Nike's Fiscal Q4 Earnings: A Turning Point for NYSE:NKE ?

Analyzing Nike's latest financial results, market strategies, and the potential impacts of global sporting events on its recovery trajectory and stock performance | That's TradingNEWS

Current State of NYSE:NKE: Analyzing Nike's Fiscal Q4 Earnings and Market Dynamics

Earnings Overview and Stock Performance

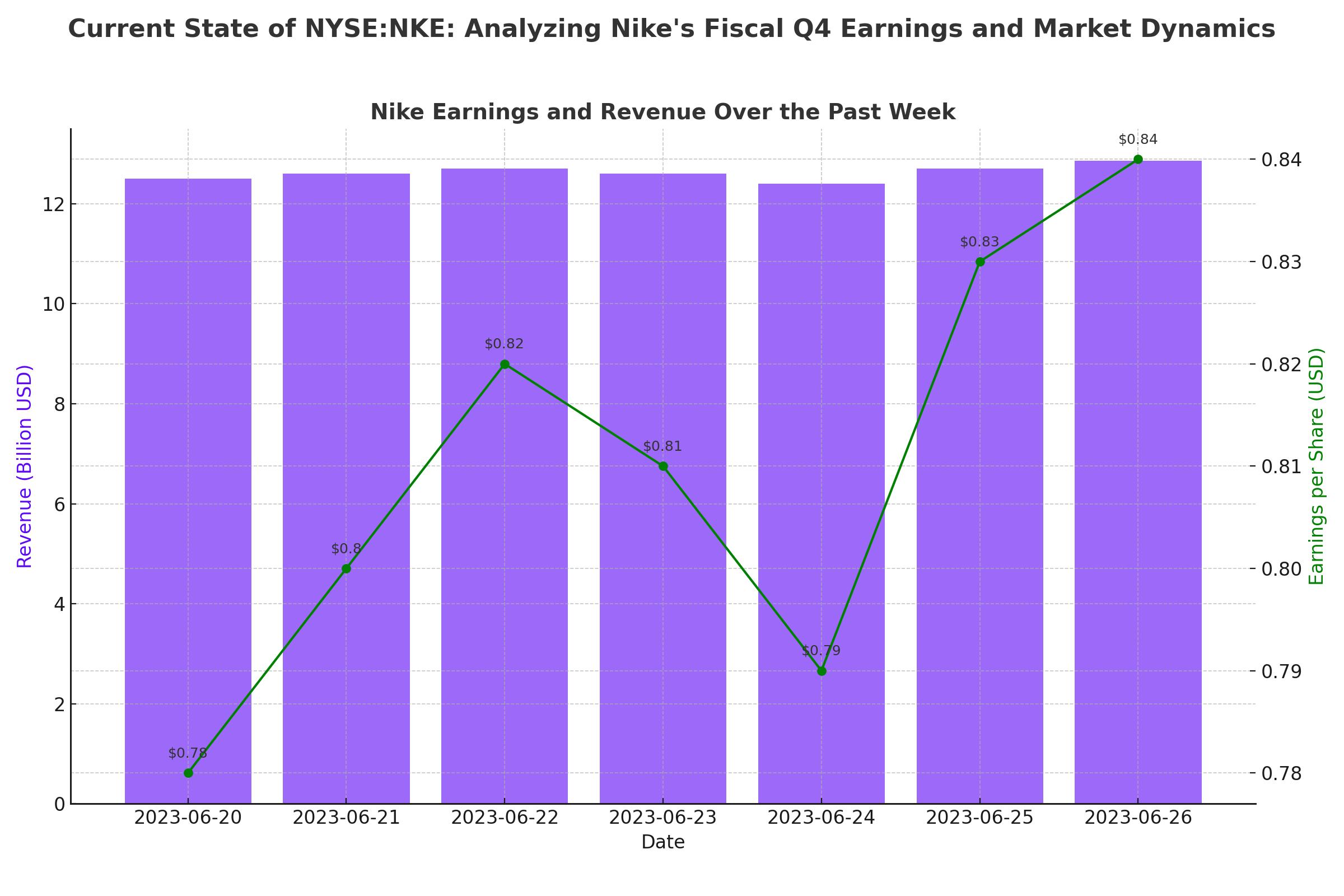

Nike, Inc. (NYSE:NKE) is poised for a crucial fiscal Q4 earnings release, with the market and investors watching closely for signs of a rebound. After a 13.4% decline in its stock value this year, Nike's performance in this quarter is more significant than ever. The sports apparel giant has seen a year marked by challenges but also potential turning points. According to FactSet, the consensus anticipates a modest revenue increase to $12.86 billion and a 27% rise in earnings to 84 cents per share, suggesting some recovery in sales momentum.

Strategic Analysis and Leadership Initiatives

Nike's strategic adjustments and leadership efforts have been focused on navigating through recent market and internal challenges. With a shift in consumer spending patterns and intense competition, Nike has invested in product innovation and brand-building. These efforts are reflected in the stabilization of their financial outlook, deemed "largely de-risked" by Oppenheimer, suggesting that the worst may be behind for NYSE:NKE.

Market Position and Competitive Landscape

Despite the optimistic long-term outlook from analysts like Oppenheimer, who have upgraded their price target to $120, challenges remain. Nike's performance in North America and Greater China remains a concern, with JPMorgan adjusting its expectations for these key markets. The firm notes potential headwinds with flat direct-to-consumer sales in North America and a downturn in Greater China, adjusting their price target to $116.

Institutional Investments and Insider Transactions

Significant movements by institutional investors underscore the shifting sentiments around NYSE:NKE. G&S Capital LLC notably increased its holdings by 105.1%, signaling strong investor confidence. However, the broader context of insider transactions can provide deeper insights into executive sentiments and potential strategic shifts, which can be further explored on Nike’s profile on TradingNEWS.

Future Projections and Analyst Sentiments

Looking ahead, analysts are cautiously optimistic about Nike's recovery trajectory. While current projections by analysts like Wedbush and Bank of America suggest a potential rise in stock value, the consensus among many remains guarded due to the uncertain economic environment and Nike’s recent performance trends. The firm’s focus will likely continue on enhancing its retail and wholesale strategies, moving slightly away from direct-to-consumer channels which have underperformed.

Cultural and Sporting Impact

Nike's cultural imprint remains strong, underscored by its presence at major sporting events such as the NBA Finals and the upcoming Paris 2024 Olympics. These platforms not only serve as significant marketing opportunities but also as tests of the brand's resonance in the competitive sports apparel market.

Conclusion

As NYSE:NKE gears up to release its Q4 earnings, the market remains on edge about its ability to turn around recent declines and set a positive trajectory for fiscal 2025. With strategic leadership efforts, market positioning, and a strong cultural presence in sports, Nike aims to reassure investors and regain its footing in a volatile market. The outcome of this earnings report will be crucial in determining Nike’s path forward amid evolving market dynamics and consumer preferences.

For real-time updates and more detailed stock information, visit NYSE

Real-Time Chart and for insider transaction details, check Nike's Stock Profile.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback