Nvidia's (NASDAQ: NVDA) Meteoric Rise and the Growing Hedge Fund Shift to Bitcoin: What Does It Mean for Stock?

As Nvidia (NASDAQ: NVDA) hits new highs, hedge funds like D.E. Shaw and Point72 are rebalancing portfolios toward Bitcoin, signaling a potential peak in the AI-driven market boom | That's TradingNEWS

NVDA: A Critical Examination of Hedge Fund Shifts and the AI vs. Crypto Debate

Nvidia's (NASDAQ: NVDA) Meteoric Rise: A Double-Edged Sword

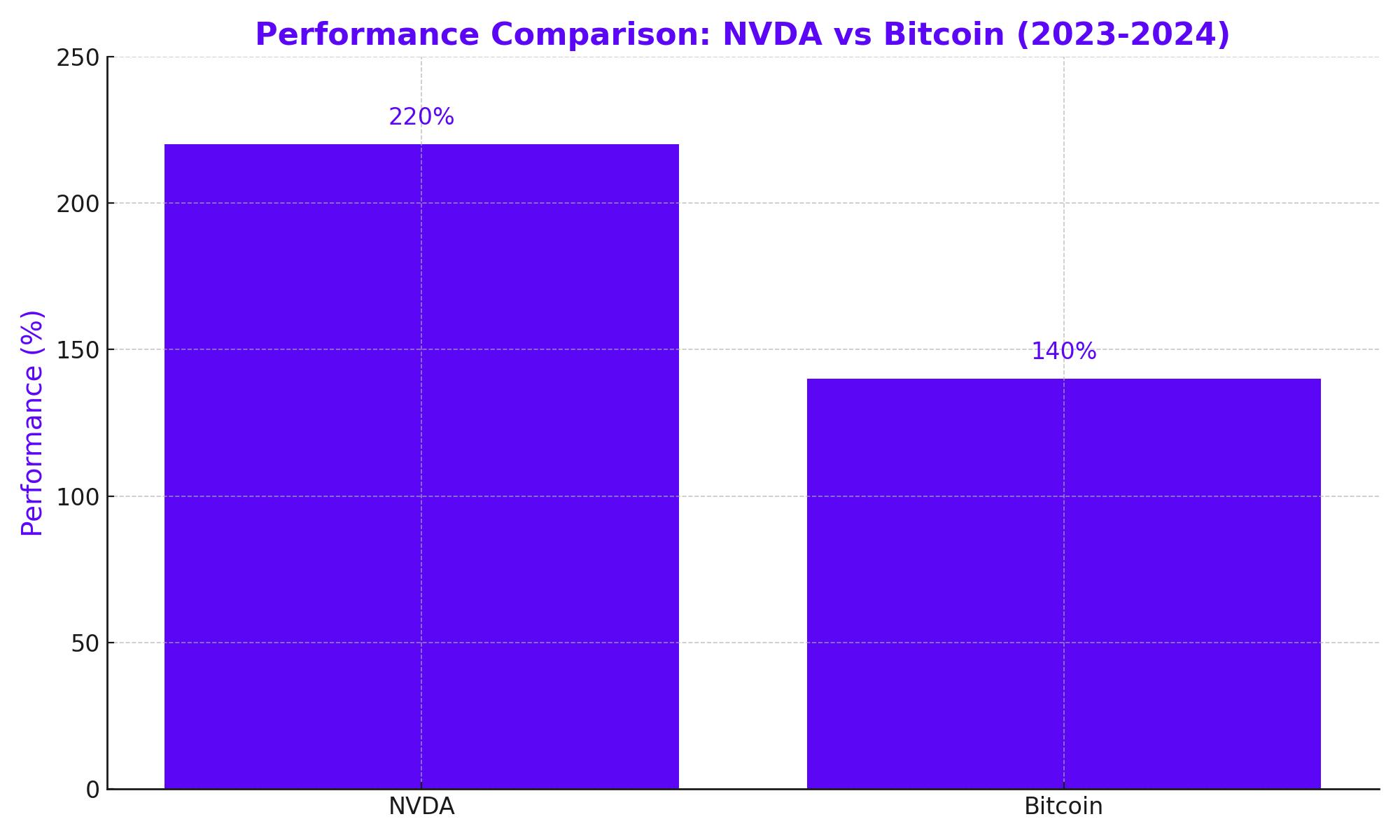

Nvidia Corporation (NASDAQ: NVDA) has been one of the standout performers in the stock market, driven by the explosive growth of artificial intelligence (AI) and its integral role in powering AI-driven technologies. As of Q2 FY2024, Nvidia reported an astounding 101% year-over-year increase in revenue, reaching $13.5 billion. This surge has seen NASDAQ: NVDA stock skyrocket by over 220% since the beginning of 2023, bringing its market cap to an impressive $1.09 trillion. Such performance has solidified Nvidia's position as a market leader in AI, but not without raising concerns about its sustainability.

Hedge Fund Movements: A Shift from NVDA to Bitcoin

Despite Nvidia's robust financial performance, some of Wall Street's most prominent hedge fund managers have begun reducing their exposure to NASDAQ: NVDA. David Shaw of D.E. Shaw, for example, sold off 12.1 million shares of Nvidia, slashing his position by 52%. Steven Cohen of Point72 also trimmed his Nvidia holdings by 16%, selling 409,042 shares. These moves are not isolated; they are part of a broader trend where hedge funds are reallocating capital into alternative assets, most notably cryptocurrencies like Bitcoin.

The Crypto Attraction: Why Bitcoin?

As hedge funds divest from NASDAQ: NVDA, they are increasingly turning to Bitcoin, particularly through the iShares Bitcoin Trust. Bitcoin’s price has seen a substantial rise, climbing to $59,000—representing a 140% increase year-to-date in 2024. The introduction of spot Bitcoin ETFs by the SEC has further fueled this momentum, drawing both retail and institutional investors. David Shaw’s acquisition of 2.4 million shares in the iShares Bitcoin Trust and Steven Cohen’s purchase of 1.6 million shares underscore the growing appeal of Bitcoin as a hedge against traditional assets like Nvidia.

NVDA vs. Bitcoin: A Comparative Performance Analysis

The divergent paths of Nvidia and Bitcoin raise critical questions about future investment strategies. While NASDAQ: NVDA remains a powerhouse in AI, its P/E ratio of 110.3 suggests that the stock may be overvalued, particularly if the AI-driven growth starts to plateau. In contrast, Bitcoin’s projected growth is staggering. Analysts at Bernstein predict that Bitcoin could reach $200,000 by 2025, offering a potential upside of 239%. This compares to a more modest 40% upside for Nvidia, based on a projected stock price of $600 over the next 12 months.

Is the AI Boom Peaking? Concerns Over NASDAQ: NVDA’s Sustainability

Recent reductions in hedge fund holdings of NASDAQ: NVDA have raised eyebrows across the investment community, signaling potential concerns about the sustainability of the AI boom. Nvidia’s stock has skyrocketed by over 220% since the beginning of 2023, pushing its market cap to a staggering $1.09 trillion. However, this meteoric rise has led to valuations that some analysts believe may be unsustainable. Nvidia’s current P/E ratio of 110.3 is significantly higher than industry peers, raising questions about whether the stock’s growth can continue at its current pace.

Furthermore, the competitive landscape is intensifying. Companies like AMD and Intel are aggressively advancing their AI technologies, potentially threatening Nvidia’s dominance in the market. For example, AMD’s recent launch of its MI300 series of data center GPUs represents a direct challenge to Nvidia’s AI leadership. This competition, coupled with the inherent cyclicality of tech stocks, could introduce increased volatility to Nvidia’s stock price, making it crucial for investors to monitor these developments closely.

Strategic Diversification: NVDA, Bitcoin, and the Quest for Balance

The strategic moves by hedge fund managers David Shaw and Steven Cohen to reduce their exposure to NASDAQ: NVDA and increase investments in Bitcoin highlight the growing importance of diversification. While Nvidia remains a powerhouse in the AI space, its high valuation and potential market volatility suggest that diversification into alternative assets like Bitcoin could be a prudent strategy.

Bitcoin, currently trading at around $59,000, offers a unique value proposition as a decentralized, deflationary asset. Its performance has been robust, with a 140% increase year-to-date in 2024. Moreover, the introduction of spot Bitcoin ETFs by the SEC has further legitimized cryptocurrency as an investment, attracting both retail and institutional investors. For instance, the iShares Bitcoin Trust, which has quickly accumulated substantial assets, offers a more accessible way to gain exposure to Bitcoin’s potential upside, which some analysts predict could reach $200,000 by 2025.

Nvidia’s Future: Navigating a Shifting Landscape

As NASDAQ: NVDA continues to innovate and expand its AI offerings, its ability to maintain market dominance will be critical. Nvidia’s growth has been fueled by its leadership in AI hardware, particularly its GPUs, which are essential for AI and machine learning applications. However, with its stock currently trading at $480, representing a 40% potential upside based on a 12-month target of $600, investors need to consider the broader market dynamics.

The growing interest in alternative investments, such as Bitcoin, and the potential for increased competition in the AI space, suggest that Nvidia’s future may involve navigating a more complex and competitive environment. Investors should weigh the risks associated with Nvidia’s high valuation and the possibility of market corrections against its long-term growth potential in AI.

Conclusion: Balancing Growth and Risk in Today’s Market

In today’s dynamic market environment, NASDAQ: NVDA presents both significant opportunities and risks. Its leadership in AI continues to drive substantial growth, but the stock’s high valuation and the evolving competitive landscape necessitate careful consideration. At the same time, alternative investments like Bitcoin offer a potential hedge, especially in the face of economic uncertainties.

For investors, the key to navigating these opportunities lies in balancing growth potential with risk management. Diversifying into assets like Bitcoin, while maintaining a position in Nvidia, could provide a more balanced and resilient portfolio. As always, staying informed and adjusting strategies based on market conditions will be crucial in making the most of these investment opportunities.