NASDAQ:NVDA Stock Analysis – Is Nvidia’s Growth Story Still Intact After the Recent 22% Drop?

Nvidia’s Market Position and AI Dominance

Nvidia Corporation (NASDAQ:NVDA) remains the undisputed leader in the AI and semiconductor industry, with its dominance in GPU-accelerated computing powering everything from cloud services to artificial intelligence workloads. Despite a sharp 22% drop from its all-time highs in early January, Nvidia continues to demonstrate impressive growth potential. The market reaction followed concerns over DeepSeek’s cost-efficient AI model and geopolitical risks tied to the U.S.-China trade war.

Even with these challenges, Nvidia’s AI infrastructure continues to be a critical pillar for major tech companies, including Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOGL), and Amazon (NASDAQ:AMZN), all of which rely on Nvidia’s H100 and Blackwell GPUs for AI computing. Nvidia’s DGX Cloud platform is another major advantage, offering AI computing power as a service, positioning the company not just as a hardware provider but as a full-fledged AI infrastructure giant.

AI Spending and Data Center Growth Fuel Nvidia’s Revenue

The AI revolution has driven record capital expenditures (CAPEX) from tech giants, and Nvidia is at the center of this transformation. According to reports, Nvidia's entire 2025 Blackwell chip production has already sold out, signaling continued demand for its cutting-edge GPUs.

Data centers remain Nvidia’s most lucrative segment, expected to generate over $113 billion in revenue in fiscal 2025, with analysts projecting a 27% CAGR through 2029. The AI infrastructure boom has led cloud service providers such as Microsoft Azure, Google Cloud, and Amazon Web Services to accelerate GPU acquisitions, making Nvidia’s chips essential for AI model training and inference workloads.

In addition, Nvidia’s partnerships with firms like IBM (NYSE:IBM), which is integrating Hopper-based GPUs into AI-powered enterprise applications, further solidify its market dominance.

DeepSeek’s Impact on Nvidia: Is the AI Disruption Overstated?

A major reason behind Nvidia’s $589 billion market cap wipeout in late January was the unveiling of DeepSeek R1, a Chinese AI model claiming to rival OpenAI’s GPT-4 at just a fraction of the cost. Reports suggested DeepSeek trained its model using just 2,000 Nvidia H800 chips compared to OpenAI’s 25,000 A100 GPUs, leading investors to question whether Nvidia’s high-margin GPU sales could be at risk.

However, there are major doubts about DeepSeek’s claims. Industry experts, including Scale AI CEO Alexander Wang, have suggested DeepSeek may actually be using 50,000 of Nvidia’s banned H100 chips, contradicting its claims of efficiency. If true, this would mean DeepSeek’s cost advantage is misleading, and Nvidia’s high-performance GPUs remain indispensable.

Additionally, the cost of AI training is expected to decline as models become more efficient. However, this will not eliminate the demand for high-end AI chips, as inference workloads will continue requiring massive computational power—an area where Nvidia remains unrivaled.

Trade Tariffs and Regulatory Risks: A Threat to Nvidia?

Beyond AI competition, U.S.-China trade tensions have been another major factor weighing on NASDAQ:NVDA. President Donald Trump’s decision to impose a 10% tariff on Chinese imports has raised concerns that China may retaliate, potentially limiting Nvidia’s 14% revenue exposure to China.

Nvidia has already faced export restrictions on high-performance AI chips like the A100 and H100, forcing the company to develop downgraded versions (H800) for Chinese customers. If trade tensions escalate, Nvidia may face further revenue losses from one of its key markets. However, Nvidia has successfully shifted focus to markets like Singapore and the Middle East, helping offset some of the potential downsides.

Is Nvidia’s Valuation Still Justified?

Following its 22% pullback, Nvidia is currently trading at a P/E ratio of 40x forward earnings, which many analysts argue is fair given its projected revenue growth.

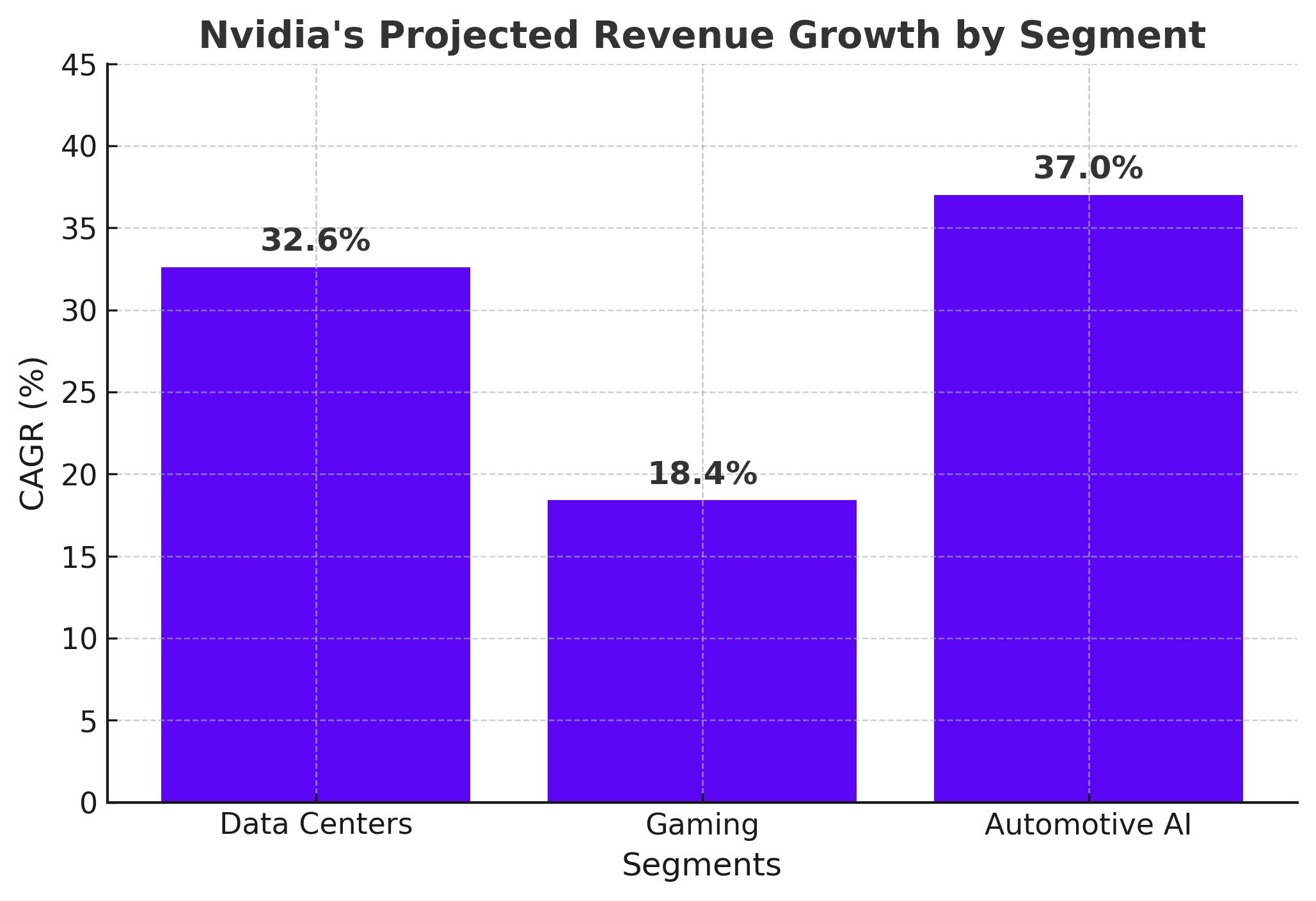

Revenue estimates suggest Nvidia will generate $132 billion in FY2025, growing at an expected 27% CAGR through 2029. This growth is fueled by:

- Data center expansion, with global demand for AI chips projected to grow 32.6% annually

- Gaming sector recovery, with Nvidia’s RTX 5000 series expected to boost GPU sales

- Automotive AI growth, with Nvidia’s self-driving car solutions expected to grow 37% annually through 2033

Based on discounted cash flow (DCF) models, Nvidia could be undervalued by up to 40%, with some analysts setting a price target of $1,200-$1,300 per share over the next two years.

Insider Transactions and Institutional Interest in Nvidia Stock

Institutional investors continue to bet big on NASDAQ:NVDA, with Lockheed Martin’s pension fund increasing its holdings by 233,920 shares. Hedge funds have also aggressively accumulated Nvidia shares, viewing the recent dip as a buying opportunity.

For a deeper look into insider trading activity and institutional movements, visit Nvidia Insider Transactions.

Buy, Sell, or Hold? Final Verdict on Nvidia Stock

Despite its recent decline, Nvidia remains the dominant force in AI computing, with unmatched GPU demand and AI infrastructure capabilities. The stock’s 22% pullback presents a compelling entry point, especially considering its expected revenue growth and potential undervaluation.

However, risks remain, including trade tariffs, potential AI competition, and regulatory uncertainties. Given these factors, investors should remain cautiously bullish, as Nvidia’s long-term outlook remains exceptionally strong.

For real-time updates on NASDAQ:NVDA, check out the Nvidia stock chart.