

However, there’s a red flag: billings declined in Q4 for the first time since Q3 2023. This means that while revenue is growing, the actual contracts signed for future revenue have slowed down, raising concerns about sustainability. If Palantir cannot maintain a 30%+ growth rate, its premium valuation could be in danger.

Does the U.S. Government’s AI Spending Guarantee Long-Term Growth?

Palantir’s deep ties to the U.S. government, defense, and intelligence sectors have been a major advantage. With the U.S. ramping up AI-driven military, defense, and cybersecurity spending, Palantir is uniquely positioned as the go-to AI software provider for national security applications.

The company’s government contracts include multi-million dollar deals with the Department of Defense, the CIA, and other federal agencies. With Project Stargate—a $500 billion AI-focused military initiative—in its early stages, Palantir is poised to secure a significant share of future defense AI contracts.

However, government contracts can be lumpy, slow-moving, and subject to political shifts. If a new administration prioritizes budget cuts in defense tech, Palantir could see slower government revenue growth. While domestic defense spending is projected to hit $510 billion over the next decade, the risk remains that competitors like Anduril, Lockheed Martin, or newer AI startups could start chipping away at Palantir’s dominance.

Can Palantir’s Profitability Keep Up with Its Sky-High Valuation?

Despite its status as a high-growth AI company, Palantir has managed to turn profitable, posting $468 million in net income for 2024. More impressively, its free cash flow margin hit a record 60% in Q4, proving the company’s ability to scale efficiently without burning cash.

However, $196.8 million of its net income came from interest income, thanks to its $2 billion cash reserves. This means that a significant portion of Palantir’s profit isn’t coming from software sales—but from earning interest on cash holdings. If interest rates decline, this income stream will shrink, making its earnings less impressive.

On the valuation side, things get even more extreme:

- Price-to-sales (P/S): 98x forward revenue

- Price-to-earnings (P/E): 250x forward earnings

- Market cap: $250 billion vs. $2.87 billion in revenue

At these levels, Palantir must continue growing at 30-40% annually for the next decade to justify its valuation. If growth slows even slightly, the stock could see a significant correction.

Will International Growth Catch Up, or Is PLTR Over-Reliant on U.S. Sales?

Another major concern is Palantir’s international business, which only grew 4% YoY in Q4. While U.S. revenue is surging, international expansion has lagged behind, with CEO Alex Karp publicly criticizing Europe’s "anemic" adoption of AI technologies.

If Palantir can expand into international markets, particularly in Europe, Asia, and the Middle East, it could open up a massive new revenue stream. However, the current data suggests that most of its growth is still U.S.-centric, leaving it exposed to any slowdowns in U.S. enterprise and government spending.

Is PLTR’s Moat Strong Enough to Keep Competitors at Bay?

Palantir’s biggest advantage is its deeply embedded, highly sticky software solutions. Unlike traditional SaaS products, once a company or government agency integrates Palantir’s AI-driven platforms into their operations, switching costs become massive.

Competitors like Snowflake (SNOW), Databricks, and Microsoft (MSFT) are all expanding into AI-powered data analytics, but none offer the full-stack integration that Palantir does. This gives Palantir a strong moat—but it must continue innovating and expanding use cases to maintain this edge.

Can NASDAQ:PLTR Sustain Its Momentum, or Is a Correction Coming?

With 36% YoY revenue growth, a 60% free cash flow margin, and accelerating commercial adoption, Palantir deserves a premium valuation—but how much is too much?

Bull Case for PLTR at $111:

- U.S. commercial revenue growing at 64% YoY, proving enterprise demand for AI is strong

- Deep U.S. government ties ensure a steady stream of high-value contracts

- High free cash flow margins (60%) and increasing operating efficiency

- Low debt and strong cash reserves provide financial stability

- AI market is expected to exceed $1.4 trillion by 2030, giving Palantir massive upside potential

Bear Case for PLTR at $111:

- Valuation remains extreme at 98x sales and 250x earnings, pricing in years of future growth

- Declining billings suggest that future revenue growth could slow down

- Heavy reliance on U.S. market—international expansion has been weak

- Interest income makes up a large portion of profit—vulnerable if rates drop

- Competitors like Microsoft, Databricks, and Snowflake are rapidly evolving

Final Verdict: Is NASDAQ:PLTR a Buy, Hold, or Sell at $111?

Palantir is undeniably one of the strongest AI software companies in the market today. Its growth rates, profitability, and dominance in U.S. government and enterprise AI solutions make it a long-term winner. However, at $111 per share, the stock is priced for near-perfection.

If the company can maintain 30%+ annual growth, expand internationally, and secure more large-scale AI contracts, then a market cap of $500 billion is possible within the next decade. But if growth slows even slightly, the stock could face a steep decline.

For long-term investors, PLTR remains a high-risk, high-reward play. If you believe in the AI revolution and Palantir’s ability to dominate the data analytics market, the stock could be worth holding—but brace for volatility along the way.