Oil Investment Must Rise 30% to Avoid Global Supply Shortages – Can Upstream Keep Up?

With demand expected to hit 110M barrels/day by 2030, will oil producers ramp up investment, or is a major supply crisis looming? | That's TradingNEWS

Oil Demand Surges Toward 110M Barrels/Day – Is the Industry Underinvesting?

The energy transition is not moving fast enough to curb oil demand, and global crude consumption is set to climb to 110 million barrels per day (bpd) by 2030, according to Vitol, the world’s largest independent oil trader. Despite widespread talk of peak demand, the reality is clear: oil consumption remains resilient, fueled by rising global population, middle-class expansion, and industrial growth. However, investment in upstream oil production is falling dangerously behind, raising concerns about future supply bottlenecks.

$660 Billion a Year Needed – Can the Oil Industry Deliver?

Wood Mackenzie warns that global upstream oil and gas investment must rise from $500 billion to $660 billion per year to sustain demand and prevent supply shocks. With existing oil fields maturing and depleting, the gap between consumption and production could widen unless the industry accelerates new developments. A failure to meet these investment needs could lead to oil price spikes and increased market volatility in the coming years.

Big Oil Focuses on Shareholder Returns – Will They Prioritize Expansion?

Major oil producers, including ExxonMobil, Chevron, and Shell, remain cautious about increasing capital expenditures. Instead, they are focused on maximizing shareholder payouts, with some companies returning up to 45% of cash flow to investors. While this financial discipline has attracted investor confidence, it raises a pressing question: can Big Oil balance profitability with the need for production growth?

Geopolitical Risks Add Another Layer of Uncertainty

The oil market remains sensitive to geopolitical disruptions. A recent drone attack in southern Russia disrupted Kazakhstan’s crude exports, highlighting the fragility of global supply chains. Meanwhile, OPEC+ is divided on whether to increase production in April, with some members arguing that the market is too weak to absorb additional barrels. The geopolitical chessboard, from U.S.-China trade tensions to Russia-Ukraine negotiations, will be a key driver of oil prices in 2025 and beyond.

Nigeria’s Plan to Boost Output – Will It Be Enough?

Nigeria, Africa’s largest crude producer, is taking steps to increase oil production by 1 million bpd by December 2026. Efforts to curb oil theft and enhance upstream efficiency have already led to an increase in output to 1.75 million bpd. The country’s ambitious Project 1 MMBOPD initiative aims to attract investment and revitalize production. However, will Nigeria’s plans be enough to offset declining output from mature fields elsewhere?

Will Oil Prices Surge as Investment Lags?

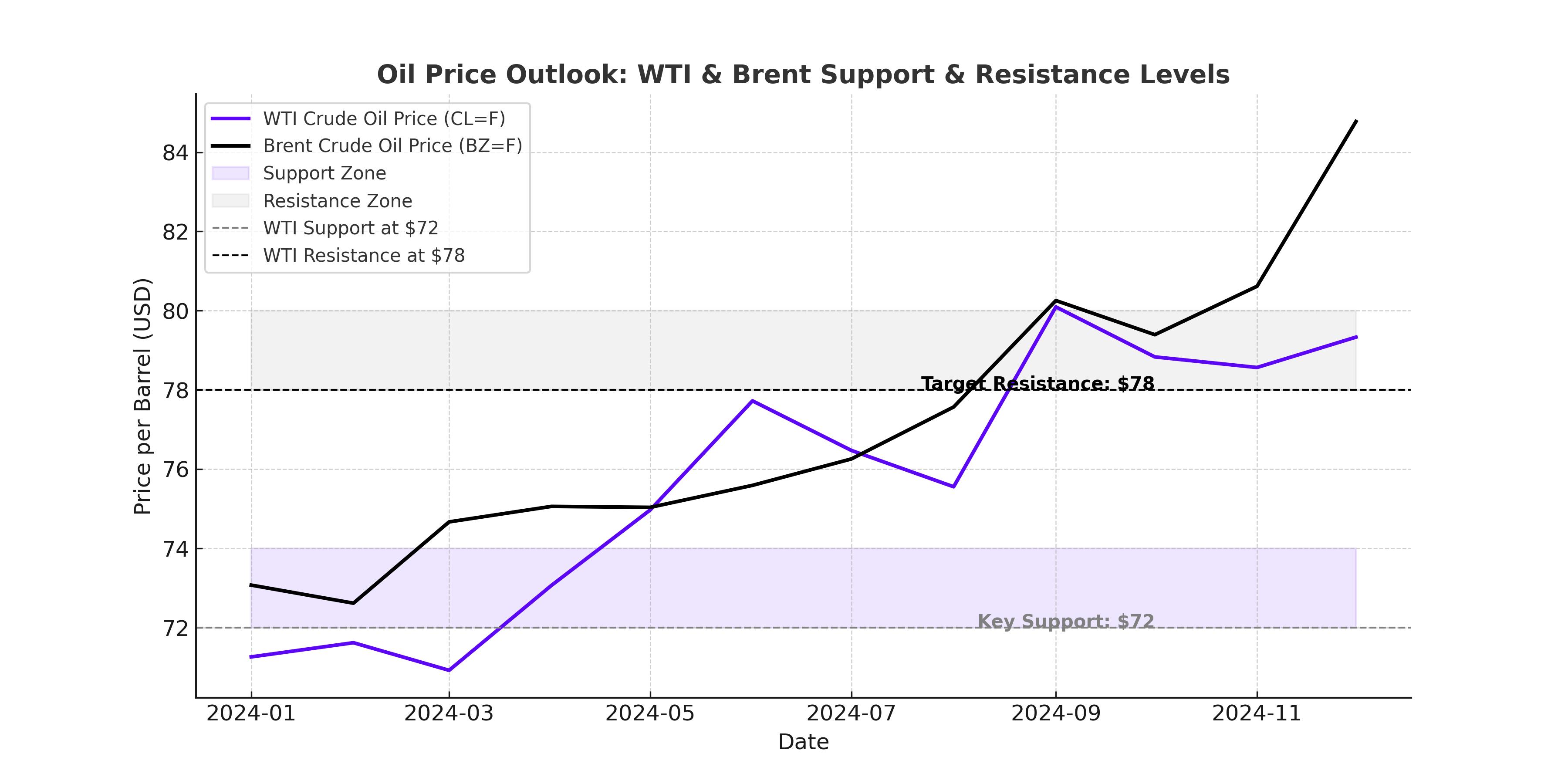

Brent crude is currently trading at $74.92 per barrel, while WTI hovers around $71.03 per barrel. As demand grows but investment stagnates, the risk of price spikes increases. Some analysts warn that unless upstream spending ramps up soon, crude prices could soar beyond $100 per barrel in the next few years. With global consumption still climbing, is the world heading for an oil supply crisis?

What’s Next for Oil? Will Investment Catch Up?

The energy sector is at a crossroads. The industry must decide whether to boost spending to meet demand or risk a supply deficit that could trigger another oil shock. With central banks prioritizing economic stability, OPEC+ weighing its next move, and governments balancing energy security with climate commitments, the stakes have never been higher. Will the world step up its oil investment, or are we heading for a market squeeze that could redefine the industry?