NASDAQ:SMCI Surges 54% – Can It Hold $60, or Is a Drop to $40 Next?

Is SMCI stock still a buy after its massive rally, or is the AI boom fading? | That's TradingNEWS

NASDAQ:SMCI Stock Faces Key Test: Can It Sustain Growth Amid Volatility?

Super Micro Computer, Inc. (NASDAQ:SMCI) has been on a volatile ride in recent months, with its stock surging over 54.8% from its November 2024 lows, significantly outperforming the broader market. The AI-driven data center boom has been a key catalyst for SMCI’s revenue growth, but concerns around its financial reporting delays and competitive pressures have kept investors on edge. The company’s latest preliminary earnings report suggests strong revenue expansion but declining margins, leading to a mix of bullish and bearish signals. With AI spending remaining a dominant force in the market, the question remains: Can SMCI sustain its growth, or will margin compression and regulatory scrutiny drag the stock down?

SMCI’s Revenue Growth Remains Strong, but Margin Pressures Loom

SMCI’s preliminary fiscal Q2 2025 earnings report delivered a mixed message. Revenue surged to $5.65 billion, representing a 54.3% year-over-year growth, but sequentially declined by 5% from the previous quarter. Adjusted EPS came in at $0.59, down 21.8% quarter-over-quarter, though still reflecting a 7.2% increase year-over-year.

The revenue beat underscores SMCI’s resilience in an AI-driven market where demand for data center infrastructure continues to climb. Major industry players such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOGL) have reiterated their long-term investment in AI and cloud computing, fueling optimism that SMCI can maintain its sales momentum. However, the company’s gross margin of 11.9%, down from 18.1% in FY2023, signals that price competition and increased costs are squeezing profitability.

SMCI’s FQ3 2025 guidance indicates further pressure, with revenue expected at $5.5 billion, reflecting 42.8% year-over-year growth but a 2.6% sequential decline. Adjusted EPS is projected at $0.54, a drop of 8.4% from the previous quarter and 18.1% year-over-year, reinforcing the trend of declining profitability despite robust top-line expansion.

AI Data Center Boom Continues, But Competition is Heating Up

SMCI has positioned itself as a key beneficiary of the AI-driven data center upgrade cycle, but competition is intensifying. The company faces increasing pressure from Modine Manufacturing Company (NYSE:MOD), Lennox International Inc. (NYSE:LII), AAON, Inc. (NASDAQ:AAON), Vertiv Holdings (NYSE:VRT), and Foxconn Technology (OTCPK:FXCOF), all of which are expanding their presence in AI-focused cooling solutions and server infrastructure.

While SMCI was an early mover in AI servers, enabling it to command higher margins in 2023, the landscape has shifted. Competitors have entered the market aggressively, driving down prices and making it harder for SMCI to maintain its previous levels of profitability. This is evident in the company’s lowered FY2025 revenue guidance of $24.25 billion, down from the previous $28 billion estimate.

Despite this, the company has set an ambitious FY2026 revenue target of $40 billion, representing a 64.9% year-over-year growth, suggesting that management remains confident in long-term demand for its products.

Institutional Investors and Insider Transactions Signal Mixed Sentiment

Institutional interest in SMCI remains high, as evidenced by its latest convertible note offering of $700 million, which has strengthened its liquidity position. The company maintains a net cash balance of -$0.5 billion, down from -$0.2 billion in Q1 2025 but still significantly better than the $0.35 billion net debt position in Q2 2024.

On the insider trading front, SMCI executives have been actively adjusting their holdings. View SMCI Insider Transactions. While some key figures have increased their stakes, others have sold portions of their holdings, raising questions about internal confidence in the company’s ability to maintain its growth trajectory.

Short Interest Surges as Market Skepticism Grows

One of the biggest red flags for SMCI is the drastic increase in short interest. Over the past year, short interest volume has soared 82.1%, indicating that bearish traders are betting against the stock’s ability to sustain its gains. Given the company’s elevated beta of 1.47x, SMCI remains highly volatile, making it a high-risk, high-reward play for investors.

While the AI-driven server market is expected to grow at a 34.3% CAGR through 2030, the stock’s forward P/E ratio of 18.3x suggests that much of this growth is already priced in. SMCI’s price-to-earnings growth (PEG) ratio of 0.49x, however, remains significantly lower than sector peers such as MOD (1.08x), LII (1.84x), AAON (2.90x), VRT (1.10x), and FXCOF (1.15x), making it appear undervalued relative to growth potential.

Technical Indicators Suggest a Breakout or Breakdown is Imminent

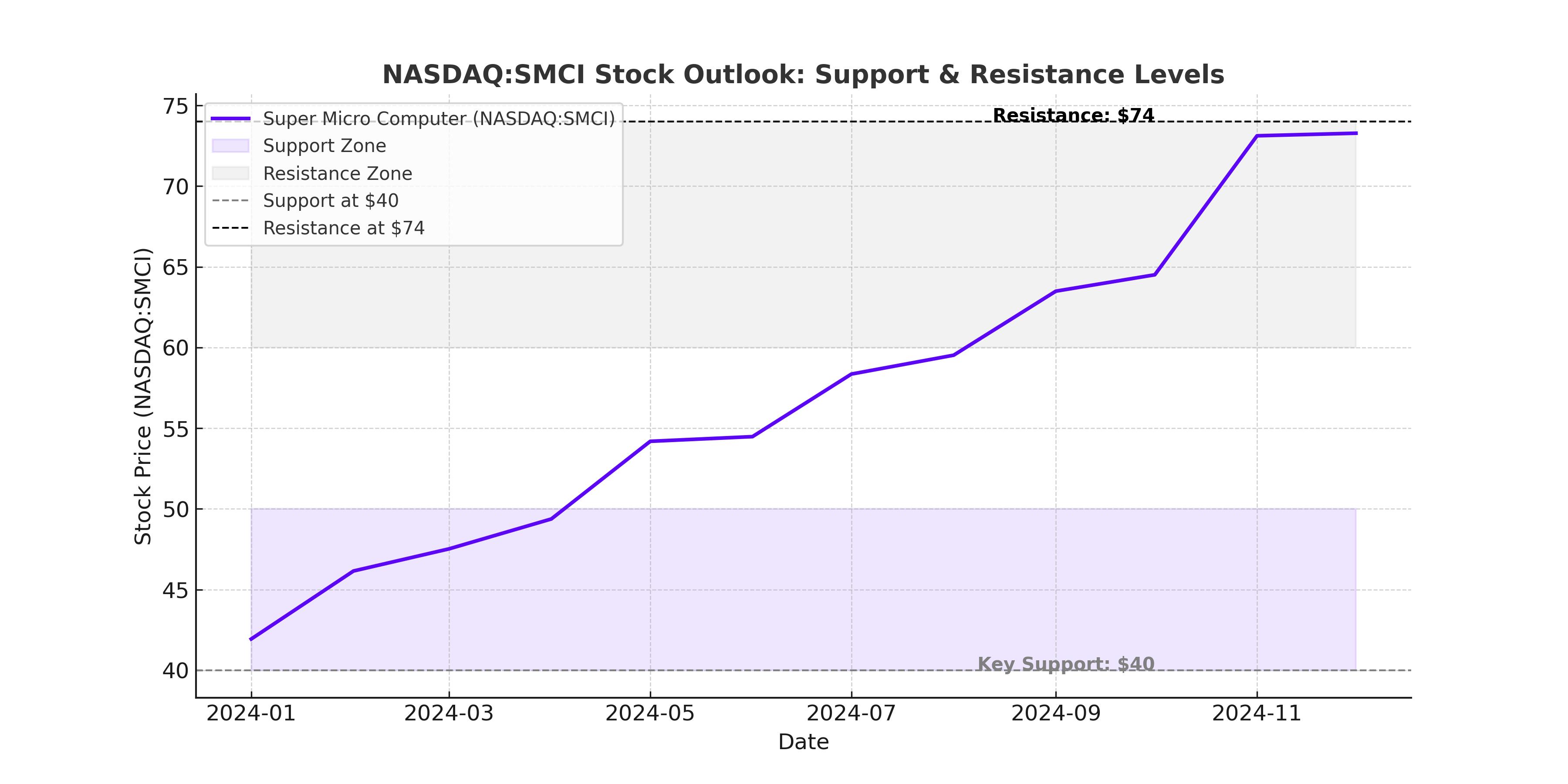

SMCI’s stock has been trading within a tight range, with key resistance at $60 and strong support around $40. The Bollinger Bands indicate that volatility is contracting, which typically precedes a sharp move in either direction.

- 50-day and 200-day moving averages: The 50-day SMA remains below the 200-day SMA, a sign that bearish momentum has not fully reversed. However, the stock recently broke above the 200-day SMA, suggesting that a bullish trend could be forming.

- MACD and RSI: The MACD has turned bullish, with the histogram showing positive momentum. The RSI has climbed to 76.63, entering overbought territory, which could signal a short-term pullback before a breakout attempt.

- Volume trends: Recent trading activity has shown increased volume on up days and lower volume on down days, a bullish indicator that suggests accumulation by institutional investors.

If SMCI can break and hold above $60, it could set the stage for a move toward $74.10, in line with prior resistance levels. Conversely, a breakdown below $40 could see the stock retrace toward its November 2024 lows of $20.

Final Outlook: Is SMCI a Buy, Sell, or Hold?

SMCI presents a compelling but risky investment opportunity. The company’s strong revenue growth, leadership in AI-driven data center solutions, and solid institutional backing make it an attractive play for those bullish on the AI sector. However, declining margins, rising competition, and increased short interest introduce significant risks.

Given the current valuation of 18.3x forward P/E, SMCI appears reasonably priced compared to its growth rate, but short-term volatility is likely to persist. Investors with a high-risk appetite may find SMCI an attractive buy-on-dip opportunity, especially if the stock retraces toward the $40 range. However, those seeking stability may want to wait for confirmation of financial filings on February 25, 2025, before making a decision.

For real-time updates and in-depth insights, check out the SMCI Stock Profile.