Occidental Petroleum (NYSE:OXY): Is $57 the Next Stop for This Buffett-Backed Stock?

With Oil Prices Holding at $75, Could Stricter Sanctions Propel OXY Higher? | That's TradingNEWS

Stricter enforcement of U.S. and allied sanctions targeting Russian oil could remove as much as 1.7 million barrels per day (bpd) from global supply. The Iranian oil export market, which rebounded to 1.6 million bpd in mid-2024, also faces renewed scrutiny with potential policy shifts under the Trump administration. Historically, sanctions on Iran reduced exports from 2.5 million bpd to just 70,000 bpd at their lowest in 2020. A return to this strategy could significantly tighten supply, supporting price stability and benefiting companies like Occidental.

Financial Resilience and Valuation

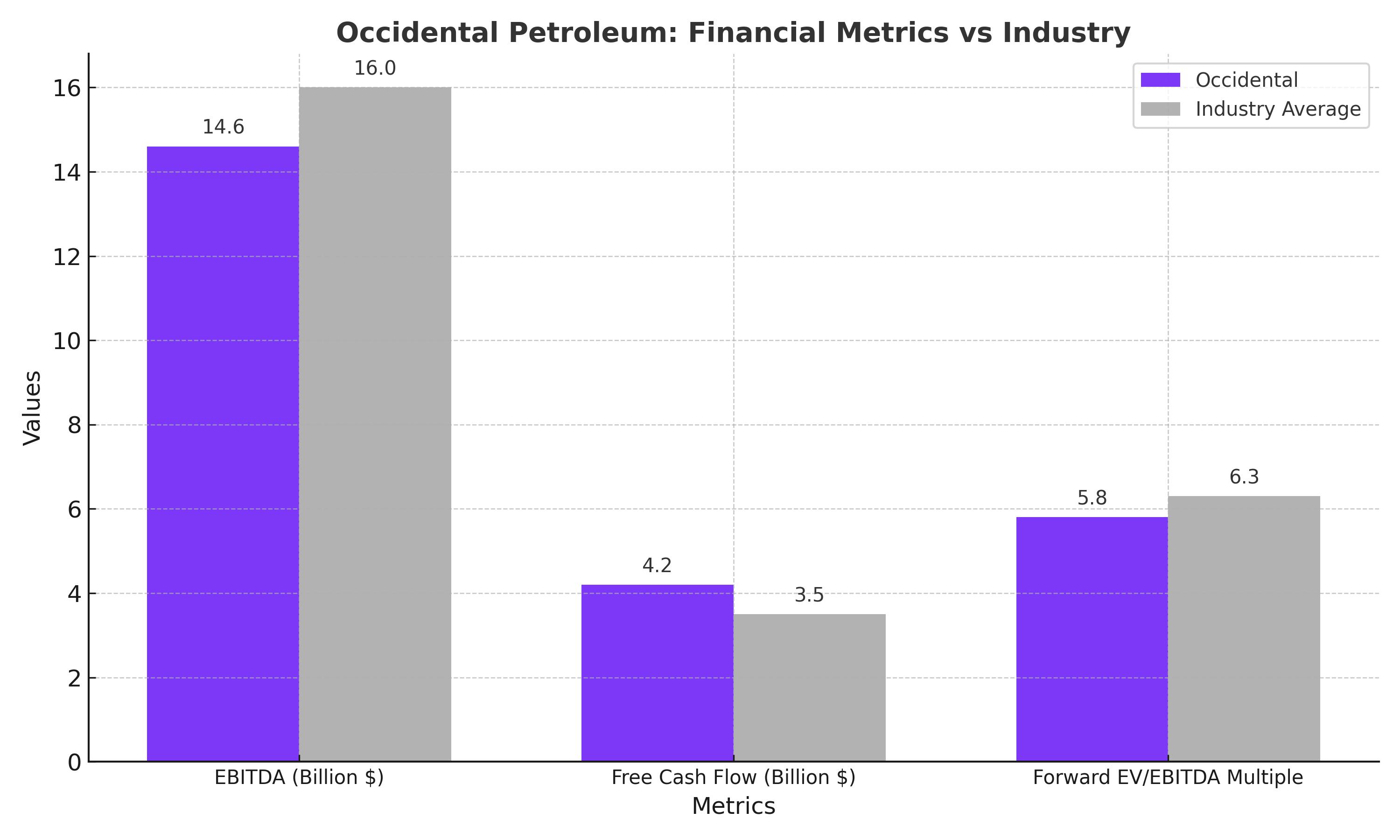

Occidental’s strong financials and conservative valuation make it an attractive opportunity in the energy sector. The company is projected to generate approximately $14.6 billion in EBITDA for fiscal year 2024, translating to a forward EV/EBITDA multiple of 5.8x, below its five-year average of 6.3x. With free cash flow expected to reach $4.2 billion, representing an 8.5% yield at current market capitalization, Occidental maintains an advantageous position for capital allocation and growth.

The stock’s undervaluation relative to its historical multiples indicates market caution about oil price recovery. However, given the potential supply constraints and Occidental’s strategic positioning in low-cost production regions, this skepticism appears misplaced. Occidental’s valuation is attractive compared to peers such as Exxon Mobil (XOM) and Chevron (CVX), which trade at similar forward P/E ratios but lack Occidental's strong Permian Basin leverage.

Operational Excellence and Delaware Basin Advantage

Occidental’s extensive operations in the Delaware Basin provide it with a competitive edge in terms of cost efficiency and resource longevity. The company’s production costs are among the lowest in the industry, enabling it to maintain robust profitability even during periods of market volatility. The Delaware Basin, where Occidental holds decades’ worth of reserves, has been a consistent growth driver. This region accounted for 52% of Occidental’s production volume in the third quarter of 2024, which totaled 1.412 million barrels of oil equivalent per day (MBOED).

The company’s ability to consistently reduce lease operating expenses per barrel underscores its operational efficiency. With existing infrastructure in place, Occidental can optimize production without incurring significant incremental capital expenditures, a critical factor in sustaining long-term profitability.

Warren Buffett’s Confidence and Shareholder Returns

Berkshire Hathaway’s increased stake in Occidental has reinforced investor confidence in the company’s prospects. Warren Buffett’s firm now owns over 28% of Occidental’s outstanding shares, having added 8.9 million shares in December 2024 at an average price of $53 per share. This accumulation highlights Berkshire’s long-term belief in Occidental’s operational strength and undervaluation.

Buffett’s vote of confidence is particularly noteworthy given his historical success with energy investments, such as PetroChina. His consistent buying of Occidental shares, even amid sector volatility, signals optimism about the company’s ability to weather short-term challenges and capitalize on favorable market dynamics.

Occidental’s robust free cash flow generation supports its shareholder-friendly capital allocation strategy. In addition to debt reduction—$4 billion repaid in Q3 2024—the company has significant room for share repurchases and dividend increases. This approach aligns with Buffett’s preference for companies that deliver consistent returns to shareholders while maintaining financial discipline.

Challenges and Risks

Despite its strengths, Occidental faces several risks. The enforcement of sanctions on Russia and Iran is not guaranteed to achieve the desired supply reductions. Russia has demonstrated resilience in finding alternative buyers, while Iran’s market strategies could mitigate some of the impact of sanctions. Additionally, intra-OPEC+ disagreements could disrupt market stability, as evidenced by Saudi Arabia’s previous moves to regain market share.

Short-term oil price volatility remains a key concern, especially if global demand growth disappoints. However, with demand projected to grow by 1.1 million bpd in 2025 and OPEC’s commitment to managing supply, these risks appear manageable.

Long-Term Growth Potential

Occidental’s strategic investments in carbon capture technology and low-carbon energy solutions position it for future growth in a decarbonizing world. While these initiatives are in their early stages, they align with broader industry trends toward sustainability and could unlock new revenue streams over the next decade.

In the near term, Occidental’s ability to leverage its Delaware Basin assets and benefit from potential oil price tailwinds sets it apart from peers. The company’s disciplined approach to capital allocation, coupled with its operational efficiencies, ensures it is well-equipped to navigate market uncertainties while delivering value to shareholders.

Investment Outlook

Occidental Petroleum’s current valuation does not fully reflect the improving oil price outlook and the company’s operational strengths. Trading at a discount to historical multiples and with a forward P/E ratio of 12.5x, Occidental offers significant upside potential, particularly if geopolitical developments tighten supply as anticipated. Warren Buffett’s continued accumulation of shares reinforces the stock’s appeal as a long-term investment.

Investors seeking exposure to a leading player in the energy sector, with strong fundamentals and a favorable risk-reward profile, should consider Occidental Petroleum. With potential upside of 20% or more based on forward earnings estimates and a fair value range of $57 to $61 per share, Occidental represents an attractive opportunity in the evolving energy landscape.

That's TradingNEWS

Interactive Brokers (NASDAQ:IBKR) at $159: Time to Buy, Hold, or Wait?