Oil Markets on Red Alert: War Threats and Fading Demand Rock Prices

With Middle East conflict heating up and China’s economy stalling, oil prices are on a wild ride—what's next for the world's most crucial commodity? | That's TradingNEWS

Oil Markets Face Volatility Amid Geopolitical Tensions and Demand Concerns

Middle East Conflict and Israel-Iran Tensions

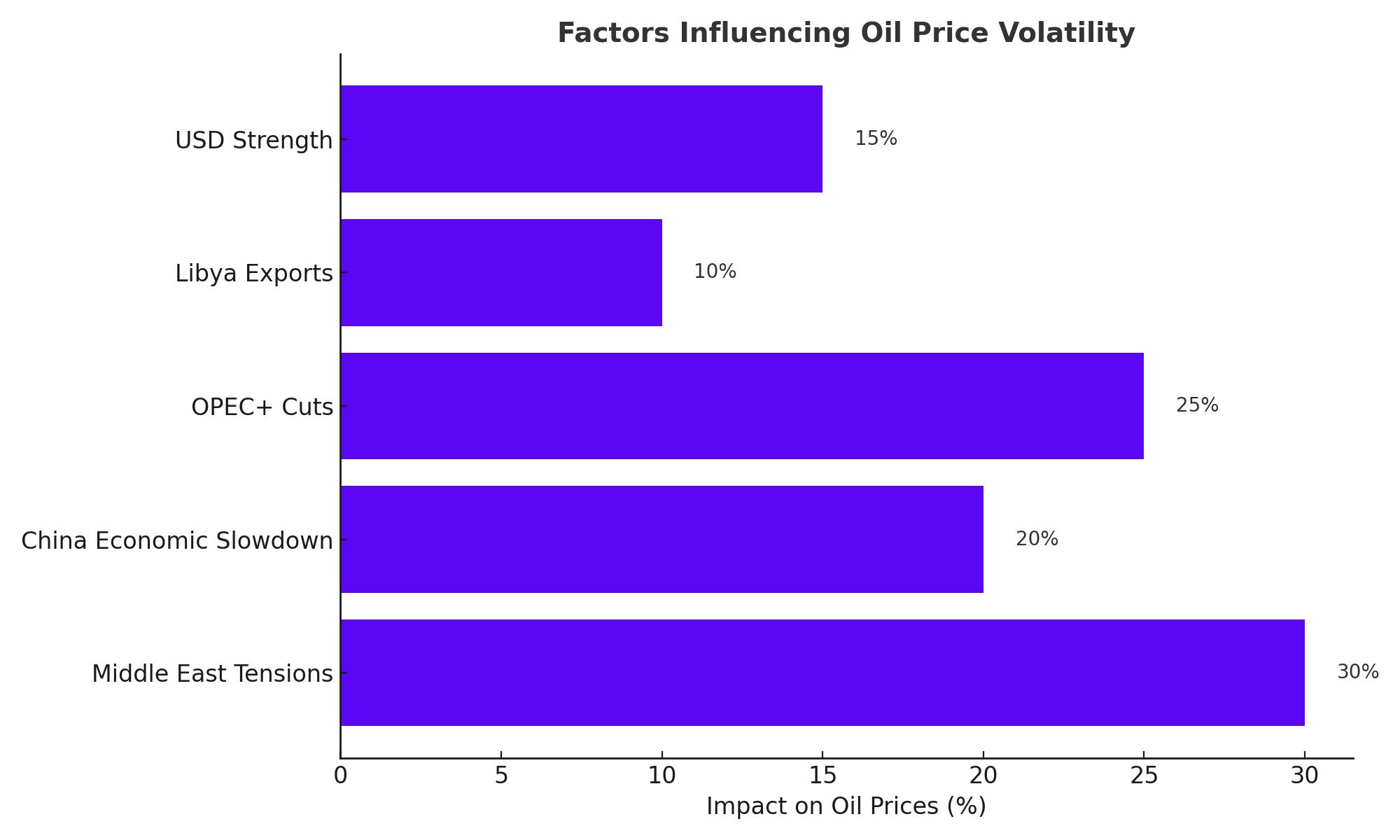

Oil prices remain under pressure as geopolitical risks in the Middle East intensify. The ongoing conflict between Israel and Iran, paired with the threat of further escalation, is rattling market sentiment. Initially, reports suggested Israel would avoid targeting Iran’s crucial oil infrastructure, causing oil prices to drop by over 4%, settling around $73.92 per barrel for Brent and $70.20 for West Texas Intermediate. However, uncertainty returned when Israeli officials hinted at potentially revising their stance, leaving the door open to striking Iranian assets. If oil infrastructure becomes a target, the conflict could severely disrupt supply, pushing prices beyond the current range. A wider regional disruption could propel prices into triple digits, as global supply tightens amidst escalating tensions.

China’s Economic Slowdown and Its Effect on Oil Demand

China’s slowing economic growth is weighing heavily on global oil markets, with weak consumer price inflation and underwhelming fiscal measures driving a reduction in demand. The world’s largest oil importer saw a sharp contraction in September’s imports, further exacerbating concerns. The International Energy Agency (IEA) has now lowered its global oil demand forecast for 2024 for the third consecutive month, predicting demand will expand by only 1.93 million barrels per day—a reduction of 106,000 barrels from previous estimates. This downturn has already led to oil price drops, with Brent crude slipping over 4% earlier this week.

OPEC+ Supply Cuts and Future Market Dynamics

Despite the market volatility, OPEC+ members have maintained their commitment to output cuts, which are set to last until December. These cuts are playing a significant role in stabilizing the market, even as demand falters. OPEC+’s cuts have helped limit the downside in prices, with Brent crude trading near $73.92 per barrel and West Texas Intermediate (WTI) at $70.20.

While supply-side constraints are propping up prices, OPEC and the IEA’s revisions to global demand forecasts highlight the challenge of balancing the market. As OPEC+ prepares to unwind some of its cuts in December, there is increasing concern about oversupply in 2025, especially given the continued growth in non-OPEC oil production.

Libya’s Crude Oil Exports Surge

Another factor influencing the supply side of the oil market is Libya's decision to accelerate its crude oil export schedule for October. Libya is expected to export 888,000 barrels per day, which adds further supply to a market already grappling with tepid demand. Libya’s increased output adds pressure to the already fragile balance between supply and demand, contributing to the downward pressure on prices.

US Dollar Strength Weighs on Oil Prices

The US Dollar Index (DXY), which tracks the dollar against six other currencies, has reached a two-month high, further pressuring oil prices. A strong dollar makes crude more expensive for foreign buyers, limiting demand. Traders are increasingly betting on former President Donald Trump winning the upcoming election, which could introduce more volatility into markets as his policies on trade and energy remain unpredictable.

Crude Oil’s Fragile Technical Outlook

From a technical standpoint, crude oil prices are struggling to maintain key levels. WTI remains vulnerable at the $70.00 level, with no clear catalyst for a strong recovery in the near term. Should prices break below the $67.11 support level, further downside toward $64.75 could be on the horizon, marking a significant risk for the oil market as traders reassess their positions.

On the upside, WTI would need to break through $71.46 and continue higher to retest the 100-day Simple Moving Average at $75.35. Until a clear bullish catalyst emerges, the path of least resistance seems to point lower, particularly given the uncertain demand outlook and growing supply.

Fitch Ratings’ Outlook on Oil Markets

Fitch Ratings has indicated that the geopolitical risk premium, which is currently adding $5-$10 per barrel to prices, could rise further depending on the developments in the Middle East. However, Fitch also notes that the fundamental supply and demand imbalance is the dominant force driving oil prices lower. OPEC’s spare production capacity remains at over 5 million barrels per day, and non-OPEC supply continues to grow, signaling that the market is well-supplied despite current tensions.

Fitch’s base case assumes Brent prices will average $70 per barrel in 2025, reflecting the downside risk posed by oversupply. Geopolitical risks remain a significant factor, but the structural overhang of supply is likely to dominate price movements over the next year.

Conclusion: Uncertainty Dominates Oil Markets

Oil markets are caught between geopolitical tensions in the Middle East and weakening demand from key economies like China. While OPEC+ supply cuts have helped limit the downside, the potential for surplus production in 2025 poses a significant risk. Traders are also closely watching the actions of Israel and Iran, as any escalation could send prices skyrocketing. For now, oil remains in a fragile state, with prices vulnerable to both upside and downside risks depending on the developments in global markets.

That's TradingNEWS

Read More

-

Stock Market Today: S&P 500 Stalls Near 6,940 As NVDA Stock And Gold Lead Into 2026

28.12.2025 · TradingNEWS ArchiveStocks

-

Bitcoin Price Forecast: BTC-USD Holds $84K Support As Bulls Target $100K

28.12.2025 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Holds $4,530–$4,550 While Bulls Aim at $4,600+

28.12.2025 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: EURUSD=X 1.1770 Floor Holds While Bulls Aim for 1.1919 and the 1.20 Break

28.12.2025 · TradingNEWS ArchiveForex