VanEck Semiconductor ETF (NASDAQ:SMH) – A Powerhouse Positioned for AI-Driven Growth Amid Market Volatility

NASDAQ:SMH: Is This the Best Semiconductor ETF for AI Growth?

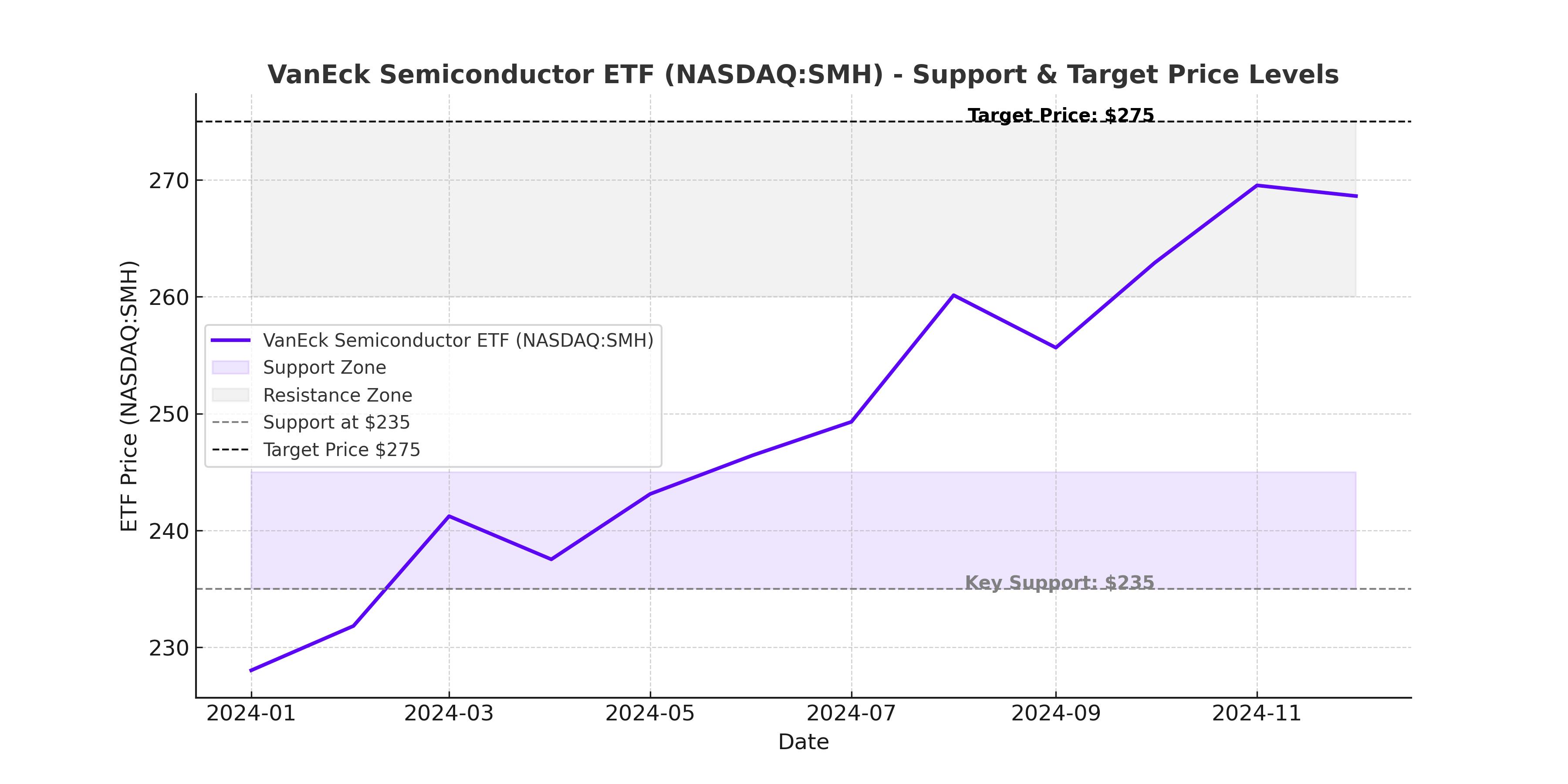

The VanEck Semiconductor ETF (NASDAQ:SMH) has seen a volatile yet resilient performance, moving mostly sideways since mid-2024, but recent market events, including DeepSeek's AI advancements and semiconductor demand surges, may signal a breakout. While short-term fluctuations have been driven by market overreactions to news of cheaper AI training costs, the long-term outlook for SMH remains strong, driven by multi-year AI spending trends, rising data center demand, and increased semiconductor manufacturing capacity from industry giants like Nvidia (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), and Taiwan Semiconductor Manufacturing (NYSE:TSM).

Despite a brief panic-driven drop to $235 per share, SMH has rebounded to the $250 range as investors recognize that AI demand isn’t slowing down but rather evolving. With NVDA’s upcoming FY2026 guidance expected to set the tone for the semiconductor market, AVGO’s custom AI accelerators gaining traction, and TSM ramping production in the U.S. and Japan, SMH may be entering a phase of accelerated growth.

Breaking Down SMH’s Holdings – Why NVDA, AVGO, and TSM Drive the ETF’s Success

SMH is highly concentrated in three semiconductor giants—Nvidia (NVDA), Broadcom (AVGO), and Taiwan Semiconductor Manufacturing (TSM)—which together account for nearly 40% of the ETF's total weight. This high concentration has proven to be a major advantage over the last decade, as these companies continue to dominate the AI chip, networking, and manufacturing spaces.

Nvidia (NASDAQ:NVDA): The 18.7% weighting in SMH makes Nvidia the dominant force in this ETF. Despite its recent 17% drop after DeepSeek's AI breakthrough news, Nvidia remains at the center of the AI revolution, supplying GPUs that power OpenAI’s ChatGPT, Meta’s AI infrastructure, and hyperscalers like Microsoft and Amazon. While skeptics worry about competition from custom AI chips, Nvidia’s CUDA software, AI ecosystem, and upcoming Blackwell GPU architecture ensure it remains indispensable.

Broadcom (NASDAQ:AVGO): The 9.9% allocation to AVGO in SMH is crucial, as Broadcom is a key supplier of custom AI chips for hyperscalers. With an estimated AI market opportunity of $60–$90 billion by 2027, Broadcom is well-positioned to grow as Google (GOOG) ramps up Trillium AI chips, Amazon (AMZN) expands Trainium adoption, and Meta (META) deploys MTIA custom AI processors. Unlike Nvidia, Broadcom benefits from a high-margin business model with long-term contracts, making it a lower-risk AI chip play.

Taiwan Semiconductor Manufacturing (NYSE:TSM): The 12.8% weighting in SMH underscores TSM’s critical role as the world’s leading chip manufacturer. The foundry produces chips for Apple, Nvidia, AMD, Qualcomm, and other semiconductor leaders. With a $40 billion capex plan for 2025, TSM is expanding its U.S. manufacturing presence in Arizona while increasing production capacity in Japan and Taiwan. As semiconductor demand continues to rise, TSM will be a cornerstone of the AI supply chain, reinforcing SMH’s long-term strength.

Is DeepSeek a Real Threat to AI Chip Demand?

The DeepSeek AI model, reportedly trained for just $5.6 million compared to OpenAI’s GPT-4 costs of $78 million, initially caused panic across semiconductor stocks, erasing over $1 trillion in market value in a single day. However, the initial overreaction is being corrected, as industry experts, including OpenAI’s CEO Sam Altman, emphasized that AI models will require even more compute power in the future, not less.

Nvidia and other semiconductor leaders are benefiting from a continued AI infrastructure boom, not shrinking demand. OpenAI’s $500 billion Stargate project, massive AI-related spending from hyperscalers like Amazon and Microsoft, and increased AI inference workloads ensure that Nvidia’s GPUs and Broadcom’s ASICs will remain in high demand.

Semiconductor Capex Boom – Why SMH Will Benefit from AI Infrastructure Growth

Hyperscalers are accelerating data center spending to meet AI computing needs, leading to record-breaking semiconductor demand. The top hyperscalers, including Amazon, Microsoft, Google, and Meta, are ramping AI-related capex to unprecedented levels in 2025:

- Amazon (NASDAQ:AMZN): $105.2 billion capex for 2025 (+26.7% YoY, 524% since 2019)

- Microsoft (NASDAQ:MSFT): $80 billion capex for 2025 (+79.8% YoY, doubling since 2019)

- Google (NASDAQ:GOOG): $75 billion capex for 2025 (+37.1% YoY, up 64.4% from 2019)

- Meta (NASDAQ:META): $62.5 billion capex for 2025 (+59.3% YoY, 314% growth since 2019)

These spending levels are unprecedented and reinforce the long-term bullish case for SMH. Since NVDA, TSM, and AVGO make up over 41% of SMH’s total holdings, the ETF is positioned to benefit from every dollar spent on AI-related semiconductor investments.

Valuation: Is SMH Undervalued or Overpriced?

At a price-to-earnings (P/E) ratio of 20.35x, SMH trades at a discount compared to other semiconductor ETFs, including:

- SPDR S&P Semiconductor ETF (NYSEARCA:XSD): 26.43x P/E

- iShares Semiconductor ETF (NASDAQ:SOXX): 20.34x P/E

- Nasdaq 100 (NASDAQ:QQQ): 22.70x P/E

While SMH is still priced above broader indices like the S&P 500 (NYSEARCA:SPY) at 17.86x P/E, it remains reasonably valued compared to its peers. With semiconductor sales expected to surpass $1 trillion by 2030, SMH remains one of the best-positioned ETFs for long-term AI-driven growth.

Will SMH Break Out in 2025?

The semiconductor sector has been in a consolidation phase since mid-2024, but 2025 could be the year SMH breaks out to new highs. Key catalysts include:

- Nvidia’s FY2026 Guidance: If Nvidia (NVDA) delivers strong revenue guidance for AI chips in its upcoming earnings call on February 26, 2025, SMH could see significant upside momentum.

- Broadcom’s AI Accelerator Demand: AVGO’s expanding custom AI chip business could become a major revenue driver, pushing SMH higher.

- TSM’s Manufacturing Expansion: With Taiwan Semiconductor (TSM) ramping up capacity in Arizona and Japan, supply constraints will ease, leading to higher chip shipments.

- AI-Driven Semiconductor Growth: The continued buildout of AI data centers by hyperscalers is a long-term bullish tailwind for SMH.

Final Verdict: Is SMH a Buy, Sell, or Hold?

With AI infrastructure spending accelerating, semiconductor manufacturing capacity expanding, and NVDA, AVGO, and TSM leading the industry, SMH remains one of the best ETFs to capture AI-driven semiconductor growth. The recent pullback due to DeepSeek’s AI announcement was an overreaction, and the ETF now trades at an attractive valuation relative to its growth prospects.

Investors looking for long-term exposure to the semiconductor industry should consider SMH a strong buy, particularly ahead of Nvidia’s upcoming earnings. Given the massive $500 billion AI investment wave underway, SMH is well-positioned to deliver outsized returns in the coming years.

Check real-time SMH stock data here: NASDAQ:SMH Real-Time Chart