NASDAQ:TSLA’s Autonomous Bet – Can It Justify a $459 Price Target?

Tesla’s AI, Robotics, and Self-Driving Push – Is TSLA a Buy Before It Explodes? | That's TradingNEWS

NASDAQ:TSLA – Can Tesla Justify a $459 Price Target with AI and Robotics?

Tesla’s Transformation Beyond EVs – Is the Market Pricing It Right?

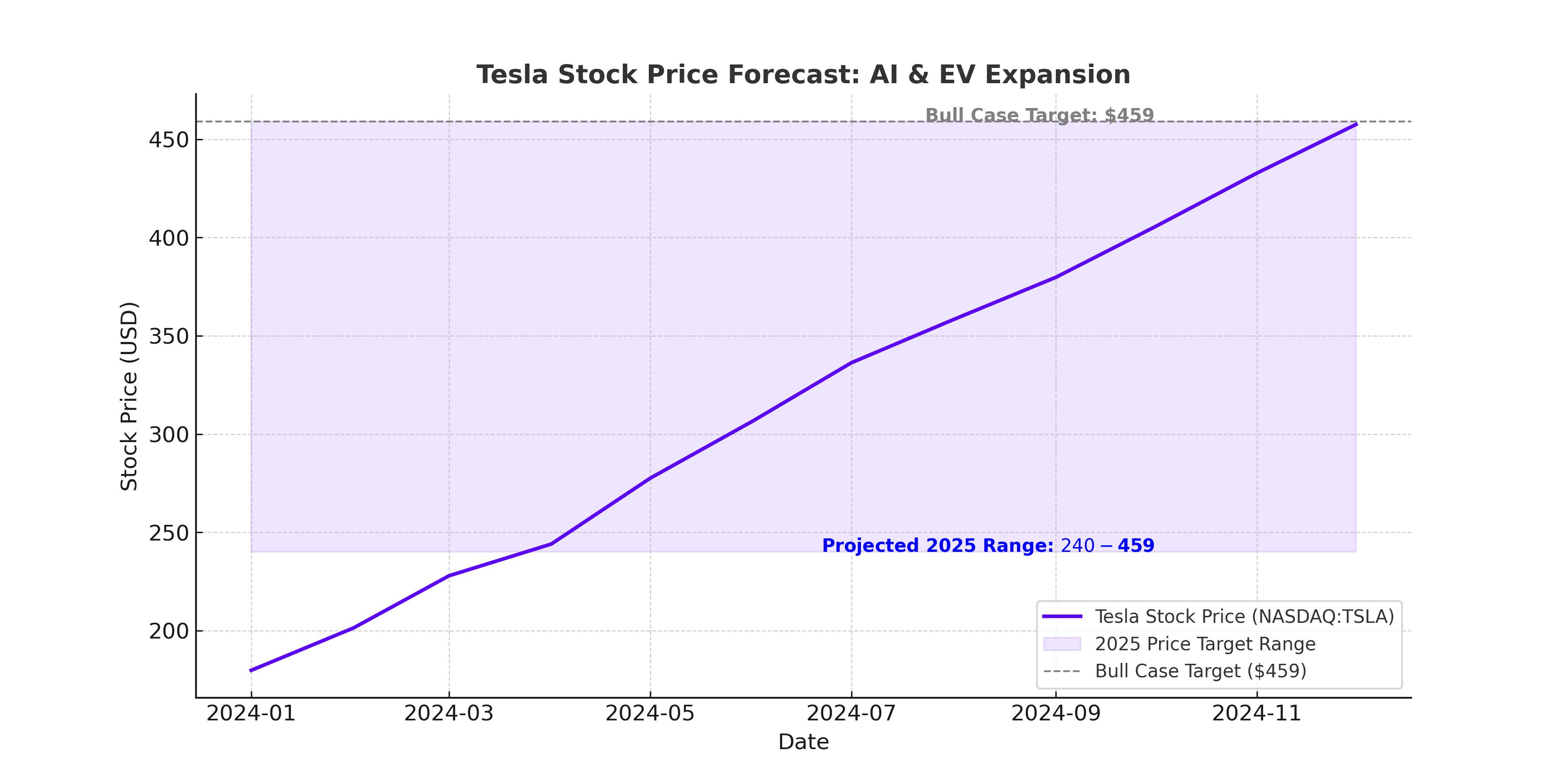

Tesla (NASDAQ:TSLA) is no longer just an automaker. With its stock hovering around $180, investors are questioning whether Tesla's AI-driven expansion can push it toward a $459 price target or if near-term pressures will stall growth. While traditional auto sales remain Tesla’s core business, margins are tightening, and production efficiency is under scrutiny. Tesla's Full Self-Driving (FSD), Optimus humanoid robot, and energy storage expansion are fueling its long-term valuation, but short-term market sentiment is mixed.

Tesla’s Core Business – Record Deliveries but Margin Compression

Tesla delivered 495,570 vehicles in Q4 2024, a new record, yet production fell 7% year-over-year to 459,445 units. This intentional move was designed to reduce inventory as Tesla transitions to its updated Model Y, but it signals slowing production efficiency. The upcoming affordable Tesla model in early 2025 is expected to boost demand, but execution remains a critical risk.

The Tesla Semi-truck is set for high-volume production in late 2025, with expectations of it becoming a $10 billion revenue stream. The key challenge is battery supply constraints, an issue Tesla is tackling with over $1 billion invested in lithium mining and processing in Texas. But delays could push timelines, further impacting near-term margins.

Autonomous Driving and AI – The Key to Tesla’s Future Valuation

Tesla’s Full Self-Driving (FSD) program is its most significant growth driver. With unsupervised FSD launching in Austin, Texas, in June 2025, Tesla is preparing to turn its cars into an autonomous revenue-generating fleet. Musk has repeatedly emphasized that Tesla’s future value is overwhelmingly tied to autonomy, meaning FSD success is non-negotiable for the company’s growth trajectory.

Beyond vehicle autonomy, Tesla is planning a robotaxi network, positioning itself as a competitor to Uber and Waymo. If Tesla succeeds, it will shift from a one-time vehicle sales model to a recurring revenue model, unlocking massive profit potential. Tesla vehicle owners will also have the option to add their cars to the robotaxi network, much like an Airbnb for cars, increasing each vehicle’s usage from 10 hours per week to over 50 hours.

The biggest risk? Regulatory approvals. While Tesla is pushing FSD aggressively, one high-profile accident could slow its momentum, impacting consumer trust and delaying mass adoption.

Optimus Robot – The Most Ambitious AI Play Yet

Tesla is betting big on humanoid robotics, with its Optimus robot already being deployed within Tesla factories. Musk expects to produce 10,000 units this year, with a long-term goal of scaling to 1 million units annually.

Each Optimus unit is expected to cost under $20,000, making it a game-changer for industrial automation. Musk has stated that this could be a $10 trillion industry, but Tesla needs to prove it can scale production efficiently. Investors betting on Tesla today aren’t just buying into EVs—they’re buying into a future where AI-powered robots drive a major share of Tesla’s revenue.

Energy Storage – The Hidden Profit Machine

Tesla’s Energy Generation & Storage division is seeing explosive growth, with revenue jumping 67% year-over-year to $3 billion in Q4 2024. Gross margins expanded from 18.91% in FY23 to 25.22%, proving that Tesla's energy business is becoming a high-margin operation.

The Shanghai Megapack factory is expected to increase production by 50% in 2025, securing Tesla’s position as a leader in global energy storage. With demand for renewable energy surging, this segment could quietly become Tesla’s most profitable division in the coming decade.

China Risks and Geopolitical Headwinds

Tesla faces serious risks in China, both from competition and intellectual property threats. BYD (OTCPK:BYDDY) has already overtaken Tesla as the world’s largest EV maker, and China’s history of copying Western technology raises concerns for Tesla’s AI advancements.

The DeepSeek AI controversy—where China allegedly reverse-engineered OpenAI’s ChatGPT—underscores this threat. If China manages to replicate Tesla’s self-driving AI, it could erode Tesla’s competitive edge, hurting its ability to dominate in the FSD licensing market.

Further complicating matters, new Trump-era tariffs could increase Tesla’s production costs. The 25% tariff on Mexican imports directly impacts Tesla, given that 20-25% of its components come from Mexico. This could compress margins further, making execution of Tesla’s affordable vehicle even more challenging.

Tesla Stock Price Forecast – Is $459 Realistic?

Tesla’s current stock price of $180 reflects short-term fears, but long-term AI-driven potential remains strong. Analysts forecasting $240 billion in revenue by 2030, with $44.5 billion in net income at an 18.5% margin, suggest a 2030 EPS of $8.90.

Using different valuation multiples:

Bull case (120x P/E): $1,068 per share

Base case (95x P/E): $845 per share

Bear case (70x P/E): $623 per share

A 50.61x EV/aEBITDA multiple gives Tesla a 2026 price target of $459 per share, assuming the successful rollout of FSD, Optimus, and energy expansion.

Final Verdict – Should You Buy Tesla Stock Now?

Tesla remains a high-risk, high-reward bet. Investors aren’t just buying an automaker—they’re betting on autonomous driving, robotics, and AI-driven automation.

If Tesla executes FSD deployment, scales its robotaxi business, and mass-produces Optimus, the stock could easily surpass $500 in the next two years. However, regulatory delays, tariffs, and competition from China pose real risks that could keep the stock range-bound between $150-$200 in the near term.

Right now, Tesla is a buy for long-term investors willing to ride out volatility.