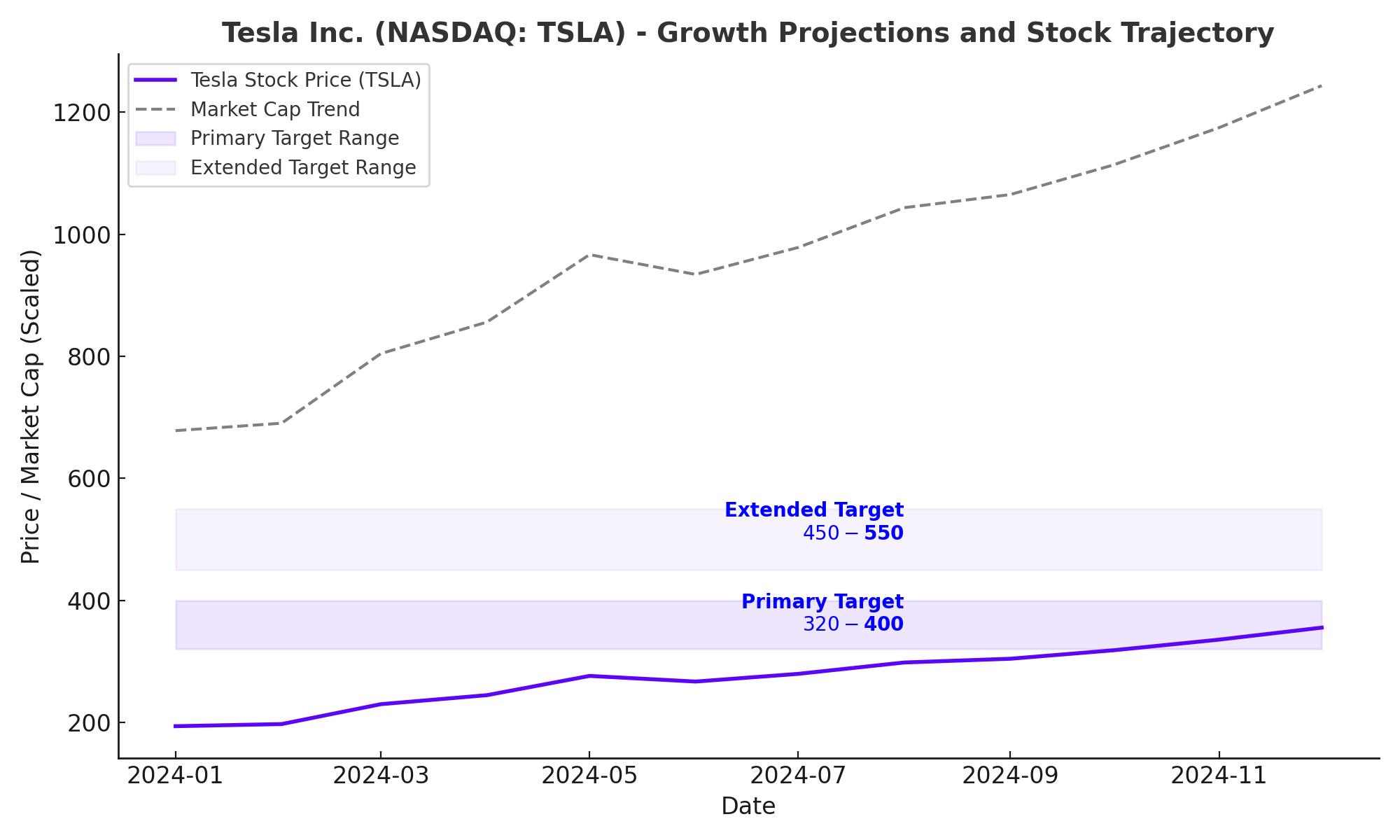

NASDAQ: TSLA's $350B Surge - Innovation or Speculation?

Tesla Inc. rides a wave of market exuberance post-election, with AI, robotaxis, and energy poised to redefine its future. Unpack the numbers and analyze its high-risk, high-reward potential | That's TradingNEWS

The Unprecedented Rise of NASDAQ: TSLA - A Deeper Dive

Tesla Inc. (NASDAQ: TSLA) has witnessed a meteoric rise in market capitalization following the U.S. elections, an increase fueled by investor optimism around Elon Musk’s ties to President-elect Donald Trump. This surge, adding over $350 billion to the company’s valuation, underscores a dramatic shift in market sentiment rather than a reflection of immediate fundamental improvements. Critics argue that Tesla's rally is driven by "animal spirits" rather than hard data, yet the potential benefits from a Trump administration's regulatory outlook are undeniable. Tesla’s position as a leader in electric vehicles, coupled with its advancements in AI and energy storage, places it uniquely at the crossroads of innovation and speculation.

Regulatory Shift and Tesla’s Strategic Position

Tesla's growth prospects under the Trump administration have sparked significant attention, especially regarding regulatory changes for autonomous vehicles and EV tax credits. Policy discussions have hinted at the potential elimination of the $7,500 federal EV tax credit, a move that could reshape market dynamics. While competitors may suffer from reduced consumer incentives, Tesla, with its established scale and profitability, could gain relative advantages by maintaining pricing power. Elon Musk has frequently emphasized Tesla’s strategic positioning in this evolving regulatory environment. Tesla’s plans to expand its robotaxi fleet, particularly with the Cybercab expected to reach volume production in 2026, could accelerate under a more permissive regulatory regime.

Musk's optimism for vehicle growth, estimating a 20%-30% increase in production next year, reflects confidence despite uncertainties. His projections underscore Tesla’s focus on maintaining its competitive edge, particularly as it transitions toward autonomy and AI-led growth. However, Tesla’s Full Self-Driving (FSD) software remains at SAE Level 2, requiring human oversight, lagging behind Alphabet’s Waymo, which has achieved Level 4 autonomy.

Tesla’s Non-Auto Ventures: A Billion-Dollar Opportunity

Tesla’s valuation extends beyond its automotive operations, with significant weight placed on its AI, energy storage, and robotics divisions. Analysts estimate that Tesla's non-auto ventures, including AI-powered robotaxis and the Dojo supercomputer, account for nearly $1 trillion of its market value. The Dojo system alone is projected to add $500 billion in market value, driven by faster adoption of network services and autonomy solutions.

Tesla’s energy storage segment also reported a 52% year-over-year growth in Q3, contributing to the diversification of its revenue streams. However, this remains a smaller part of Tesla’s overall business, with automotive operations still dominating. Revenue growth of 8% year-over-year in Q3 reflects stable but slower expansion, highlighting the challenges of scaling non-auto segments.

Competitive Landscape in Key Markets

Tesla’s performance in global markets faces stiff competition, particularly in China and Europe. Domestic EV makers in China and established automakers in Europe are rapidly introducing competitive models, often at lower price points. Tesla has countered this with strategic price cuts to stabilize demand, though such measures could pressure margins over time.

The removal of EV tax credits in the U.S., if implemented, could further test Tesla’s ability to sustain its lead. While smaller competitors may struggle, Tesla’s established market share and profitability provide a cushion.

Market Sentiment and Analyst Perspectives

The stock's post-election rally of nearly 40% underscores the market’s enthusiasm, but also raises concerns about overvaluation. Tesla trades at a forward P/E ratio of 137, far above industry averages, indicating a valuation heavily reliant on future growth expectations. UBS analysts highlight that Tesla’s current valuation implies a $1 trillion value attributed to non-auto businesses. Historically, such levels have preceded significant corrections, as seen in past instances where Tesla's auto-to-total valuation ratio dropped below critical thresholds.

Financial Metrics and Growth Outlook

Tesla’s financial metrics reflect a complex mix of growth potential and valuation risks. The company’s trailing 12-month revenue stands at $97.15 billion, with a projected CAGR of 20%-22.5% over the next five years. Analysts estimate Tesla's EBITDA margin could expand to 22.5%-27.5% by 2029, driven by its autonomous taxi operations and continued innovation in energy storage.

Tesla’s enterprise value, currently at $1.01 trillion, could reach $3.5 trillion by 2029, assuming successful execution of its autonomous vehicle strategy. This represents an enterprise value CAGR of 28.2% over five years, underscoring the long-term growth narrative. However, conservative scenarios project a lower CAGR of 15%-17.5%, highlighting risks tied to execution and regulatory challenges.

The Cybertruck and Tesla’s Resilience

Tesla’s ability to deliver on bold promises, exemplified by the Cybertruck, reinforces its reputation as a disruptor. Despite delays, the Cybertruck emerged as the third-best-selling EV in the U.S. during Q3, defying skeptics. This success bolsters confidence in Tesla’s ability to execute ambitious projects, though challenges remain in scaling new products.

Balancing Speculation and Fundamentals

Tesla’s stock embodies a delicate balance between speculative optimism and fundamental performance. While near-term challenges, including competition and regulatory uncertainties, persist, Tesla’s long-term vision centered on autonomy, AI, and sustainable energy positions it uniquely for growth. The market's focus on Tesla’s AI narrative, particularly its robotaxi ambitions, highlights shifting investor priorities.

Tesla’s valuation, while high, reflects its potential to redefine industries. Investors must weigh the risks of overvaluation against the company’s transformative capabilities. For now, Tesla remains a high-risk, high-reward opportunity, with long-term growth potential outweighing immediate concerns.

Current Stock Performance

As of November 26, 2024, Tesla Inc. (NASDAQ: TSLA) is trading at $338.59 per share, reflecting a decrease of approximately 3.89% from the previous close. The stock has experienced significant volatility, with a notable surge of around 40% since the U.S. presidential election on November 5, 2024.

Post-Election Surge and Market Sentiment

The recent rally in Tesla's stock is largely attributed to investor optimism following President-elect Donald Trump's victory. Elon Musk's support for Trump and his appointment to lead the Department of Government Efficiency have fueled expectations of favorable regulatory changes, particularly in autonomous vehicle policies. Analysts suggest that this surge is driven more by market sentiment than by fundamental improvements in Tesla's business operations.

Regulatory Environment and Potential Impacts

The incoming administration's stance on electric vehicle (EV) tax credits and autonomous vehicle regulations is pivotal for Tesla's future. Reports indicate that Trump plans to eliminate the federal $7,500 EV tax credit, which could compel Tesla to reduce vehicle prices to maintain demand. Conversely, the administration's intention to create a federal framework for self-driving cars may accelerate Tesla's autonomous vehicle initiatives, including its robotaxi service.

Financial Performance and Valuation

Tesla's financial metrics reveal a complex picture. The company's gross profit margin has declined from nearly 30% in 2021 to approximately 17% in 2024, primarily due to price reductions aimed at sustaining demand amid rising interest rates. Despite these challenges, Tesla's market capitalization has surpassed $1 trillion, exceeding the combined value of major automakers like Toyota, Ford, and General Motors. However, the stock's current price-to-earnings (P/E) ratio stands at 93.20, indicating a high valuation relative to earnings.

Analyst Perspectives

Analysts present mixed views on Tesla's stock. UBS analysts maintain a sell rating, citing the recent surge as driven by "animal spirits" rather than fundamentals. They express concerns about the potential negative impact of removing EV tax credits on U.S. demand. Conversely, some analysts highlight the potential benefits of regulatory easing under the new administration, which could favor Tesla's autonomous vehicle ambitions.

Conclusion: Hold Recommendation

Considering the current market dynamics, regulatory uncertainties, and Tesla's high valuation, a prudent approach would be to hold the stock. While the potential for favorable regulatory changes exists, the removal of EV tax credits and declining profit margins pose significant risks. Investors should monitor upcoming policy developments and Tesla's financial performance closely to make informed decisions.

That's TradingNEWS