NYSEAMERICAN: UTG – A 6.8% Yield That’s Too Good to Ignore in 2025?

With Rate Cuts Approaching and AI Energy Demand Soaring, Is UTG the Best Dividend Play Right Now? | That's TradingNEWS

NYSEAMERICAN: UTG – A High-Yield Powerhouse Positioned for Growth in 2025

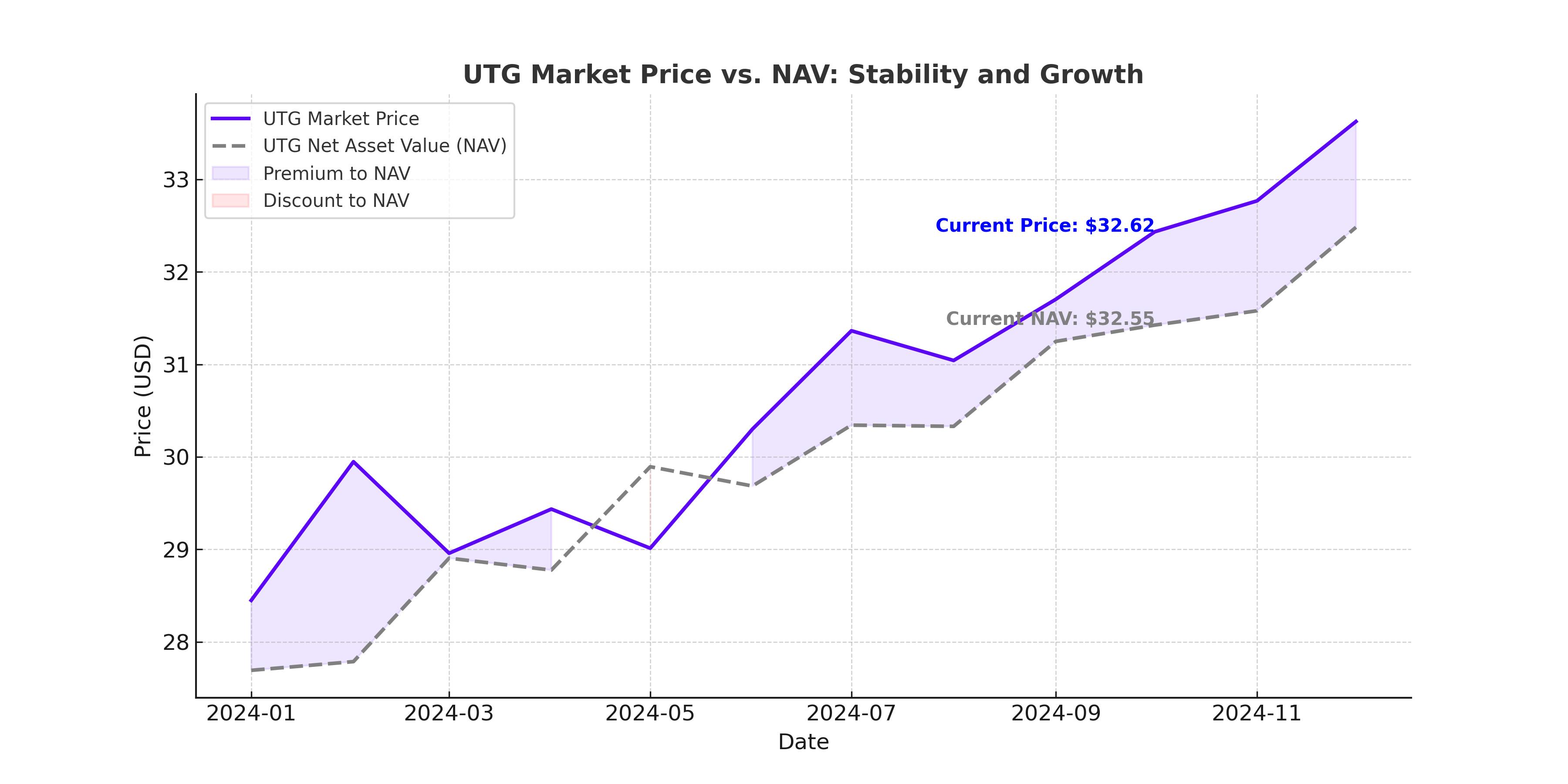

Reaves Utility Income Trust (NYSEAMERICAN: UTG) continues to deliver strong total returns and attractive income for investors seeking stable cash flow in an uncertain market. With a current dividend yield of 6.8%, a well-diversified portfolio concentrated in utilities and infrastructure, and a history of outperforming its benchmark, UTG stands as one of the most reliable closed-end funds (CEFs) for income-focused investors. Despite recent price gains, the fund remains fairly valued with a slight discount to net asset value (NAV), trading around $32.62 per share, which provides an opportunity for those looking to lock in high-yield returns.

Strong Long-Term Performance – Beating XLU and SPY

Over the past 12 months, UTG has outperformed both the Utilities Select Sector ETF (XLU) and the S&P 500 ETF (SPY) in total return, despite its focus on income generation rather than pure growth. This is an impressive feat considering that UTG’s structure prioritizes monthly distributions, a feature that makes it a strong candidate for retirees and income investors who depend on reliable cash flow.

The key reason for UTG’s superior performance lies in its active management strategy, which allows the fund to identify high-yielding, defensive utility and infrastructure stocks that can generate strong cash flows. Unlike passive ETFs, UTG benefits from the flexibility to allocate capital efficiently across high-dividend stocks in energy, communications, and infrastructure, helping it outperform even during volatile market conditions.

Interest Rate Impact – The Hidden Catalyst for UTG’s Growth

One of the biggest factors influencing UTG’s price action is the Federal Reserve’s interest rate policy. Historically, lower interest rates benefit utility stocks, as they enable companies in the sector to refinance debt at lower costs and expand capital investments without the burden of high borrowing expenses.

The Fed initially estimated four rate cuts in 2025, but this has now been revised down to just two. Despite this more cautious stance, any reduction in interest rates should still be bullish for UTG, as lower rates make high-yield investments more attractive relative to risk-free assets like Treasury bonds and money markets.

Throughout 2022 and 2023, rising interest rates negatively impacted utility stocks, as investors flocked to higher-yielding, risk-free assets. However, the tide appears to be turning. If the Fed continues to cut rates, even at a slower pace, UTG’s price could break into premium-to-NAV territory, offering capital appreciation alongside its already impressive dividend yield.

A Well-Managed Portfolio – Defensive and Growth-Oriented Holdings

UTG's $2.7 billion portfolio is well-diversified, with exposure to 58 different holdings spanning multiple industries. The fund’s composition leans heavily toward utilities (60.6% of total assets), making it highly defensive while also benefiting from the secular growth in renewable energy and infrastructure expansion.

Communications services make up 13.8% of the portfolio, while energy stocks account for 9.5%, further diversifying UTG's exposure and reducing risk. This allocation structure explains why UTG has consistently outperformed traditional utility ETFs like XLU while maintaining a lower risk profile than pure energy funds.

The fund’s largest individual holdings include major utility and energy players such as Talen Energy (TLN) at 7.89%, Vistra Corp. (VST) at 6.65%, and Deutsche Telekom (DTEGY) at 4.75%. These companies provide stable cash flows and defensive qualities, making UTG a strong performer even in challenging economic conditions.

Dividend Strength – A Reliable Monthly Payout with Growth Potential

UTG currently offers a monthly dividend of $0.19 per share, translating into an annual yield of 6.8%, which is well-covered by earnings. Over the past two decades, UTG has never cut its dividend, making it one of the most consistent income funds available today.

The fund's net investment income (NII) for 2024 was $0.49 per share, while net realized gains reached an impressive $9.86 per share. This translates to a total income from operations of $10.35 per share, meaning UTG has generated enough cash flow to cover more than four years of distributions in a single year.

For investors looking for a reliable dividend payer, UTG is one of the strongest choices in the CEF space. Its dividend consistency is particularly attractive for retirees and long-term income investors, as it provides a predictable cash flow stream unaffected by short-term market volatility.

AI Infrastructure Growth – A New Tailwind for UTG

A major overlooked catalyst for UTG is the booming AI infrastructure buildout. With tech giants like Microsoft (MSFT), Amazon (AMZN), and Meta (META) announcing over $100 billion in AI-related capital expenditures for 2025 alone, the demand for electricity, data centers, and network infrastructure is soaring.

Utilities play a crucial role in powering AI data centers, and UTG’s utility-heavy portfolio directly benefits from increased electricity consumption and infrastructure investment. The Energy Information Administration (EIA) projects a sharp increase in electricity demand, driven largely by AI, cloud computing, and 5G expansion.

UTG's significant holdings in energy and communication services make it a direct beneficiary of this trend. As AI infrastructure spending continues to accelerate, the fund's top utility stocks should see increased revenues and profitability, further strengthening UTG’s ability to pay dividends and grow NAV over time.

Premium vs. Discount – Is UTG Fairly Valued?

UTG currently trades at a slight discount to NAV of 0.33%, making it fairly valued compared to historical averages. Over the past three years, UTG has traded at a slight premium to NAV of around 0.36%, meaning there is room for a potential valuation boost if investors rotate back into high-yield assets as interest rates decline.

Historically, UTG’s price has fluctuated based on rate expectations and market sentiment toward utilities. During bull markets, UTG tends to trade at a slight premium to NAV, while it trades at a discount during rate-hike cycles. Given the Fed’s expected rate cuts in 2025, UTG could see its price appreciate back toward a premium valuation, creating additional upside for investors buying at current levels.

What Are the Risks for UTG?

While UTG is an attractive investment, there are still key risks to consider. One major concern is the fund’s leverage, which currently stands at 22.7% of net assets. While leverage enhances returns in a rising market, it can also magnify losses during downturns, particularly if interest rates remain higher for longer than expected.

Additionally, the utility sector’s heavy debt load is a potential vulnerability. Many utilities rely on debt financing for expansion, and if interest rates do not fall as expected, companies in UTG’s portfolio may face higher refinancing costs, potentially impacting earnings and dividend sustainability.

Another risk factor is market rotation away from defensive sectors. While UTG provides strong income, utility stocks tend to underperform growth sectors during periods of strong economic expansion. If investors shift capital into high-growth areas like technology and consumer discretionary stocks, UTG’s price may lag broader market indices like the S&P 500.

Final Verdict – Is NYSEAMERICAN: UTG a Buy?

UTG remains one of the best income-focused CEFs available, offering a high, reliable dividend yield, strong total return potential, and defensive sector exposure. With a 6.8% yield, well-covered dividends, and potential upside from Fed rate cuts and AI-driven infrastructure spending, UTG provides an attractive opportunity for long-term investors.

At current levels, UTG is fairly valued and offers a compelling entry point, particularly for income-focused investors looking to lock in monthly payouts and capital appreciation over time. If interest rates decline as expected, UTG should see its price appreciate further, making it an excellent choice for those seeking a low-volatility, high-income investment in a shifting economic environment.

For retirees and income-focused investors, UTG is a strong buy, providing consistent dividends and a defensive hedge against market volatility. However, investors should monitor interest rate movements and leverage levels, as higher-for-longer rates could pressure the fund’s performance.

With a long history of outperformance, stable cash flows, and exposure to growing AI infrastructure demand, UTG remains one of the most attractive CEFs on the market today.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex