Nike's Journey Through Market Volatility: A Comprehensive NYSE:NKE Analysis

"Unveiling Nike's Financial Health, Operational Strategies, and Technological Innovations: Prospects for Resilience and Growth Amidst Economic Uncertainties | That's TradingNEWS

Navigating the Turbulence: A Deep Dive into Nike's (NYSE:NKE) Market Dynamics and Future Prospects

Market Overview and Financial Health

Nike, a titan in the athletic footwear and apparel industry, currently grapples with significant market fluctuations and competitive pressures, reflective in its recent stock performance. With a closing price of $88.84, reflecting a slight decrease, and an after-hours adjustment to $88.89, the stock's journey reflects the broader challenges within the sector. NYSE:NKE's year-to-date performance contrasts starkly with its historical highs, navigating through a volatile market landscape shaped by shifting consumer preferences and global economic uncertainties.

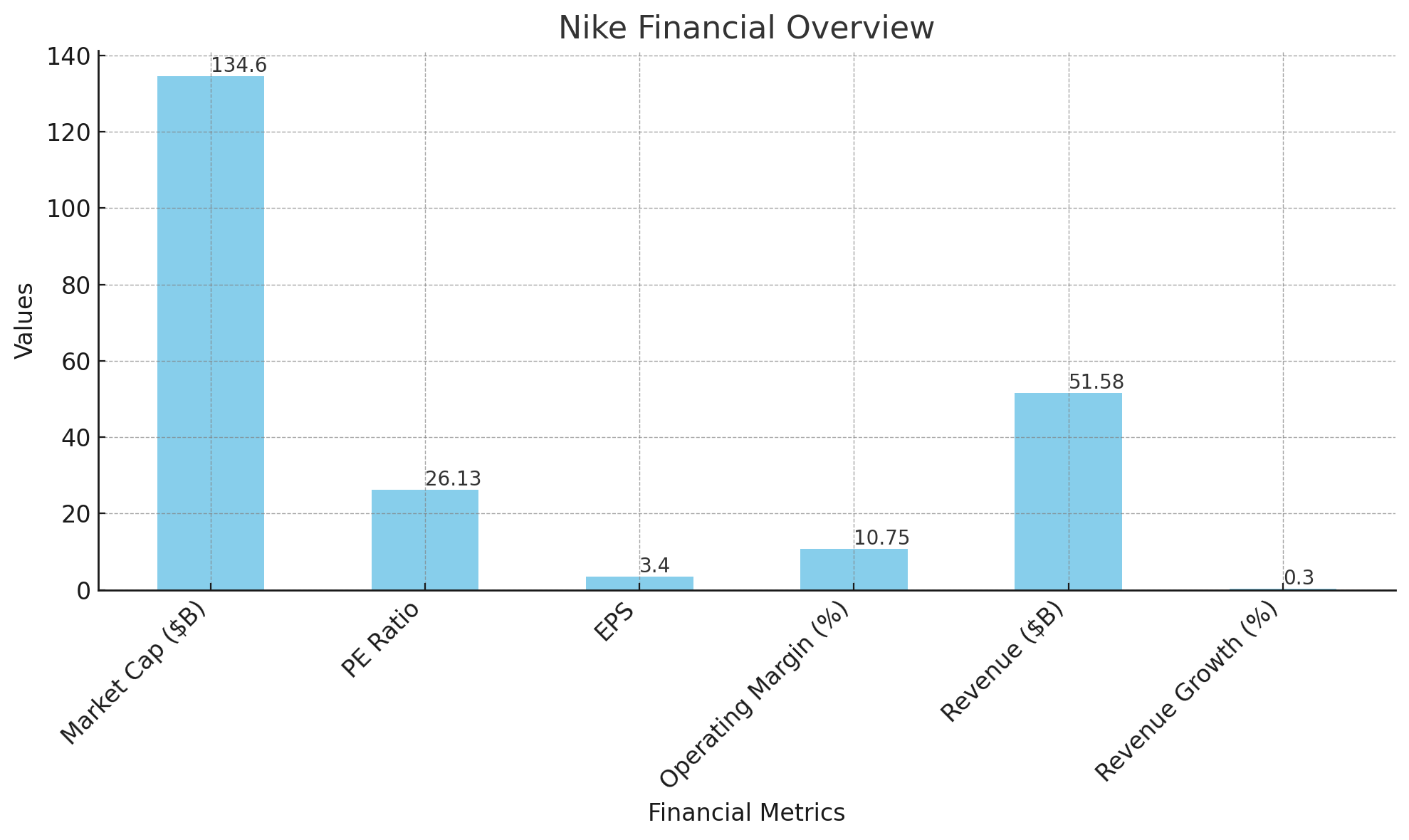

The company's market capitalization stands at $134.603 billion, underpinned by a PE ratio of 26.13, signifying investor confidence in its earnings potential despite prevailing headwinds. However, a deep dive into its financials reveals a nuanced picture. With an EPS of 3.40 and operating margins hovering around 10.75%, Nike demonstrates resilience and operational efficiency. Nonetheless, a revenue of $51.58 billion against a backdrop of a modest quarterly revenue growth of 0.30% indicates the pressing need for strategic recalibration to ignite growth engines.

Strategic Moves and Competitive Landscape

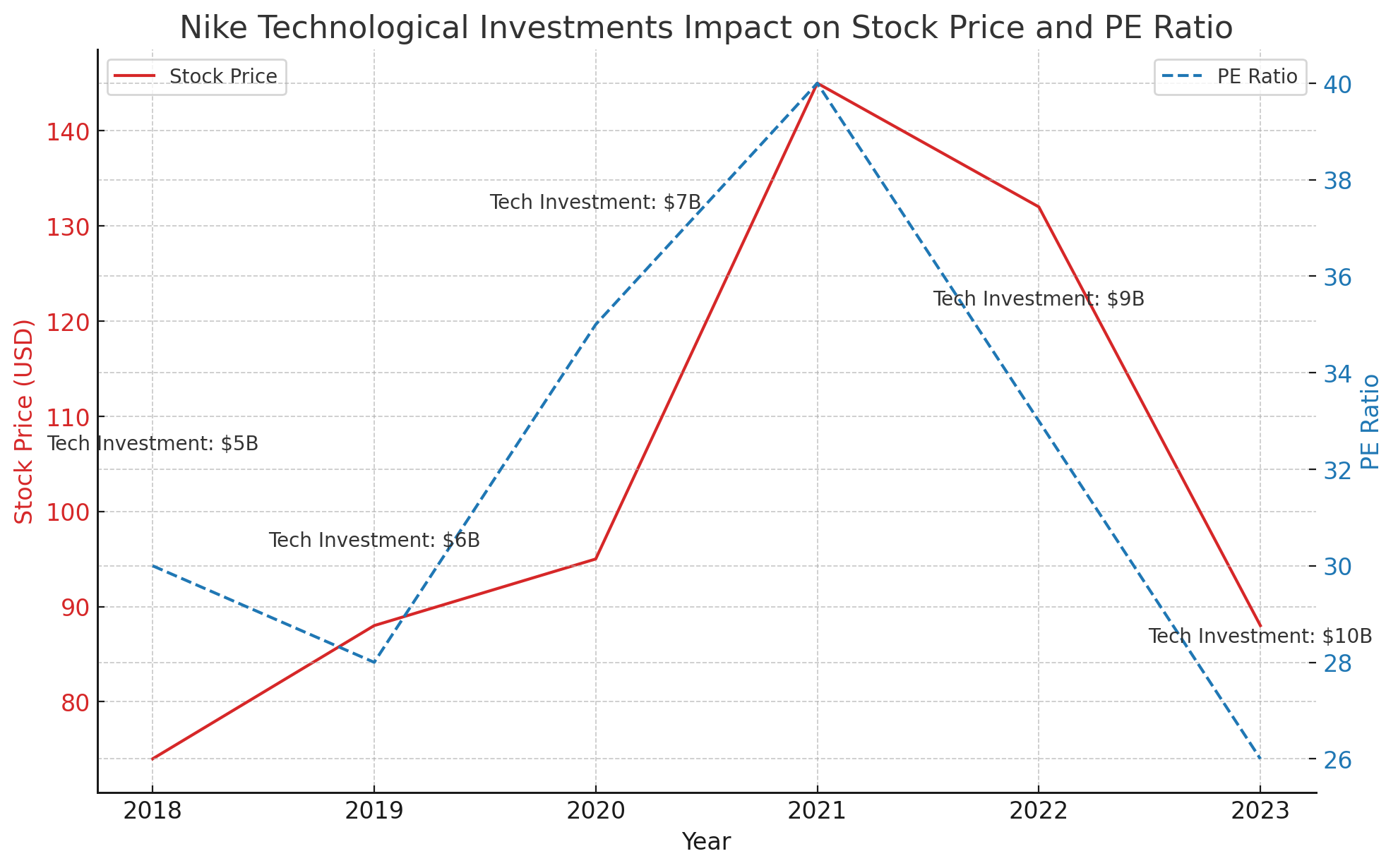

Amidst a fiercely competitive environment, Nike's commitment to innovation remains unwavering. Investments in technology and AI to streamline supply chains and align with consumer trends underscore its long-term vision. However, these initiatives have yet to translate into significant top-line growth, as evidenced by the tempered earnings and revenue forecasts extending into 2025. The current fiscal projections, coupled with an industry-wide deceleration in consumer spending, necessitate a closer examination of Nike's strategic positioning and its implications for market share.

Insider Insights and Stock Trajectory

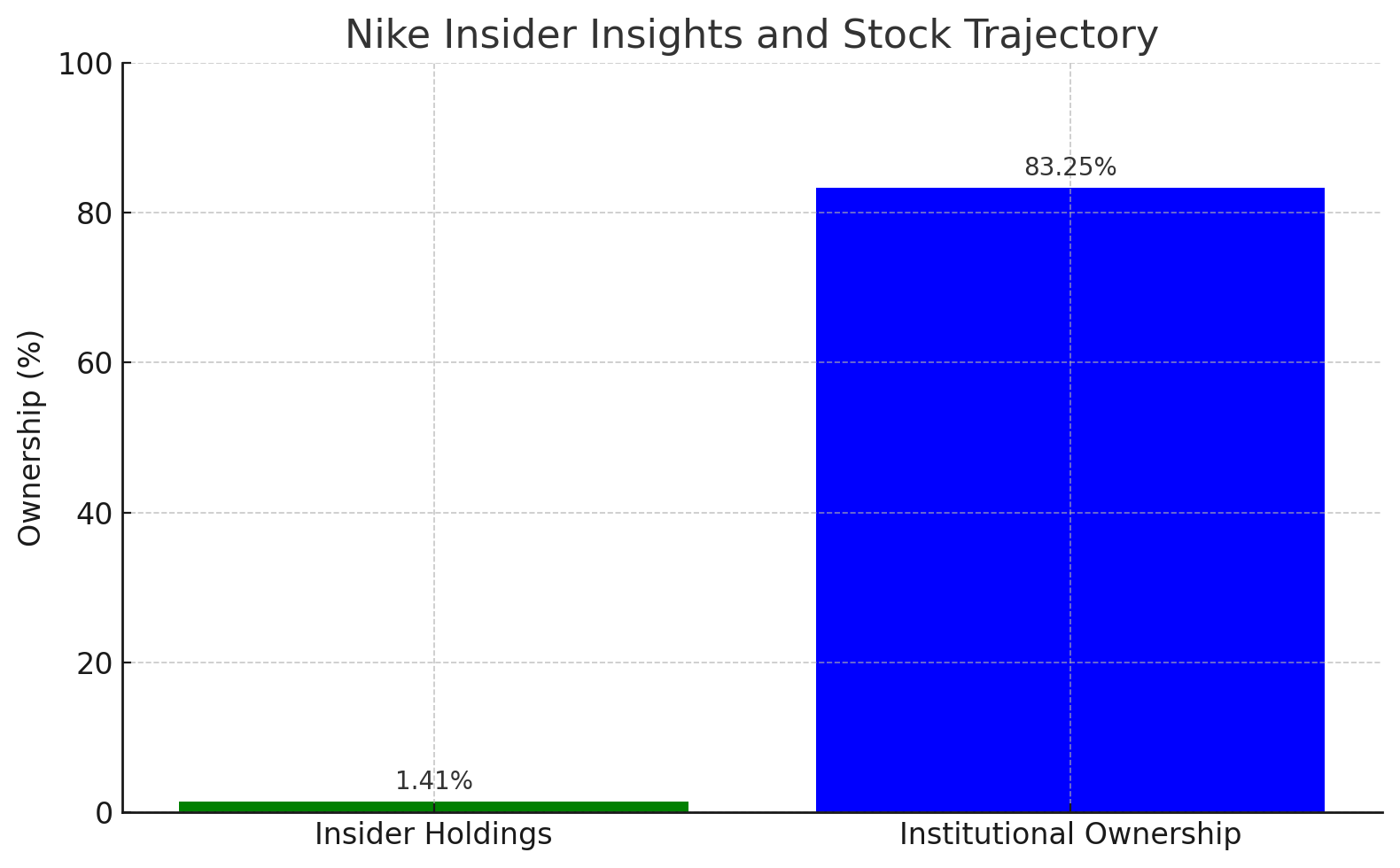

The investment community keeps a keen eye on insider transactions as a trust barometer in the company's future. With insider holdings at 1.41% and institutional ownership at an impressive 83.25%, the stock's trajectory is closely tied to these stakeholders' confidence levels. The direct link between insider transactions and the stock's performance is pivotal for potential investors, as detailed insights into these movements offer a window into the company's internal sentiment.

For those inclined to delve deeper into Nike's insider transactions, a comprehensive analysis can be found on Trading News.

Technological Investments: A Double-Edged Sword?

Nike's aggressive push into technological advancements, from AI-driven consumer insights to supply chain optimizations, is a bold bet on the future. While these investments have elevated operating costs in the short term, their long-term payoff hinges on the company's ability to convert these innovations into market share gains and revenue growth. The question remains: Will these technologies be the catalyst for Nike's resurgence in a post-2024 marketplace, or will they strain financial resources without delivering the expected competitive edge?

Market Sentiment and Future Outlook

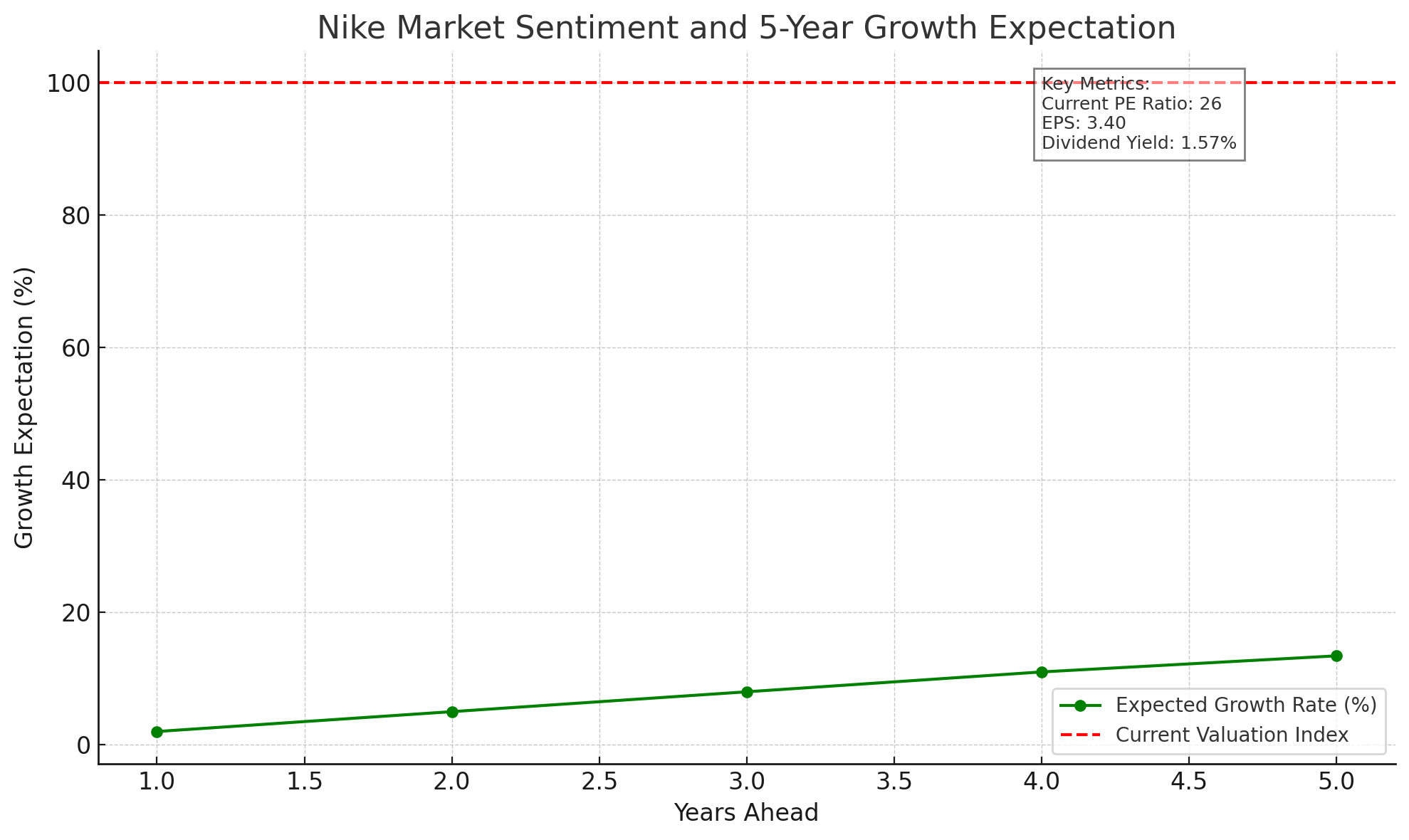

The broader market sentiment towards Nike is one of cautious optimism, underscored by a recognition of its enduring brand strength and market presence. However, the mixed financial signals and the ongoing strategic shifts have led to a reevaluation of its near-term prospects. Analysts' expectations of a 13.43% growth rate over the next five years, juxtaposed with the stock's current undervaluation, present a complex investment thesis. Nike's management is at a pivotal juncture, where the ability to navigate through the current economic turbulence and rekindle growth will determine its market positioning in the coming years.

Investment Considerations

In light of Nike's (NYSE:NKE) current market dynamics, potential investors are advised to weigh the company's growth prospects against the backdrop of increased operating costs, competitive pressures, and macroeconomic uncertainties. The stock's valuation, in comparison to its intrinsic value and historical performance metrics, offers a fertile ground for analysis. With a nuanced understanding of these factors, informed by insider transactions and strategic investments, stakeholders can make judicious investment decisions.

The link to the stock's real-time chart, provided for those seeking to track its live market performance, is here.

Financial Performance: A Closer Look

Delving into Nike's financial metrics provides a clearer picture of its standing in the turbulent market. The company reported a revenue of $51.58 billion, a testament to its global reach and brand strength. Despite the modest year-over-year revenue growth of 0.30%, this figure underscores Nike's ability to maintain its market position amidst widespread economic challenges. The EPS (Earnings Per Share) of 3.40 further illustrates Nike's profitability, even when faced with increased operational costs and competitive pressures.

Market Capitalization and Shareholder Value

With a market capitalization of $134.603 billion, Nike remains a heavyweight in the industry. This valuation reflects the collective assessment of the company's future earnings potential, albeit tempered by recent market dynamics. The PE ratio of 26.13, compared to the industry average, indicates a market expectation of higher future earnings. However, the dividend yield of 1.57% serves as a tangible return to shareholders, reinforcing Nike's commitment to returning value.

Operational Efficiency and Margin Analysis

Nike's operating margin of 10.75% speaks to its operational efficiency, particularly in managing costs relative to its revenue. In an industry characterized by high competition and fluctuating demand, maintaining a double-digit operating margin is a notable achievement. However, the forward-looking statements and revenue projections hint at the need for continued vigilance in cost management and operational optimization to sustain these margins.

Technological Investment Impact

The strategic focus on technology and AI to refine supply chains and cater to dynamic consumer preferences is a significant investment area for Nike. While these initiatives have escalated costs in the short term, they are poised to enhance long-term efficiency and market responsiveness. The balance between these immediate financial impacts and the anticipated long-term benefits will be crucial for Nike's financial health and competitive positioning.

Insider Transactions and Market Confidence

Insider transactions offer a unique lens into the confidence levels of those closest to the company's operations. With insiders holding 1.41% of the company's shares, their actions can signal their belief in Nike's strategic direction and future profitability. This insider confidence, coupled with the 83.25% institutional ownership, underscores the market's overall trust in Nike's ability to navigate current challenges and emerge stronger.

Investor Sentiment and Stock Valuation

Nike's current stock valuation, juxtaposed with its historical performance and future earnings projections, presents a nuanced investment opportunity. The stock's underperformance relative to its historical highs reflects market skepticism about immediate growth prospects. However, the anticipated 13.43% earnings growth over the next five years offers a beacon of optimism for long-term investors.

Strategic Adjustments and Forward Outlook

As Nike pivots to address its strategic challenges — from sharpening its focus on core sports to ramping up product innovation — the effectiveness of these adjustments will be closely watched. The brand's emphasis on leveraging the Paris Olympics for marketing momentum, alongside a reinvigorated approach to wholesale channels, indicates a comprehensive strategy to reclaim growth and market share.

Conclusion: The Path Ahead

Nike stands at a crossroads, with significant potential and formidable challenges ahead. The company's ability to translate its technological investments into market advantages, maintain operational efficiency, and adapt to evolving consumer demands will determine its trajectory. For investors, the key will be to balance the short-term headwinds against Nike's long-term growth prospects, brand strength, and strategic initiatives. As Nike strides forward, its journey will undoubtedly offer valuable insights into resilience and adaptation in the face of market volatility.

That's TradingNEWS

Read More

-

DGRO ETF Price: Is DGRO at $69.17 Still the Better Dividend-Growth Bet?

17.12.2025 · TradingNEWS ArchiveStocks

-

XRP Price Stuck Below $2 As XRPI at $10.74 and XRPR at $15.26 Ride $1B+ ETF Inflows

17.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Steady Near $4 as TTF Jumps on Colder Forecasts and LNG Outage Risk

17.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: USDJPY=X 155.50 Pivot Before BoJ Hike and US CPI

17.12.2025 · TradingNEWS ArchiveForex