Netflix Stock (NASDAQ: NFLX): Breaking Down Its Path to $700 and Beyond

As Netflix pushes towards a $700 stock price, its new ad-driven model and strong subscriber growth signal potential gains for investors. Explore the insights shaping its future trajectory | That's TradingNEWS

Netflix (NASDAQ: NFLX): A Dominant Force in Streaming, Adapting to New Realities

Netflix (NASDAQ: NFLX) has been the clear leader in the video-on-demand streaming market for years, but the company is far from complacent. With approximately 280 million global subscribing households, Netflix’s reach spans to nearly 600 million end users, assuming an average household size of at least two people. This sheer scale positions Netflix as a unique force in the media industry, giving it a commanding first-mover advantage. However, the streaming giant’s continued success relies on its ability to innovate, navigate increasing competition, and optimize its offerings to drive both subscriber growth and profitability.

Building a Legacy with First-Party Content

What truly differentiates Netflix from its competitors is its investment in first-party content. This pivot began in 2013 under the leadership of co-CEO Ted Sarandos, leading to the development of iconic series such as Stranger Things, Black Mirror, and Narcos. The focus on original content not only helped Netflix establish a loyal and sticky user base but also positioned it to generate a steady stream of content that is unmatched in its scope and quality.

This shift from a content distributor to a content creator enabled Netflix to create intellectual property that continues to drive subscriptions. In a market where competition has intensified with entrants like Disney (NYSE: DIS), Warner Bros. Discovery (NASDAQ: WBD), and Comcast (NASDAQ: CMCSA).

Netflix’s strategy of maintaining control over its content production has been essential in insulating the company from rivals.

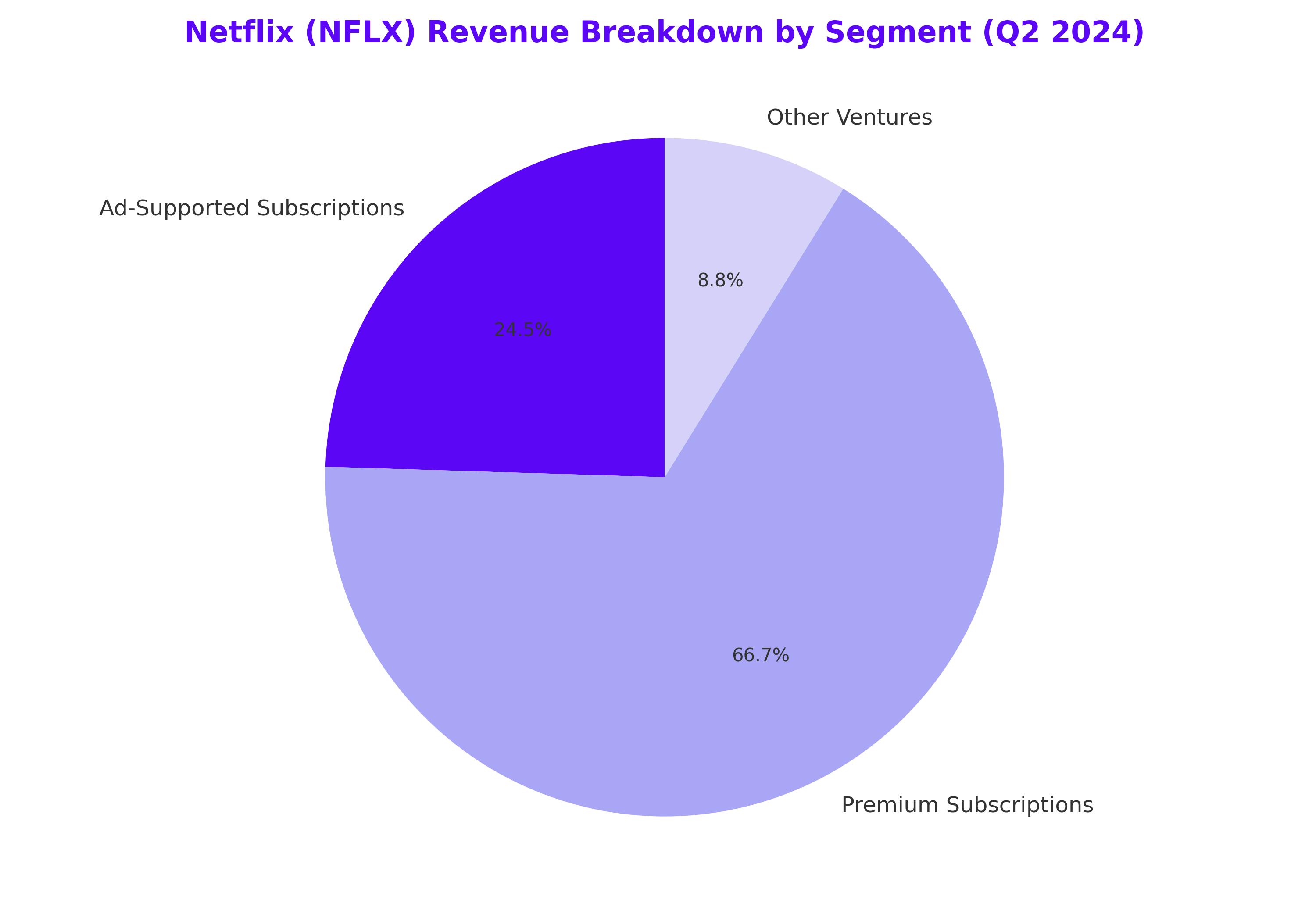

Strong Q2 2024 Earnings: Revenue Growth and Subscriber Expansion

In its Q2 2024 earnings report, Netflix showcased robust financial health, with revenue growth of 17% and a remarkable 48% increase in earnings per share (EPS). These numbers were driven by the addition of 8 million net new subscribers, alongside a 5% increase in average revenue per user (ARPU). The company’s operating margin also improved significantly, rising to 27.2%, up from 22.3% in Q2 2023. Free cash flow for the trailing 12 months surged to $6.8 billion, compared to $4.2 billion the previous year.

These strong results allowed Netflix to revise its full-year guidance upward. The company now expects top-line growth of 14-15% for 2024 and an operating margin of 26%, compared to a prior forecast of 25%. This upward revision reflects the company’s confidence in its ability to sustain both revenue growth and profitability, supported by strong operating leverage.

Ad-Supported Subscription Model: A Strategic Shift

Netflix’s move to introduce an ad-supported subscription model marks a significant evolution in its business strategy. Roughly 45% of new sign-ups in markets where ad-supported plans are available have chosen this lower-cost option. This demonstrates Netflix’s ability to attract a broader range of consumers who may have previously been priced out of the service.

The success of the ad-supported model is not only about adding subscribers but also about tapping into a new revenue stream. Advertising provides Netflix with a way to diversify its income, especially as growth in subscription numbers alone slows in mature markets. CEO Greg Peters highlighted the importance of building out Netflix’s ad-tech capabilities, focusing on delivering high-quality analytics that advertisers demand to ensure the success of their campaigns.

Competitive Landscape and Risks

Despite its strong market position, Netflix faces increasing competition. Rivals like Disney+ and HBO Max are not only ramping up their own first-party content production but also undercutting Netflix on price in some cases. However, Netflix’s first-mover advantage, scale, and content library give it a substantial moat. It also helps that Netflix has the luxury of focusing purely on its streaming business, unlike legacy media companies that must manage declining traditional media assets.

That said, Netflix’s valuation is relatively high, with a forward P/E ratio of around 33x, compared to an S&P 500 average of 24x. However, when you account for Netflix’s projected CAGR of 27%, the stock appears more reasonably priced, particularly with its PEG ratio of 1.2x, suggesting that the growth justifies the premium valuation.

The main risk associated with Netflix lies in its ability to build out the necessary ad-tech infrastructure to meet advertiser expectations. Failure to successfully monetize this new revenue stream could temper growth expectations. However, Netflix’s track record as a Silicon Valley-based disruptor gives confidence that the company will continue to execute its strategy effectively.

Expanding Content: From NFL to Sports Programming

A notable development for Netflix in recent months is its gradual entry into live sports programming. The company secured the rights to stream Christmas NFL games for the next three years, an important step in broadening its content offering. However, Netflix is taking a more cautious approach than competitors by focusing on one-off, high-impact games rather than committing to full sports league contracts, which can be prohibitively expensive.

This calculated move allows Netflix to test the waters in live sports without the huge capital outlay associated with major long-term sports rights deals, such as those recently seen with the NBA.

Valuation and Financial Outlook

From a valuation perspective, Netflix’s current P/E ratio of 33x reflects investor confidence in its future growth prospects. However, compared to other tech giants like Meta (NASDAQ META) and Google (NASDAQ: GOOGL), which trade at lower multiples, Netflix’s stock may seem expensive. However, its PEG ratio of 1.2x paints a more favorable picture, suggesting that its valuation is justified given its growth trajectory.

Netflix has proven its ability to translate revenue growth into profit margins, and analysts are forecasting a 27% CAGR in the medium term. This should continue to drive strong EPS growth and bolster Netflix’s share price, even if it appears expensive on the surface. The company’s focus on ad-supported revenue streams and continued investment in first-party content will further drive value.

Advertising: A Major Revenue Driver

Perhaps the most significant shift in Netflix’s strategy is its increasing focus on advertising. In its second annual Upfront negotiations, Netflix saw a 150% increase in ad sales commitments compared to 2023, highlighting the growing demand from advertisers to reach Netflix’s vast and highly engaged audience.

Netflix’s entry into the advertising space allows it to diversify its revenue model, making its earnings less volatile and more predictable. With plans to stop reporting subscriber numbers in 2025, the company is signaling that advertising will play a larger role in its future revenue mix. By tapping into the growing trend of cord-cutting, Netflix stands to capture significant ad dollars that are currently being diverted away from traditional linear TV.

Insider Transactions

As part of its commitment to transparency, Netflix reports regular insider transactions. Recently, CEO Gregory K. Peters sold 4,783 shares at an average price of $675.00, bringing the total transaction value to $3,228,525.00. Chairman Reed Hastings also sold 22,526 shares at an average price of $670.49, totaling $15,103,457.74. While insider selling is not uncommon, these transactions reflect ongoing interest in Netflix’s stock performance and confidence from insiders in its long-term prospects. Investors can follow more insider transactions here.

Final Thoughts: Netflix (NASDAQ: NFLX) as a Buy

Given Netflix’s leadership position, strong earnings growth, and expanding revenue streams, it remains an attractive investment. The stock is priced for growth, but when factoring in its PEG ratio, projected EPS growth, and the success of its advertising model, Netflix has the potential to continue delivering solid returns to shareholders. With new content releases like Squid Game Season 2 and Stranger Things expected to drive further subscriber engagement, and the ad-supported model gaining traction, Netflix has multiple avenues for growth.

For investors looking for exposure to a company that’s continuously evolving and adapting to a changing media landscape, Netflix (NASDAQ: NFLX) remains a strong buy. You can track real-time stock updates for Netflix here.

Read More

-

Microsoft Stock Price Forecast - MSFT at $486: Can the $3.6T AI Giant Still Justify Its Premium?

26.12.2025 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD At $1.87 With Bullish Setup Pointing Toward $2.60 Target

26.12.2025 · TradingNEWS ArchiveCrypto

-

Oil Prices Stabilize: WTI at $58 and Brent at $62 Trapped Between Sanctions Risk and 2026 Oversupply

26.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow And S&P 500 Hover Near Records As NVDA, TSLA, PLTR, NKE And CPNG Lead Moves

26.12.2025 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Holds the 1.35 Zone as Dollar Weakens into 2026

26.12.2025 · TradingNEWS ArchiveForex