Netflix (NASDAQ:NFLX): A Streaming Giant With Unmatched Growth Potential

Netflix (NASDAQ:NFLX) has shattered expectations in 2024, proving that its dominance in the streaming industry remains unrivaled. The company closed the year with a record 302 million global subscribers, adding a staggering 19 million new users in Q4 alone—far exceeding Wall Street’s expectations of 10 million. This performance highlights Netflix’s ability to not only retain but aggressively expand its subscriber base, even as competition intensifies from Disney+ (NYSE:DIS), HBO Max, and Amazon Prime Video (NASDAQ:AMZN).

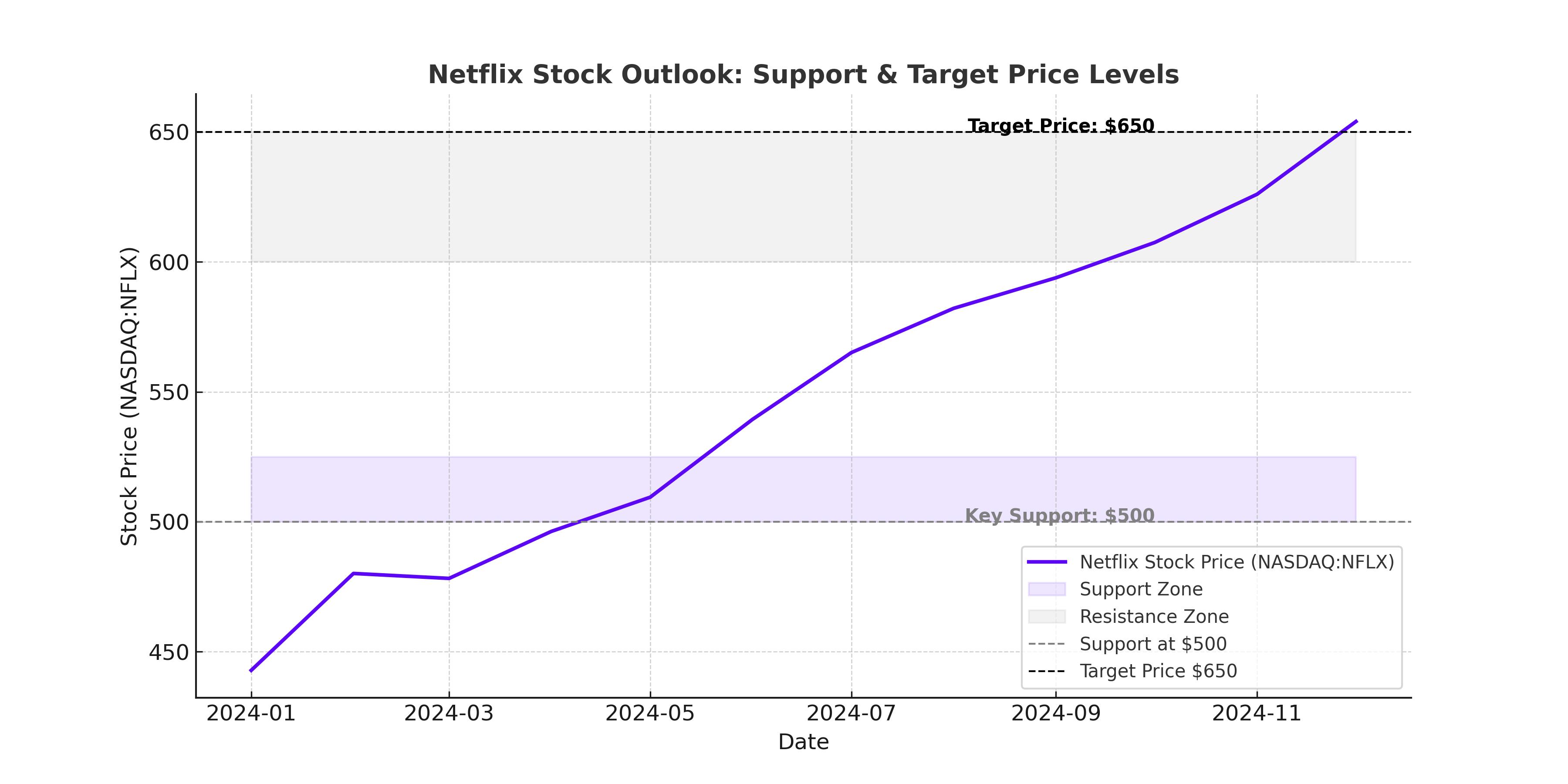

Valued at $432 billion, Netflix continues to command premium multiples, currently trading at 40x forward earnings. With revenue surging 16% YoY to $10.25 billion in Q4, the company is proving its ability to scale while maintaining strong profitability, with free cash flow of $1.4 billion. But can NFLX continue its momentum, or are risks such as rising competition, content costs, and advertising growth challenges lurking ahead?

Netflix (NASDAQ:NFLX) Revenue Growth and Subscriber Surge Defy Expectations

The most significant takeaway from Netflix’s 2024 results is the sheer scale of its subscriber growth. At 302 million subscribers, the company dwarfs its closest competitors, including Disney+ (150 million) and HBO Max (100 million).

Netflix’s password-sharing crackdown has been a game-changer, pushing more users to officially pay for subscriptions. Meanwhile, the company’s decision to gradually increase prices—without losing subscribers—demonstrates its strong pricing power.

Netflix’s Q4 financials underscore its ability to generate strong cash flow while scaling revenue. Operating margin expanded to 22.2%, while revenue hit $10.25 billion, up 16% YoY. The company’s strategy of investing in premium content, expanding into live sports, and optimizing its ad-supported tier continues to drive profitability.

Ad-Supported Tier Gains Traction, Boosting Netflix’s Advertising Revenue

Netflix’s ad-supported tier has turned out to be a bigger success than expected, with 55% of new sign-ups in Q4 opting for the ad tier, compared to 50% in Q3.

This signals a major shift in consumer behavior, as more users are willing to trade lower subscription costs for ad exposure. Netflix’s ability to monetize its growing ad-supported user base is critical, especially given its ambition to double advertising revenue in 2025.

Netflix is now competing directly with YouTube and traditional TV for ad dollars. While YouTube generated $40 billion in ad revenue in 2024, Netflix’s ad revenue remains a fraction of that. However, analysts estimate that by 2026, Netflix could be generating over $10 billion annually from advertising—a key driver of future earnings.

Netflix’s Push Into Sports and Live Content Will Strengthen Pricing Power

One of the most significant strategic shifts for NASDAQ:NFLX is its pivot into live sports. Netflix has historically avoided live content, but recent deals—including the Jake Paul vs. Mike Tyson boxing match and a select number of NFL games—are major moves that will help the company attract a wider audience.

Live sports have been one of the last strongholds of traditional cable TV, and as ESPN (NYSE:DIS) struggles with declining subscribers, Netflix is positioning itself as the go-to alternative for premium live events.

Why does this matter? Sports content is one of the few areas where consumers are willing to pay more, which allows Netflix to further increase subscription prices over time. If Netflix continues acquiring high-profile live sports deals, it will drive up engagement and expand its addressable market.

Netflix Content Strategy: More Original Hits, More Profitability

Netflix’s success has always been tied to its content dominance, and 2024 was no exception. Blockbuster series like Squid Game: Season 2, Wednesday, and Stranger Things continue to fuel engagement, while localized content from South Korea, India, and Spain is helping drive international growth.

Unlike its competitors, Netflix is not losing money on streaming. In contrast, Disney+ lost $1.4 billion in 2024, while HBO Max and Peacock continue to struggle with profitability. The reason? Netflix has perfected the art of balancing content spending with pricing power, ensuring it can grow without burning cash.

The company is also reducing spending on lower-performing content, increasing focus on fewer, higher-quality productions. This move is expected to improve margins while still delivering the hits that keep subscribers engaged.

Netflix’s Financial Strength and Expanding Margins Are Fueling Growth

Netflix is no longer just a high-growth company—it’s a profitable one. In Q4, Netflix generated $1.4 billion in free cash flow, up from just $782 million in Q4 2023.

More importantly, the company is projecting revenue of $44 billion for 2025, indicating a continued double-digit growth trajectory.

Netflix’s pricing power is also evident in its latest subscription price hikes:

- Ad-supported plan: Increased from $6.99 to $7.99

- Standard plan: Increased to $17.99

- Premium plan: Increased to $24.99

Despite these price increases, churn remains minimal, demonstrating Netflix’s sticky customer base and lack of real competition in the premium streaming space.

Valuation: Is Netflix (NASDAQ:NFLX) Overvalued or Still a Buy?

Netflix is trading at 40x forward earnings, a premium multiple compared to traditional media companies like Disney (23x) or Warner Bros. Discovery (19x). However, this premium is justified by its high margins, strong pricing power, and ad revenue expansion.

Netflix’s valuation suggests an implied price target of $1,279/share, representing a 26% upside from current levels. If Netflix successfully doubles its advertising revenue and continues its strong pricing strategy, the stock could even surpass this target by 2026.

Risks: Can Netflix Maintain Growth Amid Intensifying Competition?

Despite Netflix’s strengths, it faces several risks that investors should consider.

First, big tech competitors like Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) have unlimited budgets. Amazon is investing billions into Prime Video, while Apple TV+ is offering free trials to iPhone buyers, making subscriber acquisition more competitive.

Second, content costs are rising, and Hollywood talent continues to demand higher pay, cutting into margins. Future strikes or disputes with content creators could slow down Netflix’s ability to release new hits.

Finally, Netflix’s stock valuation leaves little room for error. Any sign of slowing subscriber growth or weaker-than-expected ad revenue could trigger a major sell-off.

Final Verdict: Is Netflix (NASDAQ:NFLX) a Buy, Hold, or Sell?

Netflix has proven its doubters wrong once again. With record subscriber growth, rising revenue, expanding profit margins, and strong pricing power, NASDAQ:NFLX remains a compelling long-term buy.

The move into sports, growth of ad revenue, and continued content dominance suggest that Netflix is far from hitting a ceiling. At $432 billion market cap, it has successfully overtaken legacy media giants and remains the dominant force in global streaming.

While risks exist, Netflix’s premium valuation is justified by its growth, profitability, and future potential. Investors should view any near-term weakness as a buying opportunity—because Netflix isn’t slowing down anytime soon.