NYSE:BABA: Can Alibaba Stock Rocket Past $150 With AI & Cloud Expansion?

Alibaba is trading at just $82, despite AI-driven cloud growth, 30%+ YoY international sales expansion, and massive share buybacks. Could NYSE:BABA be the most undervalued tech stock today? | That's TradingNEWS

NYSE:BABA – Is Alibaba's AI Surge Enough to Drive a True Comeback?

Is NYSE:BABA Positioned to Reclaim Its Former Glory?

Alibaba Group Holding (NYSE:BABA) is no longer just an e-commerce giant. The company has rapidly evolved into a dominant force in AI, cloud computing, and international commerce. Despite the regulatory crackdowns, economic slowdowns in China, and intense competition from Pinduoduo and JD.com, Alibaba is demonstrating a resurgence. Its stock has climbed 37% over the past twelve months, yet at $82 per share, it remains significantly undervalued compared to its historical valuation of over $200 per share.

With AI-driven innovation fueling cloud growth, logistics efficiency, and e-commerce expansion, Alibaba is at a turning point. The DeepSeek AI model disruptions and Alibaba’s Qwen 2.5 breakthroughs are reshaping the AI landscape, while the company’s strong financial performance, aggressive share buybacks, and improving margins could set the stage for a massive rebound. But does Alibaba have what it takes to overcome the challenges of U.S.-China trade tensions, regulatory hurdles, and an increasingly fragmented e-commerce sector?

AI-Powered Cloud Growth – Can Alibaba Challenge AWS and Azure?

Alibaba Cloud has long been regarded as China’s top cloud provider, yet it has struggled with profitability and global expansion compared to Amazon’s AWS and Microsoft’s Azure. However, the company’s recent advances in AI and large language models (LLMs) could reshape its position in the cloud computing race. The Qwen 2.5 AI model, now integrated into Alibaba Cloud, is proving to be a game-changer, with benchmarks showing superior performance over DeepSeek-V3, OpenAI's GPT-4o, and Meta’s Llama-3.1-405B.

In Q4 2024, Alibaba Cloud revenue grew by 7% YoY, doubling the previous quarter’s growth rate. More importantly, AI-related cloud products posted triple-digit revenue growth for the fifth consecutive quarter, proving that enterprise adoption of Alibaba’s AI tools is accelerating. The company expects cloud revenue to grow at an 11% CAGR through FY2027, with deeper penetration in finance, healthcare, and manufacturing.

Despite this momentum, Alibaba Cloud is still playing catch-up internationally. Unlike AWS and Azure, which dominate global markets, Alibaba Cloud is largely confined to China and Southeast Asia. The company’s attempt to spin off its cloud unit in 2023 was scrapped, signaling a shift in strategy. Instead of separating cloud from the core business, Alibaba is now integrating AI-driven solutions into e-commerce, logistics, and international commerce, creating a more cohesive ecosystem. If this strategy succeeds, Alibaba Cloud could see double-digit revenue growth in 2025, potentially unlocking significant valuation upside for NYSE:BABA.

E-Commerce Rebound – Is Alibaba Regaining Its Market Share?

Alibaba’s core e-commerce business, which contributes 46% of total revenue, has faced headwinds from intensifying competition. Pinduoduo and Douyin have chipped away at Alibaba’s dominance, with market share dropping from 52% in 2021 to 42% in 2023. However, there are signs of stabilization.

To counteract declining market share, Alibaba implemented a 0.6% software service fee on GMV, which is projected to boost commission revenue by 4-5% YoY in Q4 2024. Additionally, the 2024 Double 11 shopping festival delivered double-digit GMV growth, signaling a turnaround in consumer engagement.

Alibaba is also leveraging AI-driven logistics through Cainiao to optimize supply chains, reduce costs, and enhance customer experience. These initiatives are expected to expand EBITDA margins by 800 basis points by FY2027, bringing operating earnings to nearly $33 billion annually. If Alibaba can demonstrate margin expansion in 2025, investor confidence could surge, driving the stock price significantly higher.

International Expansion – Can Alibaba Challenge Amazon Globally?

Alibaba’s international commerce segment, which includes AliExpress, Lazada, and Trendyol, is growing at 20%+ YoY. Despite being a smaller portion of Alibaba’s revenue (11%), it presents a massive long-term growth opportunity.

The key challenge has been profitability, but Alibaba is now aggressively optimizing logistics and marketing through AI. Management expects international commerce to turn profitable within the next two years, unlocking another revenue stream.

U.S.-China trade tensions remain a risk, but Alibaba’s focus on Southeast Asia, Europe, and Latin America positions it well for global expansion. The company’s low-cost AI-powered logistics solutions could give it a competitive edge over Amazon, especially in emerging markets where infrastructure efficiency is critical.

Financials and Valuation – Is NYSE:BABA Undervalued?

Despite Alibaba’s stock rally, its valuation remains historically low. The company is trading at:

- P/E ratio of 20.24, well below its historical average of 29.4

- Forward P/E of 10.31, significantly lower than JD.com’s 12.84 and Amazon’s 50.88

- P/S ratio of 1.77, a fraction of its pre-COVID average of 8.5

- P/B ratio of 1.69, compared to 5.0 before 2020

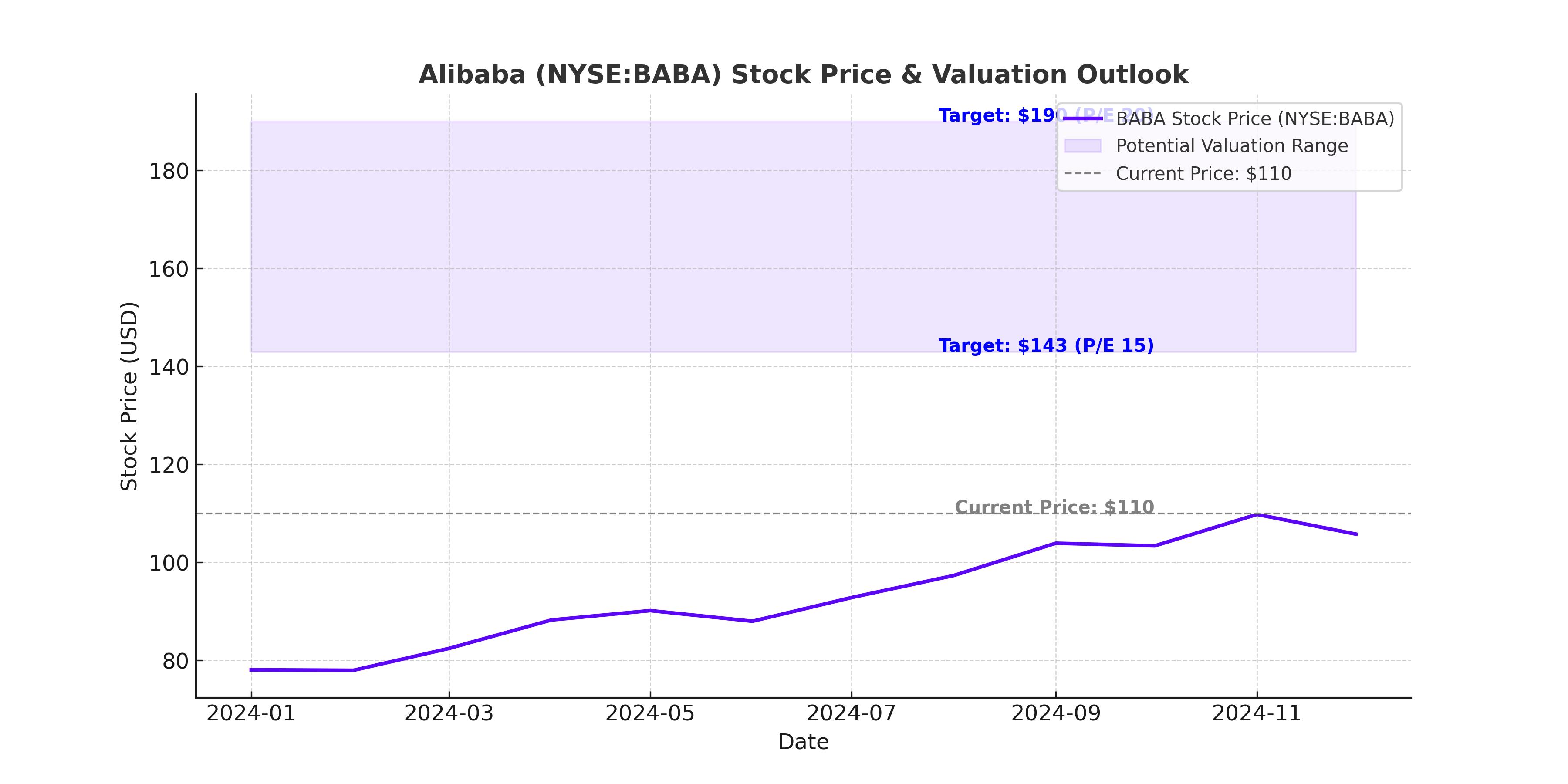

Alibaba’s 12-month forward EPS is expected to be $9.56, implying a potential price target of $190 per share if the stock reverts to a P/E ratio of 20. Even with a conservative P/E of 15, BABA could trade at $143, representing a 48% upside from current levels.

Massive Share Buybacks – How Is Alibaba Returning Value to Investors?

One of the most compelling reasons to be bullish on Alibaba is its aggressive capital return strategy. Over the past twelve months, Alibaba has repurchased $23 billion worth of shares and distributed $6 billion in dividends, despite generating $13 billion in free cash flow.

Alibaba’s buyback program has reduced shares outstanding at a CAGR of 3.3% since 2022, creating long-term value for investors. At the current pace, Alibaba’s total capital return in 2025 is expected to exceed $17 billion, representing a high single-digit distribution yield.

If Alibaba maintains strong buybacks and dividend growth, it could restore investor confidence, leading to multiple expansion and a higher stock price.

Risks – Will U.S.-China Trade Tensions Hurt Alibaba?

While Alibaba is well-positioned for growth, there are risks to consider. The Trump 2.0 administration’s 10% tariffs on Chinese imports could impact Alibaba’s international business, particularly in logistics and consumer goods. However, the overall impact is expected to be minimal, as:

- China’s exports to the U.S. have declined in recent years, reducing exposure

- The 10% tariff on Chinese goods is lower than the 25% levy on Canadian and Mexican imports, meaning Alibaba faces less pressure compared to other global players

- The initial diplomatic conversations between the Biden administration and China signal a more cautious approach to trade restrictions

Additionally, China’s regulatory environment remains unpredictable. While Alibaba has avoided major crackdowns in 2024, any new government restrictions on AI, cloud computing, or e-commerce could impact growth prospects.

Final Outlook – Is NYSE:BABA a Buy, Hold, or Sell?

Alibaba is no longer just an e-commerce company. Its AI leadership, cloud growth, and international expansion are driving a major transformation. Despite the risks of U.S.-China trade tensions and regulatory uncertainty, Alibaba’s low valuation, strong financial performance, and aggressive share buybacks make it an attractive investment.

If Alibaba can sustain 8-10% revenue growth, expand EBITDA margins, and continue its buyback program, NYSE:BABA could easily surpass $150 per share in 2025. For long-term investors, Alibaba presents a high-reward opportunity, and at current levels, the stock remains a strong buy with significant upside potential.