NVIDIA (NASDAQ:NVDA): The Powerhouse Behind AI’s Multi-Trillion-Dollar Boom

Unmatched AI demand, record-breaking revenues, and Blackwell GPUs position NVDA for explosive upside | That's TradingNEWS

NVIDIA Corporation (NASDAQ:NVDA): A Phenomenal Growth Story in the Age of AI

NVIDIA Corporation (NASDAQ:NVDA) has emerged as the uncontested leader in artificial intelligence (AI) computing and hardware, revolutionizing how data centers, enterprises, and industries function. With a meteoric rise in demand for its GPUs and AI hardware, NVIDIA’s performance continues to defy expectations, propelling the company into a new era of unprecedented growth and innovation. This dominance isn’t accidental—it's the result of visionary leadership, cutting-edge technology, and an unrelenting focus on meeting the needs of a rapidly evolving AI landscape.

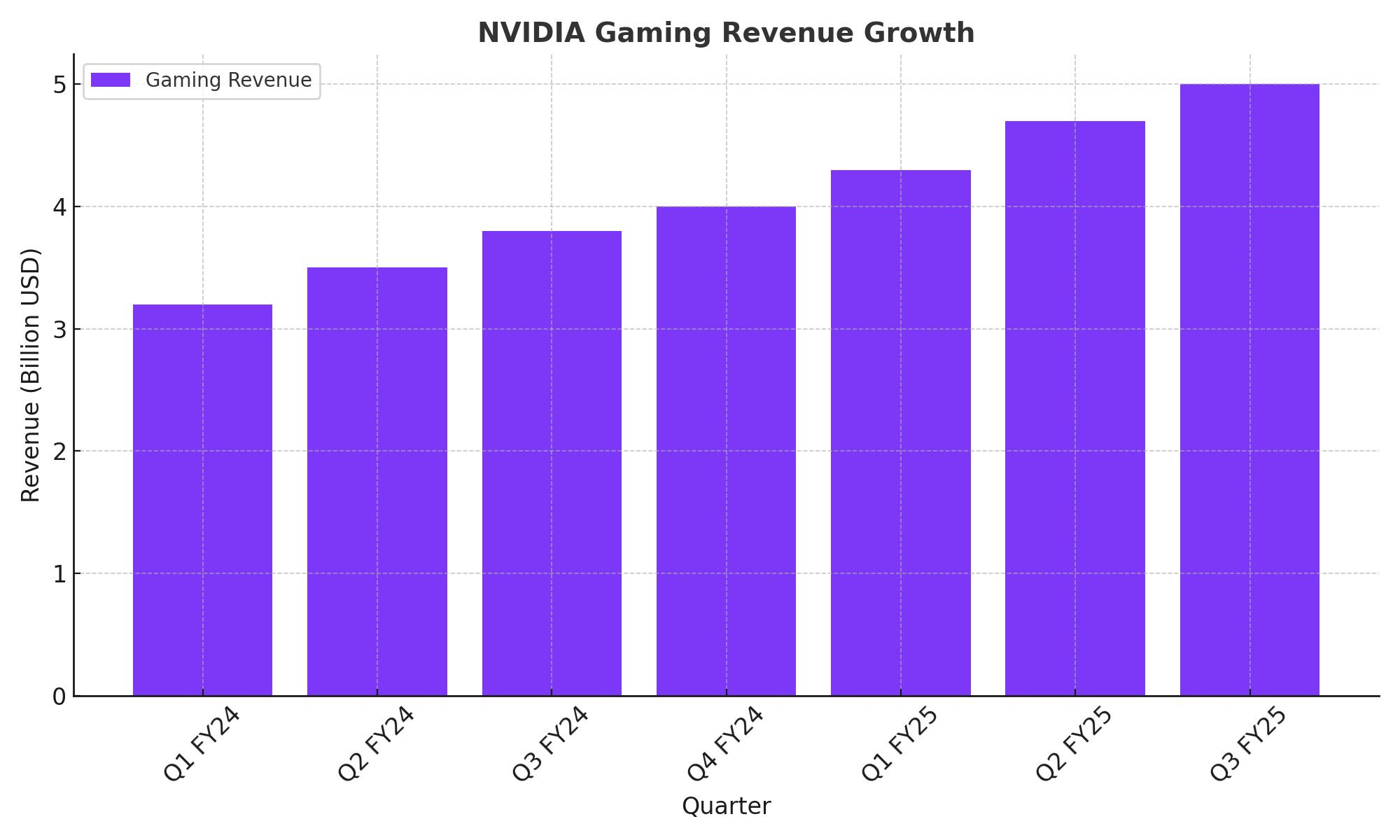

Recent earnings have underscored NVIDIA’s remarkable trajectory. In Q3 FY25, NVIDIA reported revenues of $35.08 billion, reflecting a year-over-year growth rate of 94%. The bulk of this growth came from its data center business, which posted $30.77 billion in revenue, more than doubling compared to the same period last year. These results highlight NVIDIA’s vital role in driving the AI revolution across industries.

Data Center Dominance: The Powerhouse Behind NVIDIA's Growth

The data center segment is the crown jewel of NVIDIA's operations, responsible for over 88% of its Q3 FY25 revenue. This performance reflects an extraordinary surge in demand for GPUs, fueled by the exponential growth of generative AI, machine learning, and high-performance computing workloads. NVIDIA’s Hopper architecture has driven much of this success, but the company’s upcoming Blackwell GPUs promise to set even higher benchmarks.

Blackwell, a marvel of engineering, boasts 208 billion transistors and is built using a custom TSMC 4NP process. These GPUs have already become the centerpiece of orders from hyperscalers like Google (GOOG), Microsoft (MSFT), and Meta Platforms (META). Google alone has committed $10 billion for 400,000 Blackwell GPUs, while Meta has placed an $8 billion order for 360,000 units. Despite these massive orders, NVIDIA faces ongoing supply constraints, which are expected to persist through fiscal 2026. According to CFO Colette Kress, demand for Blackwell is "staggering," and the company is racing to scale supply to meet customer needs.

Production challenges notwithstanding, Blackwell’s capabilities are poised to revolutionize AI computing. Compared to its predecessor, Hopper, Blackwell delivers up to 25 times greater cost and energy efficiency in generative AI workloads. With the ability to handle massive datasets and perform complex computations faster than ever before, Blackwell GPUs are already sold out for the next 12 months.

Explosive Revenue Growth and Financial Performance

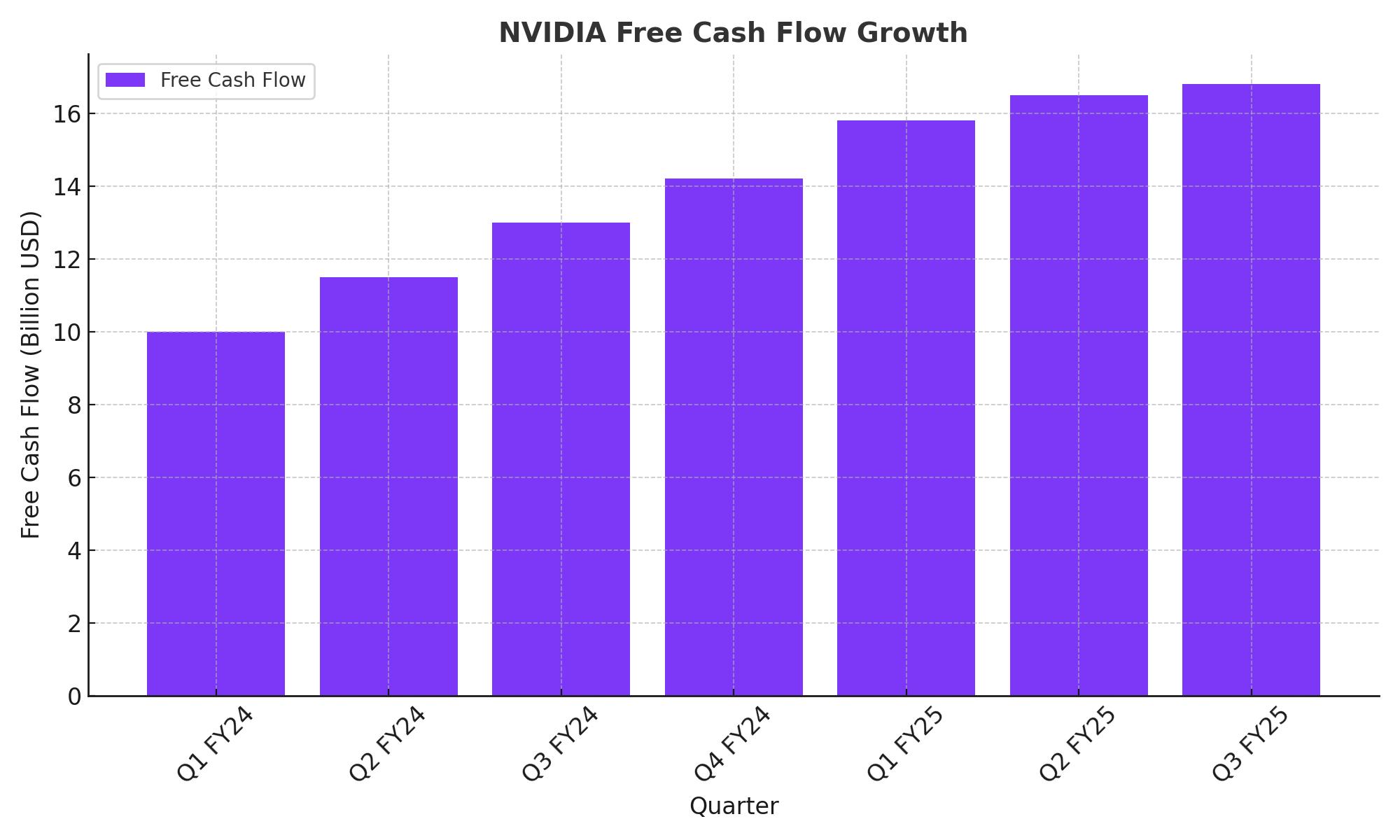

NVIDIA’s financial performance reflects its dominance in the AI ecosystem. Q3 FY25 saw the company achieve a gross margin of 75% and an operating margin of 62.3%. Free cash flow for the quarter reached $16.8 billion, translating to an impressive margin of 48%. These metrics underscore NVIDIA's ability to translate its technological leadership into robust profitability.

Looking ahead, NVIDIA has guided for Q4 FY25 revenue of $37.5 billion, a 69.6% year-over-year increase. Analysts expect even stronger results, with some forecasting revenues closer to $40 billion. At this pace, NVIDIA is projected to exceed $200 billion in annual revenue by fiscal 2026, further solidifying its position as a market leader.

This trajectory is supported by sustained demand from hyperscalers and enterprises. Big Tech companies like Microsoft, Amazon (AMZN), and Google are ramping up capital expenditures on AI infrastructure, with NVIDIA capturing 80-85% of the market for AI GPUs. The company’s long-term growth prospects are bolstered by its ability to consistently beat earnings expectations. For instance, NVIDIA's Q3 FY25 revenue exceeded its guidance by $2.6 billion, a testament to its conservative forecasting and operational excellence.

AI Revolution: A Trillion-Dollar Opportunity

NVIDIA’s CEO Jensen Huang has repeatedly emphasized the transformative potential of AI. He likens the current moment to the industrial revolution, describing AI as a new form of industrialization that will redefine industries and create trillions of dollars in economic value. NVIDIA is at the forefront of this revolution, building the infrastructure—"AI factories"—needed to power the next generation of AI applications.

The demand for AI hardware is driven by two primary factors: the modernization of existing data centers and the creation of entirely new AI-native businesses. Huang estimates that the world’s data centers, valued at roughly $1 trillion today, are undergoing a fundamental shift from CPU-based computing to GPU-accelerated machine learning. This transformation will unlock unprecedented capabilities, enabling businesses to process vast amounts of data more efficiently and cost-effectively.

Beyond modernizing existing infrastructure, NVIDIA is helping to create AI factories that generate new forms of intelligence. These factories are essential for training large language models (LLMs) like OpenAI’s GPT, which have become indispensable tools for enterprises and developers alike. NVIDIA’s GPUs are not just powering today’s AI applications—they are laying the groundwork for future innovations that will redefine industries ranging from healthcare to autonomous driving.

The Blackwell Era: A Catalyst for Continued Growth

The upcoming Blackwell GPUs represent a significant leap forward in NVIDIA's technological capabilities. With 64 Blackwell GPUs capable of performing the same work as 256 Hopper GPUs, these new chips promise to deliver unparalleled performance and efficiency. Blackwell’s cost advantages are expected to drive widespread adoption among hyperscalers and enterprises, further fueling NVIDIA’s growth.

While Blackwell is set to dominate the market, NVIDIA is already looking ahead. The company is developing its next-generation Rubin GPUs, which are expected to begin production in late 2025. These advancements ensure that NVIDIA remains at the cutting edge of AI hardware, maintaining its competitive edge in a rapidly evolving market.

Valuation: Balancing Growth and Risk

Despite its rapid growth, NVIDIA’s valuation remains a topic of debate among investors. Currently trading at a forward P/E ratio of 46x FY26 earnings, the stock appears expensive compared to traditional metrics. However, when considering NVIDIA’s unparalleled growth prospects and market dominance, this valuation is more than justified.

NVIDIA’s long-term potential is enormous. The company’s ability to capture a significant share of the $1 trillion data center market and its leadership in AI hardware position it for sustained growth. Analysts project EPS growth to $5.55 by FY27, providing a clear path for the stock to reach $200 and beyond.

However, risks remain. Supply chain disruptions, competition from AMD and Intel, and potential regulatory challenges could impact NVIDIA’s growth trajectory. Investors should also be mindful of the broader market environment, as elevated valuations could make the stock susceptible to short-term volatility.

Final Thoughts: A Stock for the AI Era

NVIDIA Corporation (NASDAQ:NVDA) is more than just a semiconductor company—it is the backbone of the AI revolution. With groundbreaking technologies like Blackwell and a dominant position in the AI GPU market, NVIDIA is poised to lead the next wave of innovation. The company’s financial performance, technological leadership, and visionary management make it a compelling investment for those seeking exposure to AI’s transformative potential.

For long-term investors, NVIDIA offers a unique opportunity to participate in a multi-decade growth story. While risks exist, the company’s strong fundamentals and leadership position in a rapidly expanding market make it a standout choice in the tech sector. As the world embraces AI, NVIDIA is set to remain at the forefront, delivering value to shareholders and shaping the future of technology.