Nvidia (NASDAQ:NVDA) Stock Analysis: Market Dominance and Future Growth

In-Depth Look at Nvidia’s Financial Performance, Strategic Initiatives, and Market Opportunities in the AI Sector | That's TradingNEWS

Nvidia Corporation (NASDAQ:NVDA) Stock Analysis: Unmatched Growth and Strategic Market Position

Overview of Nvidia's Market Position and Recent Performance

Nvidia Corporation (NASDAQ:NVDA) has firmly established itself as a leader in the semiconductor industry, particularly in the realm of artificial intelligence (AI) and high-performance computing. The company's stock has seen a meteoric rise, driven by its dominant position in the AI market and robust financial performance. As of the latest trading session, Nvidia's stock closed at $127.40, slightly below its record high of $135.58 set in June.

Financial Performance and Market Dynamics

Robust Revenue and Profit Growth

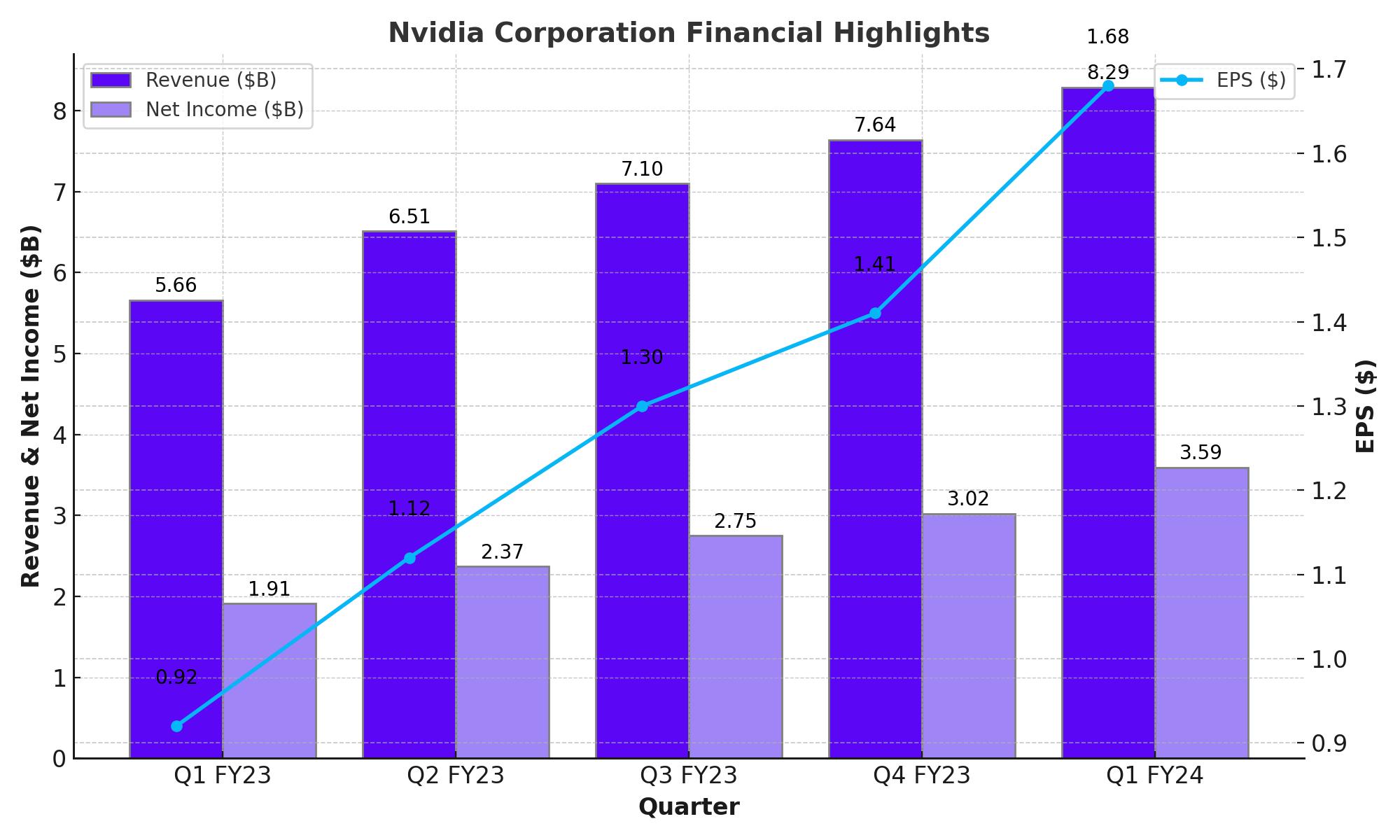

Nvidia's financial performance has been nothing short of spectacular. The company reported fiscal first-quarter revenue of $26 billion, marking a 262% year-over-year increase. Adjusted earnings per share (EPS) grew by an astounding 461%, reflecting Nvidia's strong pricing power and market demand. The data center segment, a significant growth driver, posted record quarterly revenue of $22.6 billion, up 427% year-over-year.

Stock Split and Market Reaction

In June, Nvidia executed a 10-for-1 stock split, making its shares more accessible to retail investors. Despite this, the stock experienced a short-lived pullback, losing $430 billion in market cap over three days. However, it quickly rebounded, maintaining strong support above its 21-day exponential moving average.

Insider Transactions and Market Sentiment

2024 has seen substantial insider selling, with CEO Jensen Huang leading the charge, selling over 2.1 million shares for $239 million. This insider activity, alongside a total of 41 insider sales and zero buys this year, raises questions about the stock's near-term trajectory. However, the broader market sentiment remains positive, with Nvidia's shares up 159% year-to-date.

Strategic Initiatives and Market Opportunities

AI and Data Center Dominance

Nvidia's GPUs have become the gold standard for AI and high-performance computing. The company's latest innovations, including the Grace Blackwell Superchips, are set to revolutionize the market. These chips, priced between $35,000 and $70,000, are crucial for building AI supercomputers, with some servers incorporating up to 72 of these chips, valued at $5 million each.

Expansion into AI Software

Beyond hardware, Nvidia is making significant strides in AI software. The NVIDIA AI Enterprise platform, priced at $4,500 per GPU annually, is designed to run AI workloads seamlessly across various environments, including on-premises and cloud platforms. This strategic move positions Nvidia to capture a substantial share of the $150 billion annual AI software market.

Partnerships and Ecosystem Development

Nvidia's strategy involves extensive partnerships with cloud service providers (CSPs) and server OEMs. Collaborations with Microsoft Azure, Dell, and other industry giants are aimed at building AI factories, enabling enterprises to harness Nvidia's AI capabilities without compromising data security. This approach not only drives hardware sales but also locks in long-term software revenue through NVIDIA AI Enterprise.

Technical Analysis and Future Outlook

Valuation and Growth Prospects

Nvidia's current forward P/E ratio stands at 47x, which, while high, is justified by its robust growth trajectory. The company's EPS for fiscal 2025 is projected to grow by 108% year-over-year, with a further 35% increase anticipated for fiscal 2026. Analysts suggest a fair value of $190 per share, implying significant upside potential from the current levels.

Technical Indicators and Stock Momentum

Technically, Nvidia's stock shows strong support levels, with its price well above the 50-day moving average. The relative strength index (RSI) of 57.51 indicates that the stock is not overbought, suggesting room for further appreciation. The recent pullback provides a potential buying opportunity for long-term investors.

Insider Transactions and Market Impact

Implications of Insider Sales

The extensive insider selling activity, particularly by CEO Jensen Huang, warrants close attention. While insider sales can sometimes signal a lack of confidence in future stock performance, it's also important to consider the broader context of the company's growth and market position.

Insider Transaction Highlightes:

- Jensen Huang: Sold 2.1 million shares, totaling $239 million.

- Mark Stevens: Offloaded 680,000 shares for $223 million.

- Tench Coxe and Colette Kress: Each sold 300,000 shares, with Coxe earning $290 million and Kress $36 million.

The substantial profits realized from these transactions highlight the significant value generated by Nvidia's stock over the past year.

Conclusion

Nvidia Corporation (NASDAQ:NVDA) continues to dominate the AI and high-performance computing markets, backed by strong financial performance, innovative product offerings, and strategic partnerships. Despite the recent insider selling and market volatility, the company's long-term growth prospects remain robust. Investors should consider the broader market dynamics and Nvidia's strategic initiatives when evaluating its stock.

Link to Real-Time Chart and Insider Transactions: