NYSEARCA:SCHD Is Undervalued – Is This the Best Dividend ETF to Buy Right Now?

With SCHD’s dividend yield at 3.55% and its P/E at just 13.7x, is this the best time to buy before the market rotates out of overvalued growth stocks? | That's TradingNEWS

NYSEARCA:SCHD - Is This the Best Dividend ETF Right Now?

Why Is NYSEARCA:SCHD Lagging While the S&P 500 Surges?

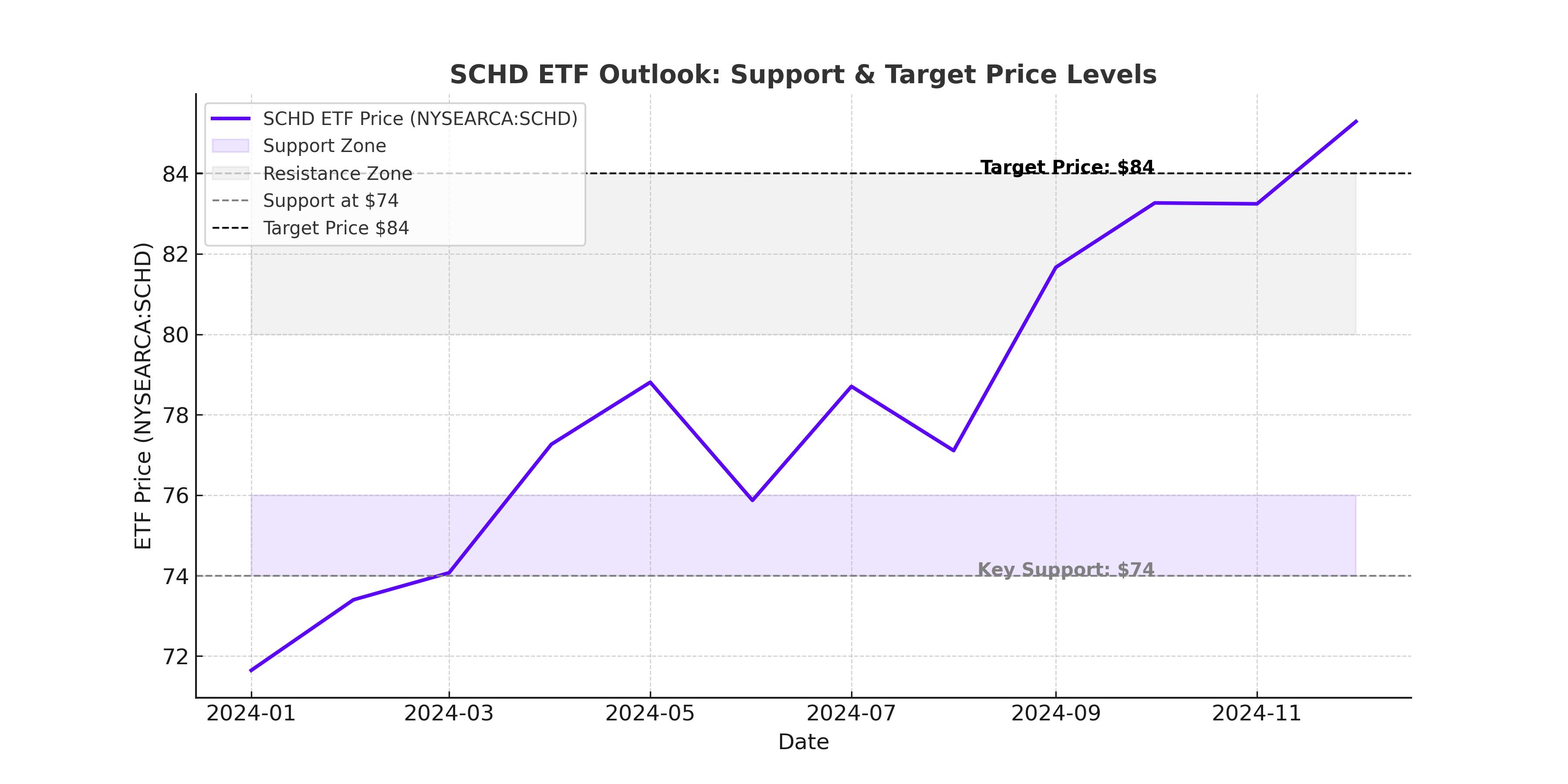

The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) is one of the most respected dividend-focused ETFs, known for its high-quality holdings, strong dividend growth, and relatively low volatility. However, while the S&P 500 (SPY) has been retesting all-time highs, SCHD has struggled to regain momentum. Many investors are now asking: Why is SCHD underperforming? Is it a buying opportunity, or are there structural issues holding it back?

Several factors have weighed on SCHD's performance, including rising long-term yields, competition from fixed-income investments, and investor rotations favoring high-growth stocks over dividend value plays. The fund’s dividend yield currently sits at 3.55%, a solid payout, but fixed-income alternatives like Treasury bonds are offering yields above 4%, making SCHD less attractive to income-focused investors.

SCHD vs. SPY: The Valuation Gap Has Never Been Wider

One of the most striking signals in favor of SCHD is its valuation gap relative to the broader market. SCHD's price-to-earnings (P/E) ratio is just 13.7x, while the S&P 500 trades at a much higher 22.2x forward P/E. This means that, on a relative basis, SCHD is far cheaper than the broader market, and dividend investors could see significant upside if valuations normalize.

Another crucial metric is SCHD’s excess CAPE yield relative to SPY, which is now at the highest level in over a decade. The CAPE yield, which is the inverse of the cyclically adjusted P/E ratio, provides a better measure of valuation by smoothing out earnings volatility over time. The fact that SCHD's excess yield is hitting record highs compared to the S&P 500 suggests that the market is heavily favoring growth over value, setting up a potential reallocation back into SCHD in the coming months.

Dividend Growth and Stability – SCHD’s Key Advantage

One of SCHD’s biggest strengths is its strong track record of dividend growth. Over the past five years, SCHD has delivered an average dividend growth rate (CAGR) of 11.04%, far exceeding the S&P 500’s dividend growth of just 3.77% over the same period. The fund's low expense ratio of 0.06% also ensures that more income is returned to investors.

SCHD’s holdings are carefully selected based on strict fundamental screens, including a 10-year history of dividend payments, strong return on equity (ROE), a solid cash flow-to-debt ratio, and consistent dividend growth. This ensures that SCHD only holds high-quality companies that are likely to sustain and grow their dividends over time.

Currently, SCHD’s trailing twelve-month (TTM) dividend yield is 3.55%, which is about 8% above its four-year average, signaling that the fund is undervalued. In contrast, SPY’s dividend yield is just 1.16%, which is 16% below its historical average, highlighting how expensive the broader market has become.

Top Holdings – A Shift Away from Growth and Tech

One of the biggest distinctions between SCHD and the S&P 500 is its sector composition. Unlike SPY, which is heavily concentrated in technology stocks like Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Amazon (AMZN), SCHD avoids these high-growth names and instead focuses on more stable dividend-paying companies.

Top SCHD holdings include:

- Pfizer (PFE) – A high-yielding pharmaceutical giant with strong cash flow

- BlackRock (BLK) – A leader in asset management and dividend growth

- Coca-Cola (KO) – A defensive consumer staple with consistent dividend payouts

- Amgen (AMGN) – A top biotech company with strong profitability

- PepsiCo (PEP) – A resilient consumer brand with steady cash flow

By focusing on mature, cash-rich companies rather than high-growth stocks, SCHD offers a more stable alternative for investors looking for dividend income and lower volatility.

Is the Federal Reserve the Biggest Risk to SCHD?

While SCHD’s fundamentals remain strong, there are macro risks that could impact its near-term performance. The biggest factor influencing dividend ETFs like SCHD is the Federal Reserve’s interest rate policy.

Over the past year, rising interest rates have made fixed-income investments more attractive, drawing capital away from dividend-focused ETFs. The 2-year U.S. Treasury yield recently hit 4.27%, meaning investors can get a higher risk-free return on government bonds than on SCHD’s dividend yield.

However, if the Fed begins cutting rates in 2025, the narrative could shift in favor of dividend stocks. Lower rates would make bonds less attractive, potentially driving income-seeking investors back into high-quality dividend ETFs like SCHD.

Trump’s Tariffs and Economic Policy – Could SCHD Benefit?

Another wildcard for SCHD investors is the return of Donald Trump’s economic policies. If Trump wins the 2024 election, we could see a return to higher tariffs on foreign goods, particularly Chinese imports.

Historically, higher tariffs have benefited U.S. dividend-paying companies, particularly in industries like consumer staples, industrials, and financials—all sectors where SCHD has strong exposure. This could create a tailwind for SCHD relative to the broader market, which is more exposed to technology and multinational growth stocks that rely on global supply chains.

Is SCHD a Buy, Hold, or Sell?

Given the massive valuation gap between SCHD and SPY, its record-high excess CAPE yield, and its strong dividend growth track record, SCHD looks like an attractive buying opportunity for long-term investors.

While short-term headwinds like rising Treasury yields and growth stock favoritism have hurt SCHD’s momentum, the long-term fundamentals remain intact. If the market begins rotating from growth to value, or if interest rates fall, SCHD could see a strong resurgence.

For investors looking for a mix of income, stability, and long-term dividend growth, SCHD remains one of the best dividend ETFs available. At current levels, this is an opportunity to accumulate shares while it trades at a discount to the broader market.

Check NYSEARCA:SCHD’s real-time stock price and charts here:

SCHD Real-Time Chart