Offshore Gas Production Set to Unlock $100 Billion Potential

Southeast Asia’s Rapid Growth in Offshore Gas Investments and Global Oil Market Influences | That's TradingNEWS

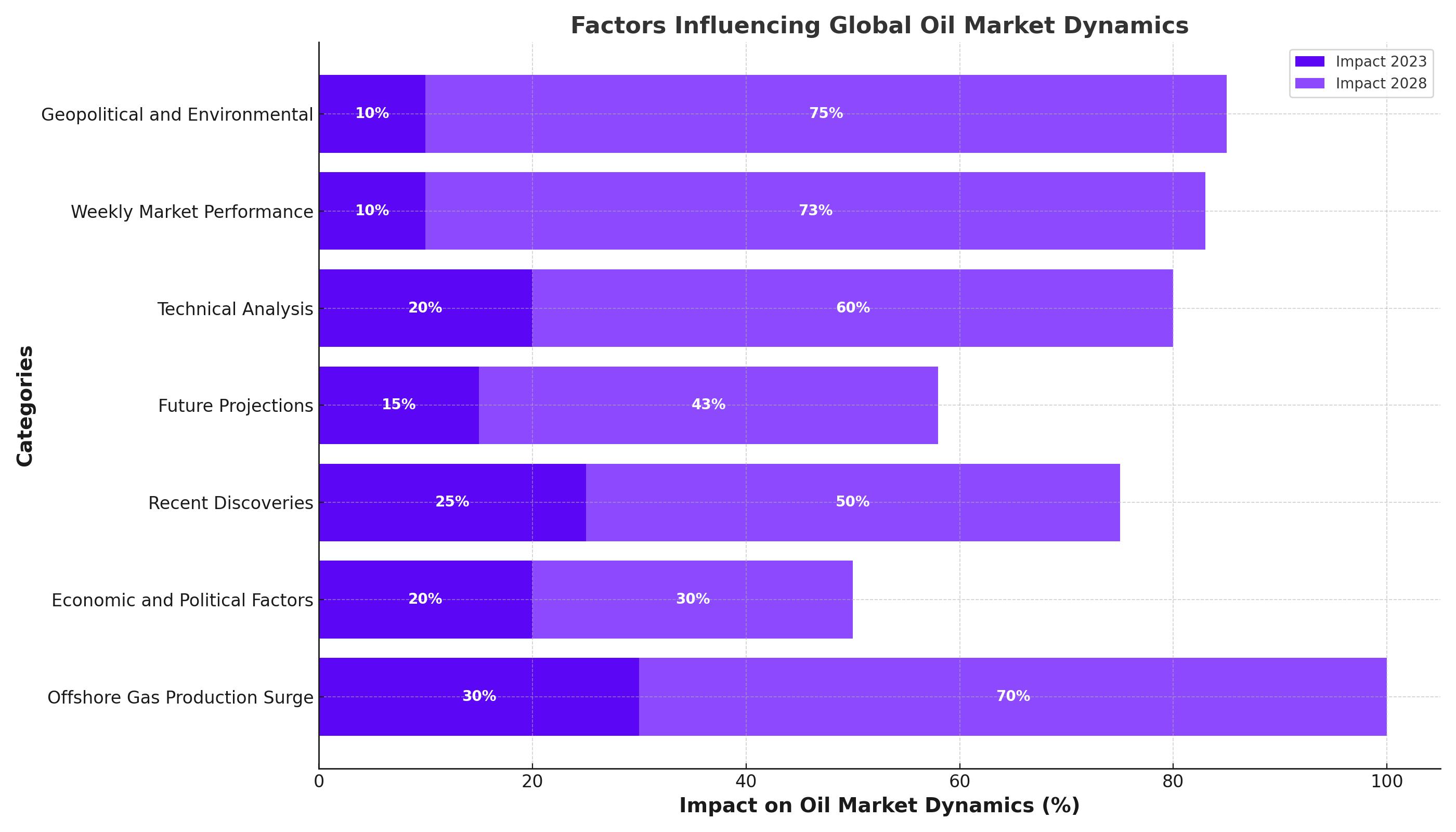

Global Oil Market Dynamics: A Detailed Analysis

Offshore Gas Production Surge in Southeast Asia

The offshore gas production in Southeast Asia is poised to unlock a $100 billion potential, driven by a series of planned final investment decisions (FIDs) expected to materialize by 2028. This represents a significant increase from the $45 billion worth of developments from 2014 to 2023, indicating a surge in the region’s offshore gas industry. This growth is bolstered by deepwater projects, recent discoveries in Indonesia and Malaysia, and advancements in carbon capture and storage (CCS), crucial for meeting the region’s sanctioning agenda.

Oil and gas majors are expected to drive 25% of these planned investments through 2028, while national oil companies (NOCs) will account for 31%. East Asia's upstream companies are emerging with a 15% share, showing potential for growth through mergers and acquisitions (M&A) and upcoming exploration ventures. Notably, TotalEnergies' substantial acquisition efforts in Malaysia could expand the role of majors to 27%.

Economic and Political Factors Influencing Oil Prices

The region’s promising future for offshore gas development faces challenges such as project delays, deepwater and sour gas economics, infrastructure readiness, and regional politics. However, the emergence of CCS hubs in Malaysia and Indonesia could be a game-changer. High carbon dioxide (CO2) content in upcoming offshore projects necessitates CCS for financing and regulatory compliance. Both countries are exploring depleted reservoirs from mature fields as potential CO2 storage sites, boosting demand for CO2 storage and fueling a surge in offshore gas development expected from 2025 onwards.

Recent discoveries and the involvement of NOCs will play a vital role in this growth, particularly in deepwater developments. For instance, Indonesia’s major projects such as Inpex-operated Abadi LNG, Eni’s Indonesia Deepwater Development (IDD), and BP’s Tangguh Ubadari Carbon Capture (UCC) are projected to account for 75% of Indonesia's total offshore gas investments slated for FID. This positions Indonesia as a formidable contender to Malaysia’s established dominance.

Price Dynamics and Future Projections

The region's gas sector anticipates substantial growth, with projected gas resources from FIDs set to rise to 58 trillion cubic feet (Tcf) by 2028, a three-fold increase from the levels observed from 2019 to 2024. This growth hinges on efficiently monetizing recent discoveries and advancing delayed developments. Operators face economic challenges, particularly in deepwater and sour gas ventures. Many projects require gas prices above historical averages of $4 per thousand cubic feet to achieve profitability, with an optimal threshold closer to $6 per thousand cubic feet.

Revising domestic gas pricing policies across the region is under discussion. A gas price of $7.5 per thousand cubic feet could potentially make up to 95% of planned developments economically viable, especially those associated with LNG projects in Indonesia and domestic supply initiatives in Vietnam. Supply chain companies could also see increased value for floater-based projects and deepwater drilling.

Recent Trends and Technical Analysis

Following a long holiday weekend in the U.S, speculators returned to the WTI Crude Oil market, producing lower prices starting last Monday. Entering last week near the 83.000 ratio, WTI Crude Oil continued its downwards slope into Wednesday, testing a low near 80.880. However, the commodity began to incrementally move higher, touching a high around 83.770 on Friday. WTI Crude Oil entered the weekend near 82.260, showing a strong amount of selling.

Day traders may want to watch price action as the Americans return to the market on Monday. Technical glances suggest the commodity is in a known price range, allowing for tests of support and resistance levels. Despite potential headwinds from demand concerns, WTI Crude Oil has shown resilience near the 81.000 support level since mid-June.

Weekly Market Performance and Influencing Factors

Oil prices concluded the week with losses after a four-week winning streak, as futures settled slightly lower on Friday amidst cautious investor sentiment influenced by weaker consumer confidence and expectations of Federal Reserve interest rate cuts in September. Brent crude futures fell by 37 cents to settle at $85.03 per barrel, while U.S. West Texas Intermediate (WTI) crude futures declined by 41 cents, or 0.5 percent, ending the day at $82.21 per barrel.

Supporting oil prices earlier in the week was robust U.S. gasoline demand, reaching 9.4 million barrels per day in the week ending July 5, the highest level for that week since 2019. Additionally, jet fuel demand showed its strongest performance since January 2020. Strong demand encouraged U.S. refiners to increase operations and draw down crude oil inventories, reflecting a positive outlook for fuel consumption amidst seasonal peaks.

Geopolitical and Environmental Considerations

The potential easing of geopolitical tensions, cracks within the OPEC+ production cut strategy, and the limited impact of Hurricane Beryl on the energy infrastructure are key factors influencing oil prices. OPEC+ extended production cuts through 2025 in June but announced a phase-out starting in October. Overproduction by key members like Russia, UAE, Kazakhstan, Iraq, and Saudi Arabia could lead to a significant decline in oil prices. The next OPEC+ meetings will be crucial in determining whether the group can maintain a unified front.

Conclusion

Despite the promising future for offshore gas development in Southeast Asia, the oil market continues to face numerous challenges and uncertainties. Economic realities, geopolitical tensions, and environmental considerations all play a critical role in shaping the future of oil prices and investments. Stakeholders must navigate these conditions with strategic investments and evolving economic policies to ensure the region's offshore gas sector achieves its full potential.

That's TradingNEWS

Kazakhstan's Record Oil Production: How Will It Affect Global Oil Prices?

WTI and Brent Oil Surge Amid Geopolitical Risks – What’s Driving Prices Above $70?