Nvidia NVDA Stock Soars as AI Demand Fuels Rapid Growth

Nvidia Approaches $3 Trillion Market Cap Amid Explosive Earnings and AI Expansion | That's TradingNEWS

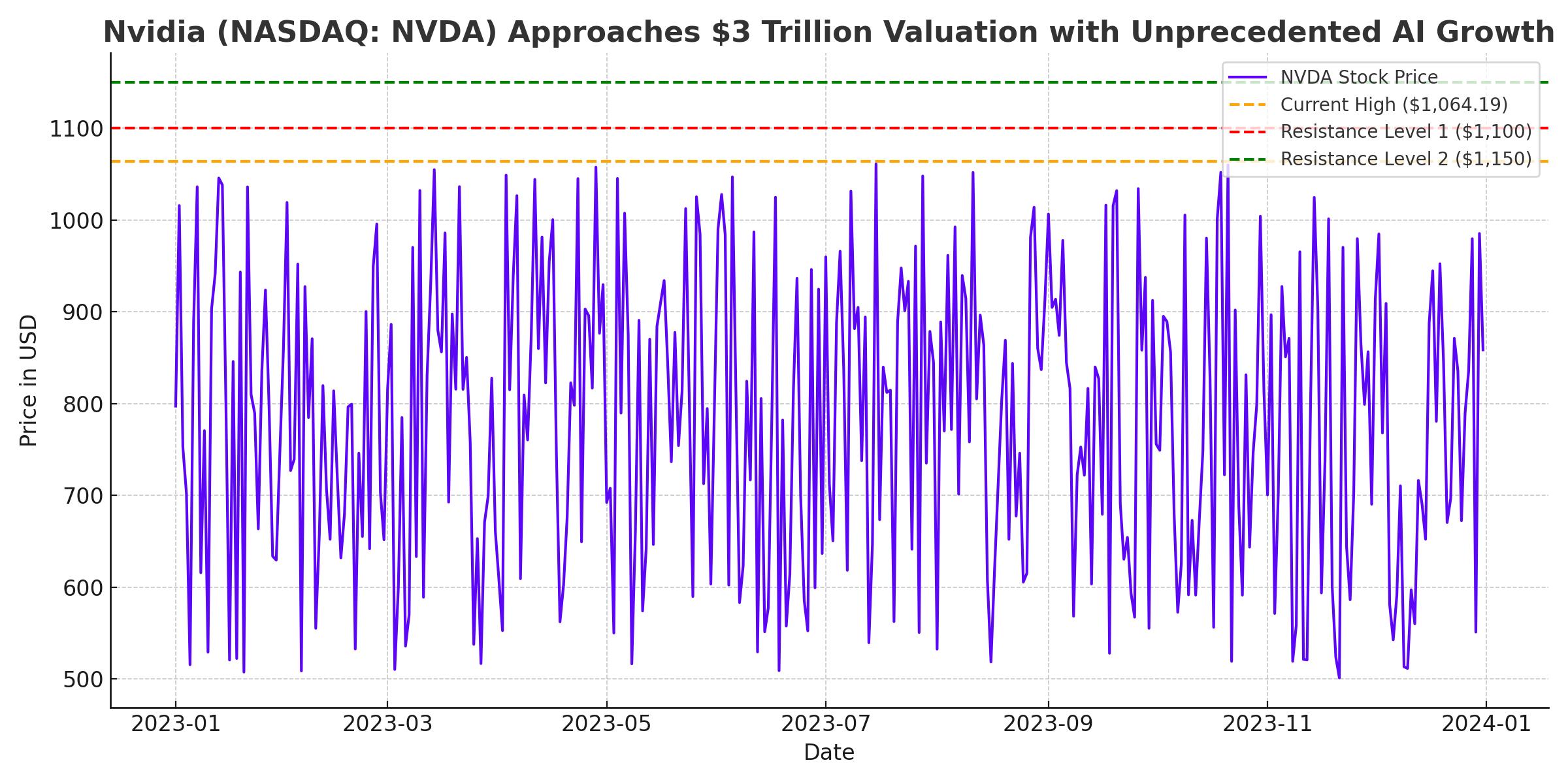

Nvidia (NASDAQ: NVDA) Approaches $3 Trillion Valuation with Unprecedented AI Growth

Market Cap Milestones and Stock Performance

Nvidia (NASDAQ: NVDA) continues to dominate the market, driven by its leading position in artificial intelligence (AI) technology. The company's stock surged 15.1% last week, reaching a record high of $1,064.19, and boosting its market capitalization to $2.661 trillion. This rapid growth places Nvidia just behind Apple ($2.913 trillion) and close to Microsoft ($3.196 trillion), highlighting its significant market presence.

Exceptional Earnings and Revenue Growth

Nvidia's financial performance reflects its dominance in the AI sector. The company reported Q1 2025 earnings per share of $6.12, a 461% increase from the previous year, with revenue soaring 265% to $26.04 billion. These impressive figures exceed market expectations and reinforce Nvidia's leadership in AI hardware.

Analysts predict continued strong performance, with expected earnings growth of 107% to $26.85 per share in fiscal 2025, followed by a 31% increase to $35.12 per share in fiscal 2026. Nvidia's consistent ability to exceed its own guidance further solidifies its market position.

AI Demand and Nvidia's Strategic Role

The surge in AI demand is a key driver of Nvidia's success. Major tech companies, including Microsoft and Apple, are investing heavily in AI, significantly benefiting Nvidia's chip business. Nvidia's GPUs are crucial for training complex AI models, making the company indispensable in the AI ecosystem.

Nvidia's role in AI extends to partnerships with companies like Elon Musk's AI start-up xAI, which recently raised $6 billion. This investment is expected to significantly boost demand for Nvidia's GPUs, underscoring the company's critical role in the AI supply chain.

Insider Transactions and Market Sentiment

For insights into Nvidia's insider transactions, including recent activities by company executives, visit the insider transactions page. Monitoring these transactions can provide valuable information about the company's internal sentiment and future prospects.

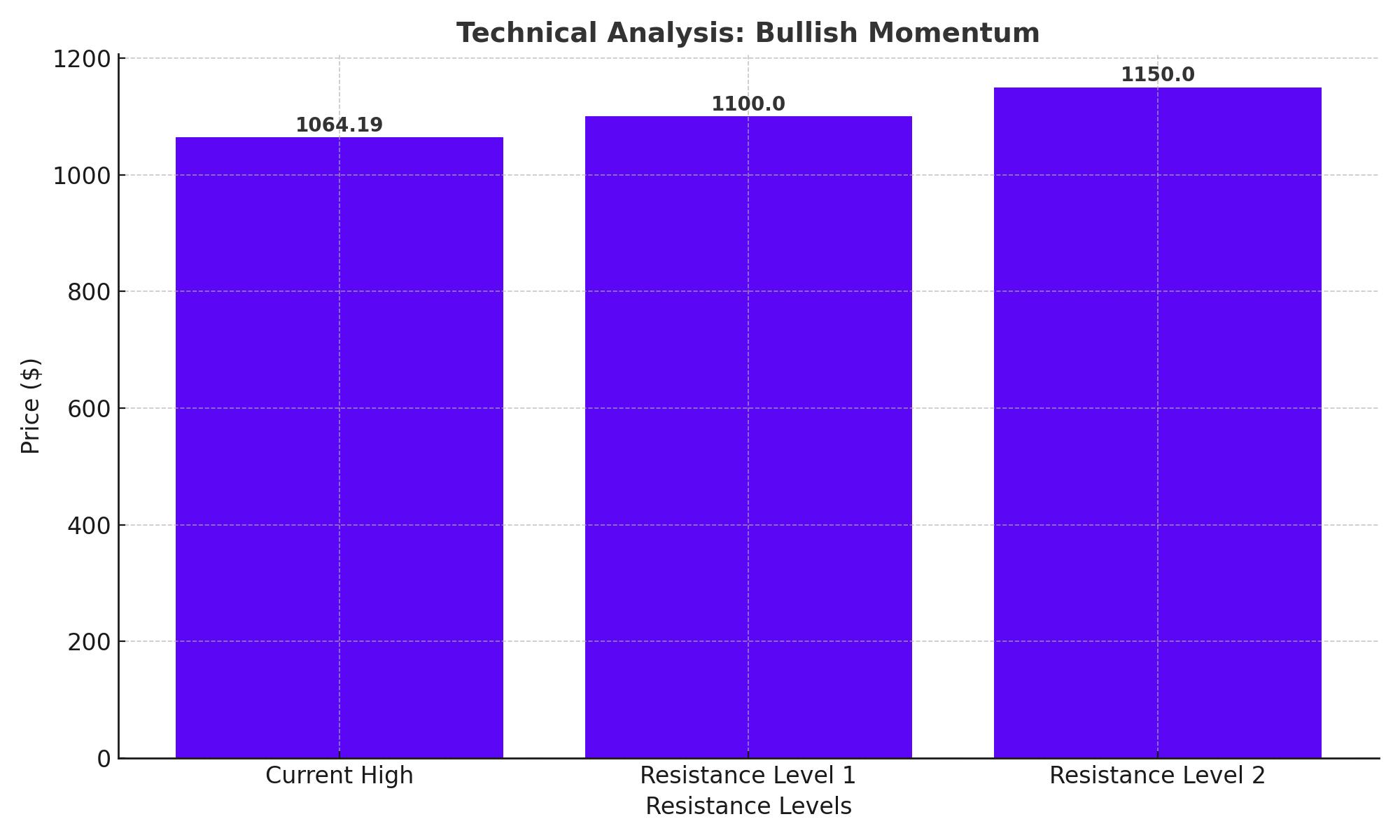

Technical Analysis: Bullish Momentum

Nvidia's stock shows strong bullish signals from a technical analysis perspective. The Relative Strength Index (RSI) indicates potential for further price increases. If NVDA surpasses its current high of $1,064.19, it could target new highs, with significant resistance levels at $1,100 and $1,150.

Broader Market Influence and Future Outlook

Nvidia's impact extends beyond its stock performance. The company's advancements in AI are setting industry standards and attracting substantial investments. The AI industry's rapid growth bodes well for Nvidia, as companies build AI infrastructure at an unprecedented pace, relying heavily on Nvidia's hardware.

Analysts, including those from UBS, expect continued volatility for Nvidia's stock but anticipate new record highs driven by ongoing AI investments. Nvidia's strategic position in the AI market and its robust financial performance suggest significant growth potential.

AI Industry Growth and Nvidia's Dominance

The AI industry's expansion is driving Nvidia's success. Companies are increasingly investing in AI infrastructure, and Nvidia's GPUs are at the heart of these developments. With significant investments from tech giants and new players like xAI, Nvidia is poised for continued growth.

Nvidia's ability to meet and exceed market expectations, combined with its critical role in AI, positions it as a key player in the tech industry. The company's market cap approaching $3 trillion underscores its significant impact and future potential.

For real-time updates and detailed analysis, visit the Nvidia stock profile.