NYSE:TSM – Taiwan Semiconductor Dominates AI Chips, but Is the Stock Still Undervalued?

TSMC’s Market Position Strengthens Amid AI Growth

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) has cemented itself as the backbone of the global semiconductor industry, particularly in the AI revolution. With Nvidia (NVDA), Apple (AAPL), AMD (AMD), and even OpenAI relying on TSMC for cutting-edge chip production, the company's market dominance continues to expand. Despite strong demand, TSMC is still trading at a forward PE of just 19.6 for 2026, while delivering 28% EPS growth for 2025.

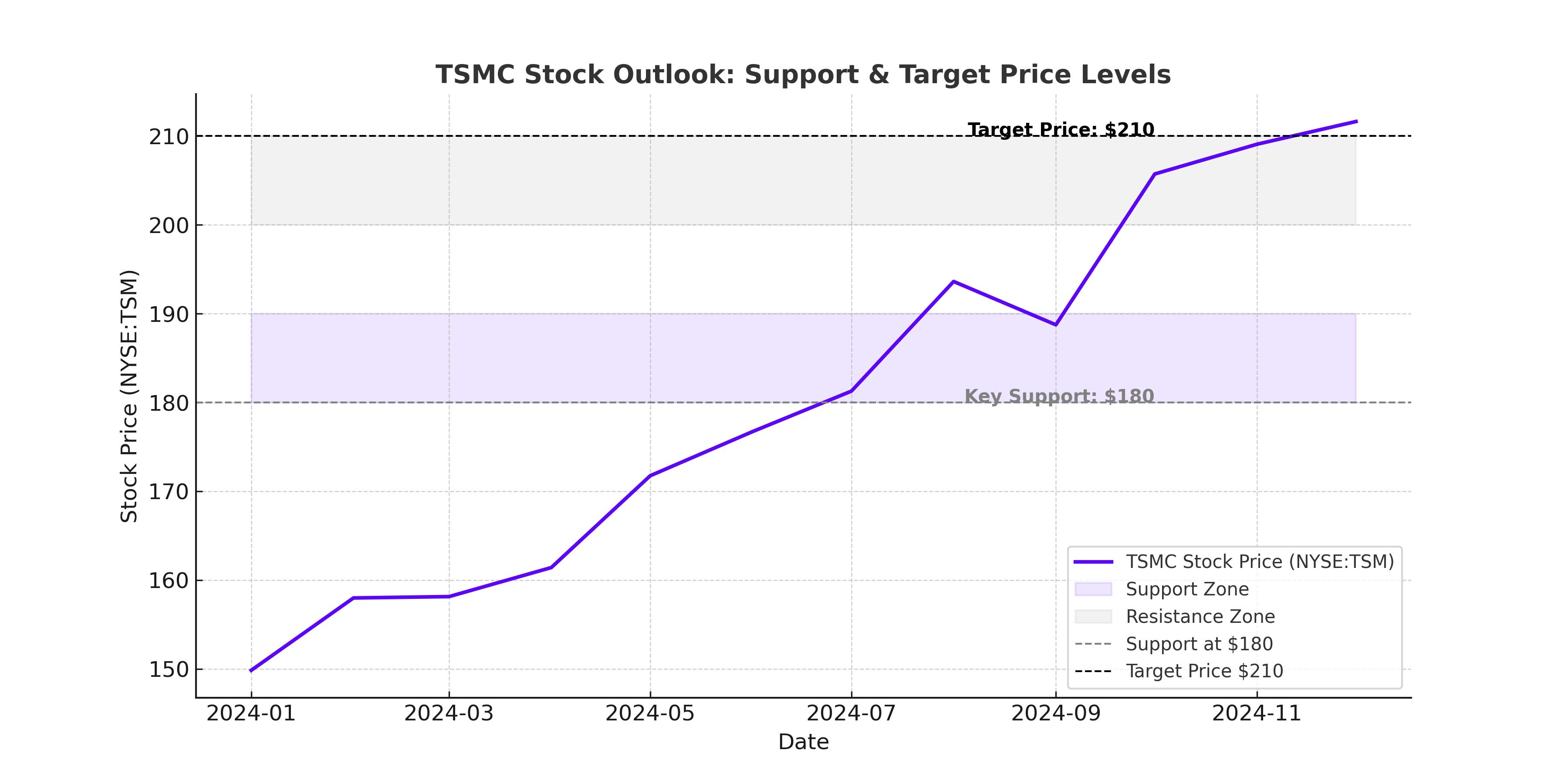

At $197 per share, TSM stock remains far below its early 2022 highs of $150, even though AI chip demand has surged since then. Given Nvidia's meteoric rise from $30 to over $700 (adjusted for splits), investors are questioning if TSMC is the next undervalued AI giant.

Can TSMC’s AI Chip Demand Offset Macro Challenges?

TSMC’s earnings in Q4 2024 beat expectations, driven by strong demand for its 3nm and 5nm chips, which contributed 74% of its total wafer revenue. With AI demand pushing Nvidia, Apple, and OpenAI to secure long-term deals with TSMC, the foundry giant is poised to maintain a strong pricing advantage.

Revenue Growth: TSMC reported a 33.1% YoY revenue jump in Q4, reaching $26.37 billion, despite an estimated $161 million loss from the Taiwan earthquake in January 2025. Even with this one-off event, TSMC reaffirmed its full-year guidance, expecting strong AI-driven growth.

Margins Expanding: Despite dilution from its N3 node ramp-up, gross margins hit 59% (up from 53% in Q4 2023), with ROE surging to 36.2%. Unlike chip designers like Nvidia and AMD, TSMC benefits from diversified revenue streams, reducing exposure to AI chip market fluctuations.

How TSMC Is Securing AI’s Biggest Deals

TSMC is the exclusive manufacturer of Nvidia’s A100, H100, and upcoming Blackwell GPUs, along with AMD’s MI300 series and Apple’s latest M3 chips. The recent announcement that OpenAI is working with TSMC to produce in-house AI chips only strengthens the company’s position.

Intel (INTC), once a competitor in advanced chip manufacturing, has struggled to scale its foundry business, giving TSMC an even greater edge. While Intel's 18A node development faces low yield challenges, TSMC’s superior 3nm and upcoming 2nm nodes solidify its dominance.

TSMC’s Expansion in the U.S. – A Strategic Shift

With geopolitical tensions rising, TSMC is making major investments in the U.S., including Arizona fabs expected to begin mass production by 2025. The U.S. government has even requested TSMC to help manage Intel’s struggling factories, signaling how dependent America is on Taiwan’s chip expertise.

This shift is critical for reducing China-Taiwan geopolitical risk, which remains a concern for investors. However, TSMC’s expansion ensures that global supply chains stay intact, and the U.S. government has an interest in protecting the company’s operations.

DeepSeek & AI Efficiency – Will This Hurt TSMC?

One of the biggest questions for TSMC is whether AI companies shifting toward efficiency over raw computing power could impact chip demand. DeepSeek’s 95% cost reduction in AI models has raised concerns that hyperscalers may reduce chip spending.

However, AI model efficiency doesn’t eliminate chip demand—it reallocates it. Companies like Amazon (AWS), Microsoft (MSFT), and Meta (META) are still investing in AI infrastructure, ensuring TSMC’s future growth isn’t at risk. If anything, AI’s expansion into edge computing and custom AI chips (ASICs, TPUs) should increase long-term demand for TSMC’s wafers.

Valuation – Is TSMC Undervalued at $197?

Despite AI tailwinds, TSMC trades at a forward PE of 19.6 for 2026, significantly lower than Nvidia’s 22x earnings multiple. Here’s how TSMC compares to peers:

| Company | Forward P/E (2026) | Expected EPS Growth (2025) |

|---|---|---|

| TSMC (NYSE:TSM) | 19.6x | 28% |

| Nvidia (NASDAQ:NVDA) | 22x | 35% |

| Intel (NASDAQ:INTC) | 28x | 15% |

| Broadcom (NASDAQ:AVGO) | 21x | 18% |

While Nvidia commands a higher multiple due to its AI chip dominance, TSMC’s valuation looks extremely attractive given its stable revenue stream, foundry moat, and pricing power.

Is NYSE:TSM a Buy, Sell, or Hold?

At $197 per share, TSMC presents one of the best risk-reward setups in the AI chip sector. Analysts expect a price target of $250-$260 within the next 12 months, reflecting a 22-26% upside. With AI chip demand accelerating, TSMC’s strong margin expansion, and a 1.5% dividend yield, the stock remains a strong buy.

The Bottom Line:

While short-term headwinds like AI cost-cutting and geopolitical concerns exist, TSMC’s dominance in advanced chip manufacturing, its deep partnerships with AI leaders, and its undervalued stock price make it one of the best AI-related investments today. If you’re looking for a stable, undervalued way to profit from AI, TSMC is a buy at these levels.