NYSE:XOM Stock at a Crossroads – Can Exxon Mobil Maintain Its Energy Dominance?

Strong Earnings, Expanding AI Energy Demand, and Dividend Growth – Is Exxon Mobil the Best Long-Term Energy Play? | That's TradingNEWS

NYSE:XOM Delivers Strong Q4 Earnings – Is Exxon Mobil a Must-Buy?

Exxon Mobil Corporation (NYSE:XOM) exceeded Wall Street expectations in Q4 2024, reporting earnings of $1.67 per share, surpassing estimates by 12 cents. While total profits fell 6% year-over-year to $33.7 billion, the company’s free cash flow remains exceptionally strong at $34.4 billion, solidifying Exxon’s position as a leader in the global energy market.

Despite the profit dip, Exxon’s core business remains resilient, supported by higher production from key projects in the Permian Basin and offshore Guyana. With crude oil prices stabilizing in the $70 per barrel range, the company continues generating significant cash flow while maintaining a competitive 11.9x profit multiple, positioning it attractively against rivals like Chevron (NYSE:CVX) and ConocoPhillips (NYSE:COP).

However, the question remains—is Exxon still a buy, or is the stock fully valued?

AI Data Centers Driving a New Energy Demand Surge

A major catalyst for Exxon Mobil’s long-term growth is the explosive demand for AI-driven data centers, which require immense energy consumption. With AI workloads expected to grow at a staggering 19% annually through 2030, Exxon’s low-cost natural gas and crude supply could position it as a primary energy provider to this new market.

McKinsey reports that global demand for AI data center capacity is skyrocketing, requiring vast amounts of electricity, much of which still relies on traditional fossil fuel sources like natural gas. As Exxon expands production in the Permian Basin and Guyana, the company is strategically positioned to meet this growing energy need while increasing long-term free cash flow.

Exxon Mobil Expands Production in Permian and Guyana – Is Growth Sustainable?

Exxon Mobil’s ability to expand production efficiently has been a key driver of its financial stability. In 2024, the company achieved 4.3 million barrels per day (bpd) of oil production, with plans to increase output by 20% by 2030.

The Permian Basin remains a crucial asset, producing 1.5 million bpd, and Exxon’s Guyana offshore operations continue exceeding expectations. The recent Pioneer Natural Resources acquisition strengthens its shale portfolio, ensuring long-term production growth.

These assets give Exxon a significant competitive edge over peers like Chevron and BP (NYSE:BP), which are struggling with declining reserves and lower-margin operations. The key question for investors is whether Exxon can sustain this production growth without excessive capital expenditure.

Free Cash Flow and Shareholder Returns – Is XOM Still an Income Play?

Exxon Mobil’s dividend yield stands at 3.7%, making it one of the most attractive income-generating stocks in the energy sector. The company has consistently increased its dividend for 42 consecutive years, demonstrating its commitment to returning value to shareholders.

In 2024, Exxon repurchased 5% of its stock float, aggressively reducing outstanding shares while maintaining high capital efficiency. Exxon’s shareholder return strategy remains one of the strongest in the sector, with total buybacks and dividends exceeding $125 billion over the last five years.

For long-term investors seeking a reliable income stream, Exxon’s strong free cash flow and disciplined capital allocation make it a compelling choice. However, with oil prices fluctuating, investors must assess whether current dividend levels are sustainable in a lower-price environment.

Is Exxon Mobil Overvalued? Profit Multiples Suggest Upside Potential

Despite concerns over fluctuating oil prices, Exxon trades at just 11.9x forward earnings, significantly lower than many S&P 500 companies. By comparison, Chevron trades at 12.0x and ConocoPhillips at 12.1x, making Exxon one of the most attractively valued large-cap energy stocks.

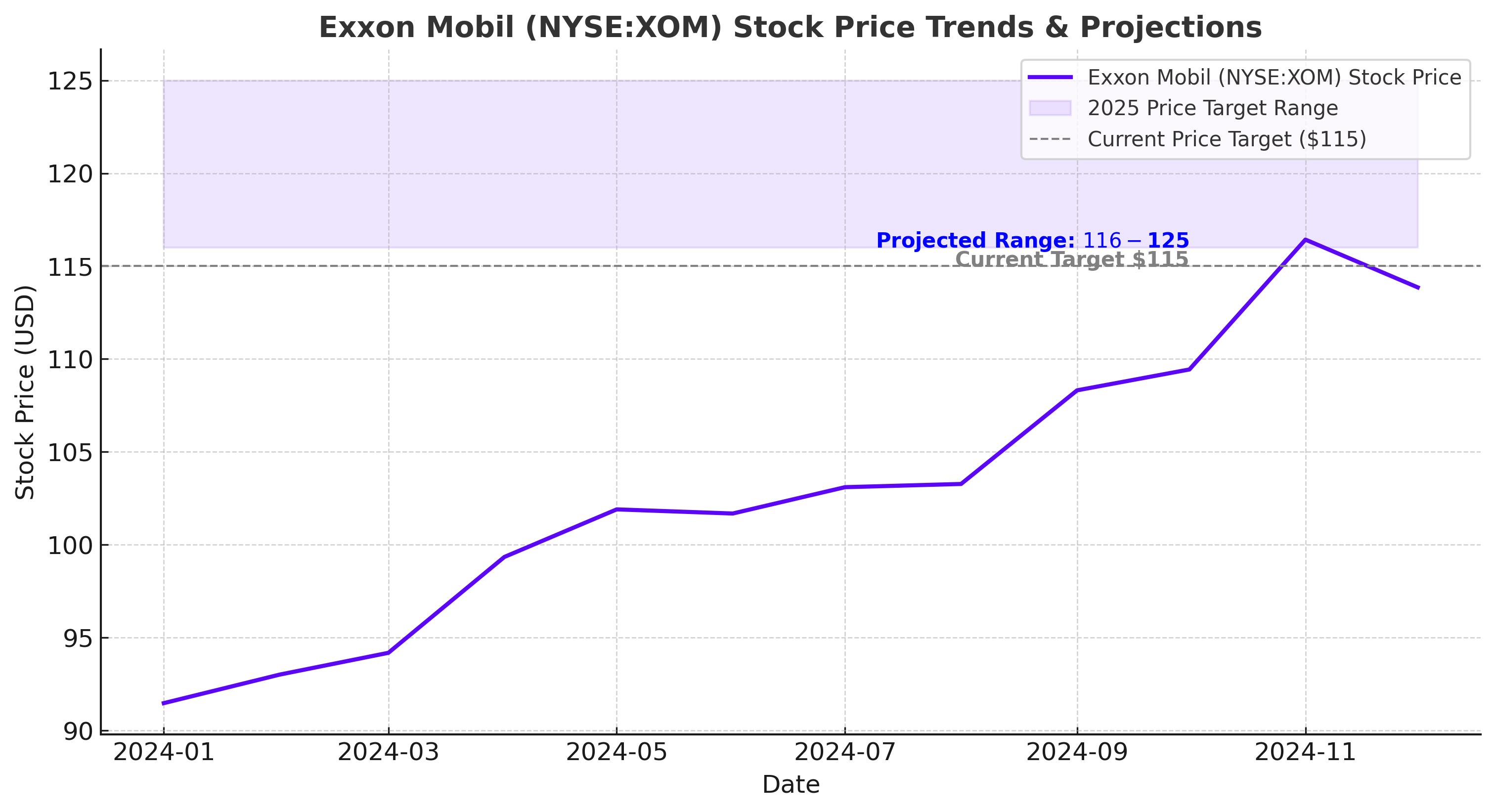

If Exxon’s AI-driven energy demand thesis plays out, the stock could re-rate to a 13-14x earnings multiple, implying a fair value range of $116 to $125 per share—a potential 10-15% upside from current levels.

While Exxon’s valuation remains compelling, investors must consider risks such as a potential economic slowdown or geopolitical factors impacting oil prices.

What Risks Could Derail Exxon Mobil’s Growth?

While Exxon remains a cash flow machine, risks exist. The biggest threat to Exxon’s bullish case is a prolonged drop in oil prices. If Brent crude falls below $60 per barrel, Exxon’s margins could shrink, leading to lower profits and reduced shareholder returns.

Geopolitical events also pose risks. If the Russia-Ukraine conflict eases and sanctions on Russian oil are lifted, global crude supplies could increase, putting downward pressure on prices. Additionally, a global economic slowdown could reduce energy demand, impacting Exxon’s revenue growth.

Another potential headwind is the growing shift toward renewable energy. While Exxon is investing in carbon capture and storage (CCS) and low-carbon initiatives, regulatory pressure on fossil fuel companies remains a risk. Investors must weigh whether Exxon can successfully navigate the transition while maintaining profitability.

Should You Buy NYSE:XOM Stock Now? Final Verdict

Exxon Mobil remains one of the strongest energy investments, backed by rising production, AI-driven energy demand, and shareholder-friendly capital allocation. With a 3.7% dividend yield, a disciplined buyback strategy, and strong free cash flow, Exxon continues rewarding long-term investors.

While risks such as volatile oil prices and regulatory pressures exist, Exxon’s low valuation (11.9x earnings) and long-term growth catalysts suggest the stock still has upside potential.

With analysts forecasting potential price targets between $116 and $125 per share, current levels may present an attractive buying opportunity. Exxon remains a high-quality, cash-generating machine in the energy sector, making it a strong buy for income and growth investors alike.