Nvidia (NASDAQ:NVDA) Faces Heavy Selling Pressure – Is the Market Overreacting?

Nvidia (NASDAQ:NVDA) has been one of the most dominant stocks of the last five years, delivering a staggering 1,600% return in that time. However, the recent market correction has erased 25% of its value from its January highs, with the stock now trading at $114, right at the midpoint of its 52-week range. This rapid decline has triggered concerns among investors, but with record-breaking earnings, leadership in AI chips, and a projected revenue of $130.5 billion in 2025, has the market gone too far in selling off NVDA?

The stock has been hit by multiple macroeconomic and geopolitical factors, including uncertainty around tariffs, fears of AI growth slowing, and rising competition from AMD (NASDAQ:AMD) and China’s growing chip industry. But despite these risks, Nvidia’s forward P/E has dropped to 19, making it cheaper than consumer staple giants like Costco (NASDAQ:COST) and Walmart (NYSE:WMT). Analysts still have a 12-month price target of $177.41, with even the lowest target of $130 still above current levels, suggesting that Nvidia may be undervalued.

AI Leadership Remains Nvidia’s Core Strength – Can It Maintain Its Edge?

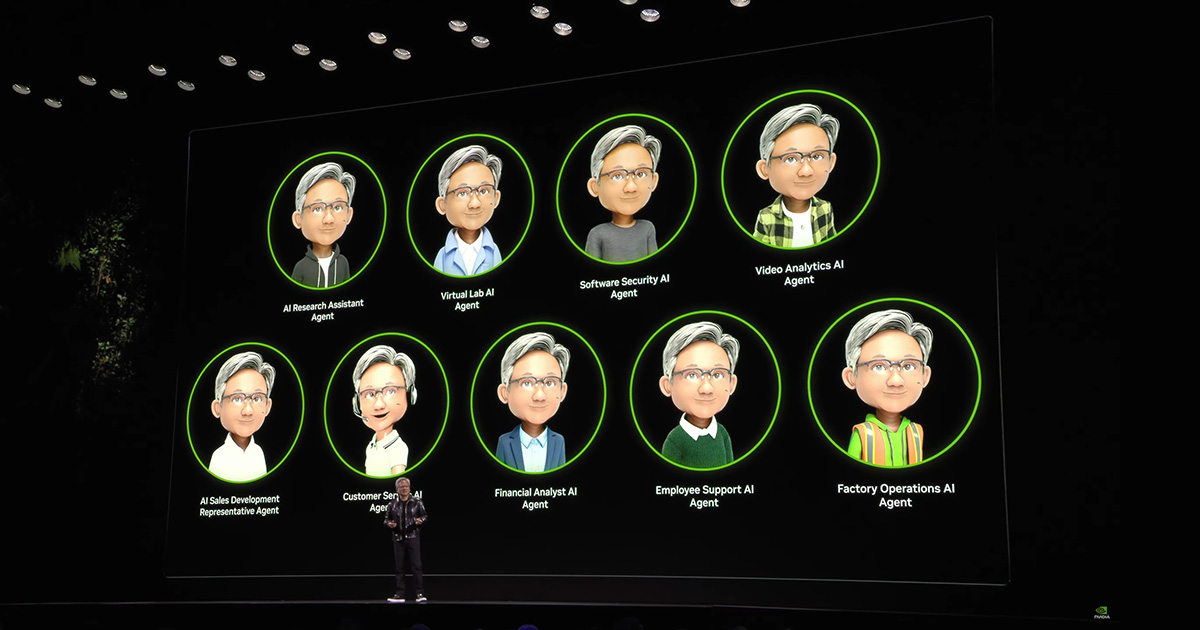

Nvidia continues to dominate the AI chip market, with over 80% of AI GPUs used by major tech firms like Amazon, Microsoft, and Meta. The company’s data center segment, which accounts for over 60% of revenue, has been its primary growth driver, with demand for AI training and inference chips skyrocketing. Despite the recent sell-off, Nvidia remains at the center of the AI revolution, making it difficult to ignore the stock’s long-term potential.

However, the company is facing growing competition from AMD and China, as well as regulatory scrutiny over exports to Asia. China’s semiconductor production is accelerating, and companies like SMIC are ramping up production, aiming to reduce dependence on Nvidia’s high-powered GPUs. Meanwhile, AMD’s MI300 AI chips are gaining traction, with Meta already using them for its Llama AI models. If AMD’s chiplet-based architecture proves more efficient, Nvidia could face pressure on margins in the AI space.

Is Nvidia (NASDAQ:NVDA) Becoming Undervalued?

Nvidia has long been criticized for its sky-high valuation, but recent earnings growth has significantly outpaced its stock price appreciation. The company’s PEG ratio now stands at just 0.27, making it one of the cheapest AI stocks relative to growth.

When comparing Nvidia’s forward P/E of 19 to its peers, it trades cheaper than Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN), while still delivering higher revenue growth than both companies. Even with a slowing AI market, Nvidia’s 2025 revenue is expected to grow by 114% YoY, driven by its AI, data center, and automotive segments.

Tariffs, Trade Wars, and Regulatory Risks – How Will They Impact NVDA?

One of the biggest risks to Nvidia’s stock price is ongoing trade tensions between the U.S. and China. The Biden administration’s crackdown on chip exports has already restricted Nvidia from selling its most advanced GPUs to China, which historically accounted for a large portion of its revenue.

Trump’s proposed 100% tariffs on Taiwan’s semiconductor exports could further impact Nvidia’s supply chain and increase manufacturing costs. If geopolitical risks escalate, Nvidia could see significant disruptions in both production and demand, leading to a further slowdown in revenue growth.

Are Nvidia Insiders Losing Confidence?

A concerning trend for investors is Nvidia’s insider selling activity. Over the last three months, insiders have sold over 2.8 million shares, while only one insider has purchased stock. This suggests that some company executives may believe the stock is fully valued or expect further downside.

For investors looking to track Nvidia’s insider activity, visit Nvidia Insider Transactions.

Technical Indicators Show NVDA Nearing Oversold Levels – A Rebound Incoming?

With Nvidia stock trading below its 50-day and 200-day moving averages, technical indicators suggest that it may be nearing oversold conditions.

The Relative Strength Index (RSI) is now hovering around 30, which is typically considered a buying signal in technical analysis. If selling pressure continues, NVDA could test the $100 level, where strong volume support exists. However, if it rebounds from these levels, the stock could easily retest $140 in the short term.

Earnings Growth Remains Strong, But Will It Slow?

Despite macro concerns, Nvidia continues to report strong revenue and earnings growth, with its latest quarterly earnings beating estimates once again.

- 2025 projected revenue: $130.5 billion (+114% YoY)

- Gross margin: 72%, among the highest in the industry

- EPS expected to grow 83% in 2025 before slowing to 30% in 2026

Analysts still forecast positive growth for Nvidia over the next three years, but there are concerns that 2029 could see negative EPS growth if AI spending slows significantly.

Is Nvidia Stock (NASDAQ:NVDA) a Buy, Hold, or Sell?

Nvidia’s recent pullback has created a compelling long-term buying opportunity, but short-term risks remain. The company is still the dominant player in AI chips, with unmatched pricing power and technology leadership, but competition is heating up from AMD and China’s growing semiconductor industry.

With the stock now trading below analyst targets, Nvidia may be undervalued at current levels. However, investors should remain cautious of trade war risks, regulatory hurdles, and a potential slowdown in AI spending.

For those looking to track real-time Nvidia stock performance, visit Nvidia Live Stock Chart.