Nvidia NASDAQ:NVDA Stock Rebounds: Evaluating Recent Movements and Future Prospects

Nvidia Surges 7% Post Sell-Off, Driven by AI Dominance and Market Confidence | That's TradingNEWS

Nvidia Corporation (NASDAQ:NVDA): Evaluating Recent Stock Movements and Future Prospects

Nvidia's Rebound After a Sell-Off

Nvidia Corporation (NASDAQ:NVDA) recently witnessed a significant rebound, with its stock surging nearly 7% on Tuesday following a multi-day sell-off. This recovery came after a sharp decline that saw Nvidia's market capitalization drop from a peak of $3.34 trillion to $3.10 trillion, losing $430 billion in value over three trading days. Despite this volatility, Nvidia remains one of the top performers in the stock market, buoyed by its central role in the artificial intelligence (AI) revolution.

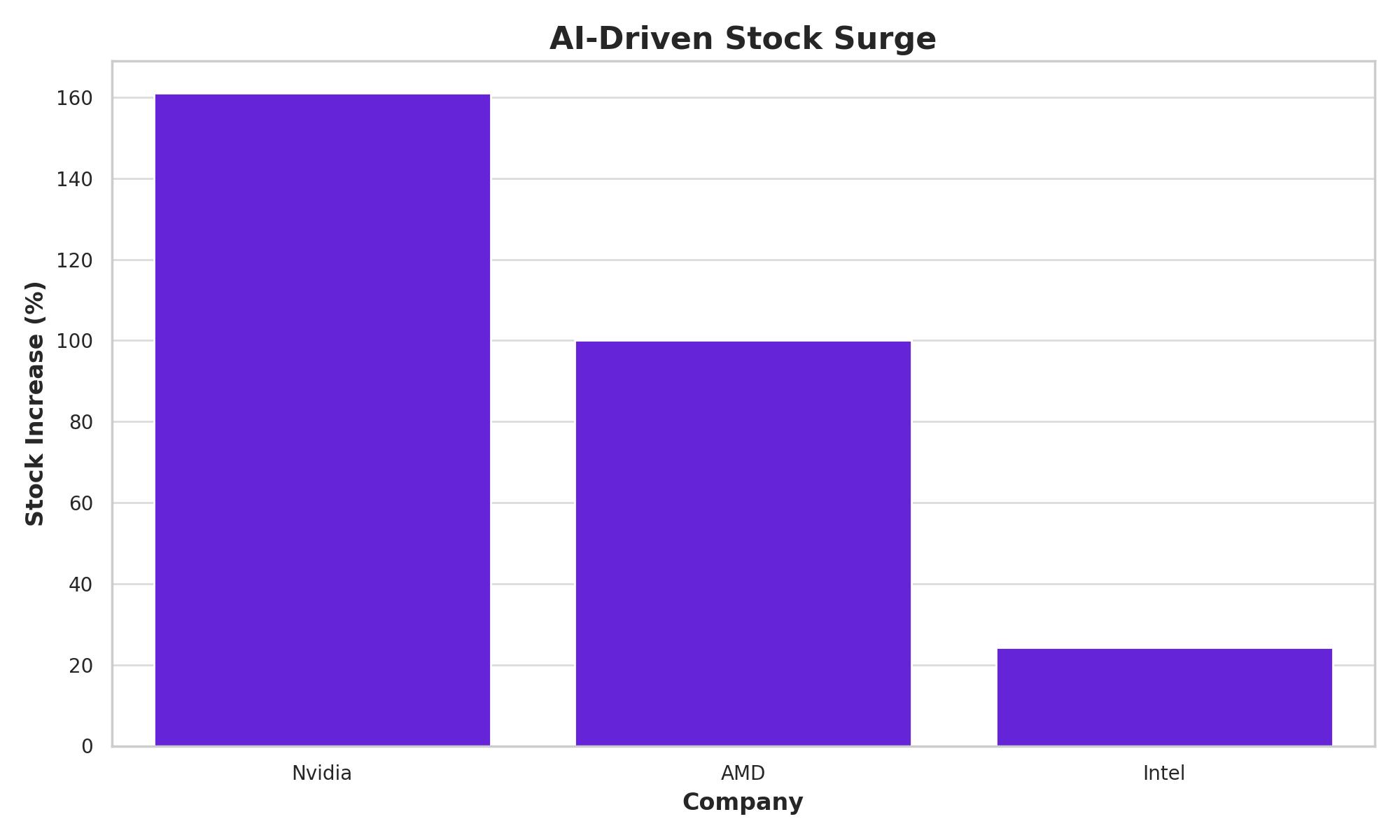

AI-Driven Stock Surge

Since January, Nvidia's stock has soared by over 161%, reflecting the company's dominance in AI technologies. Nvidia's GPUs are essential for powering AI systems, including generative AI applications such as OpenAI's ChatGPT. This surge has positioned Nvidia as a key player in the "Magnificent Seven," a group of mega-cap tech companies that have significantly outperformed the broader market. The S&P 500 index climbed 24.2% over 2023, while the Magnificent Seven's stocks saw an average rise of over 100%.

Technical Analysis and Market Dynamics

Technical Indicators and Support Levels

Nvidia's recent recovery was instrumental in lifting the tech-heavy Nasdaq, which rose 1.3%, while the S&P 500 closed 0.4% higher. Despite the recent sell-off, Nvidia's shares have demonstrated resilience, with technical indicators suggesting strong support around current levels. Analysts note that typical volatility is expected when a stock rises as quickly as Nvidia’s did, and recent movements are in line with this expectation.

Pricing Power and Competitive Position

Nvidia maintains a strong competitive position in the AI chip market. While competitors like Advanced Micro Devices (AMD) and Intel (INTC) are developing their own GPUs, Nvidia's advanced hardware and software integration, particularly with its CUDA platform, continue to offer a competitive edge. Nvidia's upcoming "Blackwell" GPU series is expected to further cement its market leadership.

Market Valuation and Future Outlook

Valuation Metrics

As of the latest trading sessions, Nvidia's stock is trading at a forward P/E ratio of 43.6x, compared to AMD's 40.0x and Intel's 24.5x. While Nvidia's valuation appears high, its consistent earnings beats and dominant market position justify the premium. Analysts like Eric Jackson from EMJ Capital forecast Nvidia's market cap could reach $6 trillion by the end of 2024, driven by continued high demand for AI technologies.

Investor Sentiment and Strategic Insights

Investor sentiment remains bullish, with expectations that Nvidia's stock will continue to perform well. The company's strong pricing power, ongoing product innovations, and significant role in AI development are key factors supporting this outlook. Furthermore, Nvidia’s strategic moves, including stock splits, are designed to make its shares more accessible to a broader range of investors, enhancing liquidity and market participation.

Conclusion

Nvidia Corporation (NASDAQ:NVDA) has demonstrated remarkable resilience and growth, driven by its critical role in the AI industry. Despite recent volatility and a brief dip in market capitalization, Nvidia's strong recovery underscores its robust market position and investor confidence. With continued innovation and strategic market positioning, Nvidia is well-placed to maintain its leadership in the semiconductor sector, offering promising prospects for investors.

For real-time updates on Nvidia's stock performance, visit this link. Additionally, for insights into insider transactions, refer to Nvidia's insider transactions page.