NYSEARCA:CHAT at $41.59 – The AI ETF Leading the Charge in 2025

Can CHAT’s Diversified AI Portfolio Deliver Long-Term Gains for Investors? | That's TradingNEWS

Analyzing NYSEARCA:CHAT’s Growth Potential Amid the AI Boom

Roundhill Generative AI & Technology ETF (NYSEARCA:CHAT) continues to attract investor attention with its significant exposure to generative artificial intelligence (AI) and its strong portfolio performance. Trading recently at $41.59, the ETF has seen a 13.6% increase since October 2024, comfortably outperforming the S&P 500’s 5.24% rise in the same period. The fund's diversified holdings across 47 tech-centric companies make it a compelling option for investors seeking growth in the fast-evolving AI landscape.

Portfolio Highlights and Performance Metrics

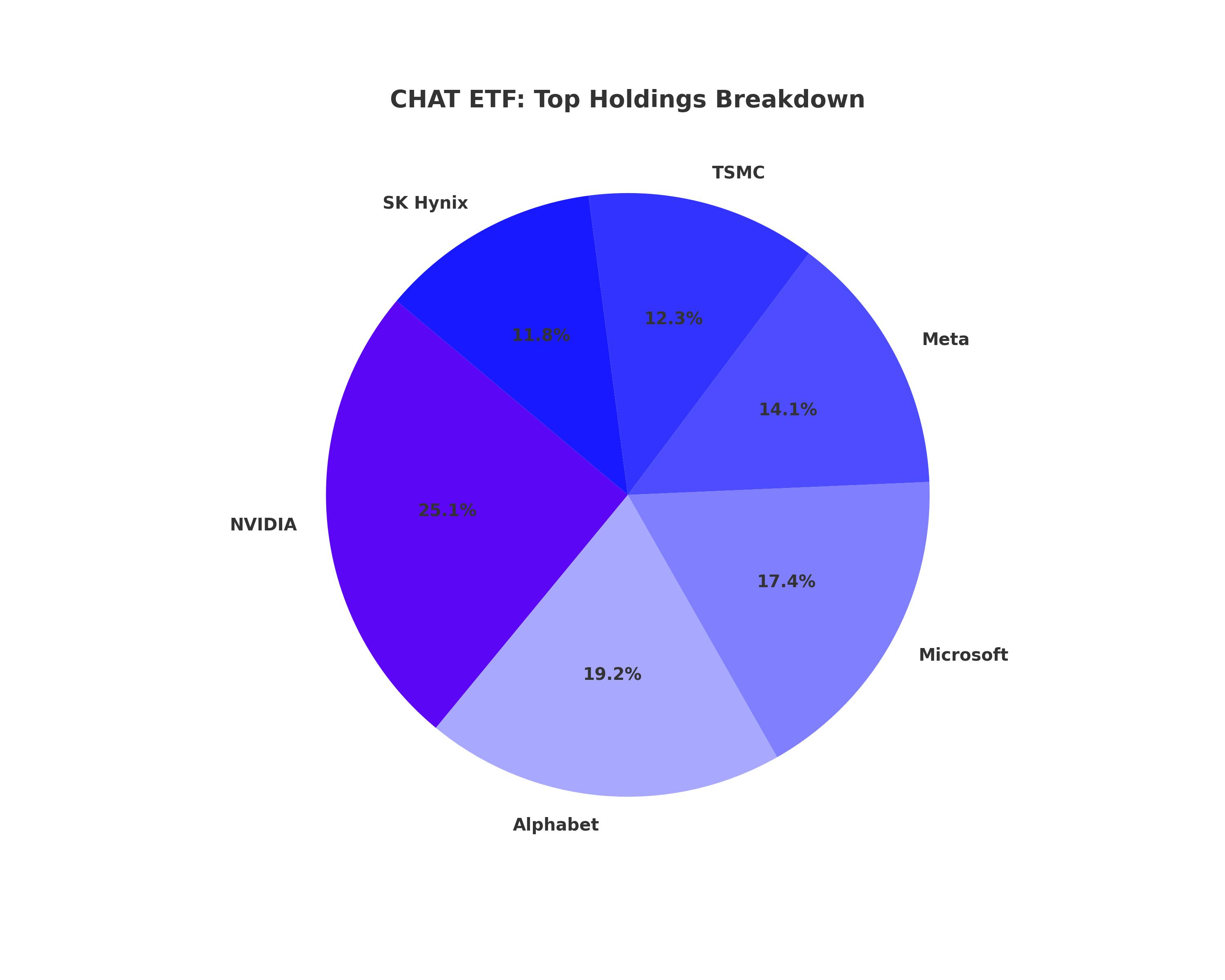

CHAT’s top holdings reflect a strategic focus on industry-leading AI and technology firms, with NVIDIA (7.45%), Alphabet (5.69%), Microsoft (5.17%), and Meta Platforms (4.17%) leading the charge. Notably, the inclusion of Taiwan Semiconductor Manufacturing Company (3.65%) and SK Hynix (3.50%) underscores its comprehensive exposure to AI-enabling infrastructure and hardware. With a beta of 1.55 relative to the S&P 500, CHAT offers amplified upside potential in bullish markets but also carries heightened downside risk in volatile conditions.

The ETF's 50-day moving average of $40.89 and 200-day moving average of $38.01 signal sustained momentum, supported by its current market capitalization of $171.77 million and a PE ratio of 37.73. Institutional interest has also been on the rise, with Flow Traders U.S. LLC acquiring 25,421 shares in the third quarter, worth approximately $951,000. Such inflows reflect growing confidence in CHAT’s strategic positioning amid expanding demand for AI-driven technologies.

Valuation and Growth Projections

CHAT is positioned between fair value and slight undervaluation based on its estimated headline internal rate of return (IRR). Current growth expectations, averaging 14.54% over the next three to five years, align well with the ETF’s forward-looking strategy. Assuming a price-to-earnings ratio contraction to 16.08x (from 19.71x) and forward return on equity of 20.90%, CHAT’s projected annualized IRR falls between 9.39% and 13.12%. This range suggests robust long-term growth potential, especially if the ETF capitalizes on its exposure to industry leaders like NVIDIA and Microsoft.

CHAT’s Role in Capturing the AI Investment Trend

Generative AI has emerged as a cornerstone of the technology sector, driving revenue growth for hardware and software companies alike. CHAT’s emphasis on generative AI positions it well to benefit from this transformative trend. Companies such as NVIDIA and Taiwan Semiconductor Manufacturing are central to powering AI infrastructure, while Microsoft and Alphabet continue to lead in software applications and cloud-based AI solutions. As CEO C.C. Wei of TSM highlighted, AI accelerators now contribute to mid-teens percentages of revenue, with projected revenue growth approaching a mid-40% compound annual growth rate over five years.

The ETF's performance also reflects its ability to adapt to market shifts. CHAT’s inclusion of both upstream and downstream tech players diversifies its risk profile while maintaining a growth-oriented focus. This balanced strategy ensures that the ETF can navigate periods of heightened market volatility while capitalizing on the secular growth trends in AI.

Risks and Macroeconomic Considerations

Despite its attractive growth potential, CHAT faces risks tied to its tech-centric portfolio and reliance on AI adoption trends. A potential pullback in AI infrastructure spending or macroeconomic headwinds, such as rising interest rates or geopolitical uncertainties, could affect its valuation. However, the broader inflationary environment appears stable, with lower energy costs and improved global trade dynamics under recent policy shifts providing supportive tailwinds.

CHAT’s higher expense ratio of 0.75% slightly reduces its net returns but is offset by its focused and actively managed approach. Investors may consider directly purchasing the ETF's top holdings to avoid this fee but would miss out on Roundhill’s active management advantages.

Technical Analysis and Market Sentiment

From a technical standpoint, CHAT is in a strong position, trading close to its recent high of $41.70. With solid institutional backing and growing retail interest, the ETF’s momentum is unlikely to wane in the near term. The fund’s beta indicates its potential for substantial returns during market upswings, though investors should be prepared for amplified volatility during downturns.

Institutional Investment and Outlook for CHAT

The institutional acquisition of CHAT shares highlights its appeal to large-scale investors seeking exposure to the AI revolution. With Roundhill Investments surpassing $4 billion in assets under management in 2024, its growing reputation adds credibility to CHAT’s growth narrative. Roundhill’s launch of nine ETFs in 2024 alone demonstrates the firm’s commitment to innovation and strategic market positioning.

CHAT’s future prospects hinge on its ability to maintain competitive returns while leveraging its diversified portfolio. Its strategic allocation across semiconductor designers, cloud service providers, and social media platforms ensures it remains well-positioned to capture value across the AI supply chain.

Final Considerations for Investors

Roundhill Generative AI & Technology ETF (NYSEARCA:CHAT) offers a compelling investment opportunity at $41.59, supported by its robust portfolio, strategic focus on AI, and favorable market conditions. While risks tied to macroeconomic factors and market volatility persist, CHAT’s valuation metrics and growth outlook indicate room for continued upside. For investors seeking exposure to the burgeoning AI sector, CHAT represents a well-rounded, high-potential choice with a track record of outperforming broader indices. Monitor the ETF’s real-time performance at Roundhill Generative AI & Technology ETF Chart.