NYSEARCA:MSTY ETF – A 100%+ Yield or a Dangerous Trap?

MSTY ETF’s massive dividend yield exceeds 100%, but is it built to last, or is it heading for a collapse? | That's TradingNEWS

NYSEARCA:MSTY – Is the Massive Yield Worth the Risk?

Understanding the High-Yield Strategy of NYSEARCA:MSTY

The YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY) has caught the attention of income-seeking investors with an astonishing dividend yield of over 100%. This ETF is structured to generate income by selling covered calls and put options on MicroStrategy (NASDAQ:MSTR) while holding short-term U.S. Treasuries as collateral. Given MSTR’s extreme volatility due to its direct correlation with Bitcoin (BTC-USD), MSTY has created a highly lucrative but highly risky investment model.

The big question for investors is simple: Can this insane yield be sustained, or is it just a short-term illusion?

How MSTY Generates Its Massive Yield

Unlike traditional ETFs that rely on stock appreciation or dividends from underlying assets, MSTY is an options-based ETF. It does not hold MicroStrategy (MSTR) stock directly but instead buys call options and sells put options on MSTR, mimicking long exposure while simultaneously generating income from the options market. The core strategy involves:

- Selling Covered Calls on MSTR: By selling call options, MSTY generates option premiums, which contribute directly to the fund’s income stream. However, this also caps potential upside gains if MSTR surges.

- Selling Put Options on MSTR: The ETF also sells put options, adding another stream of premium income. While this helps boost returns, it also exposes the ETF to downside risk if MSTR drops sharply.

- Holding U.S. Treasuries: MSTY uses short-term Treasuries as collateral, ensuring some level of stability and additional income generation.

The combination of these strategies has enabled MSTY to offer yields exceeding 100% annually, but the sustainability of such a return depends entirely on MSTR’s price movement and market volatility.

MSTY’s Performance vs. MSTR – A Reality Check

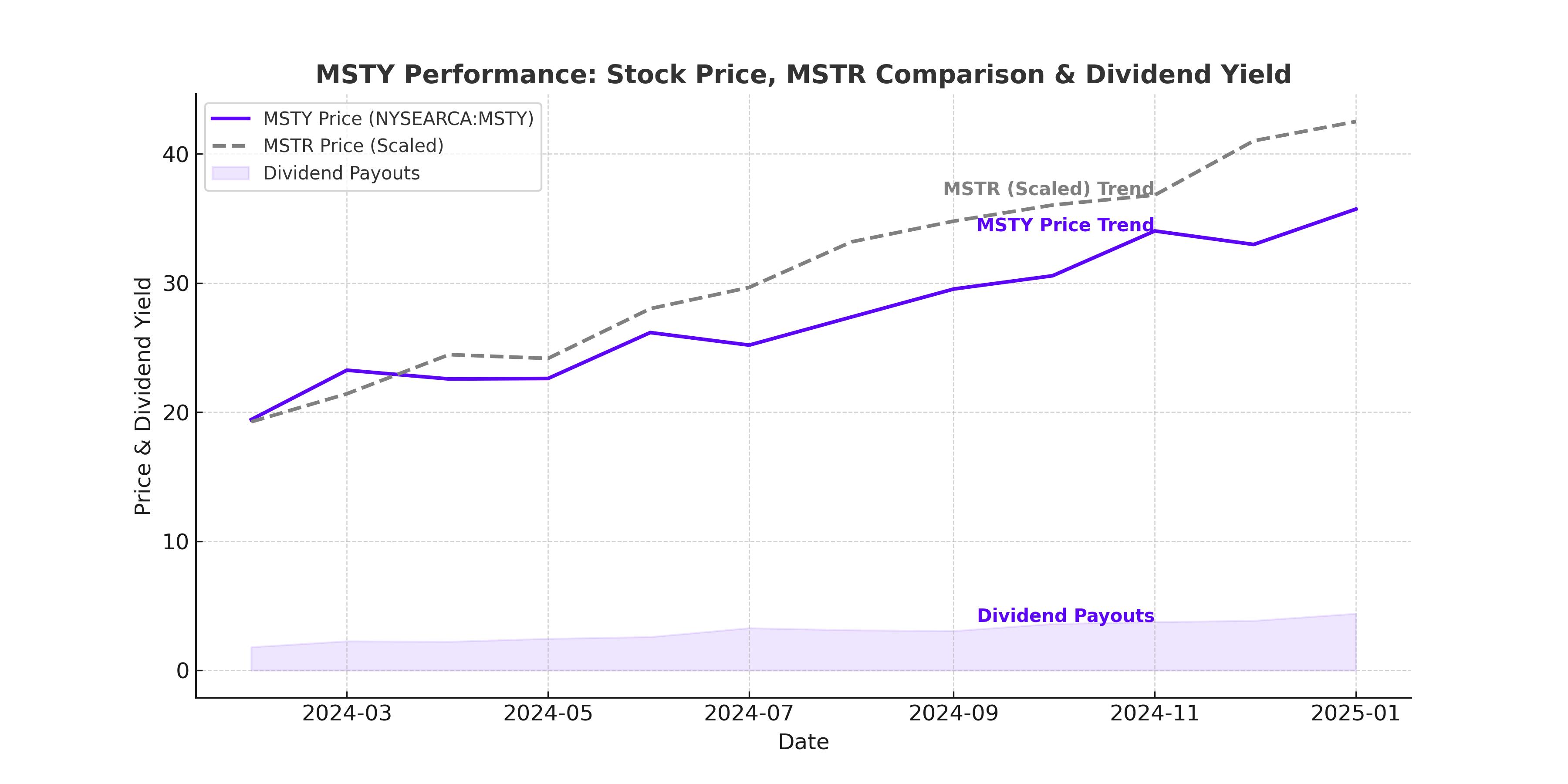

Since its inception on February 22, 2024, MSTY has experienced wild price swings, largely reflecting MSTR’s extreme volatility. Initially, MSTY surged 186%, but it has since retraced 40% from its all-time high, largely due to MSTR’s 51.5% decline over the same period.

For those thinking this fund is a safe way to gain MSTR exposure, think again. MSTY will outperform MSTR when MSTR moves sideways or rises slowly, but when MSTR enters a parabolic rally, MSTY’s covered call strategy caps upside gains. Similarly, if MSTR tanks, MSTY will generate some cushion through income, but not enough to offset major losses.

Are MSTY’s Dividends Sustainable?

The short answer: Maybe, but only in the right market conditions.

So far, MSTY has distributed $31.81 per share in dividends, which is more than its initial $20.38 opening price. However, its dividend payouts are highly variable and could shrink if:

- MSTR stock price declines – Since options premiums are based on underlying stock price, a major drawdown in MSTR will hurt MSTY’s ability to generate high option premiums.

- Implied Volatility (IV) drops – High volatility translates into higher option premiums, but if IV decreases, MSTY’s yield will decline.

- Bitcoin (BTC-USD) falls – MSTR is directly linked to Bitcoin. A Bitcoin crash would hurt MSTR, causing MSTY’s dividend to fall significantly.

The latest February 2025 dividend was $2.02 per share, which would translate to a 117% annualized yield if sustained. But since MSTR’s stock has pulled back sharply, March’s dividend is expected to be lower.

Bitcoin’s Role in MSTY’s Future

Bitcoin’s price movement is the most critical factor for MSTY’s long-term performance. MicroStrategy (MSTR) holds 499,096 BTC, meaning its stock moves almost in sync with Bitcoin’s price action.

Currently, Bitcoin is hovering near all-time highs, but many analysts expect a potential retracement toward its 50-day moving average, which could lead to a 10-15% decline. If that happens, MSTR could drop another 20% or more, further dragging down MSTY.

For MSTY to maintain its high yield, Bitcoin must remain volatile, but not experience a prolonged drawdown. If Bitcoin crashes below $70,000, MSTY’s premium income could dry up, leading to drastically lower payouts.

Is MSTY a Buy, Sell, or Hold?

Investors need to decide whether they want high-yield income with high risk.

MSTY is not a buy-and-hold ETF like traditional dividend funds. It thrives in markets where MSTR moves within a volatile but upward-trending range. If MSTR experiences sharp declines or extreme surges, MSTY will underperform significantly.

For those looking to harvest short-term income, MSTY can be attractive, especially at current levels near $20 per share. However, this is not a long-term core holding—it’s a high-risk trading vehicle designed for those who understand options mechanics and volatility cycles.

Final Verdict: MSTY is a Hold for aggressive income traders, but too volatile for conservative investors. If Bitcoin remains stable and MSTR avoids a major crash, MSTY’s high yield can persist. However, a deeper pullback in MSTR or BTC could result in sharply lower payouts.