Nebius Group (NASDAQ:NBIS): AI Infrastructure Powerhouse Targeting Explosive Growth

Can NASDAQ:NBIS Stock Surge to a $15B Market Cap?

Nebius (NASDAQ:NBIS) is on a mission to dominate AI cloud infrastructure, armed with a $2.45 billion cash reserve, near-zero debt, and strategic backing from Nvidia. With a potential tripling in market cap over the next 12 months, can this AI-driven growth engine deliver on its massive upside potential?

NASDAQ:NBIS Growth Trajectory: A Transformational Shift

Nebius has undergone a complete transformation, shedding its Russian assets and pivoting aggressively toward AI cloud services. Following its detachment from Yandex and the subsequent re-listing on the Nasdaq in late 2024, the company has aggressively expanded into high-performance AI cloud infrastructure, fueling exponential revenue growth.

In Q4 2024, Nebius reported a 462% year-over-year revenue surge, reaching $117.5 million for the full year. This growth has been driven by the company's AI infrastructure division, which accounted for over half of total revenue in Q4. With a projected December 2025 annualized revenue run-rate (ARR) of $750 million to $1 billion, Nebius is on track for one of the most explosive growth stories in the AI sector.

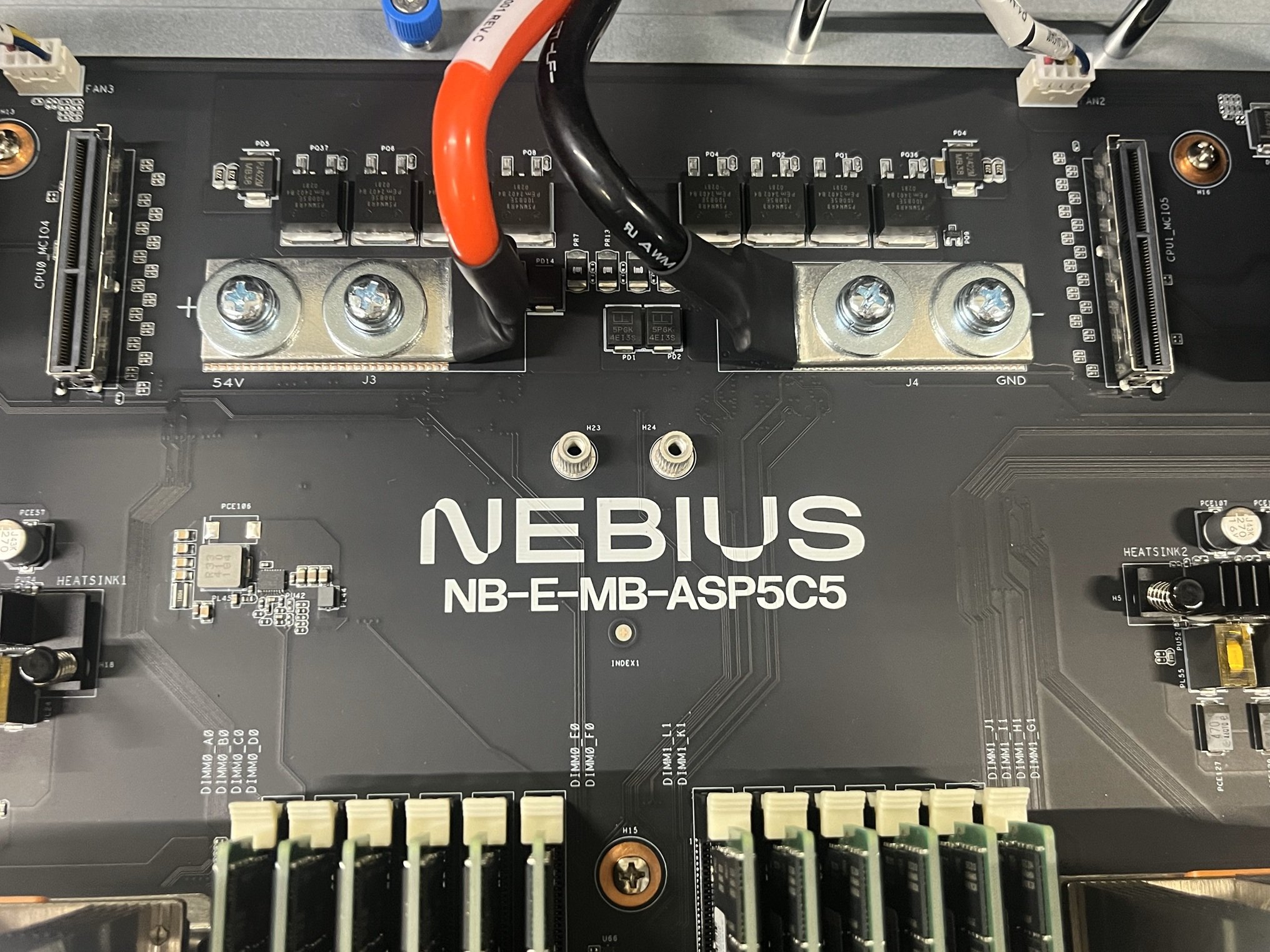

The company has invested heavily in AI-dedicated data centers, with an ambitious plan to triple its data center capacity in Finland and expand to new locations in the U.S. and Iceland. By year-end 2025, Nebius expects to be operating at 100 megawatts of AI-focused infrastructure, with the ability to scale further.

NASDAQ:NBIS Stock Performance and Valuation: How High Can It Go?

With NASDAQ:NBIS trading at $28.10 and a market cap of $7 billion, investors are eyeing its upside potential relative to AI cloud competitors. The stock currently trades at a price-to-sales (P/S) ratio of nearly 60, reflecting its high-growth nature. However, forward P/S projections drop dramatically to 12.5, making it an increasingly attractive bet as revenue expands.

In a base-case scenario, assuming $600 million in FY25 revenue and a P/S of 25, Nebius would command a $15 billion market cap—more than double its current valuation. A more bullish case, with $800 million revenue and a P/S of 35, could push the stock toward a $28 billion valuation, presenting a 300% upside for investors.

Nebius vs. AI Cloud Giants: Competing for Market Share

Nebius isn’t competing with traditional hyperscalers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud. Instead, it specializes in AI-optimized infrastructure, positioning itself alongside CoreWeave, a GPU-dedicated cloud provider that recently filed for an IPO at a $35 billion valuation.

The AI cloud market is expected to expand from $33 billion in 2023 to $260 billion by 2030, with demand outstripping supply. Major cloud providers are already at full capacity, creating an opportunity for AI-first cloud companies like Nebius to capture market spillover. Nvidia’s recent $700 million private placement into Nebius further validates its positioning as a serious player in AI infrastructure.

Capital Strength and Insider Transactions: Is Nebius a Strong Buy?

Nebius boasts a $2.45 billion cash reserve, giving it unparalleled financial flexibility to scale without dilution or debt concerns. With just $294.9 million in liabilities and near-zero debt, Nebius is one of the best-capitalized AI cloud companies on the market.

Insider transactions reveal a strong alignment with investors. The company has strategically repurchased shares while securing backing from institutional heavyweights. Investors can track insider moves at Nebius Insider Transactions.

Risks to Consider: Can NASDAQ:NBIS Maintain Its Growth?

While the growth story is compelling, several risks need to be accounted for:

- Profitability remains uncertain. The company’s aggressive capex strategy means it’s still operating at a loss.

- Market volatility. High-growth tech stocks are prone to fluctuations, and AI hype cycles can be unpredictable.

- Regulatory concerns. While Nebius now operates under Dutch laws, any lingering geopolitical concerns from its Yandex history could weigh on sentiment.

Final Verdict: Is NASDAQ:NBIS a Buy, Sell, or Hold?

Nebius presents a high-risk, high-reward opportunity in AI cloud infrastructure. The combination of rapid revenue growth, strong institutional backing, and a well-funded balance sheet creates a bullish case for long-term investors.

With a projected market cap expansion to $15 billion or beyond, NASDAQ:NBIS could be a multi-bagger AI play in 2025. However, investors should monitor execution risks and capital expenditure management closely.

For real-time price movements, check out the Nebius stock chart.