Netflix Stock NASDAQ:NFLX - Performance, Pricing Power, and Future Prospects

Examining the Key Factors Driving Netflix's Market Leadership and Growth Potential | That's TradingNEWS

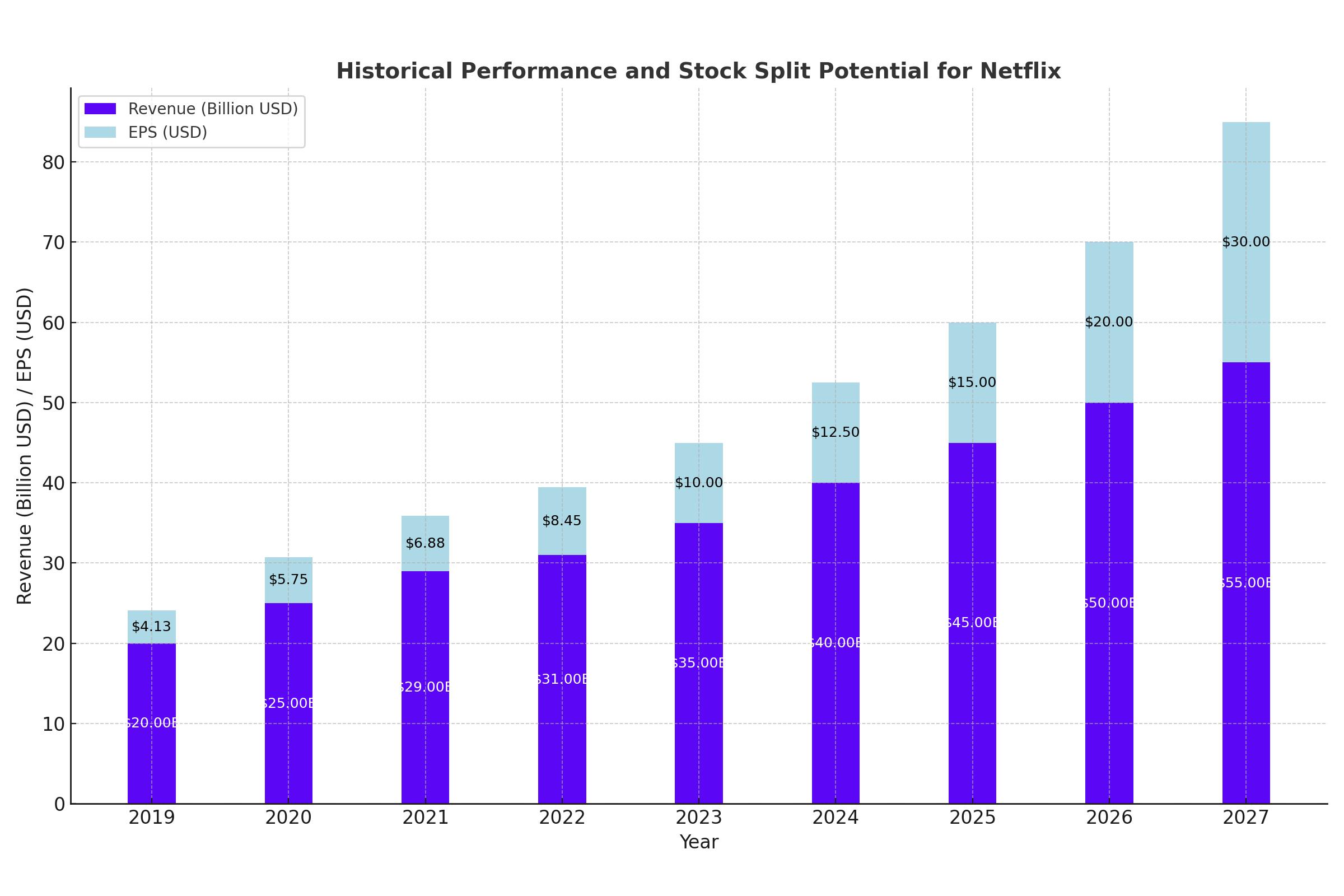

Historical Performance and Stock Split Potential

Netflix (NASDAQ:NFLX) has a history of leveraging stock splits to drive investor interest and share price appreciation. Nine years ago, the company announced a stock split when shares were trading close to current levels. With shares closing at $671.60 recently, up from $673.61 at the open, it's plausible that another stock split could be on the horizon. This move would likely appeal to retail investors and could provide an additional boost to the stock price.

Impact of Recent Earnings and Guidance

Netflix faced a stock dip in April 2023 after issuing weak guidance for the current quarter, attributing this to delays in the rollout of paid account sharing. Despite a Q1 revenue miss, the long-term growth story remains intact. Since then, NFLX has more than doubled, significantly outperforming the S&P 500 by approximately 80 percentage points.

Pricing Power and Revenue Growth

Netflix has effectively utilized its pricing power to drive revenue growth. Over the past four years, the average revenue per member per month in the US/Canada (UCAN) region has increased by more than 51%, equating to an annual growth rate of 8.6%. This pricing strategy is expected to continue, with analysts projecting double-digit revenue growth each year through 2026. Current revenue estimates indicate that Netflix could exceed $50 billion in annual revenue within the next three years, up from just over $20 billion in 2019.

Expanding Margins and Cash Flow

As Netflix scales, it continues to improve its operating margins and generate strong cash flow. The company is targeting a 25% operating margin this year, a significant increase from the low double digits in 2018. Earnings per share have grown from $4.13 in 2019 to over $30 projected for 2027. With $7 billion in cash and equivalents and $14 billion in gross debt, Netflix aims to maintain an investment-grade credit rating while generating $6 billion in free cash flow this year.

Valuation Compared to Tech Peers

Despite recent gains, Netflix's valuation remains reasonable compared to other large-cap tech stocks. NFLX trades at approximately 37.4 times this year's expected earnings, with projected earnings per share growth of 21% for 2026. This is above the average growth rate of its peers, such as Alphabet, Microsoft, Meta Platforms, Apple, and Amazon, which average around 15% growth. Netflix's strong growth potential justifies its current valuation levels.

Potential Risks and Subscriber Growth Concerns

One potential risk for Netflix is the plateauing of subscriber growth. Management's decision to stop reporting subscriber numbers in 2025 has raised concerns about future growth. While price increases will drive revenue, sustained growth will depend on continued subscriber additions. The second quarter is typically weak for subscriber growth, and the upcoming Olympics and US Presidential Election may further impact additions.

Strategic Initiatives and Sports Expansion

Netflix's venture into sports content represents a new growth avenue. The company plans to offer WWE RAW globally and has aired popular events like "The Roast of Tom Brady" and the Tyson-Paul boxing match. These initiatives are expected to boost subscriber growth and enhance engagement, positioning Netflix as a comprehensive entertainment platform.

Original Content as a Growth Driver

Original content remains a critical component of Netflix's strategy. The company plans to invest $17 billion in content this year, focusing on both scripted and unscripted shows. Successful titles like "Avatar: The Last Airbender," "Love is Blind," and "Griselda" highlight Netflix's ability to attract and retain subscribers. By catering to diverse cultures and preferences, Netflix maintains its competitive edge in the streaming market.

Justified Valuation and Analyst Sentiment

Netflix's valuation is justified by its robust growth trajectory and strategic initiatives. The stock trades at a higher multiple than its peers but is supported by strong earnings growth and cash flow generation. Most analysts rate NFLX as a strong buy, with a median price target of $654.60, reflecting confidence in the company's future performance.

Future Outlook and Strategic Focus

Looking ahead, Netflix's focus on engagement and expansion into new content areas will drive growth. The company's strategic initiatives, coupled with its pricing power and strong cash flow, position it well for continued success. Investors should monitor key metrics and upcoming earnings to gauge the effectiveness of these strategies.

Conclusion

Netflix (NASDAQ:NFLX) remains a strong performer in the streaming market, supported by effective pricing strategies, original content, and new growth initiatives. Despite potential risks, the company's valuation is justified by its growth prospects. Investors should consider NFLX a compelling buy, backed by strong fundamentals and a positive market outlook.