NYSEARCA:JAAA – Is This The Ultimate High-Yield Bond Play For 2025?

JAAA’s Yield Advantage and CLO Strength: Can It Keep Beating the Market?

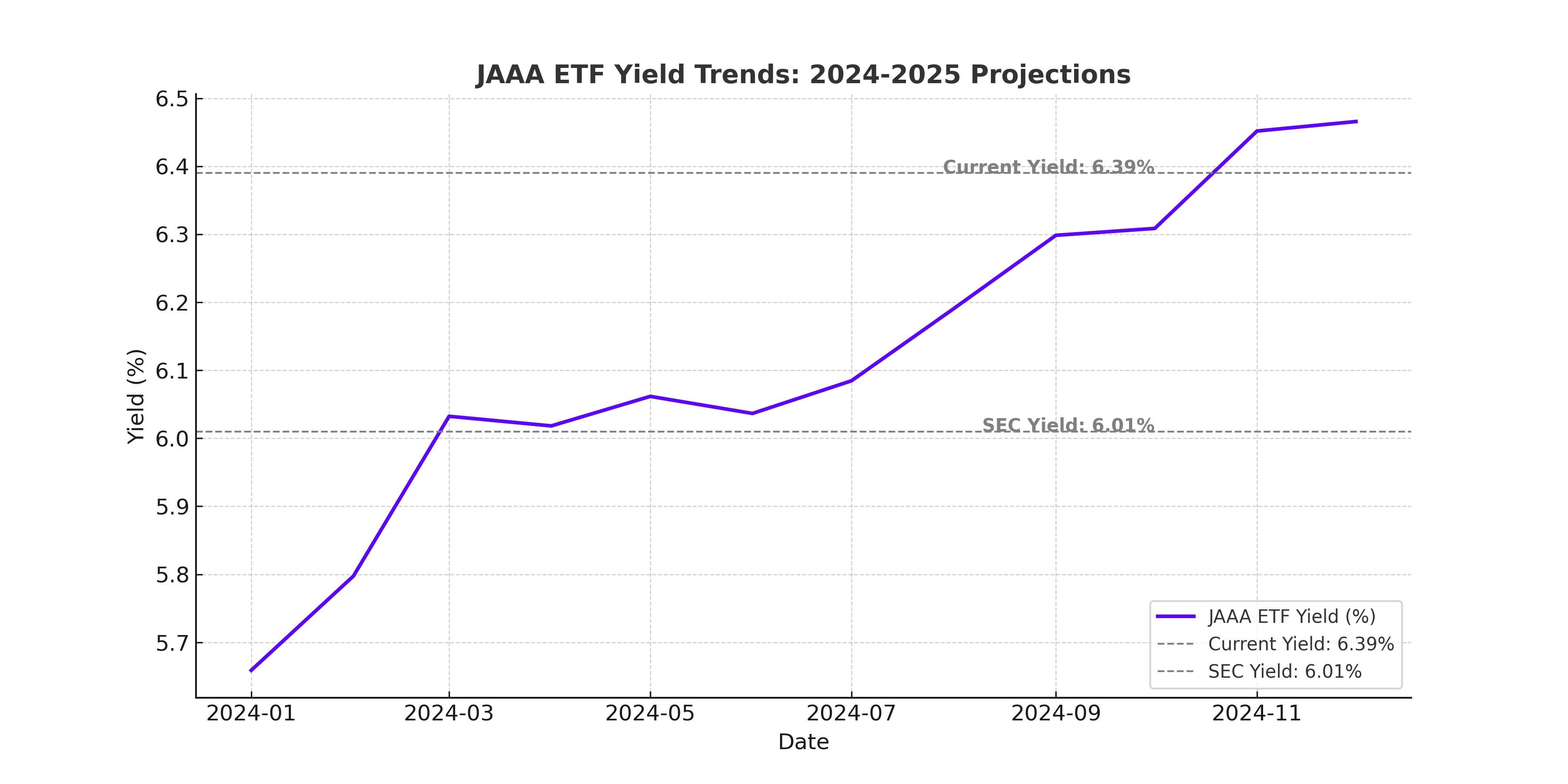

The Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) has emerged as one of the strongest fixed-income plays in the market, offering an impressive 6.39% trailing yield and an SEC yield of 6.01%. With short-duration exposure to AAA-rated collateralized loan obligations (CLOs), JAAA has positioned itself as a high-yield alternative to traditional bonds. But with interest rate uncertainty and shifting economic conditions, can JAAA maintain its market-beating performance, or will its returns compress as the Fed adjusts its policy?

Understanding NYSEARCA:JAAA – What Makes It Different?

Unlike traditional bond ETFs, JAAA exclusively invests in the AAA-rated tranche of CLOs, providing a high yield with minimal credit risk. CLOs bundle leveraged bank loans together, slicing them into tranches with different levels of risk. The AAA-rated tranches that JAAA focuses on are at the top of the capital structure, meaning they have priority on interest payments and have never experienced a default in history.

This makes JAAA fundamentally different from junk bonds, investment-grade corporate bonds, or even other high-yield ETFs. Its floating rate structure allows it to benefit from higher interest rates, unlike fixed-rate bonds that suffer when rates rise. This has been a key factor behind its strong total return performance, especially compared to bond indices.

JAAA has significantly outperformed the iShares Aggregate Bond ETF (AGG) and even the iShares Investment Grade Corporate Bond ETF (LQD) over the past two years. Floating rate debt has provided resilience amid rate hikes, preventing the massive drawdowns that plagued fixed-rate debt markets during the Federal Reserve’s tightening cycle.

Why Has JAAA Outperformed Other Fixed-Income ETFs?

JAAA’s superior total return is largely due to its ability to generate higher yields without taking on excessive duration risk. Here’s how it stacks up against alternatives:

- Treasury Bonds (SHY, IEF, TLT): JAAA yields significantly more than short-term or long-term Treasuries. While Treasuries offer safety, they lack yield, and longer-term Treasuries face steep losses in rising rate environments.

- Investment Grade Bonds (LQD): JAAA has lower default risk than investment-grade corporate bonds yet provides higher yields, thanks to its exposure to floating rate CLOs.

- Junk Bonds (HYG, JNK): High-yield corporate bonds offer similar income but carry significant credit risk. JAAA’s AAA-rated structure eliminates this risk while maintaining competitive returns.

- Bank Loans (BKLN): Senior loan ETFs like BKLN also invest in floating rate loans but have far lower credit quality than JAAA’s AAA-only exposure.

Interest Rate Uncertainty – What Happens If The Fed Cuts Rates?

The biggest risk facing JAAA investors is a decline in interest rates, which could reduce the fund’s yield. CLOs are floating rate instruments, meaning their coupon payments adjust based on prevailing interest rates. If the Fed aggressively cuts rates, JAAA’s yield could compress to sub-2% levels, similar to where it was in 2020.

However, recent developments suggest that the rate-cut cycle might be slower than initially expected. The Fed now anticipates only two rate cuts in 2025, compared to previous expectations of four cuts. This could allow JAAA to maintain elevated yields above 5% for an extended period, making it an attractive option for income-focused investors.

How JAAA’s Yield Compares To Other Fixed-Income Plays

With the current Fed funds rate at 5.25%-5.50%, JAAA is positioned to outperform most traditional bond funds. The biggest question is how well it can sustain this performance as the interest rate cycle shifts.

- Short-term T-bills are currently yielding around 5.3%, but their yields will decline faster than JAAA’s as rate cuts take effect.

- Investment-grade corporate bonds (LQD) offer yields in the 4.6% range but are exposed to credit and duration risk.

- Bank loan ETFs (BKLN, SRLN) yield 6.5%-7%, but they hold lower-rated loans and come with higher default risks.

JAAA stands out by delivering floating-rate income with investment-grade safety, making it a unique hybrid between T-bills and high-yield bonds.

JAAA’s Expense Ratio – Is It Justified?

One downside to JAAA is its 0.21% expense ratio, which is slightly higher than some investment-grade bond ETFs. However, this cost is justified due to the complexity and illiquidity of CLO markets. CLOs require active management, frequent rebalancing, and access to institutional loan markets, making them more expensive to manage than standard bond ETFs.

Is NYSEARCA:JAAA A Buy, Sell, or Hold?

JAAA remains one of the best cash-alternative ETFs for investors seeking high yields with low risk. With a trailing 6.39% yield, it offers better returns than Treasury bonds, lower risk than junk bonds, and more stability than corporate bonds.

The key risks include potential yield compression if the Fed cuts rates aggressively, but as long as rates remain above 3%, JAAA should continue to deliver attractive income.

For investors looking to park cash while earning strong income, JAAA is a BUY. If rates start falling sharply, holding JAAA could still be justified as it provides higher risk-adjusted returns than most bond alternatives. However, if the Fed moves to a zero-rate environment, a shift to other asset classes may be necessary.

Final Verdict: Why JAAA Is One of the Best Fixed-Income Plays for 2025

JAAA has proven to be a resilient, high-yield ETF with a strong track record in a rising rate environment. Its AAA-rated CLO exposure, floating rate advantage, and strong credit protection make it a compelling choice for investors seeking yield without excessive risk.

With the Fed expected to keep rates elevated for longer, JAAA is well-positioned to maintain strong returns above 5%, making it an excellent addition to any income-focused portfolio in 2025.