Oil Prices Rally Above $85 Amid US Inflation Data and Fed Rate Cut Expectations

Brent Crude and WTI Gain on Easing Inflation and Anticipated Monetary Policy Adjustments | That's TradingNEWS

Oil Prices Experience Volatility Amid Inflation Data and Fed Speculations

US Inflation Data Impacts Oil Prices

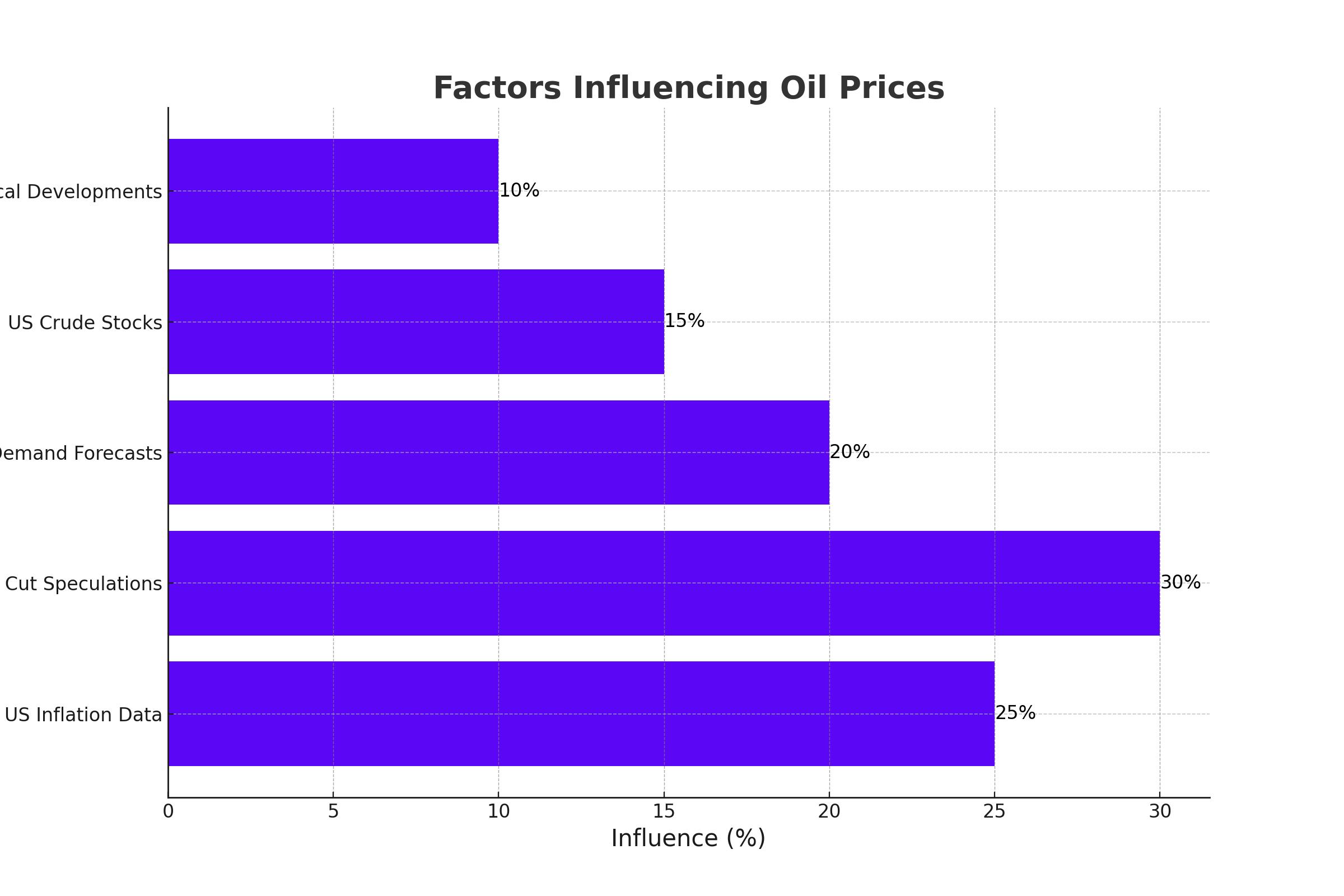

Crude oil prices saw significant fluctuations recently, influenced heavily by economic data and expectations around the Federal Reserve's policy decisions. Notably, US inflation data for June showed a monthly decline—the first in four years—which spurred hopes for an interest rate cut by the Federal Reserve in September. This data pushed Brent crude prices back above $85 per barrel, after a brief dip below this level earlier in the week due to weaker consumer price index (CPI) data from China, which indicated potential weaker oil demand.

Market Reactions and Trading Insights

The decline in monthly CPI has added to the optimism among traders, who now see a greater likelihood of the Fed beginning its policy easing sooner than expected. As of now, traders are pricing in an 89% probability of a rate cut in September, a significant increase from the previous 73%. This sentiment was echoed by market strategist Yeap Jun Rong, who pointed out that while cooling inflation supports the case for rate cuts, it also highlights the ongoing weakening of the US economy.

OPEC's Role and Demand Forecasts

OPEC's latest monthly report has also played a crucial role in shaping market expectations. The cartel reiterated its forecast of strong demand growth for crude oil, projecting an increase of 2.25 million barrels per day for the year. This optimism is driven by expectations of robust mobility and air travel in the Northern Hemisphere during the summer, which is anticipated to boost demand for transportation fuels significantly.

Brent and WTI Performance

On Thursday, Brent crude futures settled at $85.40 per barrel, up 0.4%, while US West Texas Intermediate (WTI) crude futures rose 0.6% to $82.62 per barrel. The positive price movement came after US consumer prices showed an unexpected decline, reinforcing hopes for an economic boost through potential interest rate cuts. This decline in inflation also weakened the US Dollar, providing additional support for oil prices by making dollar-denominated commodities cheaper for buyers using other currencies.

Supply Dynamics and Backwardation

US crude stocks data further influenced the market, showing a draw in inventories, which alongside declining gasoline and jet fuel stocks, helped push prices higher. The market also witnessed the steepest premium of front-month US crude futures over the next-month contract since April, indicating a supply tightness in the immediate term.

Contrasting Views on Demand Outlook

Despite the optimistic demand outlook from OPEC, the International Energy Agency (IEA) offered a more cautious perspective, projecting global demand growth to slow to under a million barrels per day this year and next. This more conservative view mainly reflects expected contractions in China’s consumption.

Canadian Dollar and Crude Oil Prices

The performance of crude oil has also impacted the Canadian Dollar (CAD), given Canada’s status as a major oil exporter to the US. The CAD found support as WTI prices extended their winning streak, trading around $82.20 per barrel. This price movement follows softer-than-expected US CPI data, which raised expectations for a potential Fed rate cut in September, thus boosting crude oil demand.

China's Natural Gas Imports and LNG Market

China's natural gas imports, including pipeline and LNG cargoes, increased by 14.3% in the first half of 2024 compared to the same period last year. This increase reflects China's efforts to stockpile fuel for power plants ahead of summer, amid lower LNG prices earlier in the year. However, the recent rise in spot LNG prices has slightly tempered China's demand for spot purchases.

Geopolitical Developments: Iran and the US

Geopolitical tensions continue to influence the oil market, exemplified by the recent release of an oil tanker seized by Iran in 2023. The tanker's cargo was sold to fund medical treatments in Iran, following a lawsuit against the US. An Iranian court ordered the US to pay $6.8 billion in compensation, highlighting the ongoing complexities in US-Iran relations.

Summary

The crude oil market is currently experiencing significant volatility driven by economic data, policy expectations, and geopolitical developments. While recent inflation data and potential rate cuts by the Federal Reserve have supported oil prices, differing demand forecasts from major agencies like OPEC and the IEA add layers of complexity to the market outlook. As always, traders and investors need to stay attuned to a broad range of economic indicators and geopolitical events to navigate this dynamic landscape.