Oil Market - Chinese Economic Slowdown Effects and U.S. Inventory Data

Detailed Insights on Oil Prices Amid China's Interest Rate Cuts, U.S. Crude Draws, and Geopolitical Tensions | That's TradingNEWS

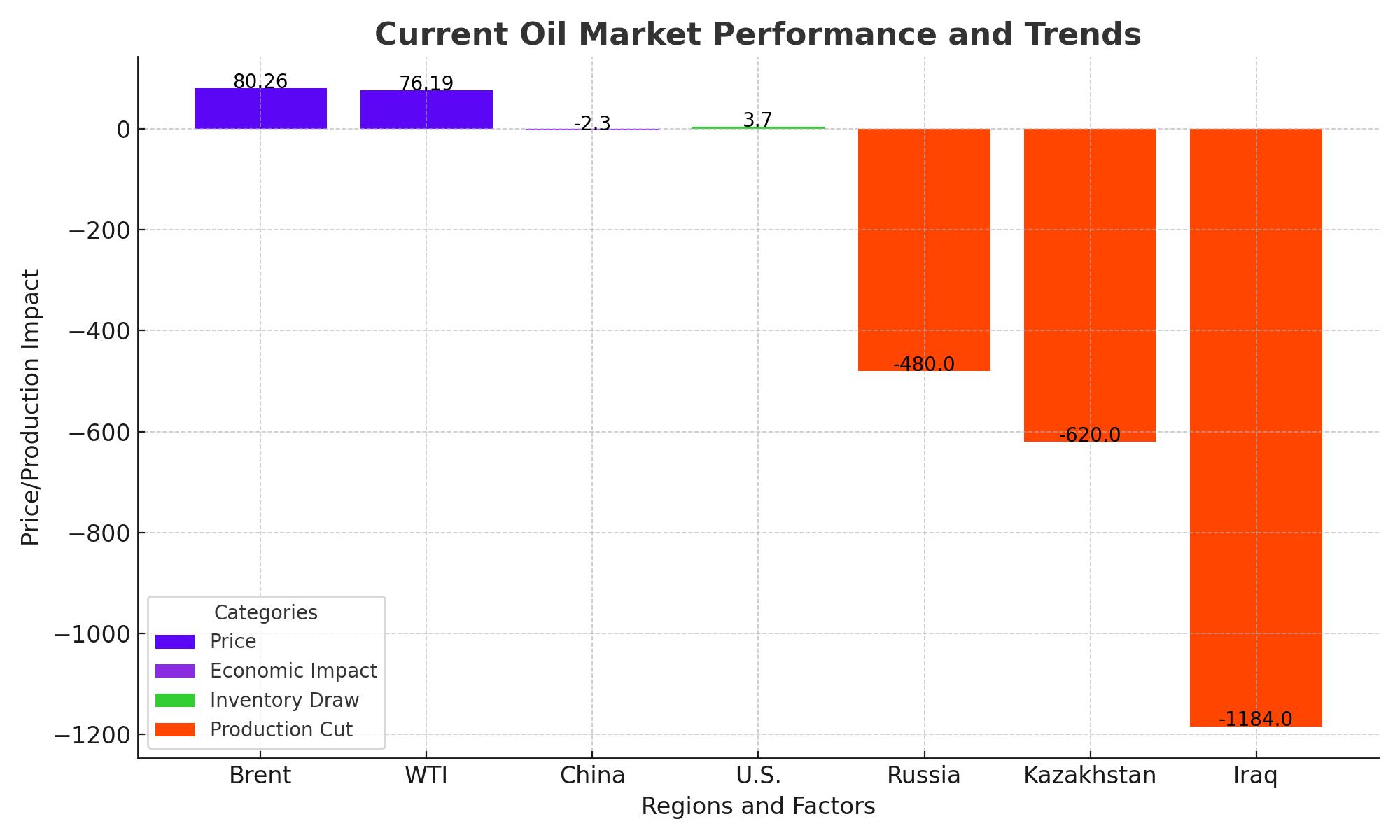

Current Oil Market Performance and Trends

Oil prices have shown significant volatility recently. In early-morning trading on Thursday, Brent crude was priced at $80.26 per barrel, while West Texas Intermediate (WTI) was trading at $76.19 per barrel. Despite a substantial draw in U.S. crude inventories reported by the Energy Information Administration (EIA), the market's attention remains focused on the global economic outlook and demand dynamics, particularly from China.

The volatility in oil prices is partly driven by the conflicting signals from different regions. While the U.S. inventory draw suggests a strong domestic demand, concerns about China's economic slowdown and its implications for global oil consumption weigh heavily on market sentiment. This duality in the market forces keeps traders on edge, resulting in fluctuating oil prices.

Impact of Chinese Economic Slowdown

China's crude oil imports and refinery runs have been on a downward trend, reflecting sustained economic growth weakness. The People's Bank of China recently cut interest rates from 2.5% to 2.3% in response to weak economic growth, raising concerns about shrinking demand. This move is interpreted as an effort to stimulate the economy but adds to the uncertainty surrounding oil demand from the world's largest importer.

Throughout the year, China has seen crude oil imports decline, with refinery runs also trending lower year-on-year. This suggests a continued weakness in economic growth, further exacerbated by the recent interest rate cut, which is seen as a reaction to these ongoing economic challenges.

U.S. Inventory Data and Refinery Margins

The EIA's recent report of a significant U.S. crude inventory draw of 3.7 million barrels last week exceeded market expectations. Additionally, gasoline stocks dropped by 5.6 million barrels, far surpassing the expected 400,000-barrel draw. These figures indicate robust domestic demand for crude oil and its derivatives. However, refinery margins are under pressure globally.

Major oil companies such as Exxon, Shell, BP, TotalEnergies, and Neste have warned investors of weak Q2 earnings due to sluggish demand and lower refining margins. Despite positive inventory data from the U.S., the global picture remains mixed, with refineries struggling to maintain profitability amidst varying demand and supply dynamics.

Geopolitical Factors and Production Adjustments

Geopolitical tensions continue to play a significant role in the oil market. Efforts to reach a ceasefire in Gaza, ongoing conflicts in other regions, and the actions of major oil-producing countries add complexity to supply forecasts. OPEC+ members, including Russia, Kazakhstan, and Iraq, have committed to compensating for overproduction to comply with output cuts, which will impact future supply dynamics.

Russia, Kazakhstan, and Iraq's agreement to offset their overproduction over the next 15 months aims to balance market supply. Russia plans to cut 480,000 barrels per day (kb/d), Iraq 1,184 kb/d, and Kazakhstan 620 kb/d. These adjustments are critical for maintaining market stability and adhering to OPEC+ production targets.

Canadian Wildfires and Supply Concerns

The wildfires in Canada have added another layer of complexity to the oil market. These wildfires have threatened production in key regions such as Alberta, curtailing output and contributing to supply concerns. The disruption caused by these natural disasters highlights the vulnerability of oil supply chains to environmental factors.

The fires have forced companies like Suncor Energy and Altair Energy to reduce production, exacerbating supply constraints. As the wildfires continue to pose a threat, the market remains on alert for further disruptions that could impact oil prices.

Why Oil Is a Buy ?

Buy: Given the recent strong market performance, strategic institutional involvement, and positive price predictions, oil presents a compelling buy opportunity for long-term investors. Brent crude is currently trading at $80.26, while West Texas Intermediate (WTI) stands at $76.19. The U.S. Energy Information Administration (EIA) reported a significant crude inventory draw of 3.7 million barrels, far exceeding expectations and indicating strong demand.

Gasoline stocks dropped by 5.6 million barrels, compared to the expected 400,000-barrel draw, further underscoring robust consumption. This decline in inventories suggests a tightening supply environment, which supports higher prices. Additionally, OPEC+ members have committed to compensating for overproduction, with Russia reducing by 480,000 barrels per day (kb/d), Iraq by 1,184 kb/d, and Kazakhstan by 620 kb/d, ensuring compliance with output cuts and stabilizing the market.

Conclusion

The oil market is poised for continued growth, driven by favorable market conditions, strategic institutional participation, and positive expert predictions. Despite inherent volatility, oil's robust performance and future potential make it an attractive investment option. The significant inventory draws, with U.S. crude stocks falling by 3.7 million barrels and gasoline stocks by 5.6 million barrels, highlight strong demand amid global economic challenges.

Institutional involvement and strategic adjustments by major oil-producing countries, such as OPEC+'s planned production cuts, support a bullish outlook for oil prices. The technical analysis indicates resilience, with oil prices maintaining higher lows and recovering from dips. Brent crude's resistance point is set around $82, which, if surpassed, could lead to further bullish trends. Investors should leverage these insights, monitor market trends, and capitalize on oil's upward trajectory, ensuring they are well-positioned to benefit from the expected growth in the oil market.

That's TradingNEWS

Read More

-

BCX ETF Price at $12.41 — WTI Up 30% YTD, and a 6.55% Monthly Yield Sitting at a 5.34% Discount to $13.48 NAV

05.03.2026 · TradingNEWS ArchiveStocks

-

XRP-USD at $1.42 — XRPI at $8.07, XRPR at $11.49, Seven Straight ETF Inflow Days Hit $1.26B Cumulative as 7 Billion XRP Exit Exchanges and RLUSD Crosses $1.5B

05.03.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: NG at $2.936 — Qatar's 77M Ton Terminal Offline, TTF Surges 70%

05.03.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 157.68 Bearish Engulfing at 157.88 — Friday NFP Targets 159.45 or 155.64

05.03.2026 · TradingNEWS ArchiveForex