NYSEARCA:IJH – The Best Mid-Cap ETF for 2025 or a Risky Bet?

With assets at $98.8 billion, a low expense ratio of 0.05%, and mid-cap stocks poised for strong M&A activity, iShares Core S&P Mid-Cap ETF (NYSEARCA:IJH) is gaining attention. But is now the best time to buy, or is there downside risk? | That's TradingNEWS

NYSEARCA:IJH – Is the iShares Core S&P Mid-Cap ETF the Best Mid-Cap Investment for 2025?

Mid-Cap Stocks Are Positioned for Growth – What Does This Mean for NYSEARCA:IJH?

Mid-cap stocks have historically offered investors the best of both worlds—greater stability than small-cap stocks while maintaining higher growth potential compared to large-cap companies. The iShares Core S&P Mid-Cap ETF (NYSEARCA:IJH) provides exposure to this category, tracking the S&P MidCap 400 Index, which includes companies with market capitalizations between $2 billion and $10 billion.

With $98.8 billion in assets under management, IJH has a price-to-earnings ratio of 12.82, which is significantly lower than the S&P 500’s 17.86 P/E ratio. This valuation gap presents an interesting opportunity—mid-cap stocks are currently trading at a discount, yet their earnings growth is expected to accelerate to 14.0% in 2025 and 16.5% in 2026.

Will Mergers & Acquisitions Drive NYSEARCA:IJH Higher?

One of the biggest potential catalysts for NYSEARCA:IJH in 2025 is the expected boom in mergers and acquisitions (M&A). Investment banks Goldman Sachs and Morgan Stanley are forecasting a sharp increase in M&A activity, fueled by fewer regulatory restrictions under the newly elected Trump administration.

With large-cap corporations sitting on record levels of cash reserves, they are actively seeking opportunities to acquire mid-cap companies with strong business models. M&A transactions typically involve buyouts at a premium, meaning that mid-cap stocks in the IJH portfolio could experience significant price jumps if they become takeover targets.

Historically, mid-cap stocks benefit the most from M&A booms, as larger corporations acquire them for growth. The most significant periods of mid-cap outperformance—including the 2004-2007 and 2014-2018 bull markets—were fueled by increased takeover activity. If this trend continues in 2025, IJH could be set for massive gains.

IJH’s Sector Allocation – Is This the Right Time for Mid-Cap Exposure?

The sector allocation of NYSEARCA:IJH provides insight into why it may be well-positioned for growth. Unlike the S&P 500, which is heavily weighted toward technology stocks, IJH has a more balanced sector exposure, making it less reliant on a single industry.

- Industrials – 21.8%

- Financials – 18.1%

- Consumer Discretionary – 13.8%

- Technology – 10.7%

- Health Care – 9.5%

- Materials, Energy, Utilities, and Real Estate – Rounding out the remaining allocation

The high allocation to industrials and financials aligns with historical trends—these sectors typically outperform when the economy is expanding. With GDP growth projections remaining strong and the Federal Reserve expected to cut interest rates in 2025, IJH’s holdings in financials and cyclical sectors could experience significant gains.

However, IJH has limited exposure to technology stocks, which have been the strongest-performing sector over the last decade. While this means that IJH may not participate in tech-driven rallies, it also provides diversification against the high valuations seen in large-cap technology stocks.

Earnings Growth & Valuation – Is NYSEARCA:IJH Undervalued?

Valuation is key when determining whether an ETF presents a strong buying opportunity. With a forward P/E ratio of 12.82, IJH is trading at a discount compared to the S&P 500’s 17.86 P/E ratio. Historically, when mid-cap stocks have traded at a discount to large caps, they have outperformed over the following 12-24 months.

Additionally, consensus estimates project that the earnings of IJH’s holdings will grow by 14.0% in 2025 and 16.5% in 2026, exceeding the S&P 500’s projected earnings growth of 13.8% in 2026. If these estimates hold, mid-cap stocks could begin closing the valuation gap with large caps, driving NYSEARCA:IJH higher.

Risks – Can Mid-Caps Handle a Market Downturn?

Despite the strong upside potential, NYSEARCA:IJH does come with risks—especially during economic downturns. Historically, mid-cap stocks are more volatile than large caps, with weaker balance sheets and higher sensitivity to market conditions.

In recent market corrections (2016, 2019, and 2020), IJH underperformed the S&P 500 due to its exposure to smaller companies that struggled during economic downturns. However, in 2022, mid-caps performed better due to their lower valuations.

Investors should also keep an eye on interest rates and inflation. While rate cuts in 2025 could boost economic expansion, a slowdown in growth or higher-than-expected inflation could put pressure on mid-cap earnings.

Buy, Sell, or Hold? The Final Verdict on NYSEARCA:IJH

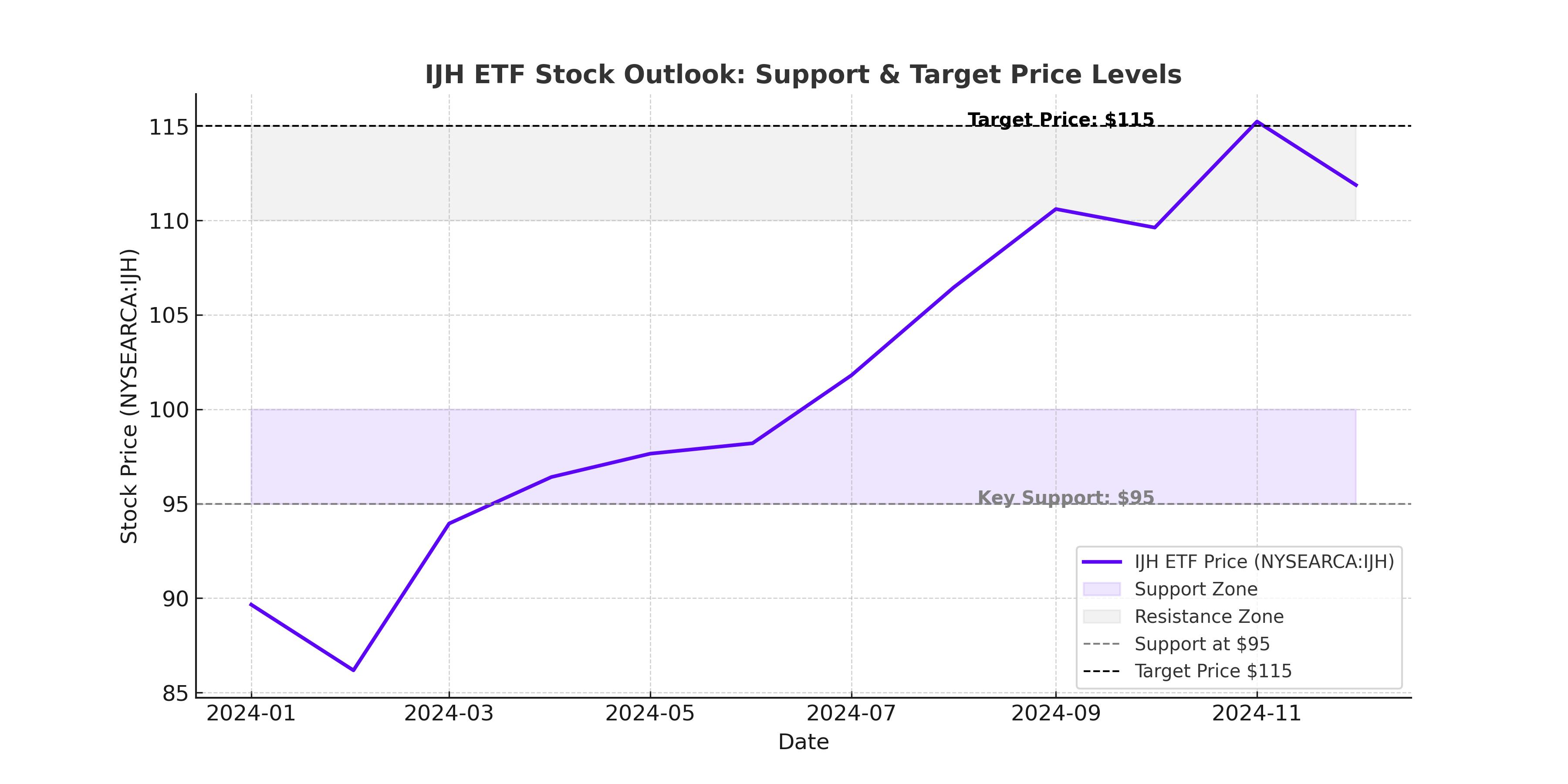

With a lower valuation than the S&P 500, strong projected earnings growth, and potential for M&A-driven upside, NYSEARCA:IJH looks like an attractive investment for 2025. The ETF is well-positioned for an environment where economic expansion continues and corporate takeovers increase.

However, investors should be prepared for higher volatility compared to large-cap ETFs. Mid-cap stocks tend to experience bigger swings during market downturns, meaning that IJH may not be the best option for defensive investors.

For investors seeking growth at a reasonable price (GARP), IJH offers a compelling risk-reward ratio. With a projected earnings growth of 16.5% in 2026 and a P/E ratio significantly below the S&P 500, the ETF could outperform the broader market over the next two years.

For long-term investors, holding NYSEARCA:IJH as a core mid-cap position while balancing it with exposure to large caps and technology stocks may be the best strategy for 2025.