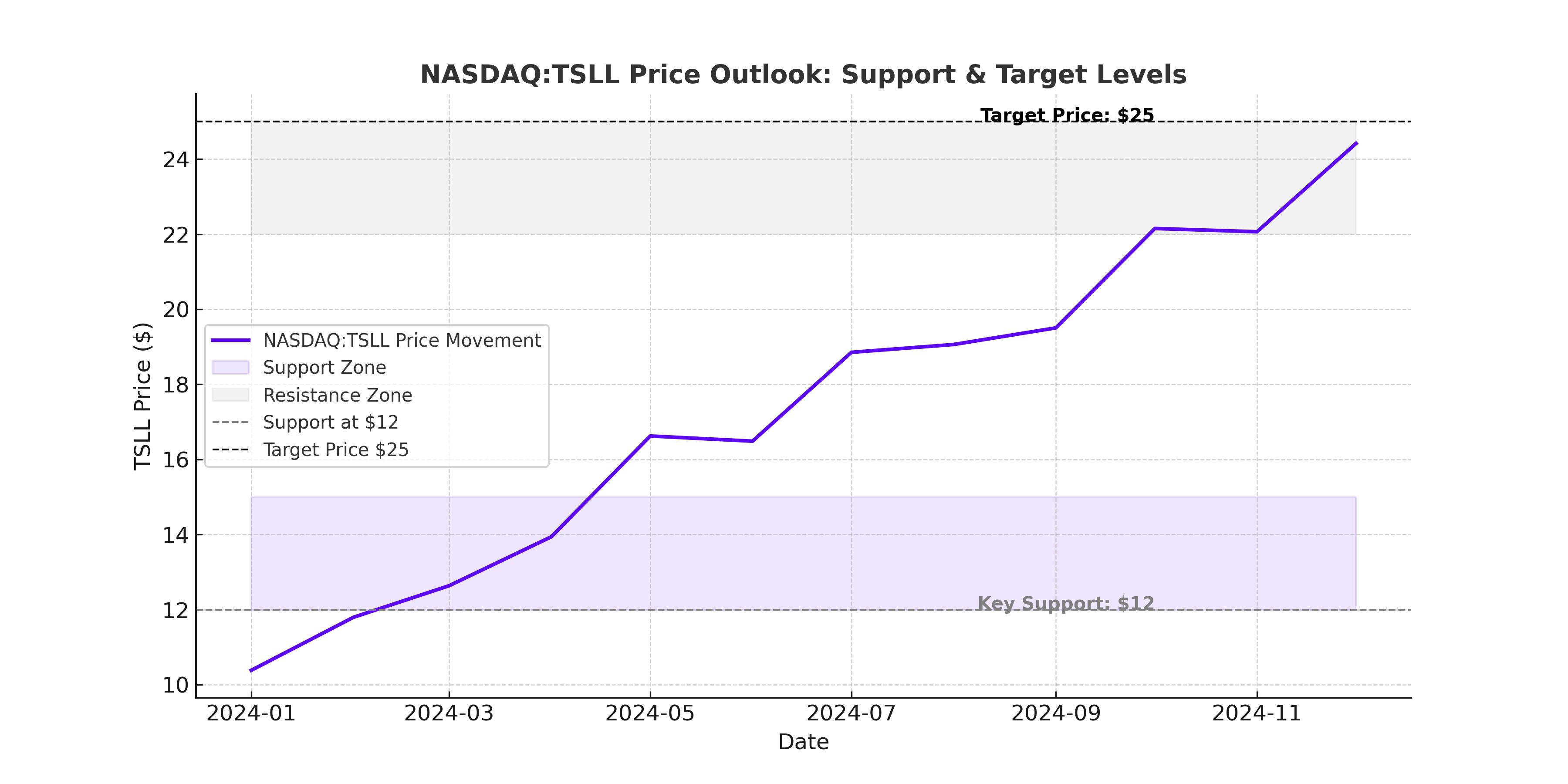

NASDAQ:TSLL – Is This Tesla-Leveraged ETF a Smart Bet or a Volatility Trap at $12.45?

Can TSLL Deliver 2X Tesla’s Gains Without Wiping You Out on the Next Dip? | That's TradingNEWS

NASDAQ:TSLL – Is This Tesla-Leveraged ETF a Profitable Trade or a Volatility Nightmare?

Understanding NASDAQ:TSLL – The High-Stakes 2X Tesla ETF

The Direxion Daily TSLA Bull 2X Shares ETF (NASDAQ:TSLL) is a high-risk, high-reward play designed for traders looking to double the daily return of Tesla Inc. (NASDAQ:TSLA). Unlike traditional ETFs that diversify across a range of stocks, TSLL is a single-stock leveraged ETF, which means it magnifies both Tesla’s gains and losses. This makes it one of the most aggressive financial instruments tied to Tesla’s performance, catering specifically to short-term traders rather than long-term investors.

TSLL has rapidly gained traction since its launch on August 9, 2022, attracting a massive $5.1 billion in assets under management and an average daily trading volume of 98 million shares. The appeal is obvious—when Tesla moves up, TSLL moves up twice as fast. But the danger is just as real—when Tesla declines, TSLL loses value at twice the rate. This extreme volatility makes understanding TSLL’s mechanics crucial before investing, as it operates differently than standard ETFs.

Why Is TSLL Seeing Massive Inflows Despite Tesla’s Struggles?

Tesla’s core electric vehicle (EV) business has faced multiple headwinds, including declining deliveries, increasing competition from Chinese automakers like BYD, and macroeconomic pressures. However, that hasn’t stopped investors from pouring money into TSLL, with a staggering $580 million flowing into the ETF since the start of 2025, including $45 million in a single day after Tesla’s most recent earnings call.

What’s fueling this optimism? It’s not Tesla’s current financial performance, but rather its bold bets on the future. Investors are focusing on:

- Robotaxi Program – Tesla’s plan to launch a driverless ride-hailing service in Austin, Texas, by mid-2025

- Humanoid Robots (Optimus) – Tesla is working to mass-produce thousands of Optimus robots by 2026, a massive shift into AI and automation

- Energy Storage Growth – Tesla’s Megapack and Powerwall businesses saw 113% year-over-year growth in Q4, signaling strong momentum outside of EVs

- AI and Dojo Supercomputer – Tesla is positioning itself as a future AI leader, with its Dojo supercomputer potentially competing with NVIDIA (NASDAQ:NVDA) for AI training dominance

Despite Tesla’s EV business posting lower-than-expected revenue of $25.7 billion in Q4, bulls are betting that autonomous driving and robotics will be Tesla’s next trillion-dollar industry, pushing TSLA—and by extension, TSLL—to new heights.

NASDAQ:TSLL vs. TSLA – Does the 2X Leverage Deliver Real Gains?

TSLL is structured to deliver 2X Tesla’s daily return, meaning if Tesla rises 5% in a day, TSLL will rise 10%. However, this only applies on a daily basis due to the ETF’s daily reset mechanism. Over longer periods, compounding effects cause TSLL to deviate significantly from Tesla’s actual performance.

For example, looking at Tesla’s recent uptrend:

- Last 3 months: Tesla stock gained +55%, while TSLL surged +132%

- Last 6 months: Tesla stock rose +75%, while TSLL soared +165%

- Since inception (Aug 2022): Tesla stock increased +22%, while TSLL actually lost -19.8%

Clearly, TSLL performs well in sustained bull markets but severely underperforms in volatile or bearish conditions. This means that holding TSLL long-term does not guarantee 2X Tesla’s returns—in fact, extended holding periods can lead to losses even if Tesla’s stock trends upward.

The Problem With Holding TSLL Too Long – Loss Recoupment & Volatility Risk

One of the biggest issues with leveraged ETFs like TSLL is asymmetric loss recovery. When Tesla drops, TSLL falls twice as hard. But making up those losses is much more difficult than it seems.

For instance, if Tesla drops 10% in a single day, TSLL will drop 20%. However, for TSLL to recover to its previous price, Tesla would need to rise by 25% the next day, which is significantly harder to achieve.

This becomes even more dangerous during choppy, volatile trading periods. Multiple consecutive down days can rapidly destroy TSLL’s value due to the compounding effect of losses.

Real-World Example of TSLL’s Loss Recoupment Challenge

- October 11, 2024 – Tesla dropped -8.8% in a single day

- TSLL lost -17.6% that day

- For TSLL to fully recover, Tesla would need to gain 21.4%—something Tesla has only done three times in the last year

This dynamic makes TSLL particularly dangerous for long-term holders, as a single steep decline can take months to recover from, if at all.

Tesla’s Valuation – A Speculative Bet With High Expectations

Tesla currently trades at a forward P/E ratio of 133, one of the highest among mega-cap tech stocks. This valuation suggests that the market is pricing in significant future growth from AI, energy storage, and robotaxis. However, the reality is that Tesla’s current business fundamentals do not justify such a high multiple—its annual revenue growth was just 2% in Q4.

Morgan Stanley analysts estimate that Tesla’s AI and autonomous businesses could add over $500 billion to its market cap, but these are long-term projections that may take years to materialize. For TSLL traders, this means they are betting on near-term hype rather than current financial performance.

Who Should Trade TSLL? Short-Term Traders vs. Long-Term Investors

Because TSLL’s daily reset amplifies both gains and losses, it is best suited for traders who actively monitor their positions and time their entries and exits carefully.

Best Use Cases for TSLL

*Short-term traders looking to capitalize on Tesla’s daily movements

*Experienced traders who can manage high volatility and leverage risk

*Investors who believe Tesla will continue its bullish momentum in the near term

Who Should Avoid TSLL?

*Long-term investors—Tesla shares are a safer way to gain exposure

*Buy-and-hold traders—TSLL’s structure is not designed for extended periods

*Investors who can’t handle significant volatility and potential steep drawdowns

Final Verdict – Is NASDAQ:TSLL a Buy, Sell, or Hold?

TSLL is one of the most aggressive ways to trade Tesla, offering massive short-term upside potential but also significant risk of compounding losses. The ETF’s daily leverage works well in strong bull markets, but in choppy or bearish conditions, it can rapidly lose value in ways that standard Tesla stock does not.

For traders who understand leveraged ETFs and can time their trades effectively, TSLL can be a powerful tool for maximizing Tesla’s price swings. However, for long-term Tesla believers, owning TSLA stock directly is the smarter choice.

Verdict: Buy for short-term trading, avoid for long-term holding.