Nvidia (NASDAQ: NVDA): Leading AI Innovation and Capitalizing on Explosive Data Center Growth

With Record Demand and New Blackwell GPUs, Nvidia's Stock Gains Momentum in a High-Stakes Tech Market | That's TradingNEWS

Nvidia Corporation (NASDAQ:NVDA): Dominating AI and Data Centers Amid Skyrocketing Demand

Massive Growth in AI Demand Positions Nvidia for Continued Success

Nvidia Corporation (NASDAQ:NVDA) has secured an unchallenged position in the AI-driven tech space, riding on the back of surging demand for its advanced graphics processing units (GPUs). Since the company pioneered AI GPUs, its products have powered data centers worldwide, making it an industry leader in AI acceleration. As AI adoption accelerates globally, Nvidia is positioned to capture a substantial share of the projected $160 billion in AI infrastructure spending anticipated for 2024. Leading tech giants like Microsoft (MSFT) and Google (GOOG, GOOGL) have already integrated Nvidia's latest Blackwell series GPUs into their data centers, underscoring Nvidia’s strategic advantage.

Financials Signal Strong Future with Revenue and Margin Growth

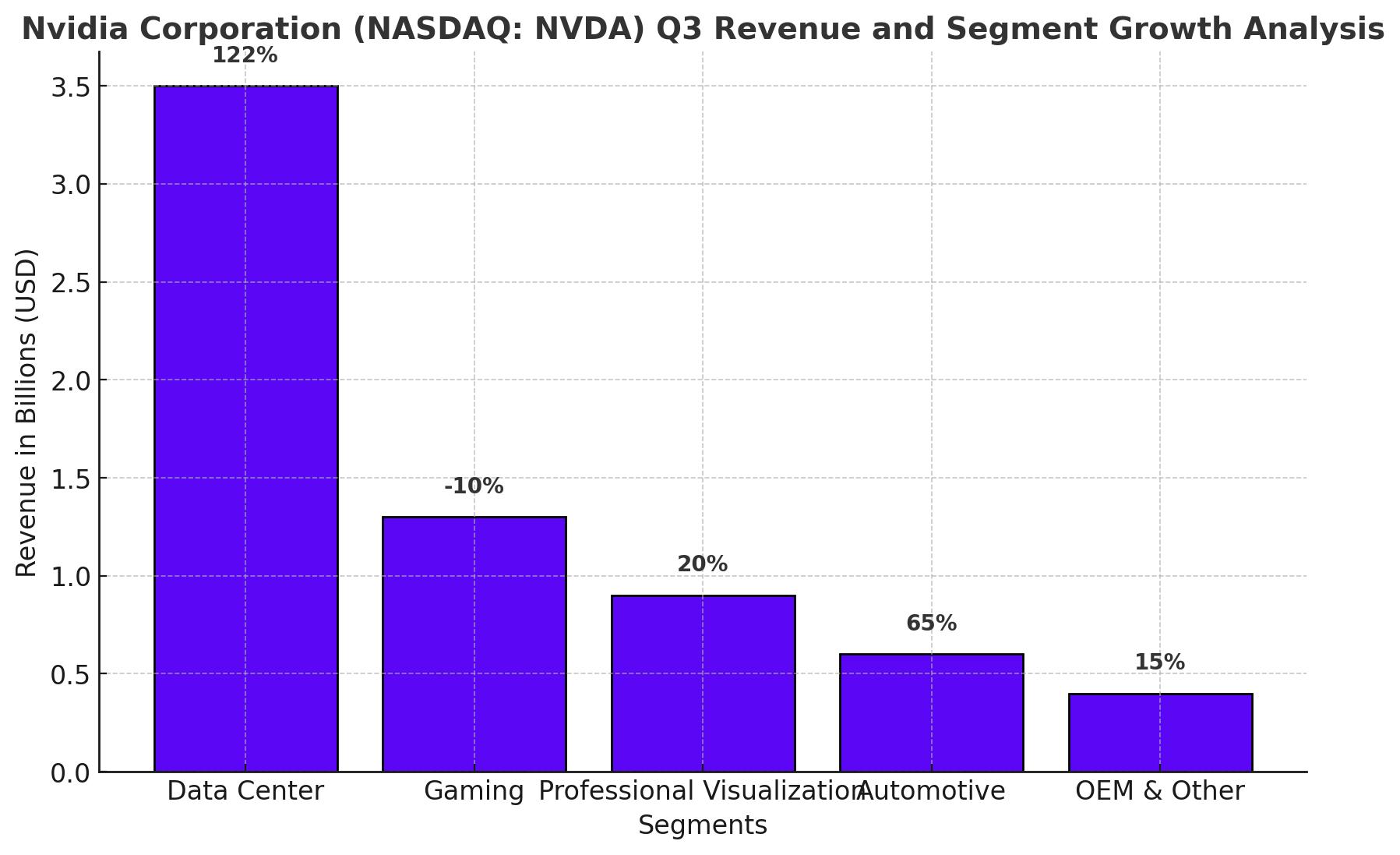

Nvidia’s financial performance has been outstanding, consistently surpassing Wall Street's expectations. In Q2, Nvidia reported revenue that topped estimates by more than $1 billion, a feat that has become characteristic of its quarterly reports over the past five periods. This robust performance is supported by impressive profit margins; Nvidia’s gross margins remain above industry averages due to its AI dominance and its near-monopoly in high-end AI hardware.

Nvidia’s growth in profitability has also sparked upward price target revisions from major financial institutions. Morgan Stanley (MS) recently adjusted Nvidia's target to $165, while Bank of America (BAC) raised theirs to $190. This consensus optimism underscores analysts’ belief that Nvidia’s profitability and growth trajectory are sustainable in the foreseeable future. View real-time NVDA chart here.

AI-Driven Revenue Upsurge Supported by Key Clients and Suppliers

Nvidia’s client roster reflects its substantial influence across various industries, from automakers to tech giants. Tesla (TSLA), for instance, has been a major Nvidia customer, potentially spending between $3 billion and $4 billion this year alone on Nvidia’s chips. With Tesla aiming to deploy up to 50,000 Nvidia GPUs in Texas, Nvidia’s revenue stream from Tesla represents a significant income source that continues to grow as Tesla expands its AI capabilities.

Supply chain partners also corroborate Nvidia's growth story. TSMC (TSM), Nvidia’s chip manufacturer, recently reported a 36% increase in revenue for Q3, partly attributed to demand for Nvidia’s products. SK Hynix (OTCPK), which supplies memory chips for Nvidia's AI servers, also reported record profits, underscoring the strong demand for components essential to Nvidia’s offerings. This supplier data reinforces Nvidia’s central role in the AI ecosystem and indicates that demand for its products is not only sustained but growing.

China Restrictions and Potential Geopolitical Risks

Despite its immense market potential, Nvidia faces challenges related to U.S. export restrictions to China. Nvidia’s management acknowledged that its data center revenues from China have been below pre-restriction levels. With the U.S. government hinting at further restrictions, Nvidia’s sales could experience additional pressure in one of its most lucrative regions. CEO Jensen Huang, while optimistic about Nvidia's role in global AI growth, has indicated that these regulatory obstacles could impact future earnings. Investors should keep an eye on Nvidia’s earnings calls for updates on how these restrictions may influence revenue forecasts.

Valuation Metrics Indicate High Growth Potential but with Risks

Nvidia’s stock is currently priced at a premium due to its robust growth metrics. As of now, Nvidia’s forward price-to-earnings (P/E) ratio far exceeds that of the tech sector average, a reflection of both its historical performance and anticipated future growth. With the company’s expected fair value hovering around $145.54 per share, Nvidia continues to offer upside potential for long-term investors.

While current valuations might seem steep, Nvidia’s monopoly on AI GPUs and its established ecosystem of hardware and software, including its CUDA platform, place it in a category of high-growth companies with formidable pricing power. For investors, the premium valuation may still be justified, as the growth trajectory of Nvidia’s core business segments points toward sustained demand well into the next decade.

Market Position and Competitive Landscape: AMD and Beyond

Nvidia’s dominance in the GPU market has limited its competition, with Advanced Micro Devices (AMD) being the closest rival. However, AMD’s Q3 data center revenue, though impressive, does not yet pose a significant threat to Nvidia’s market share. Nvidia’s annualized revenue from its data center segment dwarfs AMD’s figures, and its ecosystem of software and hardware solutions remains unmatched.

In addition, Nvidia has made significant headway into developing highly specialized chips, such as the Blackwell GPU series. With AMD and other players scrambling to catch up, Nvidia’s first-mover advantage in AI hardware gives it a unique moat that is difficult for competitors to overcome. Nvidia’s strong alliances with leading tech firms and its established CUDA ecosystem further fortify its position as the market leader.

Revenue Expectations and Valuation Revisions Point to a Buy Opportunity

Nvidia’s DCF model suggests a fair value of $145.54 per share, representing about a 4% upside from the current trading price. With Wall Street’s consensus price target slightly higher at $150.70, it’s evident that analysts remain bullish on Nvidia’s continued ability to capitalize on AI demand.

Analysts’ positive sentiment is rooted in Nvidia’s consistent outperformance and revenue surprises over recent quarters. Given its dominant position and pricing power, Nvidia is well-positioned to exceed earnings expectations yet again. The company’s potential for an upward valuation revision is supported by revenue growth in the high-double-digit range and a net margin that shows signs of expansion with each earnings cycle.

Final Analysis: Buy, Hold, or Sell?

Considering Nvidia’s market-leading position, its strong growth metrics, and the sustained demand for AI-related technology, (NASDAQ:NVDA) is rated a Buy. While Nvidia’s stock may experience short-term volatility due to high valuations and geopolitical risks, its long-term prospects make it an attractive option for investors seeking exposure to the AI revolution. For those willing to ride out potential near-term fluctuations, Nvidia offers a compelling investment in the rapidly expanding AI and data center sectors.

Nvidia’s Q3 earnings report, due next month, will likely serve as a significant catalyst for further stock movement. With Nvidia’s robust revenue growth, strong institutional backing, and dominance in a high-growth market, the stock remains a favorable choice for long-term investors.