NYSEARCA:IWM: A Deep Dive into Small-Cap Opportunities at $176.45

Exploring Valuation Discounts, M&A Growth Catalysts, and the Resilience of Small-Cap Stocks in 2025

NYSEARCA:IWM: A Deep Dive into Small-Cap Valuation, Growth, and Risks

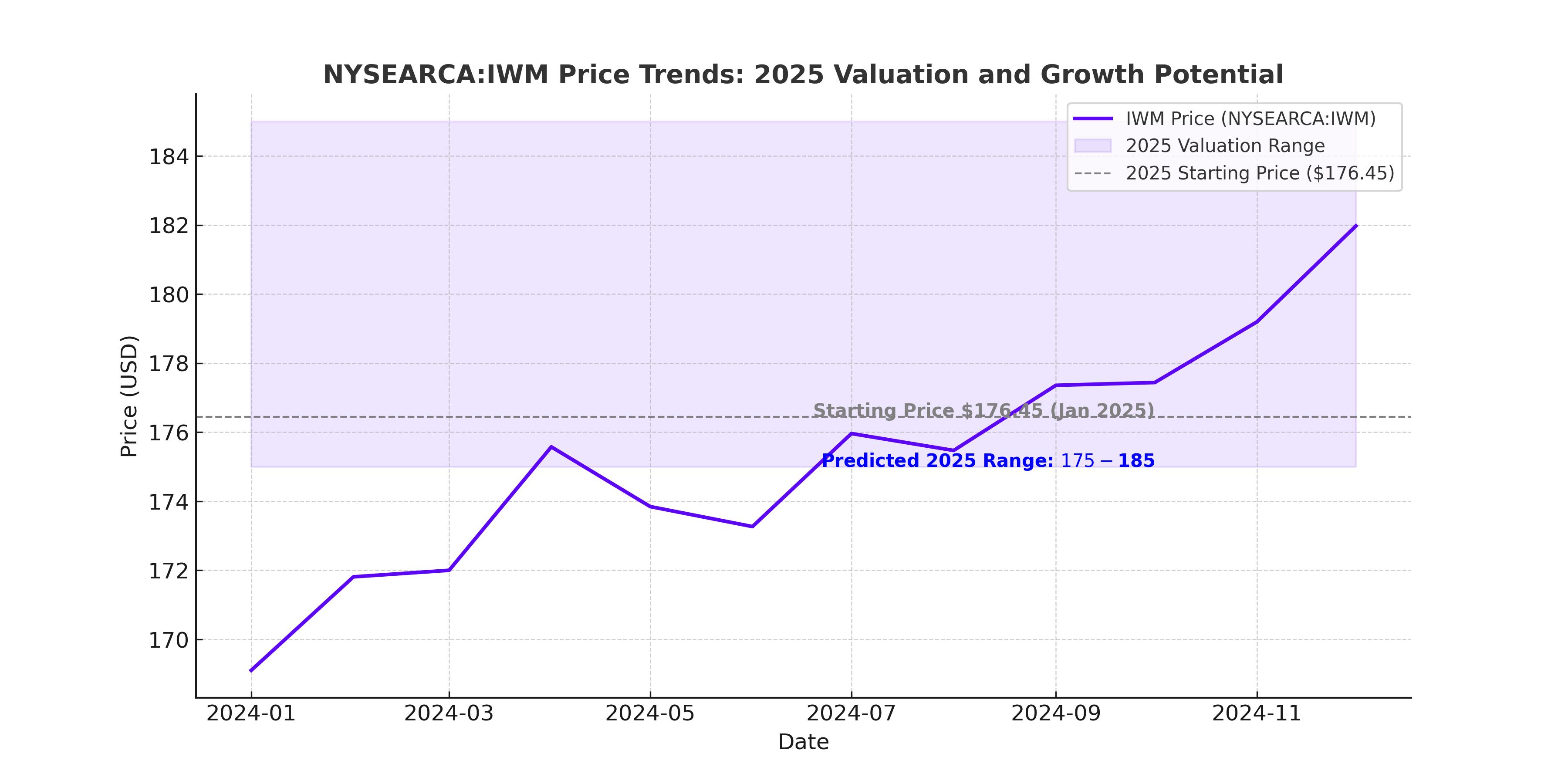

The iShares Russell 2000 ETF (NYSEARCA:IWM), trading at $176.45 as of the latest close, offers a unique lens into the U.S. small-cap equity market. Comprising roughly 2,000 stocks from the Russell 2000 Index, IWM provides exposure to a diverse array of sectors. Yet, the ETF currently finds itself at the center of a debate: Is its discounted valuation a strategic buying opportunity, or does the macroeconomic environment pose insurmountable challenges?

At a forward price-to-earnings (P/E) ratio of 15.85 and a price-to-book (P/B) ratio of 1.97, NYSEARCA:IWM trades at a significant discount compared to large-cap-focused ETFs such as the SPDR S&P 500 ETF Trust (NYSEARCA:SPY), which boasts a forward P/E of 23.86 and a P/B ratio of 4.82. This gap underscores the valuation disparity between small caps and large caps, and it raises critical questions about IWM's potential upside amid a shifting macroeconomic landscape.

Valuation Gap: A Compelling Discount for Small Caps

Small caps are trading at their most attractive levels relative to large caps in over a decade. The Russell 2000 Index's forward P/E of 16.5 is notably below the S&P 500's forward P/E of 22.1. Historically, such gaps signal a reversion opportunity, as small caps tend to outperform during economic recoveries. Despite macroeconomic uncertainties, the iShares Russell 2000 ETF offers long-term investors an opportunity to capture value at a steep discount.

Macroeconomic Backdrop: Interest Rates and Volatility

The Federal Reserve's hawkish stance continues to exert pressure on risk assets, and NYSEARCA:IWM is no exception. Small-cap companies are particularly sensitive to rising borrowing costs, given their heavier reliance on debt financing. As of January 2025, the CME FedWatch Tool indicates that interest rates are likely to remain in the 4.25%–4.50% range throughout the year. This could create short-term headwinds for IWM, particularly for the financial and industrial sectors that dominate the ETF's holdings.

However, the ETF’s valuation discount largely compensates for these risks. The yield spread between IWM and SPY, currently at -0.04%, is significantly above its 10-year average of -0.39%. This spread suggests that small caps are undervalued relative to large caps, providing a cushion against the adverse effects of higher rates.

Sector Exposure: Financials and Industrials Lead the Way

IWM is heavily diversified across sectors, with financials, industrials, and healthcare accounting for the largest allocations. The financial sector, representing 16% of IWM's holdings, stands to benefit from a potential easing of regulatory burdens under the pro-business policies of the current administration. Meanwhile, industrials, which account for 15% of the ETF, could see growth from increased infrastructure spending and reshoring initiatives, both of which are central to the administration's economic agenda.

The healthcare sector, at 13% of IWM’s composition, provides a defensive element to the ETF, as demand for healthcare services tends to remain stable even during economic downturns. These sectoral strengths underscore IWM’s ability to weather macroeconomic challenges while offering exposure to sectors poised for growth.

Mergers and Acquisitions: A Catalyst for Growth

The re-election of President Trump is expected to create a favorable environment for mergers and acquisitions (M&A) in the small-cap space. The administration's tax cuts and deregulation initiatives are likely to spur M&A activity, providing a significant tailwind for IWM. Small-cap companies often become attractive acquisition targets for larger firms seeking to expand their market presence or diversify their portfolios.

For instance, the financial sector within IWM could see a surge in consolidation activity as smaller regional banks and financial institutions attract interest from larger players. Similarly, industrial and healthcare firms within the Russell 2000 Index may benefit from strategic acquisitions, further boosting the ETF's performance.

Historical Performance: Resilience Amid Volatility

Over the past decade, the Russell 2000 Index has demonstrated remarkable resilience during economic recoveries. Historically, small caps outperform large caps during periods of market rebounds, with an average gain of 3.34% during the Thanksgiving-to-Santa Claus rally. In contrast, the S&P 500 averages a gain of 2.58% during the same period. This historical trend underscores the potential for IWM to deliver outsized returns as economic conditions stabilize.

Risks and Challenges

While NYSEARCA:IWM offers compelling value, it is not without risks. Approximately 33% of the companies in the Russell 2000 Index are unprofitable, making the ETF more susceptible to economic downturns. Additionally, IWM’s higher expense ratio of 0.19% compared to SPY’s 0.09% could deter cost-sensitive investors.

The ETF's higher volatility is another factor to consider. With a three-year standard deviation of 22.5%, IWM is significantly more volatile than SPY, which has a standard deviation of 17%. This higher volatility reflects the inherent risks of investing in smaller, less-established companies.

The Bottom Line: A Strategic Buy for Long-Term Investors

Despite the challenges posed by rising interest rates and macroeconomic volatility, NYSEARCA:IWM remains a compelling investment for long-term investors. Its significant valuation discount relative to SPY, coupled with its diversified sector exposure and historical resilience, makes it an attractive option for those willing to embrace short-term volatility.

At $176.45 per share, IWM offers a unique opportunity to capitalize on the growth potential of small-cap companies. While the ETF’s higher risk profile requires careful consideration, its valuation and growth catalysts make it a strong contender for inclusion in a diversified investment portfolio.

In summary, NYSEARCA:IWM is a buy for investors seeking exposure to undervalued small-cap stocks with the potential for outsized returns during economic recoveries. As always, thorough due diligence and a long-term investment horizon are essential for navigating the complexities of the small-cap market.

That's TradingNEWS

Read More

-

IVE ETF Near $212: Is This S&P 500 Value Play Still Cheap for 2026?

20.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $11.07 and XRPR at $15.76 Power $1.2B Inflows as XRP Fights for $2

20.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.60 Support as LNG Boom and $5 Henry Hub Calls Build Into 2026

20.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Pairs Surges After BoJ’s 0.75% Hike as Pair Eyes 161.50 Resistance

20.12.2025 · TradingNEWS ArchiveForex