NYSEARCA:BIZD – Is This 10% Yield a Safe Play in 2025?

Will NYSEARCA:BIZD Outperform as Market Valuations Look Stretched?

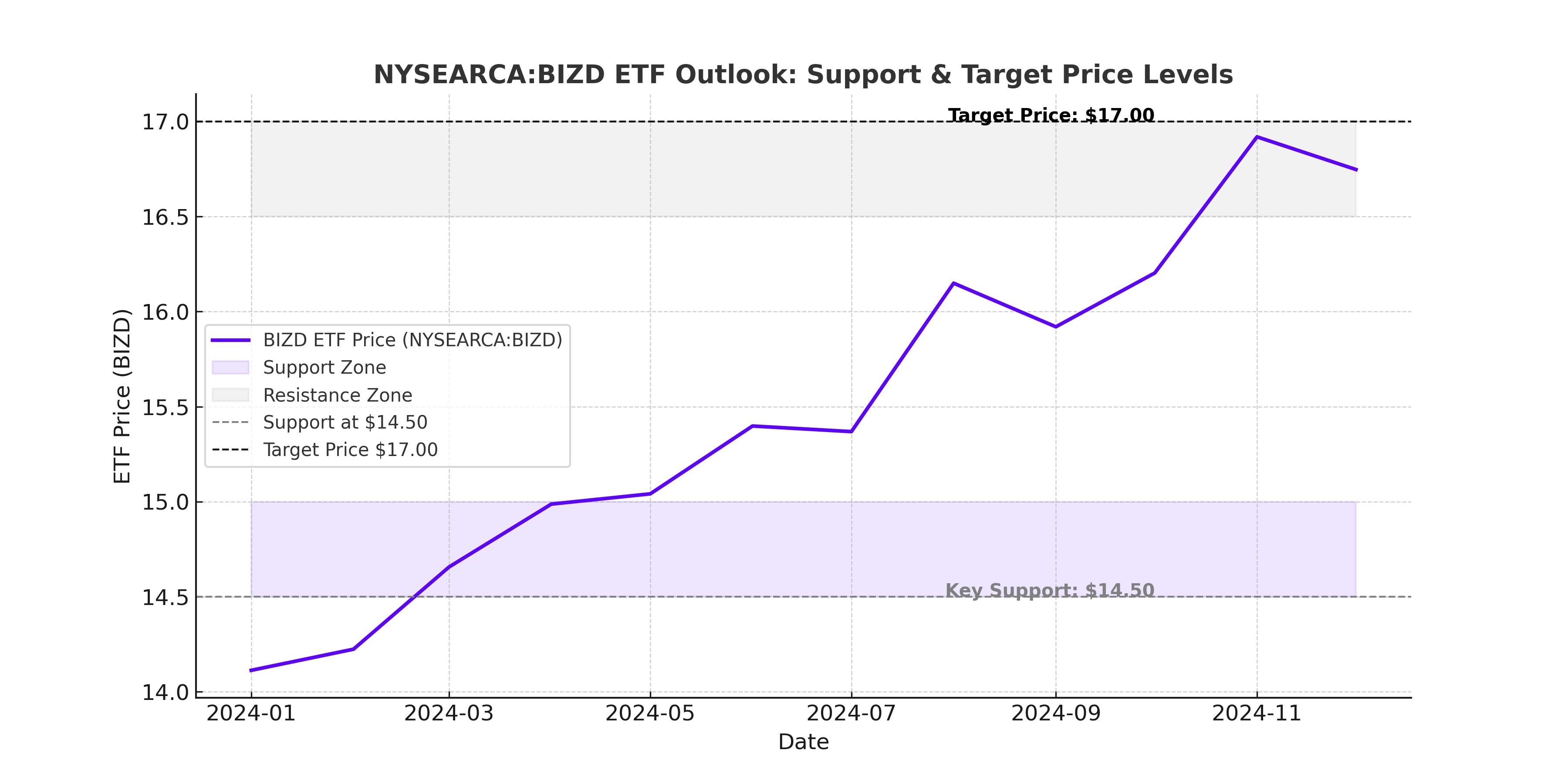

NYSEARCA:BIZD is emerging as one of the strongest income plays in 2025 as the S&P 500 and broader equity markets trade at historically high valuations. At its current price of $15.74, this ETF is delivering an impressive 10%+ dividend yield, making it one of the best high-income investments for those looking for stability while capturing significant distributions. With inflation sticking above the Fed’s target and interest rates expected to remain elevated, BIZD’s structure—primarily focused on Business Development Companies (BDCs) that lend to middle-market firms—offers a unique defensive positioning in a potentially overheated market.

While the tech-heavy Nasdaq and growth-focused ETFs are pushing valuations to extremes, BIZD remains rooted in real cash flows, secured lending, and a diversified portfolio that minimizes exposure to speculative asset classes. Investors worried about a market pullback should strongly consider whether now is the time to rotate into a high-yield, income-focused vehicle like BIZD.

NYSEARCA:BIZD's Portfolio – A Deep Dive into High-Yield BDCs

Unlike traditional equity ETFs, BIZD is structured to provide exposure to a basket of top-tier BDCs, firms that specialize in direct lending to private, middle-market companies. These companies operate in industries ranging from technology to healthcare, real estate, and industrials, providing capital to businesses that would otherwise struggle to secure financing from traditional banks.

BIZD’s top holdings include Ares Capital (NASDAQ:ARCC), FS KKR Capital (NYSE:FSK), Blackstone Secured Lending (NYSE:BXSL), Blue Owl Capital (NYSE:OBDC), and Sixth Street Specialty Lending (NYSE:TSLX). These BDCs have established themselves as dominant players in the private credit space, with strong track records of loan underwriting, credit quality, and interest income generation.

The structure of BIZD ensures broad diversification, with the largest BDCs comprising no more than 20% of total assets, ensuring that no single firm dominates the ETF’s risk exposure. Each of these BDCs operates with a portfolio of secured, floating-rate loans, which means that rising interest rates have actually boosted income generation over the past two years.

At a time when growth stocks are trading at extreme multiples, BDCs remain reasonably valued, with most of BIZD’s top holdings trading near book value. Ares Capital, for example, trades at 1.1x book value, while FS KKR Capital is hovering close to 1.05x book value. This means that while the broader market is at risk of a major valuation reset, BIZD’s underlying assets are already priced at historically reasonable levels.

Can NYSEARCA:BIZD Maintain a 10%+ Dividend Yield?

A major factor driving investor interest in BIZD is its 10%+ annual dividend yield, making it one of the most attractive ETFs in the high-income space. But is this yield sustainable in 2025 and beyond?

One of the most important aspects of BIZD’s holdings is that the majority of BDCs operate on floating-rate loan structures, meaning that their interest income rises in tandem with benchmark rates. Over the past two years, as the Federal Reserve aggressively raised rates, BDCs have benefited from higher lending margins and expanded earnings power.

Even if rate cuts come in 2025, the decline is expected to be gradual, ensuring that BDC income streams remain elevated relative to historical levels. With most BDCs already pricing in a moderate rate environment, the risk of a major earnings collapse is low. Additionally, most BDCs maintain low non-accrual rates (typically below 2%), ensuring that loan defaults remain minimal even in a slowing economy.

For context, Ares Capital (ARCC), the largest BDC in BIZD’s portfolio, generated net investment income of $1.04 per share in Q4 2024, significantly above its $0.48 per share quarterly dividend payout. This strong dividend coverage suggests that BIZD’s distributions are well-supported by actual earnings, rather than being fueled by leverage or unsustainable payout ratios.

How Does NYSEARCA:BIZD Compare to Broader Market ETFs?

Investors currently holding traditional equity ETFs, such as the SPDR S&P 500 ETF (NYSEARCA:SPY) or Invesco QQQ Trust (NASDAQ:QQQ), might wonder if BIZD provides a better alternative in 2025.

From a valuation standpoint, the S&P 500 is currently trading at a forward P/E ratio of 20.5x, while the Nasdaq 100 is sitting at an even higher 26.3x forward earnings. In contrast, BIZD’s top holdings are trading at an average forward P/E below 10x, with several names sitting close to book value.

While tech stocks and AI-related plays have driven much of the market’s recent gains, the reality is that the risk-reward ratio is becoming increasingly stretched. The major indices are heavily reliant on a handful of mega-cap stocks like Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA), and any downturn in these names could result in a broader market correction.

BIZD, by comparison, does not rely on capital appreciation to generate returns. Instead, it provides a highly predictable stream of income, making it an attractive hedge against a potential downturn in speculative growth stocks.

What Are the Risks for NYSEARCA:BIZD in 2025?

No investment is without risks, and BIZD is no exception. While its high yield is attractive, investors should consider the potential downside scenarios.

The most significant risk factor is credit deterioration within its BDC holdings. While non-accrual rates remain low, an economic slowdown could increase loan defaults and reduce net investment income. If default rates rise, BDC earnings could decline, putting pressure on dividend distributions.

Another concern is interest rate risk. If the Federal Reserve aggressively cuts rates in response to a major economic slowdown, BDC income could decline as floating-rate loans reset lower. However, given the Fed’s current positioning, most forecasts suggest a gradual rate-cutting cycle rather than a sharp decline.

Lastly, while BIZD offers an attractive dividend yield, it does not provide the same long-term capital appreciation potential as traditional growth-focused ETFs. For investors looking to maximize capital gains, BIZD may not be the best option, as its return profile is more income-driven than price-driven.

Is NYSEARCA:BIZD a Buy, Sell, or Hold?

At its current price of $15.74, BIZD remains a strong buy for income-focused investors looking to capture double-digit yields in a market that appears increasingly overvalued. With its diversified portfolio of top-tier BDCs, well-covered dividend payouts, and reasonable valuations, BIZD offers one of the most compelling high-yield investment opportunities in 2025.

For those seeking a stable, high-income alternative to traditional equity ETFs, BIZD provides both downside protection and consistent cash flow, making it an ideal addition to an income-oriented portfolio.

While macroeconomic risks remain, the combination of strong earnings coverage, floating-rate loan exposure, and historically reasonable valuations suggests that BIZD will remain a resilient performer in 2025 and beyond. Investors looking to reduce equity exposure while maintaining strong cash flow generation should strongly consider BIZD as a core holding in a diversified portfolio.