NYSEARCA:ARKF – Is the ARK Fintech Innovation ETF a Buy or a Risky Gamble?

Is NYSEARCA:ARKF Positioned for a Fintech Boom or Facing a Harsh Reality Check?

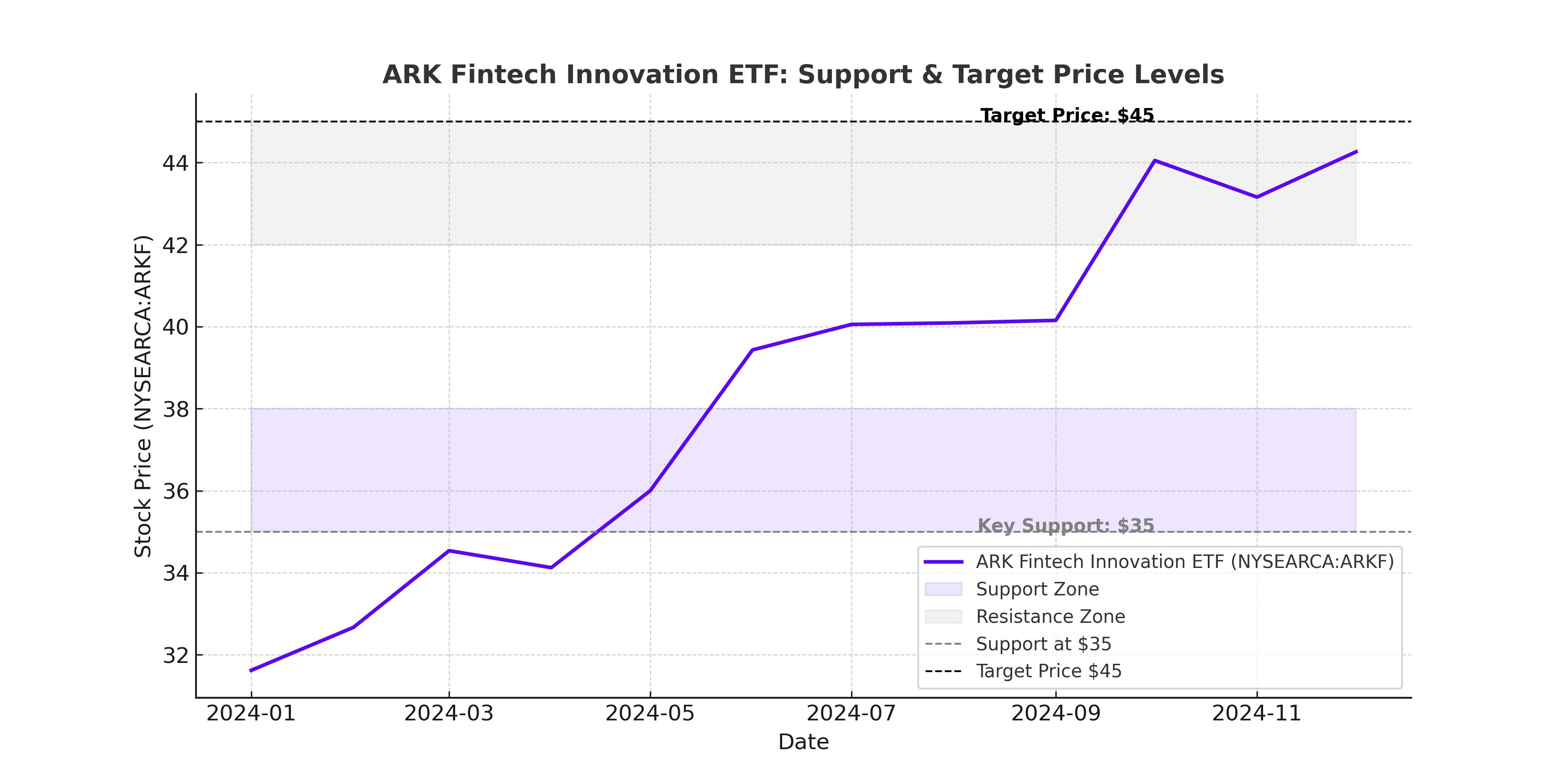

ARK Fintech Innovation ETF (NYSEARCA:ARKF) has surged nearly 50% year-over-year, fueled by aggressive bets on digital financial solutions, decentralized banking, and next-gen fintech disruptors. With a heavy allocation in high-growth companies like Shopify (SHOP), Coinbase (COIN), Robinhood (HOOD), and Block (SQ), ARKF has built a portfolio that thrives on the intersection of finance and technology, betting that traditional banking is on the decline while digital transactions and AI-driven financial services will dominate.

The ETF, actively managed by Cathie Wood's ARK Invest, has seen its assets under management (AUM) rise to $12 billion, reflecting strong investor interest in its disruptive innovation strategy. But despite the hype, does ARKF justify its valuation? With high volatility, regulatory uncertainty, and a portfolio exposed to speculative fintech plays, ARKF carries significant risk alongside its potential rewards. The key question is—is this rally sustainable, or is ARKF a high-risk bet on an uncertain future?

ARKF’s Portfolio – A High-Risk, High-Reward Fintech Bet

ARKF’s portfolio is concentrated in North American fintech stocks, with over 80% of its holdings based in the U.S. and Canada. This regional focus limits diversification, exposing the fund to regulatory shifts, economic downturns, and policy changes that could disrupt its core investment themes. More than 60% of ARKF’s assets are allocated to mid and large-cap companies, while over 40% of the fund’s holdings are in financial services, though heavily overlaid with technology.

The fund’s top holdings include:

- Shopify (SHOP) – a leader in e-commerce infrastructure, expanding digital payments

- Coinbase (COIN) – the dominant cryptocurrency exchange in the U.S.

- Robinhood (HOOD) – a retail trading platform with growing crypto exposure

- Block (SQ) – formerly Square, innovating in merchant services and mobile banking

- Palantir (PLTR) – an AI-driven analytics firm with growing financial sector applications

Digital Banking, AI, and Decentralization – ARKF’s Core Themes

ARKF is betting on the long-term growth of digital banking, decentralized finance (DeFi), and AI-powered financial services. The global fintech market is projected to grow at 17.5% CAGR through 2030, making this sector one of the fastest-growing in tech. AI-driven credit assessments, real-time payment solutions, and decentralized wallets are reshaping the industry, enabling companies like Coinbase and Robinhood to challenge traditional financial institutions.

Buy Now, Pay Later (BNPL) is another core focus of ARKF. Companies like Affirm (AFRM) and Shopify are driving BNPL adoption, offering zero-interest loans and flexible payments. While BNPL adoption continues to grow, regulatory scrutiny has intensified, with concerns over consumer debt accumulation and default risks. If regulators impose stricter lending requirements, ARKF’s exposure to BNPL players could become a liability.

ARKF’s Valuation – Is the ETF Overpriced or a Bargain?

Despite its rally, ARKF’s price-to-sales ratios across key holdings remain reasonable, suggesting the fund isn’t yet in overvalued territory. However, enterprise value-to-EBITDA (EV/EBITDA) ratios indicate that some of its companies remain in aggressive growth mode, relying on future profitability rather than current earnings strength.

A high-interest rate environment poses risks for fintech firms, many of which rely on debt to scale operations. While ARKF’s holdings benefit from strong revenue growth, sustained high rates could pressure valuations, particularly for speculative stocks that need cheap capital to fund expansion.

ARKF’s Risk-Adjusted Returns – A Solid Performance in a Volatile Sector

ARKF’s Sharpe ratio, which measures excess return over risk-free assets, remains positive, indicating that the ETF is delivering strong risk-adjusted returns. Its Sortino ratio, which accounts for downside risk, is also favorable. However, these metrics lag broader market benchmarks like the S&P 500 (SPY), meaning ARKF carries higher volatility and drawdown risks.

With an expense ratio of 0.75%, ARKF is cheaper than most actively managed hedge funds, yet more expensive than broad-market ETFs. Investors must weigh whether its active management justifies the higher fees compared to passive fintech funds.

Regulatory and Market Risks – Can ARKF Survive a Fintech Crackdown?

Regulatory uncertainty is a major risk for ARKF’s holdings, particularly in digital wallets, BNPL services, and crypto-related financial products. If global regulators impose stricter capital requirements or classify fintech lenders as systemically important financial institutions (SIFIs), the business models of Coinbase, Robinhood, and Block could face headwinds.

A broader economic downturn would also impact ARKF’s core constituents. Consumer credit tightening, declining discretionary spending, and reduced demand for speculative fintech services could hurt revenue growth across ARKF’s portfolio. If consumer loan defaults rise, BNPL providers and digital credit platforms could see increased delinquency rates, forcing tighter lending standards.

Buy, Sell, or Hold – Is ARKF a Strong Investment?

ARKF is a high-risk, high-reward play on the future of financial technology. It offers exposure to some of the fastest-growing companies in fintech, digital banking, AI-driven finance, and decentralized transactions. The fund’s 50% rally in the past year reflects growing investor confidence in fintech’s ability to disrupt traditional banking, but ARKF is not without risks.

For growth-focused investors with a high-risk tolerance, ARKF presents an attractive long-term opportunity. Its holdings are positioned at the forefront of fintech disruption, and if its companies execute well, the ETF could deliver substantial returns in the coming years.

For conservative investors, the fund’s volatility, regulatory uncertainty, and reliance on speculative growth stocks may be concerning. With interest rates still elevated and regulatory risks on the horizon, ARKF could see significant price swings, making it unsuitable for risk-averse portfolios.

At its current valuation, ARKF is a speculative buy for investors who believe in the long-term fintech transformation. Its performance will be heavily dependent on regulatory trends, interest rate movements, and consumer adoption of next-gen financial solutions. If these factors align in its favor, ARKF could continue its upward trajectory—but if fintech sentiment shifts, the ETF could see significant downside.