Nvidia (NASDAQ:NVDA) Is Dominating AI – Can It Sustain Its Unstoppable Growth?

Big Tech’s AI Spending Explosion Fuels Nvidia’s Dominance

The AI infrastructure boom has shifted into overdrive, with Big Tech pouring over $318 billion into AI development in 2025 alone. Microsoft (MSFT), Amazon (AMZN), Google (GOOGL), and Meta (META) are leading the charge, funneling massive capital into expanding data centers and compute capacity. And the undisputed winner of this spending spree? Nvidia (NASDAQ:NVDA).

With over 90% market share in AI GPUs, Nvidia is at the center of this AI arms race. Amazon alone is set to spend $100 billion, Microsoft is committing $80 billion, Alphabet is allocating $75 billion, and Meta is putting in $63 billion. These numbers represent a 70% YoY surge in AI infrastructure spending—an unprecedented increase. The sheer scale of this investment ensures sustained, high-margin demand for Nvidia’s chips, networking solutions, and full-stack AI computing power.

But that’s not all. The recently announced Project Stargate, a $500 billion private-sector AI initiative backed by OpenAI, SoftBank, and Oracle, has created another massive demand surge. The first $100 billion phase, focused on building AI data centers in Texas, is expected to fuel $174 billion in Nvidia GPU sales over the next five years. Nvidia’s market position has never been stronger, and the company is effectively printing money with its AI chips.

Blackwell Chips – Already Sold Out Before Launch

If the demand for AI infrastructure wasn’t already insane, Nvidia’s next-gen Blackwell chips have been fully booked for the next 12 months—before they’ve even launched. The upcoming B100 AI GPUs are expected to deliver a 3-5x performance increase over the current H100 chips, setting a new benchmark in AI computing. Nvidia has not only cornered the market but is also exercising incredible pricing power.

Currently, H100 GPUs are selling for $25,000 each, while Blackwell is expected to push beyond $40,000 per unit. This price surge, combined with higher margins and improved efficiency, means Nvidia is set to expand its revenue base without needing to increase unit sales significantly.

Even though hyperscalers like Amazon, Google, and Microsoft are developing their own custom AI chips, the reality is that they remain reliant on Nvidia's CUDA software ecosystem and GPU stack. Google’s TPU, Amazon’s Trainium, and Microsoft’s Azure Maia chips are nowhere near the level of Nvidia’s ecosystem integration, developer support, and sheer computational power.

The AI Infrastructure Economics – Why Nvidia’s Market Is Only Expanding

Understanding Nvidia’s long-term potential requires looking at the sheer economics behind AI infrastructure. AI compute power is not just increasing—it’s doubling roughly every 6-9 months, meaning the need for GPUs is not slowing down—it’s accelerating.

Project Stargate’s Texas-based AI data centers alone are projected to need 256,000 GPUs per facility, leading to $8.7 billion in Nvidia chip sales per location. With 20 such facilities planned, Stargate alone will generate $174 billion in Nvidia revenue over the next few years.

And that’s just one project. When combined with the broader $800 billion in AI CAPEX commitments across the industry, Nvidia’s total addressable market (TAM) is projected to exceed $2 trillion over the next decade. This includes:

- Cloud infrastructure, expected to hit $837.9 billion by 2034

- AI accelerators, projected to reach $54.7 billion by 2030

- Edge AI, growing to $163 billion by 2033

- AI-powered data analytics, forecasted at $236.1 billion by 2033

- Data center modernization, surpassing $1 trillion

Earnings Preview – Will Nvidia Smash Estimates Again?

Nvidia is set to report Q4 FY2025 earnings on February 26, and expectations are sky-high. In Q3, the company posted $35.1 billion in revenue, a staggering 93.6% YoY increase, with a 75.8% gross margin.

For Q4, analysts expect:

- Revenue of $38 billion (+73% YoY)

- Data center revenue up 84% YoY, driven by AI infrastructure growth

- EPS of $0.85 per share

Given the relentless AI spending and Blackwell demand already exceeding supply, Nvidia could easily outperform once again. The bigger question? How much further can NVDA stock climb?

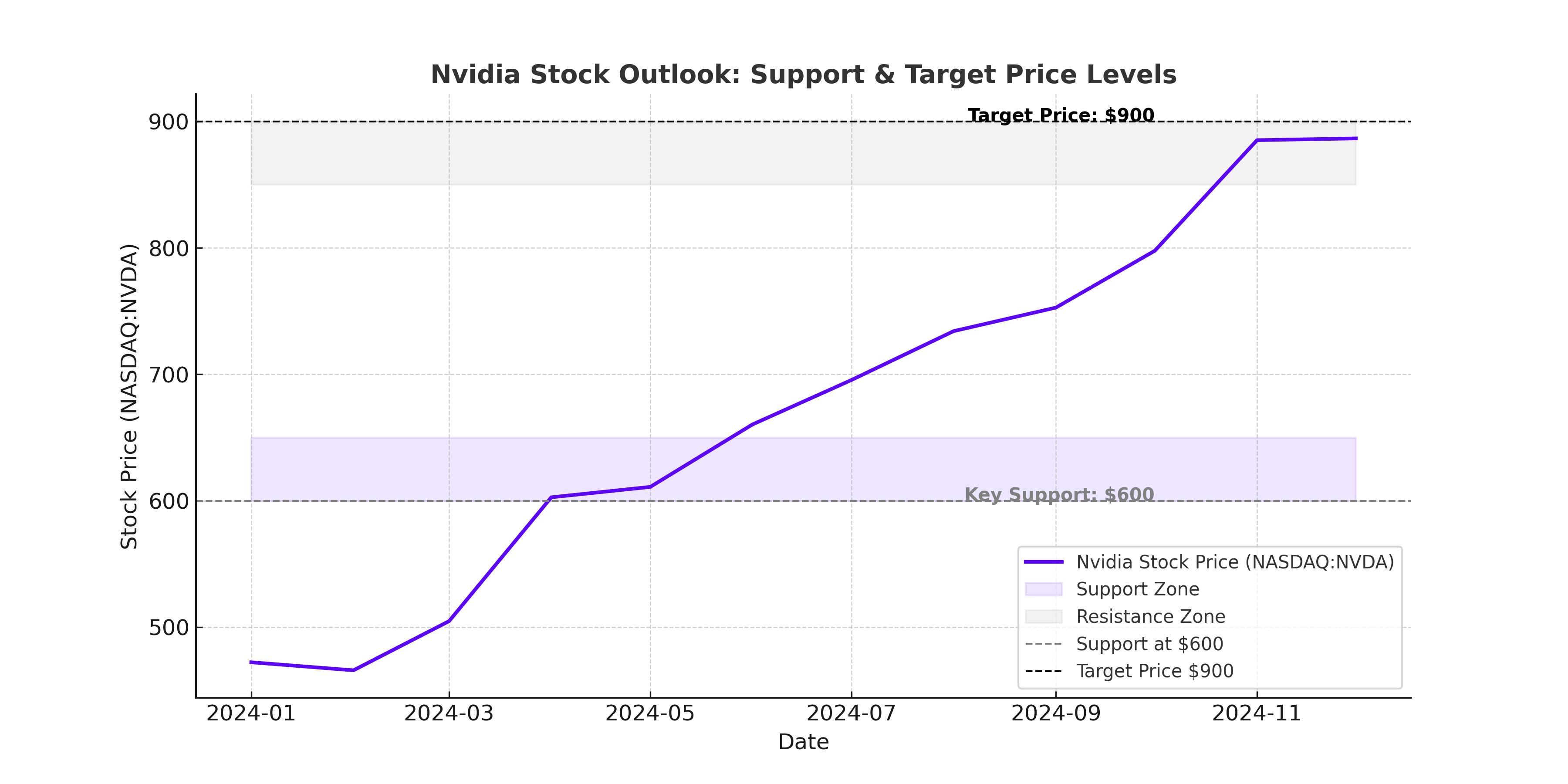

Is Nvidia Stock Still a Buy? The Valuation Case

Nvidia currently trades at 31.6x forward P/E and 26.3x EV/EBITDA, numbers that some may call expensive—until you realize this is a company growing revenue by nearly 100% YoY with record-high margins.

If Nvidia were a high-growth SaaS stock, it would be trading at 15-20x sales. But Nvidia isn’t just a software company—it’s the backbone of the entire AI revolution.

Nvidia’s market dominance, insatiable demand, and multi-year AI investment boom make it difficult to argue for any kind of meaningful pullback. With over 90% AI GPU market share, hyperscalers committed to $800 billion+ in AI spending, and next-gen Blackwell chips already fully sold out, Nvidia remains in a category of its own.

Risks to Consider – What Could Derail Nvidia?

While Nvidia is in an extremely strong position, no stock is risk-free. Key risks include:

-

Supply Constraints – Blackwell chips are facing production limitations despite aggressive ramping by TSMC (NYSE:TSM) and Foxconn. Nvidia’s biggest challenge isn’t demand—it’s being able to meet it.

-

Government Regulations & Export Controls – The U.S. government’s restrictions on AI chip sales to China have already impacted Nvidia’s revenue in that region. While Nvidia has introduced modified chips for compliance, any further restrictions could hurt future sales.

-

Hyperscalers Developing Their Own Chips – Amazon, Microsoft, and Google are all working on in-house AI accelerators. However, these custom chips currently lack the performance, software support, and flexibility of Nvidia’s ecosystem. The risk remains, but Nvidia’s CUDA dominance keeps its moat intact.

Final Verdict – Can NVDA Stock Hit $1,000?

With AI infrastructure spending in overdrive, Nvidia’s competitive edge, and Blackwell already selling out months in advance, NVDA stock remains one of the most compelling long-term AI plays in the market.

Short-term volatility may occur around earnings, but the AI boom is nowhere near slowing down. With a $2 trillion total addressable market, $800 billion+ in AI CAPEX commitments, and insurmountable pricing power, Nvidia’s path to $1,000 per share is becoming increasingly realistic.

For long-term investors, NVDA remains a strong buy with significant upside ahead.